Torsten Asmus

Investment thesis: Even though there are plenty of official statements in regard to the Federal Reserve’s commitment to its current path of monetary tightening, economic data coming our way in the next few months may potentially challenge that resolve. The Direxion Technology Bull 3x Shares ETF (NYSEARCA:TECL) is potentially one of the most intriguing investment options if one wants to try to time the Federal Reserve’s pivot. Tech companies tend to be especially affected by interest rates, as they often need to access capital in order to carry out new projects, as the fast pace of technological change tends to require constant retooling of activities. The timing for betting on TECL is not here yet, but as I shall explain in this article, by the spring at the latest the Federal Reserve will probably have plenty of reasons to reverse course, as more and more economic data points will probably show a significant decline in economic activities, even if inflationary trends will continue to persist. At that point, this ETF should take off aggressively. However timing is everything, therefore one has to closely follow when it is time to make a move.

About the fund.

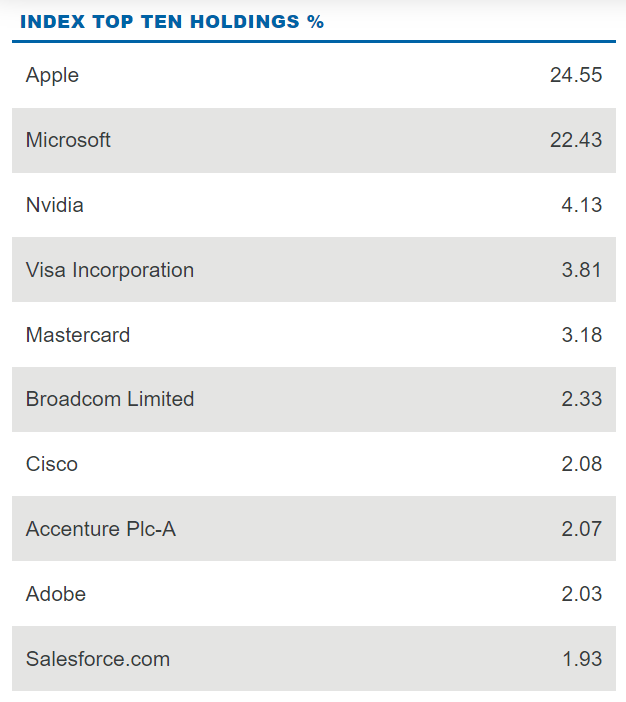

The composition of the fund is heavily weighted towards two companies, Apple (AAPL) and Microsoft (MSFT), with these two companies collectively making up about 45% of the entire fund.

Direxion

The rest of the top ten are all well-known household names in the tech sector, with these top names collectively making up about two-thirds of the entire fund.

Seeking Alpha

As we can see, the TECL fund is down by about two-thirds over the past year, which is a testament to the risks involved if one gets the timing of investing in its shares wrong. The expense ratio of nearly 1%, which amounts to a slow-paced erosion of one’s investment in the long-term, but this is by no means a long-term buy and hold. The fund’s expense ratio is not exactly the deciding factors in whether one opts to invest in this fund or not. The prospects of a reverse in the Federal Reserve’s current path, on the other hand, make this fund a very enticing prospect. First, there is the fact that tech stocks are likely to outperform if interest rates start moving back down. Then there is the 300% amplification of any average move of the fund’s components, according to proportion of each component. Between these two factors, a well-timed investment decision could come with a huge potential upside.

Fundamental economic factors that are likely to cause a Fed pivot suggest that next spring might be the turning point.

For the past few months, there have been numerous predictions of an imminent reversal of the Federal Reserve’s current path of monetary tightening. Most of it seems to have been based on wishful thinking rather than fundamentals. Yes, inflation stopped rising after one reading above 9%, and it is now down to just above 8% per month for a few months in a row. Month-over-month numbers are also encouraging, with inflation rising at a very moderate pace if the monthly numbers were to be annualized.

The problem with it is that it comes within the context of oil prices have declined by about 40% from this year’s highs, which should have helped to make a bigger dent in inflation. The fact that it did not make a significant dent suggests that inflation has become self-sustaining, in other words, it is no longer fed by the initial factors that helped to ignite it. All impending events and other indications are that oil prices are not likely to see any further declines from current levels. If anything, we may see an increase, which will put further upward pressures on inflation in the coming months.

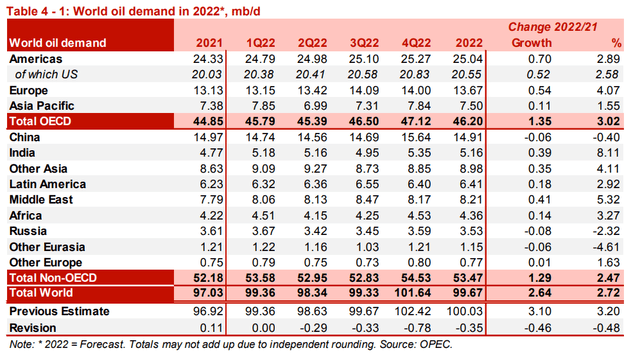

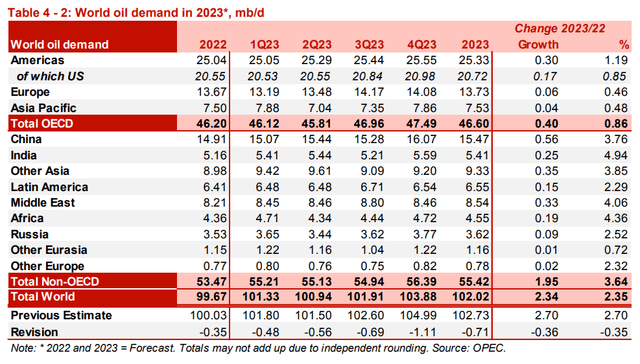

Looking at the latest OPEC monthly report, there are finally some downward revisions to global oil demand trends, in the face of what now seems to be a limping global economy, that might soon start outright shrinking if current trends persist.

OPEC

OPEC

As we can see, for the current quarter there was a significant downward revision in demand, and for every quarter in 2023 as well. I am personally looking one year out at the last quarter of 2023, which is where I think we need to see a further decline in demand of another 2 mb/d in addition to the 1 mb/d in forecast demand reduction, before we can assume that oil prices can head further down, providing the world’s central banks with an opportunity to do their part in suppressing inflation through monetary tightening.

The reason why further demand destruction is most likely needed is that supplies are unlikely to be there to meet the demand growth trajectory we are seeing this quarter and going into next year. Between the US release of strategic reserves being on the verge of ending, Russian oil supplies being curtailed by sanctions, and OPEC seemingly unwilling to step in and make up for those shortfalls in supply, the flows of oil that are needed to meet that level of demand are simply not there.

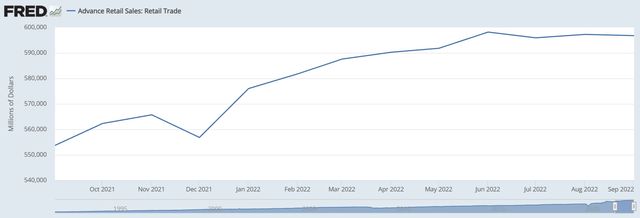

The signs of the demand destruction that is needed to tackle inflation will come in the form of backward-looking data within the world’s most important economies, such as consumer demand data, jobs data, and manufacturing. The latest consumer demand data in the US for instance suggests that we are seeing a flattening in consumer demand.

St. Louis Fed

Other data points, like manufacturing and jobs data, have not been collaborating in this regard so far. Some indirect evidence seems to point towards these factors aligning into place in the next few months, but it remains to be seen. I expect that data points in the EU in particular will start to come in very ugly in the next few months, due to the unsustainably high energy prices. I expect that by spring of next year the economic data coming from most major economies around the world will be sufficiently bad to expect that global oil demand has been flattened at current consumption rates or lower.

There is one major factor that could throw this thesis into the dustbin, namely a Chinese policy pivot. It could scrap its Zero COVID policy just as the rest of the global economy enters demand destruction mode. Together with other stimulating factors, it could relaunch the Chinese economy onto a faster economic growth trajectory, which could be enough to offset the level of demand destruction we are starting to see some early evidence of, in the EU and US. If that happens, the US Federal Reserve as well as the ECB could be forced to remain on their monetary tightening trajectory for longer. It goes without saying that the timing of this trade, betting on a Fed reversal would have to change accordingly

There are also some potential factors that could move the timing of this tech ETF trade up by a few months. For instance, peace could break out between Russia & Ukraine, thus the Russia-Western World proxy war would end as well. That would help to ease up the global energy inflation situation, especially in Europe, but indirectly it would help the entire world. For instance, it would greatly ease the pressure on the US to export natural gas & diesel fuel. Food prices could benefit as well, since apparently, even though this was not the direct intention, Russian food & fertilizer exports have been impacted by the sanctions.

Investment implications:

I am not by any means a tech expert, which is why I mostly shy away from covering tech stocks. There are certainly some interesting potential bargains I identified for my own investment needs, that I find to have long-term value after they sold off heavily this year. AMD (AMD) for instance is now trading at just about $58/share after going as high as $168. With a forward P/E of around 15 and decent growth prospects beyond the recent global economic slowdown, it is probably a bargain at current levels, even if it may still have some more downside in the shorter term. Intel (INTC) is now trading at just over $26/share, while just over a year ago it was at $68. It is trading at a forward P/E of just over 12. Unlike AMD, it also comes with a generous dividend of over 5.5%, thus in the absence of a dividend cut, one can also enjoy getting paid to wait out the market rebound for semiconductors. I have been buying both stocks recently because I see both of them going higher in the long term. I am not overly concerned about the timing, because I am willing to wait for the fundamentals to be reflected in the performance of their stocks.

The TECL fund cannot be approached the same way. The amplified nature of the moves it makes relative to the overall market movements of its main component companies is as great of a risk factor on the downside, as it is a potential opportunity on the upside. For this reason, timing is everything, and this potential investment opportunity needs to be well-timed, in relation to the desperately awaited Fed pivot. If one can time this well, both in terms of entry as well as exit, it can potentially be one of the best trades of the decade for most people. It is an opportunity worth keeping an eye on. But it is also an opportunity that is not without some serious risk, in case the Federal Reserve play will not go according to plan.

Be the first to comment