francisblack

Commodity prices have been on a wild ride over the past two years. Production declines caused by years of underinvestment and labor and acute supply chain shortages (initially triggered by lockdowns) have dramatically improved the supply-demand landscape in favor of most commodities. Despite immense price increases and inflation, most commodities have yet to return to their 2000s peaks as commodities were at extreme lows before 2020 due to the general glut. Without a stark change in fundamentals, such as immense global production growth or demand declines, it does not appear likely the long-term commodity bull market will end.

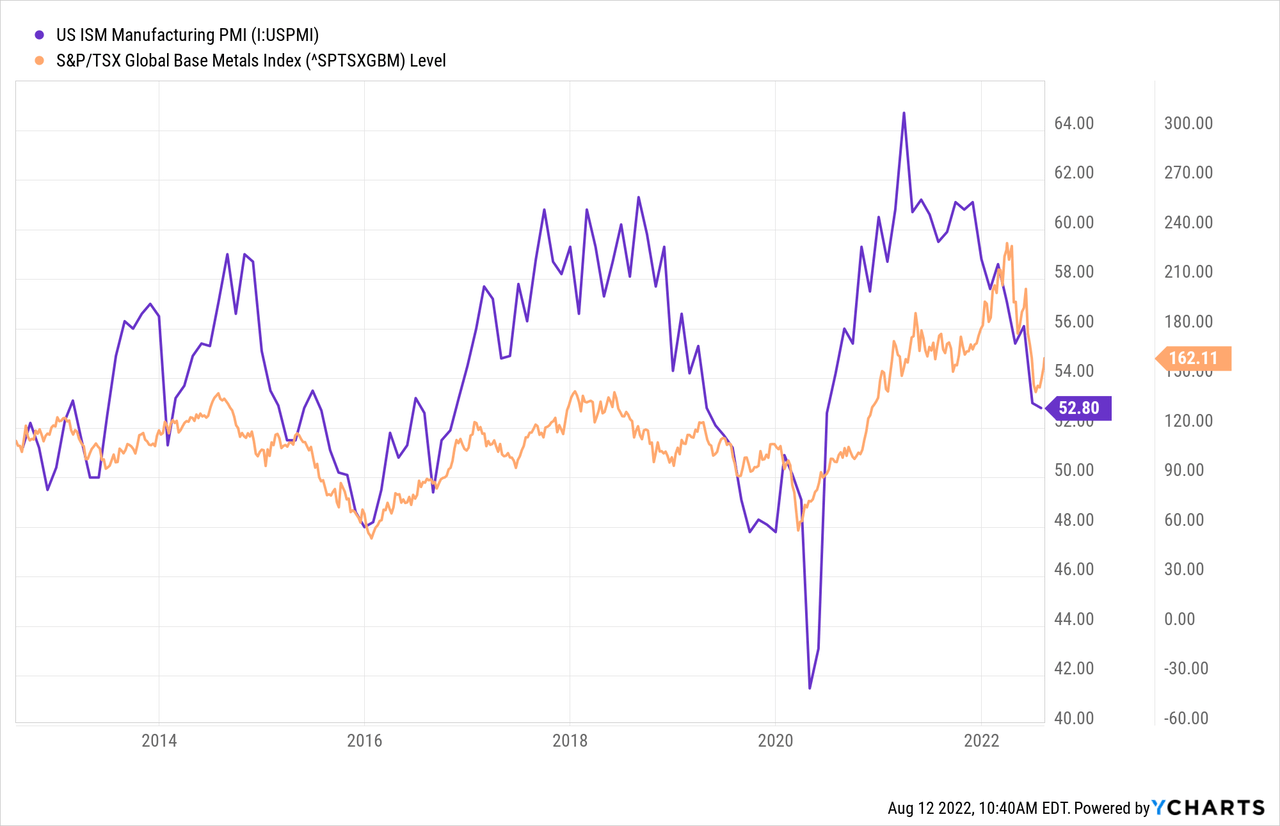

In recent months, many commodities, metals, in particular, have seen relatively large corrections as economic demand has shown clear signs of declining. The U.S economy is currently in a recession by traditional measures, though there has not yet been a rise in unemployment, suggesting potential resilience in core demand. Of course, with the U.S manufacturing PMI in steep decline and most leading economic indicators, overall demand for base metals is likely to slow, leading to a temporary slowdown in commodity price growth. See the strong correlation between the U.S manufacturing PMI and base metals prices below:

The decline in manufacturing activity certainly indicates a temporary slowdown in base metals. However, with global supply as weak as it is, prices may continue to rise, mainly if dovish monetary policies artificially support the economy and exacerbate inflation. Indeed, base metals may be nearing a correction low as prices have increased over the past two weeks as the manufacturing PMI nears historical minimums. As I’ve explained in recent articles, I believe the current economic slowdown will impact the service-centered economy (technology, banking, etc.) more than the goods economy (mining, manufacturing, etc.) due to stagflationary dynamics. Additionally, white-collar over-employment in the “services economy” and blue-collar underemployment in the “goods economy.”

Mining stock valuations generally remain low despite the massive rally since 2020. In my view, given my bullish long-term outlook on base metals, the recent correction offers a solid discount buying opportunity. While base metal miners are often more volatile, they are one of the best hedges against inflation. I still believe inflation is a general investing risk factor given the likelihood of renewed Federal Reserve easing during recessions.

Over recent weeks, I have covered numerous companies (X, AMR, IPI , DAC, ARLP, FANG) that I believe are solid commodity-centric dip-buying opportunities. One firm that could be added to that list is the Canadian mining giant Teck Resources (NYSE:TECK). However, the firm has significant risks associated with the likely large decline in Q3 earnings given the recent drop in metals prices. Based on my analysis, it appears Teck may likely see a return toward near-zero profitability in Q3 but may see a strong recovery in 2023.

Teck Resources Q3 Earnings Outlook

Teck Resources is one of Canada’s largest mining companies and is the most diversified, with significant operations in metallurgical coal, zinc, and copper. Steelmaking coal usually makes up around 70% of the company’s gross profit (2Q Rep. pg. 38), with most of the remainder split between copper and zinc. In recent years, the firm has worked to dramatically expand its copper mining operations to benefit from growth in electricity-centered markets (electric vehicles, etc.).

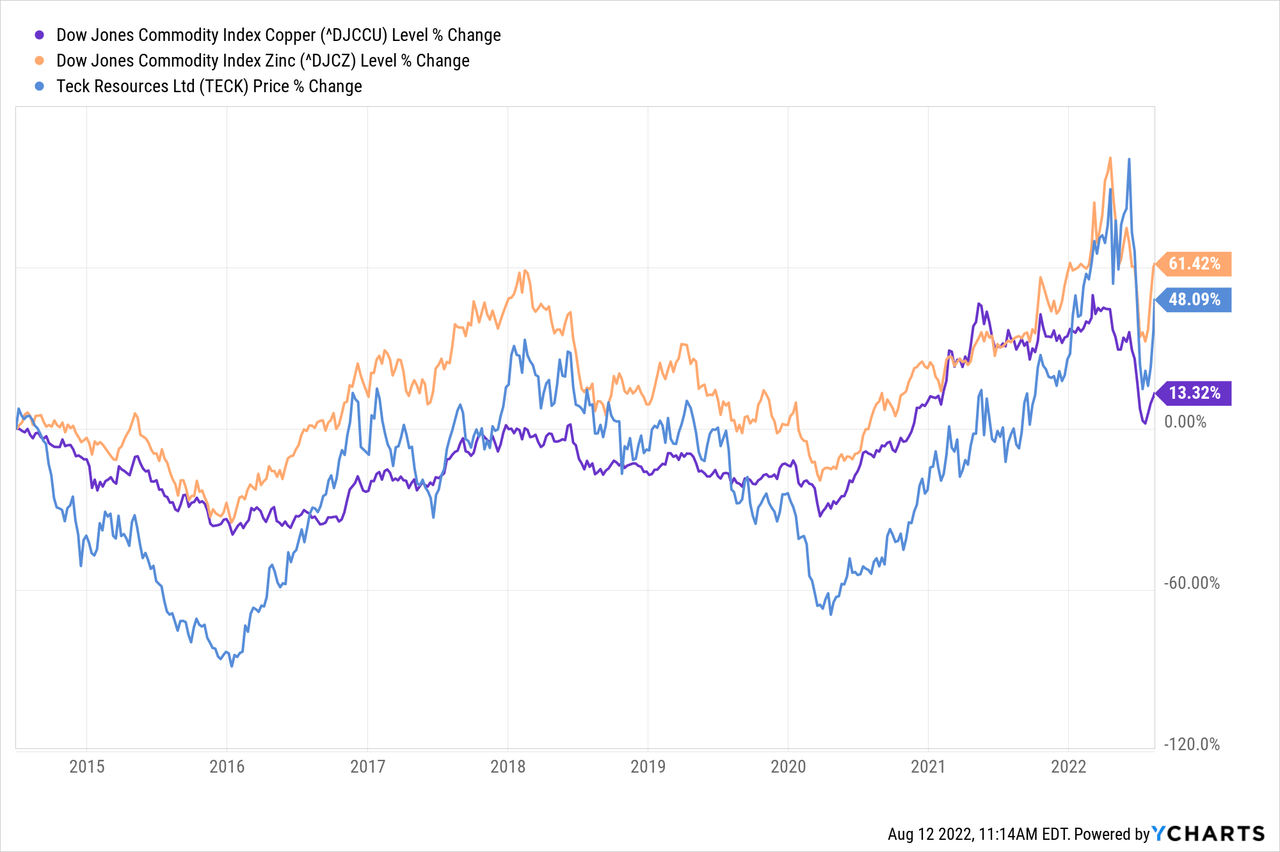

Over the past two months, copper and zinc have both erased most of the “Russia-Ukraine” shock gains from early this year. Teck has declined dramatically from ~$45 to ~$25 peak-to-trough from early June to mid-July. As with metals, Teck has rallied since back to ~$34. Over the long run, Teck has a robust correlation to these two metals. See below:

Steelmaking coal is the primary driver of Teck’s gross profit. Unlike copper and zinc, there is hardly a “global commodity price” for steelmaking coal due to its high variability. However, steelmaking coal prices are generally very similar to copper and zinc as they are driven by similar fundamentals in the steel and iron market – namely, cycles in global manufacturing activity and general mining development and investment. Steelmaking coal has been hit harder by the recent shock than copper, with premium prices down ~62% in July from their spring peak.

Teck was selling steelmaking coal at $453 per ton during Q2. Today, prices are likely closer to $220 per ton based on Australian futures prices (~$233 lower). The firm was selling copper at an average of $4.32 per pound, and copper futures are now down to ~$3.66 per pound ($0.66 lower). The company was selling zinc at an average of $1.78 per pound in Q2, now down to ~$1.66 ($0.12 lower, though zinc is significantly above its July bottom of ~$1.30). Lastly, Teck’s oil sand operation in Fort Hills exposes it to the Western Canadian Select oil price, currently at $80 – down $16 from Teck’s Q2 realized an average of $96. Finally, Teck owns a variety of currency hedging contracts and has significant direct exposure to the CAD/USD exchange rate, which is currently 1.28 CAD per $1, which is unchanged from Teck’s Q2 average.

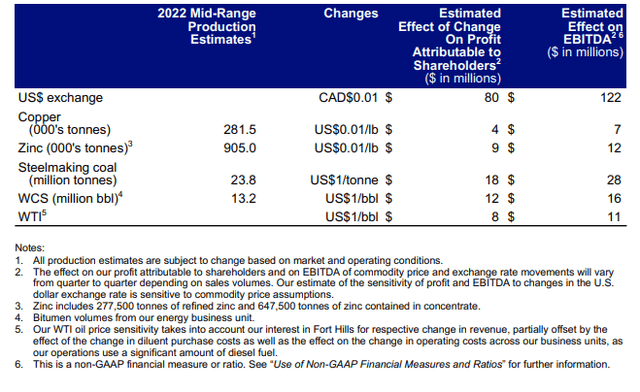

Fortunately, Teck publishes an estimated annualized earnings sensitivity to changes in commodity prices. See below:

Teck Resources Earnings Commodity Sensitivity (Teck Resources Q2 Earnings Report)

Using today’s prices and Teck’s estimates, we can expect the following changes to its bottom line:

- Copper segment’s income by ~(264M) (-66 X 4M) and EBITDA by ~(462M) (-66 X 7M)

- Zinc segment’s income by ~(108M) (-12 X 9M) and EBITDA by ~(144M) (-12 X 12M)

- Steelmaking coal segment’s income by ~($4.19B) (-233 X 18M) and EBITDA by ~($6.52B) (-233 X 28M)

- WCS segment’s income by ~($192M) (-16 X 12M) and EBITDA by ~($256M) (-16 X 16M).

Together, this brings our total estimated annual income change to ~(4.75B) and estimated EBITDA change to ~(7.38B). This equates to a quarterly change in estimated income of ~(1.19B) and an EBITDA change of ~(1.85B). In Q2, the company had a total net income of $1.3B, an EBITDA of $2.43B, and an EPS of $2.40. Given our estimated changes in earnings, based on today’s commodities prices, we can calculate a Q3 net income of ~$110M, EBITDA of ~$580M, and an EPS of ~$0.20.

Before we conclude these estimates, it must be pointed out that there are many assumptions both in Teck’s sensitivity estimates and my analysis. The firm’s production volume and unit costs may be different than forecast. It’s hedging, financing, and operating changes may also lead to unseen changes in expenses. Additionally, I made estimates using global futures prices which may differ from the firm’s realized prices. Even more, average Q3 prices are unlikely to reflect today’s specific price. That said, we’re making these estimates in the middle of the quarter when commodity prices are most likely to reflect average quarterly levels.

Unit production costs may be lower than estimated due to recent declines in transportation fuel costs. However, as noted in Teck’s last earnings calls, labor and materials shortages have driven mining costs significantly higher and will likely continue to do so over the coming years. Overall, while there is some expected variability around the earnings estimate I found, I believe it represents a solid ball-park outlook for Teck’s Q3 earnings.

Clearly, Teck’s income will likely experience dramatic declines this quarter as commodity prices have slipped close enough to unit costs that the firm’s operating and other expenses will probably eat most of its gross profits. Unless there is a rapid upward movement in commodity prices, I expect Teck’s Q3 income to be nearly zero. While this is a dramatic decline from Q2, Teck hardly broke even last year. Metals prices have risen materially since their June peaks and may break much higher over the coming six weeks if the trend continues. However, I do not believe investors would be wise to bet on a Q3 earnings beat as evidence suggests it will likely be below current estimates.

The Long-Run vs. The Short-Run

When investing, it is best to understand one’s holding period clearly. I would not buy stock in TECK from a short-term standpoint as it seems very likely the company will face Q3 earnings revisions. The mining stock segment got ahead of itself earlier this year on war speculation and unrealistic economic expectations. Today, the market meets the reality that high economic demand can not be sustained if prices rise too sharply.

The U.S and the global economy are in a contraction that is resulting in a decline in demand for most commodities. This trend is particularly notable in China (where most base metals flow), which is currently reeling from decades of over construction and a substantial property bubble. I believe these factors will likely keep the demand for steel and copper from rising soon, hampering Teck’s short-term potential.

However, from a long-term perspective, Teck may be a buying opportunity. The company is one of the largest and most diversified. Unlike many, it has most of its operations in more-developed areas with historically fewer labor and political risk factors (see Chile and South Africa). The company is among the few that have grown operations in recent years despite significant headwinds. Teck may also benefit tremendously if global central banks return to a stimulative stance. Still, I would not personally buy TECK until its Q3 earnings report is out or the market re-adjusts its earnings expectations.

Be the first to comment