Photon-Photos/iStock via Getty Images

Investment Thesis

Teck Resources (NYSE:TECK) explores and produces natural resources. Its operations are focused on activities related to exploration, mining, and minerals processing.

Since 90% of its gross profits are derived from steelmaking coal and copper, the driving forces behind these two commodities are the overarching focus of this bullish investment thesis.

There are many reasons to be bullish on Teck Resources. However, the blemish in this investment thesis is that Teck Resource’s capital return program leaves a lot to be desired. As it stands, investors are likely to see approximately 2.9% yield via dividends and buybacks.

If Teck Resources meaningfully increases its sustainable dividends, it would be easy to become even more bullish here.

Why Teck Resources? Why Now?

Teck is a mining and mineral development with business units focused on copper, zinc, steelmaking coal, and energy.

That being said, steelmaking coal makes up 55% of its total gross profits, with copper making up 34% of its total gross profits. Accordingly, steelmaking coal and copper together make up approximately 90% of its total gross profits. Thus, the main drivers of investors’ returns come from steelmaking coal and copper prospects.

Steelmaking coal is also known as metallurgical coal or coking coal. Steelmaking coal is used in about 72% of global steel production. Steel is an important commodity that’s used in rail, bridges, buildings, and general infrastructure. For context, you can’t embrace President Biden’s infrastructure bill without steel. It’s simply not going to happen.

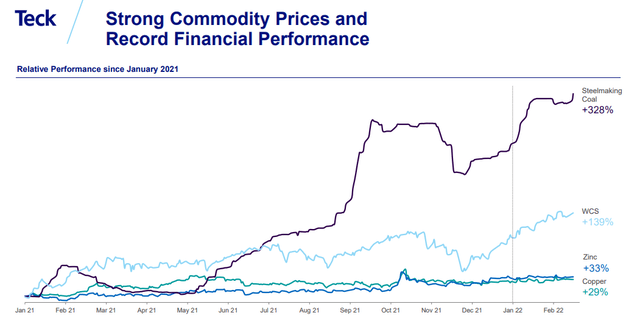

Teck investor presentation, Q4 2021

Moreover, above you can see that steelmaking coal prices have increased meaningfully in 2022. Consequently, steelmaking coal is going to remain in elevated high demand for now.

Also, we have to keep in mind that China’s impetus to limit its carbon-dense manufacturing implies that positive dynamics are in place that constrains further steelmaking coal production, thereby leading to positive supply and demand balances.

Furthermore, even though Covid-induced restrictions in China are temporarily denting demand, I fully expect this to be very short-lived, and China’s demand for steel products to bounce back.

Next, even though copper prices look relatively stable, we have to keep these prices in the bigger context.

Trading Economics, copper prices

As you can see above, copper prices are very close to a 5-year high. Thus, from different perspectives, both steelmaking coal and copper prices are proving Teck Resources with very favorable drivers.

TECK Stock Valuation – Reasonably Priced

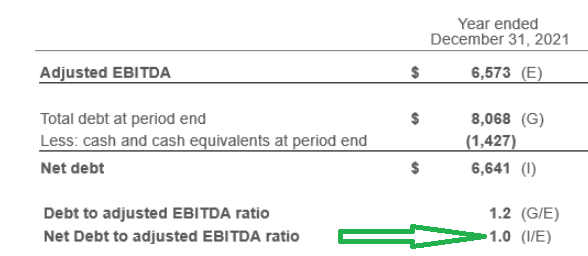

Teck Resources Q4 2021

The good news here is that given Teck Resource’s EBITDA in 2022, the business ended up with a net debt to EBITDA ratio of 1x. That’s certainly attractive.

But this doesn’t detract from the fact that it still carries around $8 billion of debt.

In fact, management highlights that the first 30% of any available cash flow will be automatically returned to shareholders. With the balance to be used for either growth capex or debt reduction.

Thus even though further buybacks will be announced regularly, as it stands right now, the bulk of the shareholder return for 2022 is expected to be $635 million in aggregate via dividends and share repurchases.

Thus, for a stock that’s priced at $22 billion, this implies that investors are getting a 2.9% yield via capital returns.

On a positive note, this 2.9% yield doesn’t factor in anything in terms of the share price appreciation of Teck Resource’s shares.

If you believe that we are at the start of a commodity supercycle, as I do, there’s bound to be a massive change in investment sentiment, that could lead to a meaningfully higher re-rating in commodity stocks across the board.

In that event, Teck Resources could be lifted higher, together with the tide that lifts all boats.

The Bottom Line

Your ability to find super high-quality investment, to a meaningful extent, is proportional to how hard you work and under how many rocks you look.

The more rocks that you look under, the more selective you can be. If you only need to find 1 or 2 investments every so often, then you are in a lucky position that you don’t have to compromise if the investment doesn’t exactly fit your risk tolerance and investment appetite. You can be very choosy in your stock selection.

So while I’m bullish on this name I find that its balance sheet is slightly more leveraged than I would like it to be. This will hamper its ability to return massive amounts of capital to shareholders. Thus, I’m finding even better investment opportunities elsewhere. Whatever you decide, good luck and happy investing.

Be the first to comment