Ari Widodo/iStock via Getty Images

Investment Thesis

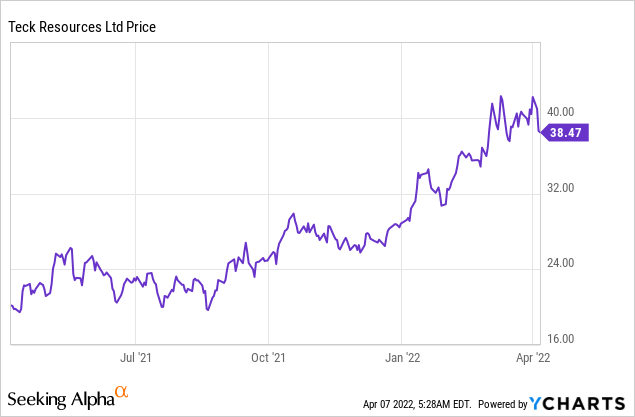

I looked at Teck Resources (NYSE:TECK) last few months and watched the stock of this wonderful Canadian-based mining company skyrocket. I ended up buying the stock for only $38, which is only slightly below the current price.

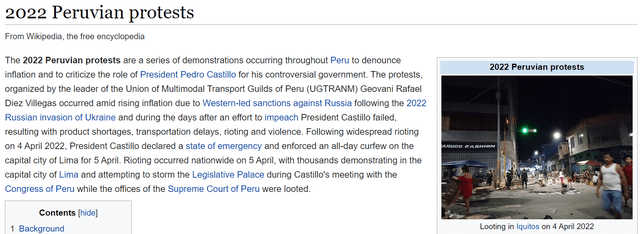

Now, I am thinking about increasing my position in TECK, expecting that the recent correction is just an overreaction and that the current socio-political situation in Peru, the second-largest copper producer in the world, plays into the hands of Canadian companies in general and Teck Resources, in particular, is one of the most sustainable and promising players of this industry.

Why Do I Think So?

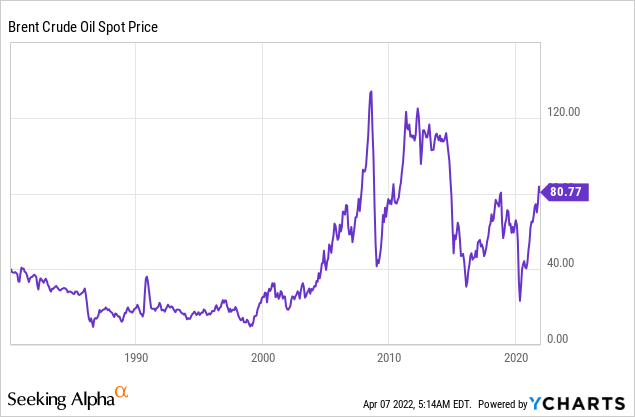

If you follow the oil and gas market, you know that the price of crude oil reacts very strongly to any news about unrest and uprisings in exporting countries. A striking example is the events that took place in several Arab countries in the early 2010s – this historic event is called the Arab Spring. As Professor Paul Stevens wrote, following the protests in Tunisia and the events that followed, the price of oil rose from $94.90 per barrel to $120 in a very short time.

Many traders thought that the protests would spread to the major oil producers in the Gulf, but that did not happen. Also, supply chains were not really disrupted at that point, so fear, not fundamentals, was the cause of the violent reaction in the commodity markets at that time.

History seems to be cyclical when we look at the protests in Peru today and their impact on another commodity market – copper.

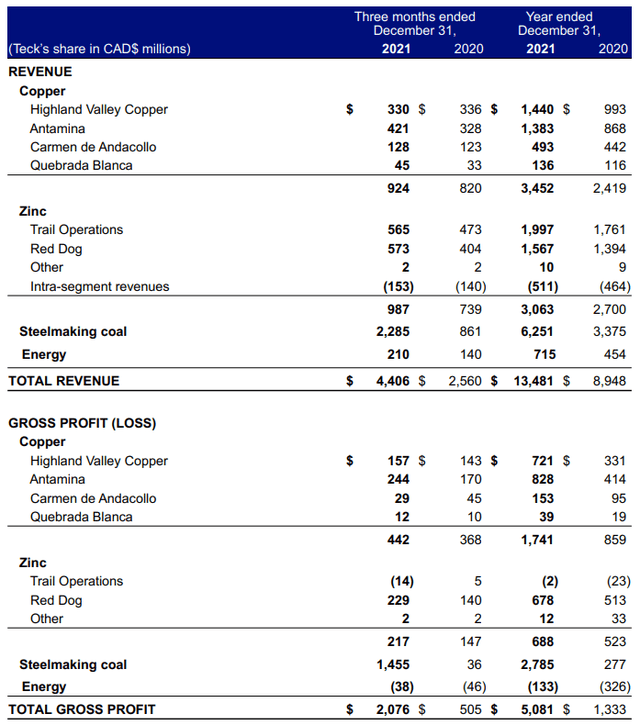

It should be clear that Peru is not only a major producer of copper but also of zinc – the country ranks second in the world for zinc ore exports, so reading today’s news made me think of Teck Resources, which in FY2021 earned 13.2% of its gross profit from zinc sales (copper sales accounted to 33.4%).

Teck Resources Limited 2021 Fourth Quarter News Release

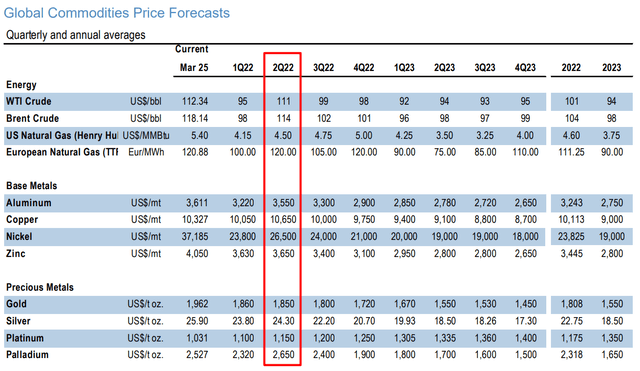

The uprising in Peru came at a time when the deficit of zinc, copper, and other metals is starting to rise – according to analysts at JPMorgan (report dated March 27), prices for all base metals are likely to be higher in the 2nd quarter of 2022 compared to the 1st quarter.

JPMorgan, Global Commodities Report, March 27 (With Author’s Notes)

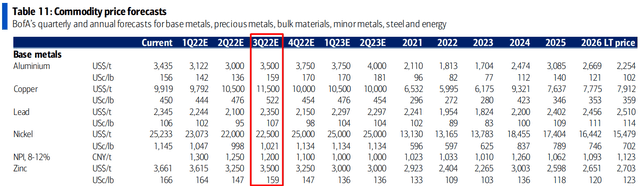

Demand for copper and zinc appears to remain strong through Q3 2022, which Bank of America’s analysts factor into their price forecasts as well:

BofA’s Quarterly and Annual Forecasts for Base Metals, Author’s Notes

In general, 2022 is going to be very profitable for all companies in this sector, because the recovery from the pandemic is not yet complete, and the energy crisis forces us to look for alternatives whose success depends largely on the availability of copper and zinc:

Analysts agree that the long-term future demand prospects for copper are bright. The base metal is an essential element needed as the world moves away from fossil fuels – as mentioned, the electric vehicle and energy storage sectors are at the forefront of the green energy transition.

[Source]

Zinc is used in energy storage systems for its qualities of recyclability, safety, low cost, and zero emissions. These include uses in several battery chemistries used in electronics, industrial, marine, aeronautic, and remote power supply applications.

[Source]

Therefore, Teck Resources, in my opinion, will be better positioned to meet demand, because protests always cause uncertainty and the risk of supply disruption, which has already suffered greatly over the past 2 years. Customers will gradually seek replacements for Latin American sellers – this is the main operational growth opportunity for TECK.

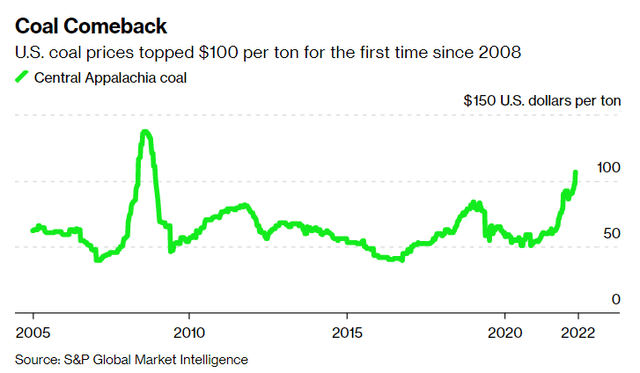

In addition, more than half of Teck Resources’ gross profit comes from the sale of steelmaking coal – prices for this commodity were already soaring before the protests in Peru due to the looming energy crisis in Europe.

Of course, the events in Peru have no impact on the coal market – the country does not have large reserves/production of this commodity. However, the recent embargo imposed on Russia has caused coal prices in Europe to rise to record levels once again:

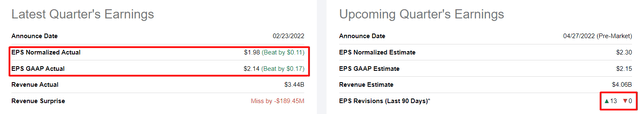

So the unrest in Peru combined with the new sanctions against Russia, the disruption of supply chains, and the ongoing energy crisis create a kind of perfect storm for Teck Resources, but only in a positive sense. Management at TECK announced in its latest quarterly report that it plans to increase production of copper and zinc in the first quarter of 2022 and maintain production of steelmaking coal at about the same level as in the 4th quarter of 2021. Considering how much prices have risen in the last quarter, I look forward to TECK’s 1Q 2022 report on April 27 (pre-market) – with a high degree of probability, the company will be able to beat analysts’ forecasts, as it did in the last quarter.

Seeking Alpha, TECK, Earnings, Author’s Notes

Valuation

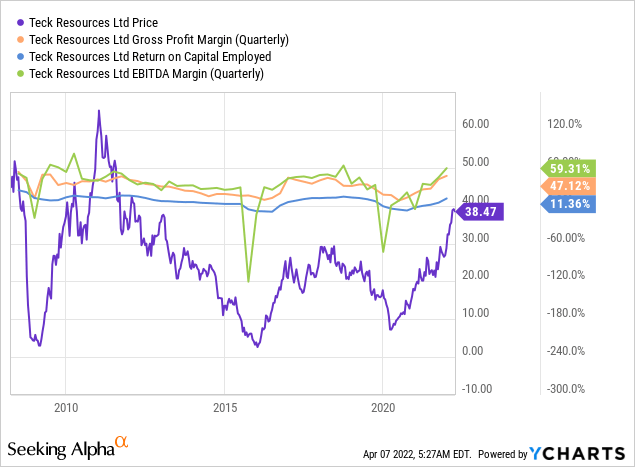

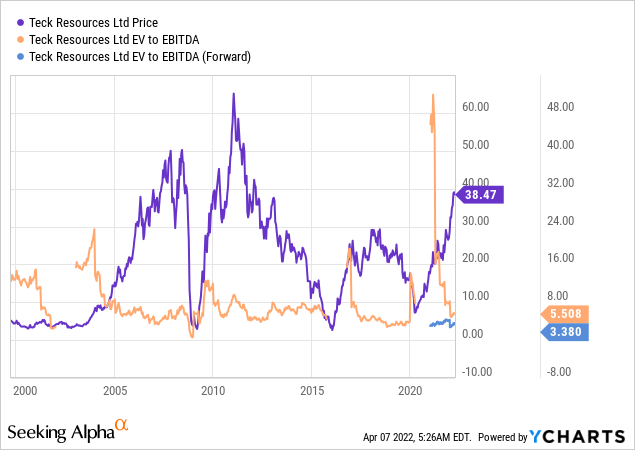

The price of TECK recovered to pre-pandemic levels – as did the company’s profitability and profit margins:

However, in pre-Covid times (2018-19), the company did not have as many prospects as it has today – there was not yet an energy crisis and certainly not as much demand for copper and zinc.

It is particularly gratifying that the company’s valuation is about the same as it was 2-3 years ago when no one suspected the current growth potential of the end market.

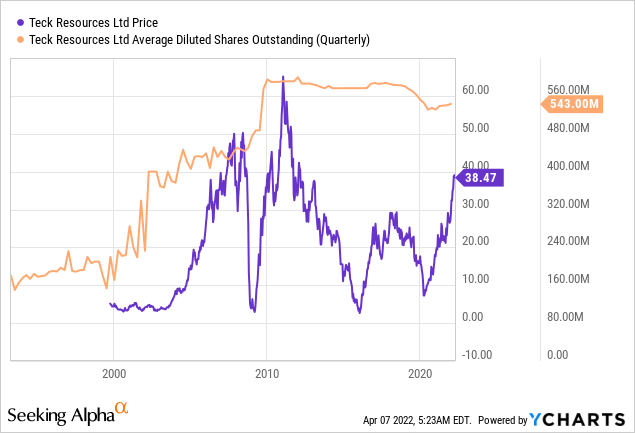

In addition, the number of shares outstanding since 2010 (the peak price) has decreased – the supply of shares has become more limited against the backdrop of more interesting prospects, which I mentioned above.

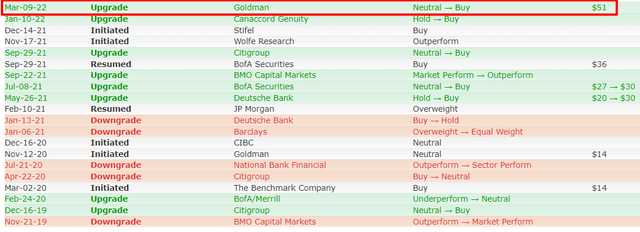

I would like to think that today’s events in Peru will serve as a catalyst for TECK to make another run upward – in any case, that would be logical. Therefore, I agree with Goldman Sachs’ price target of $51/share by the end of 2022:

Risks & Bottom Line

The main risks I consider are the following:

- The macroeconomy and the broad stock market. After yesterday’s Fed minutes, the stock market continued to correct, taking with it not only highly overvalued stocks of fast-growing companies but also value stocks with clear growth and development prospects. TECK was no exception in this regard – perhaps we will see lower entry prices than the current ones as liquidity in the stock market decreases.

- The insignificance of protest activity in Peru. If the protests end quickly, buyers of Peruvian copper will most likely not look for a replacement, and then my thesis will no longer make sense.

- The slowdown in industrial activity. Expensive base metals eventually lead to a slowdown in the economy as end buyers begin to reject them – it simply becomes prohibitively expensive. In this case, sales volumes could fall significantly despite higher prices for copper, zinc, and steelmaking coal – we cannot rule out seeing this as early as the Q1 2022 results at the end of April.

Despite all the risks, I believe that TECK, as one of the most attractive companies in its industry in its region, will be able to take advantage of the current geopolitical situation in the world and squeeze the maximum benefit out of it for itself and its shareholders. My price target is the same as GS’s One – $51 per share by the end of 2022. I hope to see a new rally after the upcoming quarterly report.

Happy investing and stay healthy!

Be the first to comment