Ian Gavan/Getty Images Entertainment

Published on the Value Lab 12/6/22

The main event for TeamViewer (OTCPK:TMVWF) has been its major marketing partnership with Manchester United (MANU). Having their logo plastered on the CR7 jersey has cost them a lot in EBITDA, with marketing costs more than 2xing YoY. EBITDA is still coming down despite operating leverage and cost containment, but we believe it is for a good cause. Firstly, these marketing partnerships don’t levy from the bottom line forever, and while they do, they provide a valuable exposure that TeamViewer needs as it goes from being known for its one remote access app to being a major enterprise tech player with an innovative AR platform for manufacturing. Billings growth continues to show underlying traction but there’s more to come in punctuated bursts from AR. We continue to be long.

Look at the Results

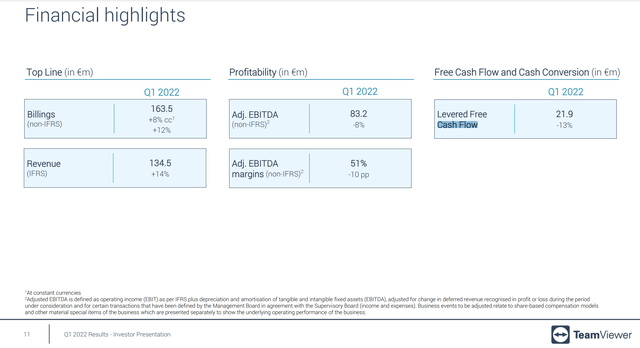

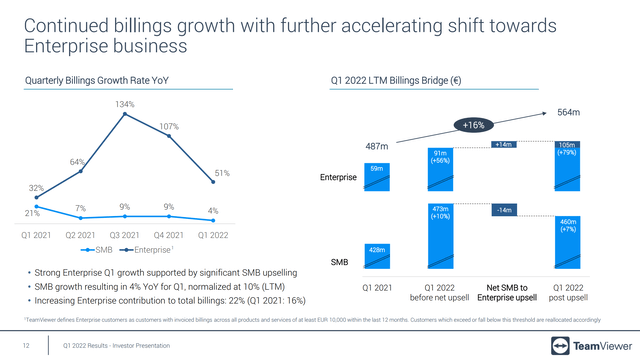

Let’s give the results a quick look. Firstly, billings are up, and new adds to subscriptions will mature due to some deferral into revenues. We like the situation as it stands. Enterprise billing is rocketing, and SMB billing despite some recategorisation of those segment sales into enterprise due to upselling, all thanks to growing ticket values within the segment.

Financial Highlights (Q1 2022 Pres)

Enterprise is now around 20% of the business’ billings, representing the highest ticket customers, and also a reflection of strong marketing partnerships with companies like SAP SE (SAP) which has its own warehouse management solutions for which TeamViewer is providing the AR and AI angle.

TeamViewer Upselling (Q1 2022 Pres)

The AR business is also growing with more bespoke partnerships with large clients. We mentioned last time Ford Motor (F) and ABB Ltd (ABB) as major clients who are adopting TeamViewer AR solutions for their state-of-the-art manufacturing. This already underlines the opportunity in predictive maintenance and remote maintenance as a market opportunity, with maintenance being a recurring and essential process for all manufacturing firms. It also represents the economics of the AR opportunity which bursts with growth upon the forging of more of these partnerships. Since some integration of the Frontline AR platform appears to be required to be able to add that exceptional value, contract economics will be more apparent as that portion of the business matures. The company informs us that half of the enterprise discussions are around AR and not just remote access products now and that the pipeline is growing nicely.

Final Thoughts

From a valuation consideration, the partnership with Manchester United is important. First of all, the bottom line has been severely impacted by the agreement to have TeamViewer logos front and center on MANU jerseys. The increase in marketing OPEX amounts to about 25% of current EBITDA. It is a massive amount. Sales growth and cost containment have limited declines in EBITDA to 8%, and EBITDA should get lapped as TeamViewer rides on the back of secular trends supported by a now essential manufacturing industry (thanks to inflation) embracing an important avenue of cost disruption. Most importantly, these costs are fixed, and are discretionary to an extent. The company can eventually cancel the partnership, and a new logo would appear on MANU logos in the season after the five-year period, also returning about 50 million EUR back to the bottom line annually. The deal of around 250 million EUR over the next five years is now also appearing in the cash flows, with a decline in levered cash flows of 13% with the first payments being made. The company trades at an 18x EV/EBITDA multiple. Normalising EBITDA for the extraordinary marketing spend puts it at a 14.4x multiple. With traction already proven in AR before the partnership, a 14x multiple seems low given how concrete and already in place the AR offering is. As a great GARP opportunity with a special situation angle, we like this stock and remain comfortably long.

If you thought our angle on this company was interesting, you may want to check out our service, The Value Lab. We focus on long-only value strategies, where we try to find international mispriced equities and target a portfolio yield of about 4%. We’ve done really well for ourselves over the last 5 years, but it took getting our hands dirty in international markets. If you are a value-investor, serious about protecting your wealth, our group of buy-side and sell-side experienced analysts will have lots to talk about. Give our no-strings-attached free trial a try to see if it’s for you.

Be the first to comment