pcess609

By Jay Jacobs

Growth investments have broadly struggled in 2022 due to the shifting macro environment with the Federal Reserve’s aggressive interest rate hikes intended to curb inflationary pressures.

Its impact on markets has been significant, with the S&P 500 down -16.14% on the year through August 31 – the worst start in nearly 50 years.1 But growth-focused investments such as the technology sector have been hit even harder: Through the first nine months of the year, the Nasdaq 100 Index was down -24.38%, while the S&P Technology Select Sector Index was down -21.80%).2

While this year is proving challenging for investors, the market sell-off may provide a silver lining: It opens the door for tax loss harvesting, which can both unlock potential tax benefits as well as offer an opportunity to reevaluate one’s portfolio amid the rising rate environment.

We believe there are three ways investors can seek to capture losses and reallocate to other potential growth opportunities.

Sharpen Growth Exposures: Target Precise Growth Opportunities Amid The Regime Shift

What worked in the past may no longer suffice in this new regime. In 2021, the Fed’s dovish monetary policies benefited virtually all asset classes, with many growth stocks and funds among the biggest winners.

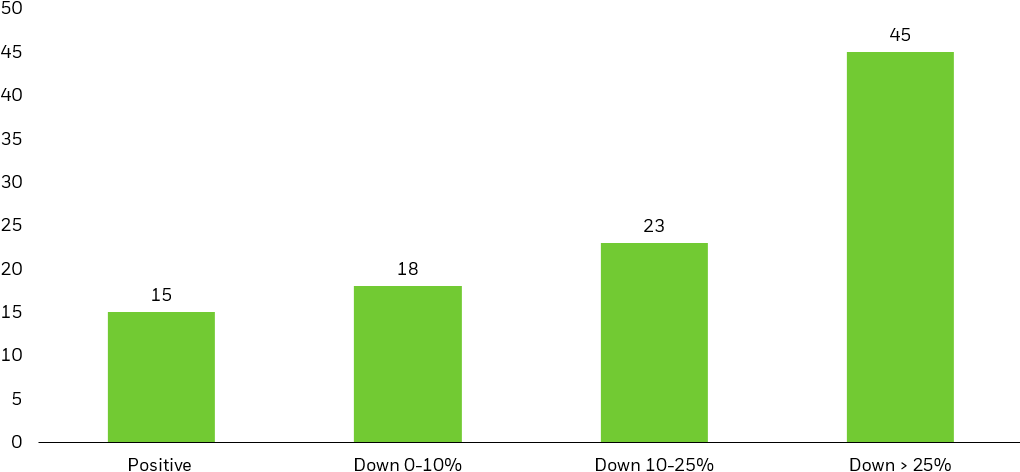

Yet in the current environment of rising rates and a shakier economic outlook, stocks in growth sectors like technology have not enjoyed the same tailwind. Approximately 45 names in the Nasdaq 100 Index were down more than 25% year-to-date, through the end of August.3

iShares recently posted a relevant article, A Masterclass in Diversification, which underscores why diversification matters – especially in volatile markets.

# of Nasdaq 100 constituents by YTD performance bucket

Source: FactSet, BlackRock, September 2022. Performance calculated as year-to-date total return through 8/31/22.

Note: Index performance is for illustrative purposes only. Index performance does not reflect any management fees, transaction costs or expenses. Indexes are unmanaged and one cannot invest directly in an index. Past performance does not guarantee future results.

Chart description: Column chart showing the number of Nasdaq 100 constituents across four year-to-date performance buckets: positive returns, down 0-10%, down 10-25%, and down more than 25%. The chart shows how many large cap companies within the index have had negative performance so far this year.

As a result, investors looking for continued growth exposure may need to seek out more targeted opportunities which, despite broader economic headwinds, could still benefit from long-term structural shifts in technology, demographics, and other areas.

Megatrend investing seeks to identify specific segments of the market which may be poised for potential long-term structural growth opportunities irrespective of sector, country, or size.

As an illustrative example, the Morningstar Exponential Technologies index “is designed to deliver diversified exposure to companies poised to benefit from innovative technologies with exponential growth potential.”4

The index targets several innovations propelled by long-term structural forces, including big data & analytics, cloud computing, energy transition technologies, fintech, health care devices and therapies, connectivity, nanotechnology, transportation, and robotics.

In today’s environment, a potential strategy to gain access to such an exposure includes harvesting losses in negatively performing growth-tilting funds and swapping them with more targeted megatrend strategies.

Spread Out The Risk: Avoid Overly Concentrated Bets By Shifting From Individual Stocks To Diversified Investments

Tumultuous markets also have a way of humbling individual stock selections. This year is no exception. Many names that were lauded for their stellar performance over the past two years – particularly large cap growth companies – have seen their fortunes reverse.

Some investors buy individual stocks with the intent of gaining exposure to a broader theme rather than the prospects of an individual company. Investment in a fast-growing electric vehicle stock for instance, can often be rooted in broader excitement around paradigm-shifting changes like the shift from gas to electric transportation.

Yet, investing in a single stock to capture a theme could present potentially avoidable risks. Attempting to pick the top future beneficiary of transformational changes can prove difficult and may miss a wider opportunity set.

For example, within the EV theme, not only are there several auto manufacturers who could benefit from rising EV adoption, but also there are several other areas of the EV value chain from battery producers, battery material suppliers, and technology developers that could benefit as well.

Diversified investment vehicles like ETFs can offer a means of reducing these potential risks and pain points. A potential strategy investors may want to consider for pivoting into such investments: selling individual stock positions with unrealized losses and swapping them with megatrends ETFs that provide more diversified exposure to the investment theme (please note wash sale exceptions).5

The iShares Product Screener can help investors by identifying ETFs that have exposure to a particular stock, among several other positions for improved diversification.

Maintain Exposure: Harvest Losses, While Staying Invested In High Conviction Themes

Investors may have experienced recent underperformance across existing thematic exposures. For example, indexes tracking the robotics, genomics and blockchain themes performed negatively through the first 8 months of the year.6 Although near-term performance has suffered, the downturn affords an opportunity for investors to capture losses and fine-tune their exposures.

While some thematic strategies can be too highly concentrated and volatile and others can be too dilutive and duplicative, investors may want to consider megatrend ETFs with four principles in mind:

- Precision: Built to capture the pure-play names driving cutting-edge themes to new frontiers.

- Diversity: Intended to capture niche players across a theme’s full value-chain across the globe.

- Agility: Designed to evolve as a theme advances and key players change

- Affordability: Priced at the low end of the range for comparable options in the market today.

Conclusion

With growth investments broadly performing negatively thus far this year, investors may want to consider harvesting losses and allocating to positions which may be better suited for the new market regime. We’ve identified three potential tax loss harvesting strategies:

- Sharpen growth exposures: Consider swapping under-performing growth investments with exposures that zero-in on high growth potential themes dictated by structural shifts in technology, demographics, and more.

- Spread out the risk: Investing in a single stock to capture a theme could present potentially avoidable risks. Megatrend ETFs can address this pain point by investing in dozens of pure-play stocks across a theme’s value chain, providing the access to narrow investment themes offered by single stock investment, but with the potential benefits of diversification.

- Maintain exposure: Consider investments that will maintain portfolio allocation to individual sectors or themes, while increasing exposure to areas of high growth potential.

iShares’ breadth of megatrend ETFs provide targeted exposure to high growth themes across breakthrough technologies, climate, demographics, global wealth, and urbanization.

| © 2022 BlackRock, Inc. All rights reserved.

1 FactSet, YTD through August 31, 2022. Past performance is not indicative of future results. 2 FactSet, YTD through August 31, 2022. Past performance is not indicative of future results. 3 FactSet, YTD through August 31, 2022. Past performance is not indicative of future results. 4 Morningstar, September 21, 2022. 5 Note: The Internal Revenue Service has not released a definitive opinion regarding the definition of “substantially identical” securities and its application to the wash sale rule and ETFs. The information and examples provided are not intended to be a complete analysis of every material fact respecting tax strategy and are presented for educational and illustrative purposes only. Tax consequences will vary by individual taxpayer and individuals must carefully evaluate their tax position before engaging in any tax strategy. 6 FactSet, YTD performance of the NYSE FactSet Global Genomics and Immuno Biopharma Index, NYSE Factset Global Blockchain Technologies Index, and NYSE FactSet Global Robotics and Artificial Intelligence Index, through August 31, 2022. Past performance is not indicative of future results. Carefully consider the Funds’ investment objectives, risk factors, and charges and expenses before investing. This and other information can be found in the Funds’ prospectuses or, if available, the summary prospectuses, which may be obtained by visiting the iShares Fund and BlackRock Fund prospectus pages. Read the prospectus carefully before investing. Investing involves risk, including possible loss of principal. Index performance is for illustrative purposes only. Index performance does not reflect any management fees, transaction costs or expenses. Indexes are unmanaged and one cannot invest directly in an index. Past performance does not guarantee future results. Index performance does not represent actual Fund performance. For actual fund performance, please visit www.iShares.com or www.blackrock.com. Diversification and asset allocation may not protect against market risk or loss of principal. Funds that concentrate investments in specific industries, sectors, markets or asset classes may underperform or be more volatile than other industries, sectors, markets or asset classes and than the general securities market. Transactions in shares of ETFs may result in brokerage commissions and will generate tax consequences. All regulated investment companies are obliged to distribute portfolio gains to shareholders. The information provided is not intended to be tax advice. Investors should be urged to consult their tax professionals or financial professionals for more information regarding their specific tax situations. The Funds are distributed by BlackRock Investments, LLC (together with its affiliates, “BlackRock”). The iShares Funds are not sponsored, endorsed, issued, sold or promoted by Bloomberg, BlackRock Index Services, LLC, Cohen & Steers, European Public Real Estate Association (“EPRA®”), FTSE International Limited (“FTSE”), ICE Data Indices, LLC, NSE Indices Ltd, JPMorgan, JPX Group, London Stock Exchange Group (“LSEG”), MSCI Inc., Markit Indices Limited, Morningstar, Inc., Nasdaq, Inc., National Association of Real Estate Investment Trusts (“NAREIT”), Nikkei, Inc., Russell or S&P Dow Jones Indices LLC or STOXX Ltd. None of these companies make any representation regarding the advisability of investing in the Funds. With the exception of BlackRock Index Services, LLC, which is an affiliate, BlackRock Investments, LLC is not affiliated with the companies listed above. Neither FTSE, LSEG, nor NAREIT makes any warranty regarding the FTSE Nareit Equity REITS Index, FTSE Nareit All Residential Capped Index or FTSE Nareit All Mortgage Capped Index. Neither FTSE, EPRA, LSEG, nor NAREIT makes any warranty regarding the FTSE EPRA Nareit Developed ex-U.S. Index or FTSE EPRA Nareit Global REITs Index. “FTSE®” is a trademark of London Stock Exchange Group companies and is used by FTSE under license. © 2022 BlackRock, Inc. All rights reserved. BLACKROCK, BLACKROCK SOLUTIONS, BUILD ON BLACKROCK, ALADDIN, iSHARES, iBONDS, FACTORSELECT, iTHINKING, iSHARES CONNECT, FUND FRENZY, LIFEPATH, SO WHAT DO I DO WITH MY MONEY, INVESTING FOR A NEW WORLD, BUILT FOR THESE TIMES, the iShares Core Graphic, CoRI and the CoRI logo are trademarks of BlackRock, Inc., or its subsidiaries in the United States and elsewhere. All other marks are the property of their respective owners. iCRMH0922U/S-2431578 |

This post originally appeared on the iShares Market Insights.

Be the first to comment