metamorworks/iStock via Getty Images

“The more the panic grows, the more uplifting the image of a man who refuses to bow to the terror.” – Ernst Junger

Today, we take a look at a small tech services stock that came public last summer. Like almost every small-cap debut from that ‘vintage’, the shares find themselves in ‘Busted IPO’ territory. Most of the recent IPOs analysts have had similar declines which seem to have been merited. In case of the particular Busted IPO, there appears to be a bit of ‘Throwing the baby out with the bathwater‘ trading action around it. An analysis follows below.

Company Overview:

TaskUs, Inc. (NASDAQ:TASK) is a New Braunfels, Texas based digital business process outsourcing concern, operating digital call centers and providing content security for social media, ecommerce, delivery, fintech, and many other verticals. As of December 31, 2021, the company boasted a client roster of over 100 technology concerns, including 16 that paid it more than $10 million and 72 that generated more than $1 million in FY21. TaskUs was formed in 2008 and went public in June 2021, raising net proceeds of $120.7 million at $23 per share. Its stock currently trades for around $15.50 a share, translating to an approximate market cap of $1.5 billion.

February Company Presentation

The company is capitalized by two classes of stock. The 27.4 million shares of publicly traded Class A stock confer economic interest and one vote per share. The 70.0 million shares of privately owned Class B stock bestow economic rights, ten votes per share, and is convertible into Class A stock. Owing to this arrangement, Blackstone (BX) and the company’s co-founders control 96% of the voting rights.

Revenue Disaggregation

TaskUs employs 40,100 ‘teammates’ worldwide in eight countries with the majority (~27,100) residing in the Philippines. Currently, with pandemic concerns still menacing, ~90% work from home. They perform three primary services for the company’s clients: Digital Customer Experience (Digital CX); Content Security; and Artificial Intelligence Operations (AI Ops).

February Company Presentation

Digital CX provides user support via chat, SMS, social, or in-app to ride-sharing, e-commerce, food delivery, and media streaming clients – essentially digital call centers – as well as customer acquisition and product launch services. Emphasizing the digital nature of TaskUs offerings, only 8% of this revenue line item was generated from voice services. DoorDash (DASH) is its largest client, responsible for 11% of TaskUs’s total topline. Overall, Digital CX accounted for FY21 revenue of $487 million, representing 64% of the company’s total. According to Market Reports World, the total addressable market for customer care outsourcing is ~$70 billion and should grow at a CAGR of 3% to 4% through 2027. There are plenty of competitors (~40) in the space, with Teleperformance (OTCPK:TLPFF), TTEC Holdings (TTEC), Concentrix (CNXC), Webhelp, and Sitel Group amongst the largest. Owing to the digital nature of its offering and its fast-growing digital technology customers, TaskUs believes the long-term growth opportunity from its target customers to be 20% to 25%.

February Company Presentation

Content Security moderates content on social media and other marketplace platforms to make sure it complies with its clients’ guidelines. Ever have your ‘objectionable‘ post removed from Meta Platforms’ (META) Facebook? There is a chance it was a TaskUs employee who was responsible as the company is one of ten or more outside moderators contracted by Facebook to perform this task. Meta is by far TaskUs’s largest client, responsible for 27% or its total topline (from Content Security and other services) in FY21. Content Security generated FY21 revenue of $169 million, or 22% of the company’s total. The content security market, which is dominated by Facebook and Google’s (GOOG) (GOOGL) YouTube is estimated at $4 billion to $5 billion but is expected to accelerate at a CAGR of 30% to 40% through 2023. For these accounts, TaskUs contends with the likes of Accenture (ACN), Teleperformance, Genpact (G), Concentrix, and Majorel.

February Company Presentation

AI Ops includes data tagging, annotating, and transcription services for the purpose of increasing the efficiency of AI algorithms. AI Ops generated FY21 revenue of $105 million, comprising 14% of TaskUs’s total. AI services is currently a ~$20 billion market that should grow at a 21% CAGR over the next five years.

February Company Presentation

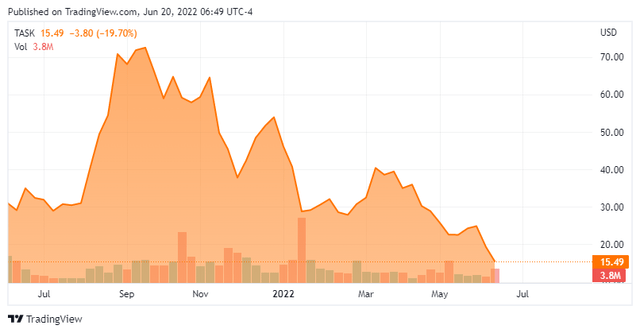

Stock Price Performance

After pricing its IPO at $23, TaskUs’s first trade as a public company transpired at $27.55 and its stock did not look back, peaking at $85.49 a share in late September 2021, putting (at that time) its price-to-FY21 sales ratio at 10.9. This enthusiasm was defensible as the company was growing revenue at 59% to $760.7 million and Adj. EBITDA at 76% to $187.9 million in FY21 (vs FY20) while it was bottom line profitable, eventually earning $1.26 a share on a non-GAAP basis, up 66% over FY20. Additionally, it had less than a 1% share in markets that were anticipated to grow meaningfully.

Then, the selloff began. In addition to the risk-off trade hurting high-flyers like TaskUs, there were company-specific concerns. A significant portion of TaskUs’s workforce is in the Philippines and India, owing to the fact that labor in those geographies has been very cheap relative to first-world economies. For proof of this dynamic, one needs to look no further than the company’s revenue per employee metric, which was only $22,800 in FY20 and $24,000 in FY21, yet TaskUs was profitable. Concerns that labor wage inflation in these two countries would rise significantly more than the company’s revenue per employee – thus, squeezing margins – weighed on the stock. Also, worries about TaskUs’s revenue concentration – with its two largest clients collectively responsible for 38% of its topline – negatively impacted valuation.

Then on January 20, 2022, short selling house Spruce Point Capital Management issued a report echoing the aforementioned concerns as well as some additional ones about the company’s accounting for certain items (e.g., the pandemic) and other mostly minor credibility issues in January 2022. The market took the report to heart, walking away from a stock that was already down 58% from its September 2021 highs, falling another 15% that day to $30.13 and not finding a bottom ($25.12) until shortly before its 4Q21 earnings announcement and update on February 28, 2022.

Recent Earnings Reports

That report included a gain of $0.34 a share (non-GAAP) and Adj. EBITDA of $56.2 million on revenue of $226.8 million versus a gain of $0.22 a share (non-GAAP) and Adj. EBITDA of $32.9 million on revenue of $138.8 million in 4Q20, representing year-over-year gains of 55%, 70%, and 63%, respectively. EBITDA margin was 24.8% for the quarter and 24.7% for FY21. The bottom line matched Street consensus while the topline was $10.8 million better. Its average net retention rate was 141% in FY21 while it added 41 new clients during the year at a win rate of 49%.

February Company Presentation

The company also addressed the concerns hurting its stock price. First, many of its contracts have cost of living increases incorporated into them, which should mitigate any perceived labor cost concerns. Second, after Facebook (from which revenues should be flat in FY22), management expects two of its next four top clients to grow revenues at triple digits in FY22 and the other two to grow at a double-digit rate. Furthermore, flat revenue from Facebook is a function of a program that will shift resources overseas in a move to save its client money. Facebook has already responded in kind, awarding two more opportunities to TaskUs, which should ensure that revenue growth from its top client will resume in FY23.

February Company Presentation

Also, heartening to the market was TaskUs’s outlook, with management projecting FY22 topline growth of 30% to $990 million (at a range midpoint) versus Street expectations of $956.2 million. FY22 Adj. EBITDA margin was forecasted at 23%, or $227.7 million, representing a 21% increase over FY21.

Buoyed by this news, the market bid shares of TASK 16% higher to $33.37 in the subsequent trading session, which the stock has given up over the last two months as equities have entered a bear market.

May Company Presentation

On May 9th, the company reported first quarter results. TaskUs had a non-GAAP profit of 34 cents a share as revenues rose over 55% on year-over-year basis to nearly $240 million. Both top and bottom line numbers slightly beat the consensus estimate.

First Quarter 2022 Financial and Frontline Highlights

| ($ thousands, except per share amounts) | Three months ended March 31, | |||||||||

| 2022 | 2021 | % Change | ||||||||

| Service revenue | $ | 239,680 | $ | 152,871 | 56.8 | % | ||||

| GAAP net income | $ | 11,586 | $ | 16,507 | (29.8) | % | ||||

| GAAP net income margin | 4.8 | % | 10.8 | % | ||||||

| Adjusted EBITDA | $ | 54,131 | $ | 39,541 | 36.9 | % | ||||

| Adjusted EBITDA margin | 22.6 | % | 25.9 | % | ||||||

| Non-GAAP Adjusted Net Income | $ | 34,965 | $ | 28,198 | 24.0 | % | ||||

| Non-GAAP Adjusted Net Income margin | 14.6 | % | 18.4 | % | ||||||

| GAAP diluted earnings per share | $ | 0.11 | $ | 0.18 | (38.9) | % | ||||

| Non-GAAP Adjusted EPS | $ | 0.34 | $ | 0.31 | 9.7 | % | ||||

Leadership guided to $980 million to $1 billion worth of revenues in this fiscal year, representing 30% sales growth over the prior fiscal year. The company also added just over 10% to its workforce over the quarter.

| 2022 Outlook | |||||

| Second Quarter | Full Year | ||||

| Revenue (in millions) | $241.5 to $243.5 | $980 to $1,000 | |||

| Revenue growth (YoY) at midpoint | 35% | 30% | |||

| Adjusted EBITDA Margin | 22.5% | 23% | |||

Balance Sheet & Analyst Commentary:

TaskUs did burn through $32.7 million of cash from operating activities in FY21 as accounts receivables expanded $76.2 million to $162.9 million as a large client (most likely Facebook) went from paying immediately to paying per contract terms. It also invested $59.4 million into technology and site expansions. The company had cash of $77.7 million and long-term debt of $183.4 million at the end of first quarter of 2022. The balance sheet is in sound shape with net leverage of under 0.9.

Since first quarter earnings were posted, seven analyst firms including Goldman Sachs and BTIG have reissued Buy or Outperform ratings on the stock. Albeit several ratings contain downward price target revisions. Price targets proffered range from $35 to $45. Wells Fargo maintained its Hold rating and $37 price target on TaskUs’s post earnings announcement. There has been no insider activity in the stock so far in 2022. Under three percent of the shares are currently held short.

Verdict:

On average, analysts expect the company to earn $1.40 a share (non-GAAP) on revenue of just a tad under $1 billion in FY22, representing 9% and 31% improvements over FY21.

May Company Presentation

The significant selloff leaves shares of TASK trading at a forward PE of around 11, a forward price-to-sales ratio of around 1.5, and a forward EV/Adj. EBITDA of approximately 7. Given its growth trajectory, these are more than reasonable valuations, and management has demonstrated prudence regarding its forecasts as a publicly traded concern.

“The wisest rule in investment is: when others are selling, buy. When others are buying, sell. Usually, of course, we do the opposite. When everyone else is buying, we assume they know something we don’t, so we buy. Then people start selling, panic sets in, and we sell too.” – Jonathan Sacks

Be the first to comment