Byrdyak/iStock via Getty Images

I previously covered U.S. retailer Target Corporation (NYSE:TGT) in a comparative analysis along with industry giant Walmart Inc. (WMT) when both stocks fell off a cliff due to lower-than-expected earnings and lowered forecasts. Since my article, both stocks have hit new 52-week lows, and Target bottomed at about $140, down nearly 50% from its all-time high. Since then, the stock price has risen about 20%, but is still well below pre-1Q earnings levels. In my last article, I wrote that I didn’t think the stock was a buy at $160 because Target, with its very large SKU count, could be disproportionately affected by persistent supply chain bottlenecks and inflationary pressures. The retail environment is fiercely competitive, and retailers with leaner inventory structures have an advantage.

In this article, I will provide deeper insights into Target’s seasonality in terms of margins, inventory management and cash management, and share my thoughts on the company’s upcoming Q2 results, which are expected to be released on August 17.

Margin Pressures

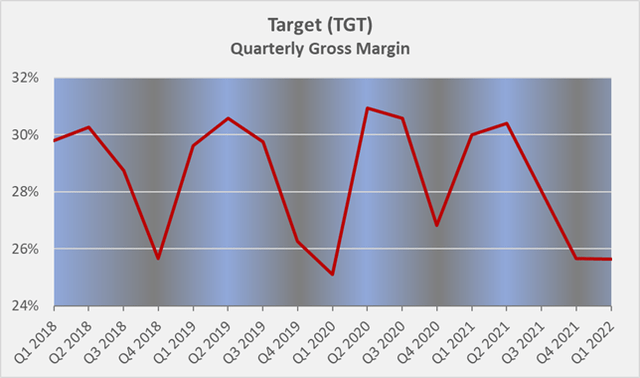

Investors clearly did not expect Target’s first-quarter earnings to decline so significantly, as evidenced by the magnitude of the stock price drop. In the first quarter of 2022, operating income fell nearly 50% to $1.3 billion, and the company’s gross margin declined 430 basis points year-over-year. Compared to the margin pressure Clorox (CLX) is currently facing (e.g., 730 basis points year-over-year in the fiscal fourth quarter), that does not sound like much, but it is important to remember that retailers typically operate on much lower margins than the manufacturers of the products they sell. Figure 1 shows that Target’s gross margin on a quarterly basis is fairly cyclical, declining in the fourth quarter and recovering in the first quarter of the next year. In 2022, however, gross margin has not recovered due to inflationary pressures.

Figure 1: Target’s quarterly gross margin (own work, based on the company’s 10-Qs and fiscal year-end 8-Ks containing quarterly data)

Retailers are under pressure from both sides and need to be careful about passing on price increases to customers, whose switching efforts are likely to be small given the large number of retailers. It should come as no surprise, then, that retailers are lagging other industries when it comes to gross margin recovery. However, loyalty programs often enable retailers to retain and grow their base of returning customers. Target’s loyalty program is tied to the use of the Target Debit Card, Target Credit Card or Target MasterCard and offers a 5% discount on nearly all purchases, as well as free shipping on Target.com. The company continues to offer customers excellent value, and management has a knack for sourcing and forecasting consumer demand.

Target, like its competitors, will continue to pass on price increases to consumers, but it will take a while for profitability to recover. Management knows this and has communicated the problems accordingly. To mitigate the impact of unusually high fuel and transportation costs and large inventories, management announced a plan to reduce inventory levels, add storage capacity near U.S. ports and optimize supply chains.

Therefore, it does not seem unreasonable to expect another bad quarter in terms of gross margin. Reducing inventories will improve operating cash flow, but of course put pressure on margins. Since management did not announce its aggressive inventory management program until June, i.e., well after first quarter results were released, investors should expect to see the corresponding impact in the second quarter, which ends in late July or early August, and beyond. Of course, it is unreasonable to expect the margin pressure to persist. In the long term, management expects operating profitability to return to the 8% range, which is certainly strong for a retailer with such a broad merchandise assortment.

Implications On Target’s Free Cash Flow

The measures announced at the beginning of June are likely to result in an increase in operating cash flow compared with the previous quarter, mainly due to inventory markdowns. This should show up in Target’s cash flow statement for the second quarter of 2022 and, of course, for fiscal 2022 as a whole. Of course, the markdowns will continue for a while, so investors should take this effect into account when evaluating Target’s normalized free cash flow, as this apparent boost to free cash flow is not sustainable (but of course comes after a quarter of heavy inventory build-up).

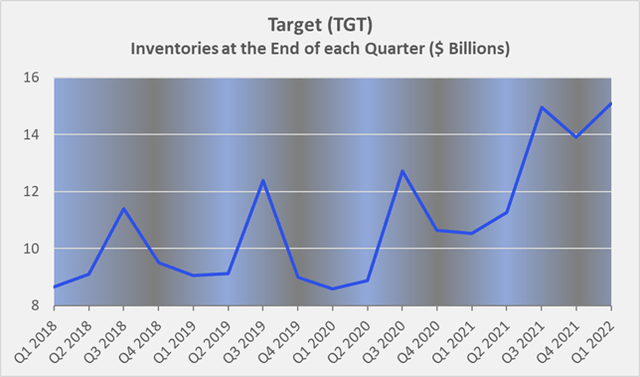

While Target reported a positive change of $114 million in Q1 2021, the company reported a negative change in inventories (an increase) of nearly $1.2 billion in Q1 2022. As a result, Q1 2022 free cash flow decreased nearly $3 billion (!) year-over-year from $599 million to negative $2.35 billion. The extent of the increase in inventories (in volume and value terms) is shown in Figure 2. Inventories increase in Q3 in preparation for the holiday season and are depleted during that time. Not so much, however, in Q4 2021, so it is safe to conclude that the markdowns will be very significant, putting severe pressure on Target’s margins. Consumers benefit from this development and I expect this to dampen consumer price inflation in the coming months, as many companies are plagued by inventory issues (e.g., also manufacturing companies like Stanley Black & Decker (SWK) – see my recent article).

Figure 2: Target’s inventories at the end of each quarter (own work, based on the company’s 10-Qs and fiscal year-end 8-Ks containing quarterly data)

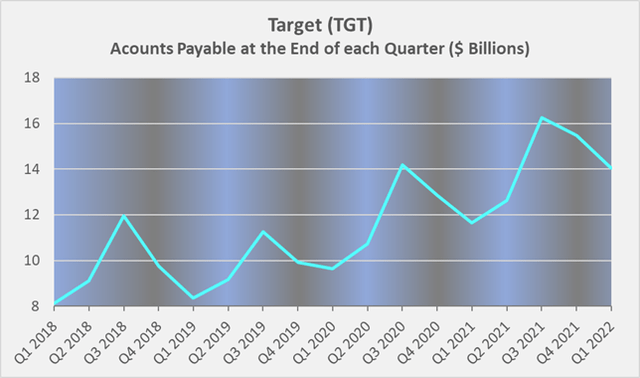

Target’s disproportionate year-over-year decline in free cash flow is also attributable to the negative $1.56 billion change in accounts payable. The sharp decline in trade payables in the fourth quarter and first quarter of the following year is due to the fact that the company usually reduces said liabilities, which were incurred in the course of building up inventories for the holiday season (Figure 3).

Figure 3: Target’s accounts payable at the end of each quarter (own work, based on the company’s 10-Qs and fiscal year-end 8-Ks containing quarterly data)

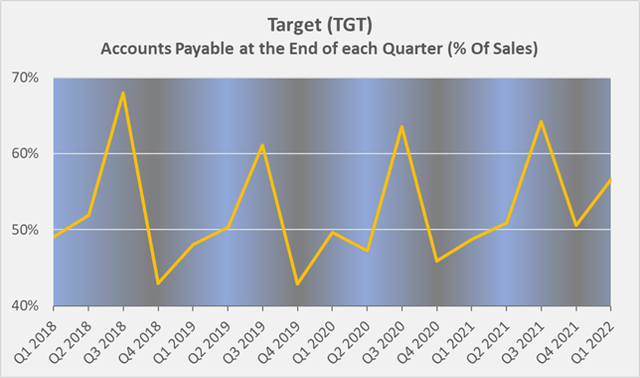

As a retailer, Target cannot smooth its working capital by cashing in receivables (its customers typically pay immediately), and investors should expect negative free cash flow in the first half of 2022 from that perspective as well. However, the company will likely increase its accounts payable due to the seasonality of its business, which will naturally benefit free cash flow in the second quarter and beyond. Critical investors might argue that Target’s accounts payable is still disproportionately high compared to prior years, but I would counter that it is well proportioned relative to sales (Figure 4). Target’s quarterly sales have grown at a compound annual growth rate (CAGR) of nearly 11% over the past four years, or 12% on a three-year annualized basis.

Figure 4: Target’s accounts payable at the end of each quarter as a percentage of sales (own work, based on the company’s 10-Qs and fiscal year-end 8-Ks containing quarterly data)

What To Expect On Wednesday, And A Consolation For Long-Term Holders

I expect analysts and the media to focus on Target’s gross margin, which I believe will continue to be under pressure as the company reduces its excessive inventory levels. It is possible that this will lead to a resurgence of selling pressure, especially in the event that the current optimistic market sentiment wanes. Investors looking to open a position ahead of the earnings release on Wednesday should also keep in mind that rival Walmart issued a profit warning just a few weeks ago amid ongoing inventory problems and high inflation.

Long-term oriented investors, of course, should not overreact and sell on emotion if the company reports another poor quarter. Target’s management is astute, the company is well capitalized, has a long-term debt rating of A (Standard & Poor’s), pays out only a small portion of its earnings as dividends, and has taken steps to restore operating profitability. Management’s long-term view appears to be very optimistic, as evidenced, for example, by the generous 20% dividend increase announced in June. Inventory markdowns will hurt profitability in the short term, but will most certainly lead to strong customer traffic. If Target times its price increases well, the current situation could actually prove beneficial to the company, as its procurement teams are very aware of current and near-term consumer expectations.

I therefore share the optimism recently expressed by UBS analyst Michael Lasser. He believes Target is “well positioned to capitalize on changing consumer behaviors and habits.” However, I expect companies like Costco Wholesale (COST) to do better operationally (though not necessarily from a stock price perspective) because their supply chains are much simpler and inventory management overhead is therefore much lower, largely due to the fact that Target offers about 20 times as many stock keeping units as Costco Wholesale.

I currently do not own Target stock in my portfolio and am still reluctant to opening a position here. Investor sentiment has improved dramatically in recent weeks, which I personally consider largely unfounded. Also taking into account that consumer credit numbers look increasingly negative, I do actually expect a clouding of investors’ sentiment in the fall or winter. However, I am keeping the stock on my watch list as I think Target is an excellent and well-run company.

Thank you very much for taking the time to read my article. In case of any questions or comments, I’m very happy to read from you in the comments section below.

Be the first to comment