onurdongel

On Thursday, August 25, 2022, midstream giant Targa Resources Corp. (NYSE:TRGP) announced its second quarter 2022 earnings results. One of the prevailing trends that we have been seeing in the midstream industry is that many companies are posting very solid results with significant year-over-year growth. We certainly see that in Targa Resources’ results, as the company beat the expectations of its analysts in terms of revenues and posted fairly substantial year-over-year cash flow growth.

It is unlikely that this will be the only growth that we see from this company in the near term, however, as it has quite a few growth projects in the works that we should see consummated in the near future. Unfortunately for most people that invest in this sector, however, Targa Resources has a very low 1.59% yield, so the company is unlikely to appeal to the typical income-seeker that invests in midstream companies. The company has also given no indication as to if and when it will increase the payout, so that may be another strike against it. Although a traditional midstream investor may not be interested, these results were still quite good and show that the company may be attractive to a more growth-oriented investor.

As my long-time readers are no doubt well aware, it is my usual practice to share the highlights from a company’s earnings report before delving into an analysis of its results. This is because these highlights provide a background for the remainder of the article as well as serve as a framework for the resultant analysis. Therefore, here are the highlights from Targa Resources’ second-quarter 2022 earnings results:

- Targa Resources brought in total revenues of $6.0558 billion in the second quarter of 2022. This represents a 77.28% increase over the $3.4159 billion that the company brought in during the prior-year quarter.

- The company reported an operating income of $451.9 million during the reporting period. This is an 83.85% increase over the $245.8 million that the company reported in the year-ago quarter.

- Targa Resources announced the construction of a new natural gas processing plant in the Permian Basin that will be capable of processing about 275 million cubic feet of natural gas per day.

- The company reported a distributable cash flow of $533.4 million in the current quarter. This compares very favorably to the $339.5 million that the company reported last year.

- Targa Resources reported a net income of $372.7 million in the second quarter of 2022. This represents an enormous 983.43% increase over the $34.4 million that the company reported in the second quarter of 2021.

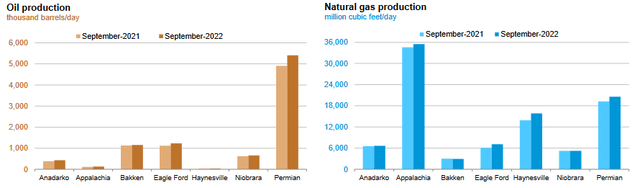

It is essentially certain that the first thing that anyone reading these highlights will notice is that every measure of financial performance improved substantially compared to the prior-year quarter. There are a few reasons for this. One of the major ones is that the company’s gathering and processing system in the Permian Basin had considerably higher volumes than in the same quarter of last year. This is not particularly surprising since the purpose of gathering pipelines is to grab produced at the wellhead and then transport them to a long-haul pipeline or a processing plant. Over the past year, the upstream production in the Permian Basin has increased significantly due to the steep increases in energy prices that we have seen over the period:

U.S. Energy Information Administration

Naturally, if production increases, the number of resources carried by Targa Resources’ gathering pipelines will also go up. This increases the company’s revenues because of the business model that is used by this kind of pipeline. In short, Targa Resources enters into long-term contracts with the actual producer of the resources to carry the crude oil and natural gas away from the well. The customer pays Targa Resources based on the volume of resources that are transported. Thus, an increase in volumes results in higher revenue for Targa Resources. This higher revenue means that more money is available to make its way down to the company’s bottom line.

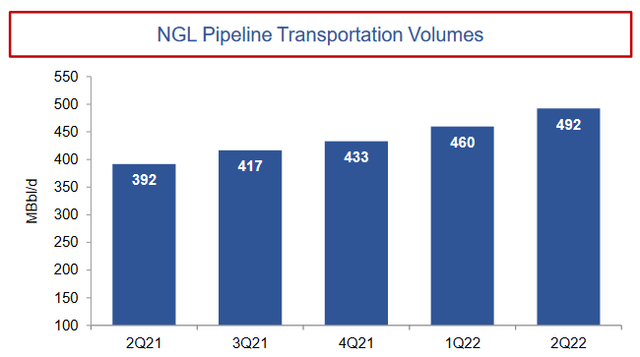

It was not only the gathering pipelines that saw higher volumes during the quarter. As I pointed out in a previous article, the global demand for natural gas liquids has been growing substantially. Targa Resources benefited from this during the second quarter as its natural gas liquids pipelines saw record volumes during the quarter. This follows on the heels of a string of repeated volume increases:

These pipelines work under the same volume-based contractual business model as the company’s gathering pipelines. We can therefore see that the record volumes here also served to increase Targa Resources’ revenues and cash flows. Admittedly, Targa Resources does not actually provide any reason for the higher volumes as the company only states that it was caused by higher volumes coming from both its own and third-party gathering systems. This could be simply a side effect of the increased crude oil and natural gas drilling but as already mentioned the demand for natural gas liquids has been growing. Thus, it seems quite likely that these volumes will continue to increase going forward as a direct result of these two factors as long as energy prices remain high.

There is another factor that will likely drive growth over the remainder of the year besides simply growing volumes. The biggest catalyst for this growth is a recent acquisition. In July 2022, Targa Resources completed the acquisition of Lucid Energy Delaware. This is a natural gas gathering and processing company that owns and operates 1,050 miles of natural gas gathering pipelines and 1.4 billion cubic feet per day of natural gas processing capacity. Thus, we can see that this acquisition should significantly increase Targa Resources’ presence in the natural gas midstream space, which could prove to be very beneficial going forward. This is because of the incredibly strong fundamentals for natural gas, which I have discussed in many previous articles (such as this one).

However, the most important thing for our purposes today is the fact that Targa Resources completed this acquisition in July. Thus, we should see the impact of the new assets reflected in Targa Resources’ third quarter results. This should provide a significant quarter-over-quarter financial boost. The combination of the solid performance of the company’s original businesses plus this acquisition may be one reason why management increased its 2022 guidance in connection with the earnings announcement.

This acquisition is certainly not going to be Targa Resources’ only source of growth. In fact, the company has a number of growth projects that are currently under construction and expected to come online in the near future. Perhaps the most important of these projects is the Legacy I and Legacy II natural gas processing plants in the Permian Basin. These two plants together are capable of processing approximately 275 million cubic feet of natural gas per day.

The nice thing here is that Targa Resources has already secured contracts from customers for the use of this capacity. Thus, we know that they will be cash flow positive as soon as they come online. Therefore, we can be sure that the growth will happen as soon as they start operating. The first of these plants that will come online is Legacy I, which will occur in the next month or so. We can therefore expect a relatively small impact from this facility beginning operations in Targa’s third-quarter results but we should especially expect to see a boost to the company’s fourth-quarter results because it will be operational for the entire quarter instead of only a small percentage of the period.

As noted in the highlights, the growing demand for natural gas has prompted Targa Resources to begin construction on another natural gas processing plant. This is the Greenwood plant, which is also located in the Permian Basin. This plant will be capable of processing approximately 275 million cubic feet of natural gas per day so it is in the same size range as the other plants that Targa Resources has been constructing. As is the case with the company’s other natural gas plants, Targa Resources has already secured contracts for the use of this processing capacity so we can be sure that the plant will be accretive to the company’s revenues and cash flows once it starts operations. This plant’s planned start-up date is late in the fourth quarter of 2023 so we can expect it to drive the company’s growth heading into 2024.

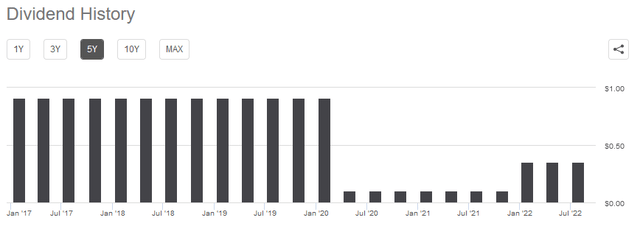

One of the biggest reasons why many investors purchase shares in midstream companies like Targa Resources is because of the outsized yields that they tend to pay out. However, Targa Resources is a notable exception to this as the company’s 1.59% current yield is nothing to write home about. This low yield is the result of a substantial dividend cut that the company implemented back in 2020, although it did increase it earlier this year:

However, management has provided no indication if and when the dividend will be increased again and so new money is only going to receive the meager yield currently available for the time being. This is not nearly enough to appeal to most income-focused investors considering that many of Targa Resources’ peers are paying yields above 5% at current prices. With that said though, the company’s strong growth prospects may attract some investors that are seeking that. As is always the case, it is critical that we ensure that the company can actually afford the dividend that it pays out since we do not want to find ourselves the victims of another dividend cut.

The usual way that we analyze a midstream company’s ability to carry its dividend is by looking at a metric known as the distributable cash flow. Distributable cash flow is a non-GAAP metric that theoretically tells us the amount of cash that was generated by the company’s ordinary operations that is available to be distributed to the stockholders. As stated in the highlights, Targa Resources had a distributable cash flow of $533.4 million in the second quarter of 2022. However, the company only pays out $109.8 million in common and preferred dividends. This gives the company an impressive coverage ratio of 4.86x. Analysts generally consider anything over 1.20x to be reasonable and sustainable and as we can see, Targa Resources easily surpasses that. Overall, we can see that this dividend is almost certainly sustainable.

In conclusion, Targa Resources does appear to have a decent bit to offer an investor, albeit not one seeking income. In particular, the company has some significant growth prospects that should position it well heading into both 2023 and 2024. This might result in some increases to the dividend, but management has not stated that. The company’s strong and growing presence in the natural gas space is nice to see as well given the strong demand growth for this substance that we will likely see over the next few years. Overall, the company may be worth considering.

Be the first to comment