microgen/iStock via Getty Images

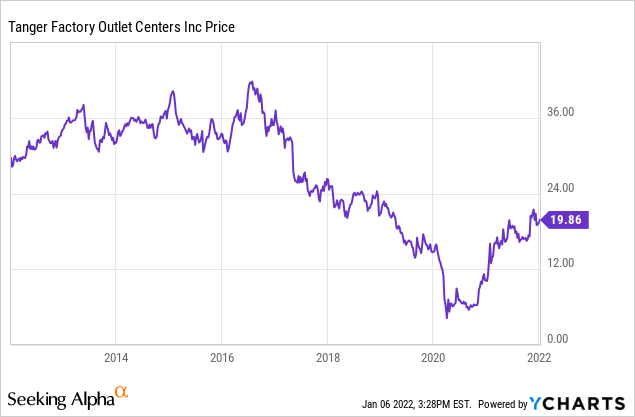

Upwinded by e-commerce, with its business model seriously challenged, Tanger Factory Outlet Centers (SKT) – along with all the other regional mall REITs – went into a serious nosedive in 2016.

And just when it seemed it couldn’t get any worse, the COVID pandemic came along and emptied the stores of customers. From its all-time high of $42.20 on August 1, 2016, to its nadir of $4.05 on April 3, 2020, Tanger lost a horrifying 90% of its value in less than 4 years’ time.

Well-known COWhands (“Cash Only Wanted” investors) kept singing the company’s praises all the way down, even calling it a SWAN. I’m not sure how you can “sleep well at night” while that is happening, but if Tanger is a SWAN, that was one heckuva SWAN dive.

During this death-defying plunge, the company staunchly kept the dividend unchanged as long as they could, and even gradually raised it by about 10%, from $1.30 per share in 2016 to $1.42 per share in 2019. But alas, the inevitable finally caught up, and Tanger suspended its dividend entirely for most of 2020. When they resumed paying the dividend, it was slashed by half, to $0.71 per share, leaving investors with the worst of both worlds: greatly diminished income, and a huge loss in valuation.

Coming up for air

Most of the mall REITs have not recovered, but Tanger has come up for air in a big way, and its short-term growth prospects are intriguing.

How did they do it?

While I can’t answer that question definitively, I can pass along a lot of clues. Management took a combination of short-term steps and long-term strategic shifts, and essentially reinvented the regional mall in the process.

Short-term steps

First, as a stop-gap measure, they deferred rent for many of their tenants. They reasoned that a mall full of shuttered and dark store fronts would be depressing for customers and further harm the businesses of their remaining profitable tenants. So rather than insist on enforcing their current leases, they renegotiated to defer rent payments. This kept more stores open, and kept the mall looking more vibrant than it would otherwise appear. The strategy proved to be effective, as 98% of deferred 2020 rents due this quarter have been paid.

To fill the vacancies, they drastically reduced the lease lengths. Short-term tenants were far better than no tenants at all. And in many cases, new leases were signed, offering the tenants variable rent, rather than fixed rates.

In both cases, these types of lease deals will be phased out over time as conditions improve.

Long-term strategic shifts

They also added food services including sit-down, quick serve, and grab-and-go stands, as well as other features, like entertainment stores, kiosks and amenities, to entice customers to stay in the mall longer, and thus spend more money. They also used some of the vacated space for marketing, rather than retail, creating a small but rapidly growing new revenue stream, which they will continue developing. As CEO Stephen Yalof said on the Q3 earnings call:

There’s a lot of eyeballs and we’ve discovered lots of locations, places for us to do onsite center marketing, things like digital directories, backlit sign boards, partnerships with certain retailers that allow them to take over car doors.

Most importantly, Tanger shifted its merchandise focus from products customers can easily purchase online to products that customers want to experience first-hand before buying. For example, say you want to buy a new bed. Sure, you can buy one online, and if it turns out you don’t like it, you can always ship it back, right? But how big a hassle is it to ship a bed? So there are things that don’t sell easily online, and those are the types of products Tanger has shifted to. Furniture and home furnishings are now a key part of the product array, along with wellness and beauty.

But the management team thought it through even further than that. They want to reach a much younger customer base, so they greatly amped up their social media presence, turning the shopping experience virtual as well as live. As Yalof said:

Our digital channels, including our website, app, and social channels complement our on-center experience and help to attract new customers, particularly in young demographics. Activations and shopper amenities such as Virtual Shopper and our web hosted flash sales continue to engage and draw a younger consumer while providing an omni-channel experience.

The result is essentially a reinvention of the regional mall. Necessity has once again proved to be the mother of invention. As CEO Stephen Yalof summed it up:

The successful execution of our strategic plan is evident across all of our key metrics, including occupancy, rent spreads, tenant sales and our focus on driving non-rental revenues, all of which continued to contribute to core FFO growth.

And management hinted at further interesting ideas in store. Yalof again:

A lot of the markets where our shopping centers are positioned have a great housing component surrounding . . .There are we’d say about two-thirds of our properties have un-monetized peripheral land and as our shopping centers are the center of the energy in the geographies that they serve, that outparcel land is just raised in value.

Source: tangeroutlet.com

Healthy Q3 results

Occupancy has returned to pre-pandemic levels, at 94.2%. Leasing spreads rose 240 basis points, almost mirroring the general 2.7% increase in retail rent spreads generally. Gains are particularly strong in the Midwest, and (you guessed it) the Sunbelt. While these leasing spreads pale in comparison to the double-digit spreads being generated in the industrial and self-storage sectors, it is nevertheless a sign that market dynamics have turned in the landlords’ favor.

Foot traffic in the centers has returned to pre-pandemic levels. Tenant sales reached an all-time high of $448 per square foot for the 12 months ended September 30, which is actually a 13% increase over the same period in 2019.

Q3 core FFO per share of $0.47 crushed the average analyst estimate of $0.04. That was a 9.3% increase from the Q2 figure of $0.43, and an uptick of 6.8% year-over-year.

Q3 total revenue of $112.5M also smashed the consensus estimate of $92.0M. That was up 11.1% from the previous quarter, and 9.0% year-over-year.

According to CFO James Williams, same center NOI for the consolidated portfolio increased 11.5% for the third quarter to $73.8 million, driven by a better than expected rebound in variable rents and other revenues.

As Yalof puts it:

We continue to see traffic, sales, leasing, and business development results improve. We’re on a clear path to sustained same-center NOI growth and along with our new long-term growth initiatives and operational efficiencies, we believe, we have a compelling opportunity to create value over time.

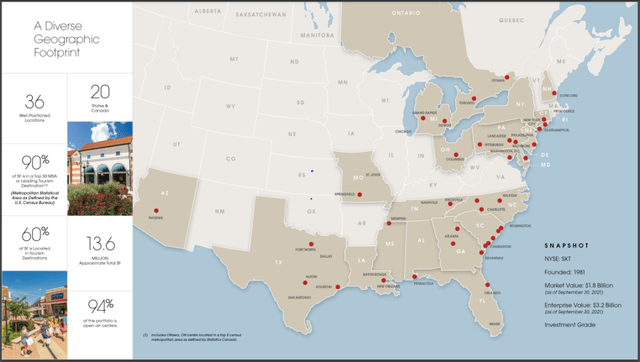

Tanger has a diversified tenant base of more than 500 high-quality retailers, most of which are pursuing an omnichannel retailing strategy. Tanger owns 36 centers, spread across 20 U.S. states and Canada.

Source: Tanger company website

Leo Imasuen recently wrote:

While eCommerce will continue to grow, it is quite clear that Tanger fills a niche for physical connection. How large this niche is, will be seen in the years ahead as the company moves firmly past the light at the end of the tunnel. The worst pandemic wise has come and gone and now Tanger has seized the chance to define itself in a new world that will likely remain in a state of flux.

Balance sheet improvements

In August, Tanger completed a public offering of $400 million of senior notes at 2.75%, the lowest coupon in company history. They used the proceeds from the sale to pay off higher-interest debts. As a result, the company currently has no significant debt maturities until April 2024.

As of September 30, net debt to adjusted EBITDA had improved to 5.3x for the trailing 12 month period, down significantly from 7.2x for the comparable 12-month period of the prior year.

Tanger’s debt ratio is still very high at 66%, but the balance sheet has a bond rating of BBB-

Dividends tattered, but stabilized

As I mentioned above, Tanger suspended its dividend entirely for most of 2020, and when they resumed paying the dividend, it was slashed by half, to $0.71 per share. Gone are the days when Tanger was a high-yield play, and its dividend growth numbers look dreadful, but the current dividend is an above-average 3.70%. Tanger’s dividend earns a very safe B+ rating from Seeking Alpha Quant Ratings on a payout ratio of just 40%.

Source: tangeroutlet.com

Which way now?

The consensus forecast calls for Tanger to achieve a whopping 35% FFO growth in 2022. That is extraordinary for a mature REIT, and has been in operation more than 40 years.

The consensus forecast for 2023 shows FFO growth slowing to just 2.4%, so Tanger appears to be only a one-year growth play going forward. However, if the FFO growth analysts expect in 2022 actually materializes, it is likely price will rise along with it, and dividends will be increased accordingly.

Seeking Alpha contributor Long Player said this:

Once the expenses of leasing the vacant spacing are in the past, this company is likely to throw off a lot of cash flow. It will be up to management to decide what to do with that cash flow. . . The company has excellent prospects of recovering cash flow to levels seen in the past and quite probably to higher levels.

But the future is not all sunshine and roses, even in the short term. Jeffries recently warned of risk from supply chain issues and rising labor costs. Indeed, Yalof himself admitted that the impact labor and supply chain issues will have on the company is unknown.

The bottom line

Expert opinions on Tanger are all over the map. The Seeking Alpha Quant Ratings are Neutral on Tanger, yet gives the company high marks for everything except Growth. The Seeking Alpha authors are Bullish, but the Wall Street analysts on the site are Neutral. Zacks rates it a Strong Buy. Compass Point rates it a Buy, and Evercore ISI has upgraded it to In-Line. The Street and Ford Equity Research rate Tanger a Hold, while TipRanks gives it a dismal score of 2 out of 10. In other words, it’s anybody’s guess.

My guess is that this brilliantly-managed company will post sterling results in 2022, then level off into a COW (Cash Only Wanted) in 2023 and beyond. So I am Bullish on Tanger in the short term, Neutral in the longer term.

I am debating whether to take a stake in the company. There are only two things holding me back. One is that I take a longer-term view, rather than speculating on short-term pops. The other is, there are lots of good opportunities in REITs right now. I can’t invest in them all, and there may be even better moves than Tanger.

Be the first to comment