JaCZhou/E+ via Getty Images

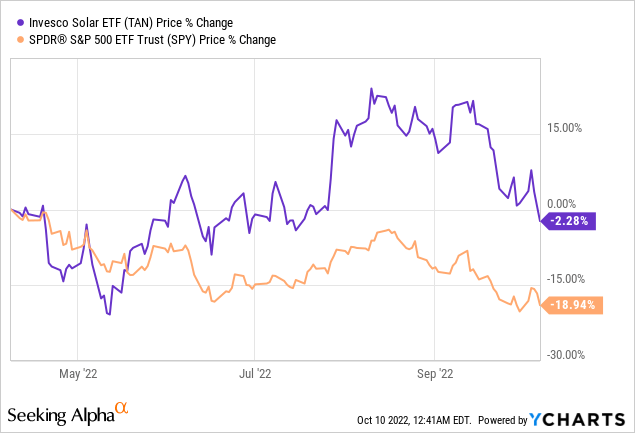

The Invesco Solar ETF (NYSEARCA:TAN) offers targeted exposure to global companies across the solar industry supply chain. This is a high-growth segment benefiting from several tailwinds as a cost-effective renewable energy solution that leverages emerging technologies like battery storage. The surge in oil and gas prices has highlighted the attraction of solar while the recently passed U.S. “climate bill”, or Inflation Reduction Act, is set to add further momentum to the group.

Even with the challenging macro environment, it’s encouraging to see that the TAN ETF has outperformed the broader market this year. We’re bullish and view the latest correction as another buying opportunity with more upside going forward.

What is the TAN ETF?

TAN technically tracks the “MAC Global Solar Energy Stock Index” which has a float-adjusted market capitalization weighting across 46 stocks. The eligibility criteria consider both U.S. and foreign stocks heavily involved in the solar business. This includes equipment producers from photovoltaic panels, inverters, and energy storage systems.

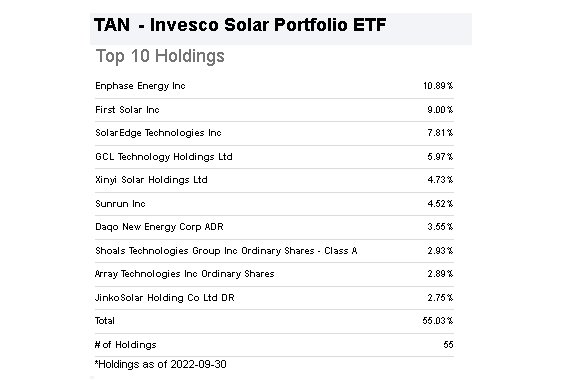

The largest holding in the fund is currently Enphase Energy Inc (ENPH), with an 11% weighting. The company is recognized as a leader in combining solar, battery, and software solutions for both residential and commercial applications. ENPH with a market cap above $30 billion is profitable which drives a layer of quality to TAN compared to some of the smaller players that are still ramping up operations.

First Solar Inc (FSLR), with a 9% weighting in TAN, is relatively unique as a U.S.-based manufacturer of solar modules with its outlook supported by a new facility coming online that is set to more than double capacity. China-based JinkoSolar Holding Co Ltd (JKS), and Canadian Solar Inc (CSIQ) also produce panels serving the worldwide market.

The strategy also covers suppliers of raw materials that are critical to the technology like polysilicon which is manufactured through a chemical refinement process like Daqo Energy Corp (DQ) and GCL Technology Holdings Ltd (OTCPK:GCPEF). Down the list of holdings, there are also large-scale utilities and solar power producers with Germany-based “Encavis AG” as an example.

The takeaway here is that the industry is interconnected across the supply chain with most stocks capturing similar market themes as suppliers, customers, or competitors of each other.

Seeking Alpha

The Inflation Reduction Act is a Game-Changer For Solar

Declining costs and the climbing efficiency of solar technology and the advanced in the related power storage systems have made solar the main source of new electricity generation installs globally. According to the International Energy Agency (EIA), solar is now the “king of electricity“, representing upwards of 35% of all new deployments with growth expected to an annual average of 13% over the next decade with upwards of $4.5 trillion in total spending through 2050. This is a worldwide theme with most countries embracing solar as part of government-led efforts to reduce carbon emissions and support clean energy.

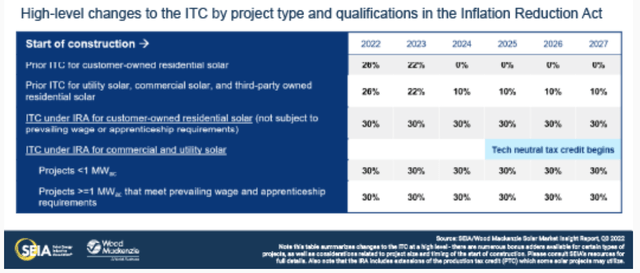

Indeed, the long-term opportunity here is massive as part of the allure of the TAN ETF. As mentioned, a major development has been the passage of the Inflation Reduction Act (IRA) in the U.S. which was officially signed into law on August 16th. Within the package, nearly $390 billion are directed at energy investments toward solar primarily through tax credits over the next decade.

The game changer is an extension of the investment tax credit (ITC) and production tax credit (PTC) that were previously set to expire or be phased down. The deal provides some certainty to the industry when thinking about multi-year projects and spending cycles. Importantly, there are also provisions supporting the manufacturing of solar components domestically along with incentives towards the adoption of residential rooftop solar for consumers.

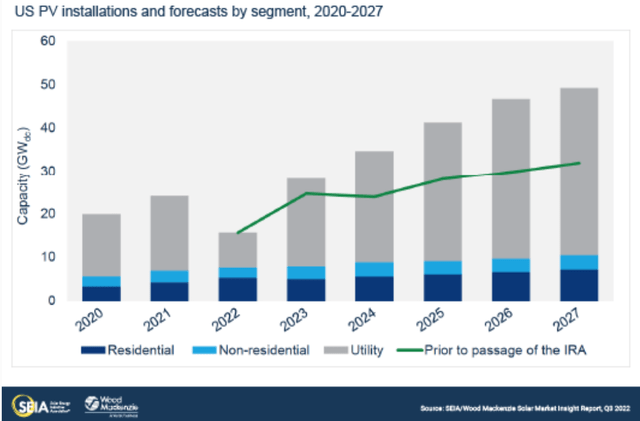

According to the Solar Energy Industries Association (SEIA), the result here is that U.S. solar deployments are expected to climb 40% higher or an incremental 62GW through 2027 compared to prior forecasts. Utility solar, which is seen as typically price-sensitive, benefits the most with a 47% increase compared to the outlook without the Inflation Reduction Act incentives.

The report notes that there are some ongoing near-term supply chain challenges expected to improve through next year. The price of polysilicon, for example, has been elevated based on tight supplies which are expected to only normalize going forward. The full impact of the IRA is expected to be felt starting in 2024.

TAN Captures Strong Growth Outlook

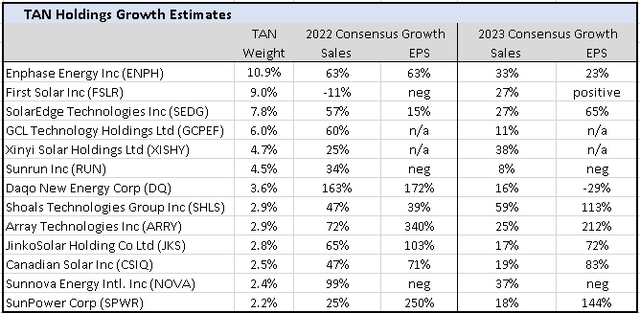

As it relates to the TAN ETF, the setup here is a boon for the underlying companies with an exceptional growth outlook. Among the top holdings, the data we’re looking at shows an average consensus revenue growth above 50% for 2022 which is followed up by a 26% increase for the group in 2023. Impressively, earnings are also accelerating with the trend based on not only the strong demand for solar applications, but also improving margins. Investors would be hard-pressed to find another industry or ETF with this type of growth momentum.

source: Seeking Alpha (table by author)

The other side of the discussion comes down to valuation. The good news is that amid the market, most names are trading well off their highs representing a discount to peak multiples.

Looking out into 2023, premiums and the 1-year forward P/E narrow for the group considering the expected earnings upside. On this point, we’ll note that the U.S. and developed market players like Enphase Energy, First Solar, and SunPower trade at a large spread compared to Asia-Pac names across JinkoSolar and Daqo New Energy. While each ticker has a specific bullish case based on company-specific dynamics, the allure of the TAN ETF is that picking winners and losers from the group is not necessary with the ETF benefiting from the high-level themes.

TAN Price Forecast

The difficult macro outlook amid slowing economic growth, high inflation, and rising interest rates as global trends have added volatility to solar names. The concern is that a deepening recession would limit the demand for new solar projects forcing a revision lower to revenue and earnings estimates for the group. That being said, we argue that solar may be better positioned to weather the proverbial storm as a relatively defensive sector.

We already discussed the ongoing shift worldwide towards solar technology as a clean and renewable energy source. This aspect has likely gained importance this year in the context of the geopolitical scenario of the Russia-Ukraine conflict and the surge in oil and gas prices.

Beyond the Inflation Reduction Act of the United States incentivizing solar applications, Europe in particular is facing some urgency to establish energy independence away from Russian natural gas. The latest headlines of OPEC moving forward with a 2 million barrel per day oil production cut simply adds to positive sentiment toward solar as a viable alternative.

To be clear, the relationship between solar and high energy prices is not perfect. There is still a “tech” aspect of the industry that is subject to broader financial market conditions, particularly among the more speculative names in the group. The performance of the TAN ETF will also be dependent on the trading action of the largest holdings subject to corporate headlines and earnings trends. Nevertheless, the conviction here is that the long-term outlook will ultimately generate positive returns for the group through diversification.

Final Thoughts

Looking at the ETF price chart, TAN has pulled back around 15% from its mid-August highs and is currently trading below the initial climate bill headlines back in July. Ultimately, we believe the next big move in the fund is higher.

The way we see it playing out is that the fund can rally through two distinct scenarios. First, an improvement to the macro outlook and general sentiment towards risk assets could spark a new wave of momentum in solar names as high-growth leaders. It’s ugly right now, but the possibility that economic conditions evolve better than expected or inflation surprises to the downside would be positive for all stocks.

On the other hand, we also see TAN gaining in a scenario where oil and gas prices take another leg higher, potentially based on Russia-Ukraine headlines. In this case, solar could prove to be one of the few industries that benefit from further macro uncertainties.

Be the first to comment