sankai/iStock via Getty Images

By Tony DeSpirito

Seeking resilience

2022 started with rising interest rates, high inflation and unthinkable violence and human tragedy in Europe. Uncertainty is high, investing is more complicated, and we believe active stock selection is more important. As Q2 begins, we see:

- Opportunity to add to stocks unduly punished in the downturn

- Longer-term potential in value-oriented strategies

- U.S. stocks holding an edge across global asset classes

Market overview and outlook

A confluence of negative factors set U.S. stocks up for a difficult start to 2022, with the S&P 500 recording its worst January since 2009 and officially hitting correction territory (a 10%+ decline) in February. Growth-oriented stocks were at the epicenter of the pain amid fears of rising rates and a slowing economy.

We see both a short- and longer-term opportunity taking shape. In the near term, we believe indiscriminate selling has created attractive entry points, particularly into some high-growth-potential stocks. At the same time, we believe investors should prepare for a longer-run regime shift as the once familiar slow-growth, low-rate environment transitions to a new world order that may warrant greater selectivity and a rebalance toward value.

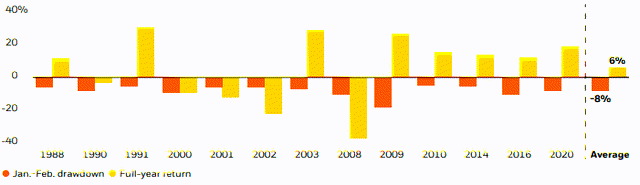

Bad start doesn’t necessarily presage a bad year

Source: BlackRock Fundamental Equities, with data from FactSet as of March 2022

Chart shows years with Jan.-Feb. S&P 500 drawdowns in excess of 5 since 1988 and the average of those years. Past performance is not indicative of current or future results. It is not possible to invest directly in an index.

A time for resilience

The investing backdrop is mired in uncertainty. Just as the global economy is looking to emerge from pandemic malaise, a callous war has applied new pressures to a global system that was looking to normalize interest rates and process the effects of the highest inflation seen in decades.

Intraday market volatility has been dramatic and stock selling has become indiscriminate, as is often the case in big market swings. We believe this has opened attractive entry points, particularly into some growth stocks that have been punished beyond what their fundamentals would imply.

The prevailing backdrop highlights the importance of building resilience into portfolios. We believe this is best achieved through diversification and a focus on quality – particularly stocks of companies with strong balance sheets and healthy free cash flow characteristics.

A new chapter in the investing playbook

Amid the uncertainty, one thing we feel relatively certain about is that we are exiting the investing regime that had reigned since the Global Financial Crisis (GFC) of 2008. That was marked by low-to-moderate economic growth, alongside low inflation and interest rates. The new environment is still taking shape but will undoubtedly entail higher inflation and rates than we knew from 2008 to 2020.

Stock selection matters more

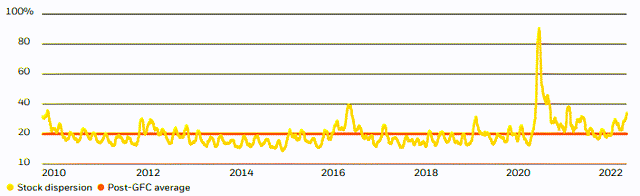

We see stock selection becoming more important as companies navigate higher inflation and rates with varying degrees of agility. Stock dispersion – a measure of the potential risk/return outcomes for individual stocks – already sits well above its average since the GFC, as shown in the chart below.

A more discerning market

Source: BlackRock Fundamental Equities, With Data From Refinitiv, March 2022

Chart shows the dispersion among stocks in the Russell 1000 Index displayed as a 21-day moving average from July 2009 to March 2022. It is not possible to invest directly in an index.

Higher inflation than the roughly 2% we knew before the pandemic will challenge companies’ cost structures. Investors must discern which companies are most impacted by rising costs and which have the pricing power to pass those higher costs through to consumers and maintain their profit margins. From there, the question is how much of this is (or is not) reflected in stock prices.

As part of our analysis, we look for companies with unique products or services, durable cost advantages, or that operate in consolidated and rationale industry structures. We think businesses selling labor-saving equipment and technology will benefit as companies seek to offset higher wages. Software solutions and some industrial equipment are two potential beneficiaries.

Value revisited

Inflation has implications for both the overall level of the market and for market internals, particularly the value versus growth debate. Value stocks have dominated so far this year as rising rates weighed on growth stocks. Growth stocks are considered long-duration because their cash flows are realized further into the future. Higher rates drag on the present value of these future cash flows. Value stocks, meanwhile, are shorter-duration with cash flows that are front-end loaded – capital is returned to shareholders earlier in the investment lifecycle.

The period of extremely low interest rates was very good for growth stocks – and very challenging for value investors. The road ahead is likely to be different, restoring some of the appeal of a value strategy.

Top of mind for Q2

How does the war in Ukraine affect the outlook for U.S. stocks?

The war is clearly a human tragedy. It is also a concern for global growth and a source of volatility as the highly uncertain situation evolves. Russia is a major exporter of oil and natural gas, particularly to Europe, and a removal of that supply from the system (formally through sanctions and/or informally through private curtailment) would put further upward pressure on energy prices and inflation.

Perversely, the situation could favor U.S. stocks, as they are more insulated than their European counterparts from energy price spikes and the direct impacts of the war and its economic ramifications. It is also worth noting that bonds, which typically gain an edge in times of risk aversion, are providing less portfolio ballast today as correlations to equities have converged. This may give U.S. equities a TINA (there is no alternative) advantage across global assets.

How big of a concern are Fed rate hikes?

When it comes to the Fed, we believe it’s more about the destination (the final Fed Funds rate) than the pace in getting there. The Fed has achieved its goals (economic growth, full employment) and is behind in adjusting monetary policy away from the emergency measures put in place in the early weeks of the pandemic.

The process of normalizing interest rates from a zero bound does not cause us great worry about the value proposition in stocks. Our models suggest the 10-year Treasury yield would need to reach 3-3.5% before we would question the risk/reward in equities.

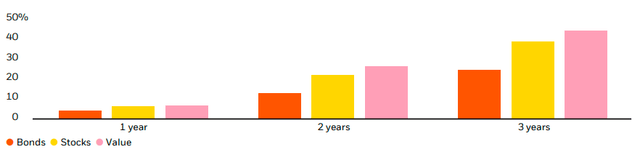

We also looked at the performance of stocks and bonds in periods after the Fed started hiking rates and found that equities outperform, with the value style historically in the lead. (See chart below.) We further found that the energy and financial sectors have provided the greatest outperformance of the broad market in the three years following the start of a hiking campaign.

Taking hikes in stride

Source: BlackRock Fundamental Equities, with data from Bloomberg, as of March 2022

Bonds are represented by the Bloomberg Aggregate Bond Index, stocks by the Russell 1000 Index and value by the Russell 1000 Value Index. Chart shows average returns in periods after the Fed initiated a rate-hiking regime: 1983, 1987, 1994, 1999, 2004, 2015. Past performance is not indicative of current or future results. It is not possible to invest directly in an index.

What is the outlook for inflation and its impact on company profits?

We do not see inflation sustaining at the current decades-high level over the long term, but we do expect it will settle into a range higher than the sub-2% seen in the post-GFC period. This is because some inflation, such as shelter and services inflation, is “sticky” – meaning it will not work its way out as easily as other inflation pressures where a rebalance of supply and demand will naturally create price stability. We could see inflation move toward its new long-run trend starting in the second half of this year. If we use the Atlanta Fed’s “Sticky CPI” gauge as the worst-case predictor, we estimate that could put inflation in the 3-4% range.

A look at company profit margins in the last rising inflation period, from 1965 to 1982, showed a general decline. If we assume margins will return to their prior long-run average once inflation subsides, we think there could be an underappreciated opportunity in companies that may be pressured by higher costs in the current moment but with a track record of passing those costs through to the consumer on a lagged basis.

A time for active decision-making

Times of uncertainty can test investors’ fortitude. We believe these are the moments when active, fundamental-based stock selection and thoughtful portfolio construction can provide a measure of solace and have a profound impact in the pursuit of long-term financial goals.

This post originally appeared on the iShares Market Insights.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment