Frogman1484

It’s been a little over 4 ½ months since I bought back into Atlas Air Worldwide Holdings Inc. (NASDAQ:AAWW) in an article with the painfully unoriginal title “Buying Back into Atlas Air Worldwide”, and in that time, the shares have risen about 40% against a loss of about 10% for the S&P 500. My regulars know what time it is. It’s time to brag. You obviously came here for that, but you may also be interested to know whether it makes sense to buy more of this stock at current prices, hold, or sell and take profits. I’ll make that determination by looking at the most recent financial performance as well as the stock as a thing distinct from the business. Before getting into all of that, though, I want to write very briefly about the cause of the run up in stock price.

We’re all fairly busy people, and it seems that the preciousness of time grows ever greater with each passing year. For that reason, I want to save you as much time as possible, which is why I write a “thesis statement” paragraph at the beginning of every article. This paragraph is further evidence of the fact that I’m absolutely obsessed with trying to deliver as pleasant a reading experience for you people as possible. You’re welcome. I’m of the view that $102.50 is a ceiling for the stock price, and thus investors have received most of what we’re going to receive here. I think there’s very little “juice left in the tank” from current prices. An investor who buys today may enjoy another couple of dollars of capital gains. Against this theoretical upside is the very real possibility that this deal isn’t consummated. If the deal isn’t consummated, the shares will likely drop in price to pre-deal levels. I don’t like investments that offer upside potential of a few dollars and downside potential of $30-$35. Additionally, I think the most recent financial results reveal a pernicious drag on profits that will linger for some time. Finally, and unsurprisingly, the shares are now quite richly priced. For these reasons, I’ll take my chips back off the table today. I may miss out on some future upside, but I’ll be able to sleep a bit better. Thus ends the “thesis statement” paragraph. If you read on from here, and end up feeling a bit of nausea because of my tiresome bragging, or the fact that I spell certain words correctly, that’s on you.

Acquisition Speculation

The shares started to spike in price even before Atlas confirmed on August 4th that they would be acquired by an investor group for $5.2 billion. This valuation works out to a price of about $102.50 per share. The deal is expected to close in the final quarter of this year or the first quarter of next. The nature of the world, though, is such that our expectations are sometimes subverted, and that nothing is ever certain.

Someone suggested to me that expressing worries about getting financing is a pretty standard negotiation tactic, and that may be so, and it may or may not be something the investment group is engaged in here. I’m not willing to speculate on that, though. It’s theoretically possible that challenges with financing are a bluff. It’s theoretically possible that someone knows this and is then able to extract a higher price than $102.50. I’m not willing to speculate in that way, though, and so I’m going to assume $102.50 is a theoretical ceiling. I also want to explore what these investors will be getting for their $5.2 billion, because if the deal doesn’t go through, we’ll be left with an operating company and it’s good to understand the most recent financial performance of that company.

Financial Update

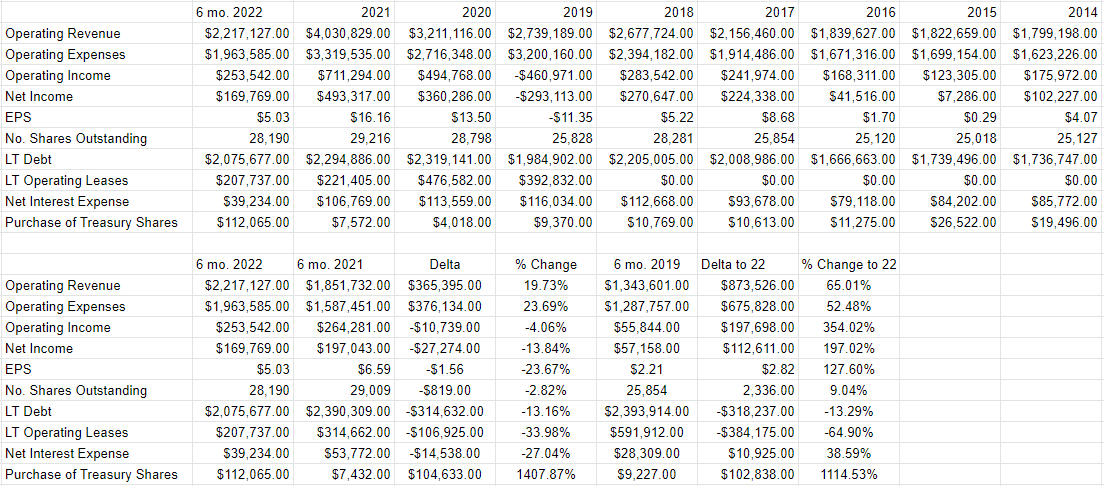

Previously, I characterized the financial performance here as being “rather good.” I’ve changed my mind somewhat. While the company is still profitable, the pernicious effects of growth in fuel and salary expenses are starting to creep into the income statement. Specifically, while revenue was up a very nice 19.7% from year ago levels, net income was about 13.8% lower. The issue here is the growth with both salaries/benefits, and aircraft fuel. Between 2021 and now, the former grew 42%, and the latter was up a staggering 67%. This is significant, because these two expenses are a large driver of profitability. For example, for the first six months of 2022, the two combined represented 61.8% of total expenses for the company. So, as salaries and fuel go, profitability goes. I don’t know if you readers have been keeping up with current events, but these two cost drivers are expected to get worse before they get better.

It’s not all bad news out of Atlas, though. The capital structure has greatly improved over the past year, with long term debt down by fully 13%. More impressive still is the fact that interest expenses have declined massively from $53.8 million during the first six months of 2021 to $39.2 million for the first six months of 2022.

While I don’t think this company is financially troubled in any way, I’m increasingly of the view that the profitability spurt we saw between 2017 and 2021 won’t be repeated anytime soon. While I’d be happy to buy more of this stock at the right price, I think the “growth” days are largely behind it.

Atlas Air Financials (Atlas Air investor relations)

Atlas Air Worldwide’s Stock

I’ve written so many times in the past that the stock is distinct from the underlying business that maybe a small percentage of my readership might be starting to possibly get bored of me droning on about it. In case you’re new here, I’ll just go through my thinking in bullet points.

- The company sells air services, and its profitability is largely impacted by fuel and labor expenses as previously discussed.

- The stock, meanwhile, is a supposed proxy for the business that is traded often, and goes up and down in price depending on the crowd’s ever changing views about the future profitability of the company.

- The stock may also be buffeted by the pronouncement of a fashionable analyst who may opine on the company or a related company.

- The stock is also buffeted by the crowd’s changing views about the health of “the market” and the attractiveness of “stocks” as an asset class.

- Finally, the stock may be buffeted by rumors about a buyout, as we’ve seen here.

Thus, the stock is a much more volatile instrument, affected by many factors beyond those impacting the business.

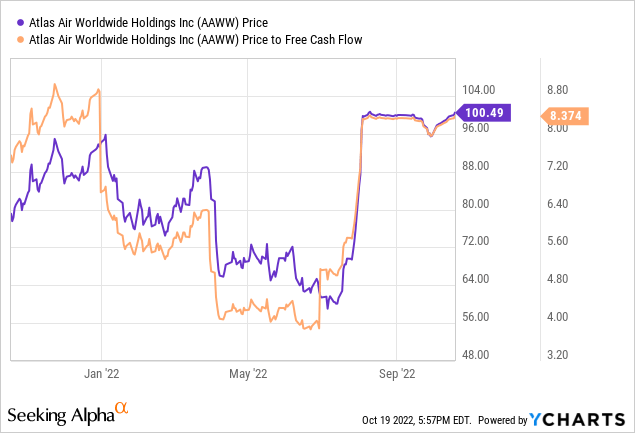

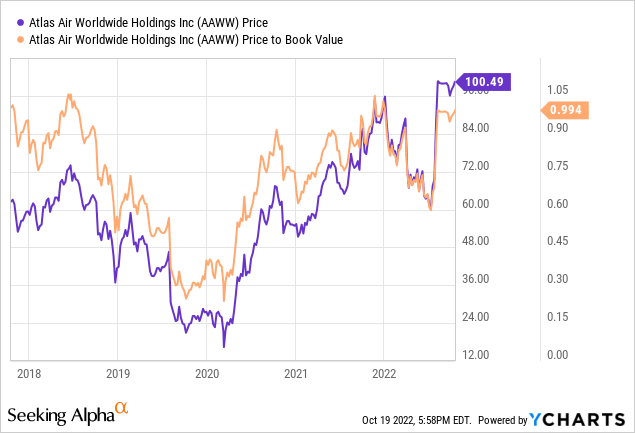

In my experience, the only way to make money trading stocks is to spot discrepancies between the crowd’s current views about the future and subsequent reality. It’s also my experience that cheaper stocks make better long term investments. This is why I insist on trying to only ever buy stocks when they’re cheap, and eschew them when they’re dear. My regulars know I measure whether or not a stock is cheap in a few ways, from the simple to the complex. On the simple side, I look at the ratio of price to some measure of economic value, like sales, earnings, free cash flow, and the like. Ideally, I want to see a stock trading at a discount to both its own history and the overall market. In my previous missive on this name, I bought back in because the shares were trading at a price to free cash flow of 4.35 and the shares were trading at a price to book value of about 0.717. Fast forward to the present, and shares are between 38% and 91% more expensive per the following:

While I don’t think history repeats, I’m of the view that it rhymes. The last time the shares were this richly priced on a price to book basis, they went on to perform badly. While this doesn’t constitute a proof, it is one more data point for me to fret about.

Given the above, I can’t remain long at current levels. Profits are hampered by wage and fuel pressures. Most of the upside from the potential buyout has already been achieved. There’s a greater than zero chance that the deal won’t go through, and I strongly suspect that this would have a negative impact on price. I think there’s much greater downside than upside potential here at the moment. I would recommend that investors take the money and run at this point.

Be the first to comment