Opera Ads and partnership with Google Makes OPRA a digital advertising role player Khaosai Wongnatthakan/iStock via Getty Images

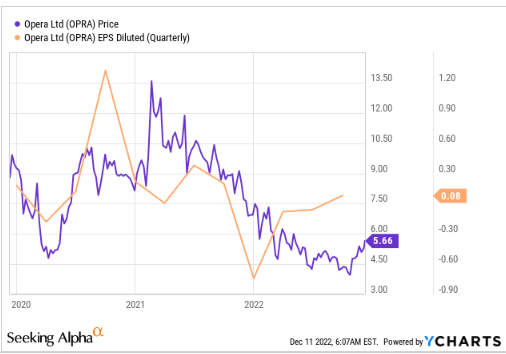

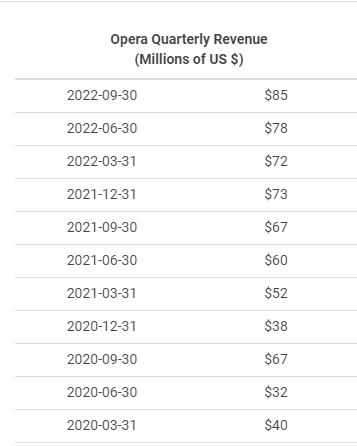

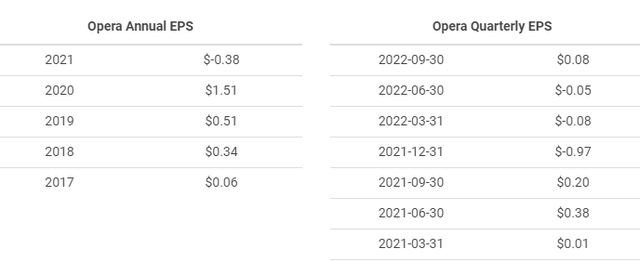

Take your profit on Opera Limited (NASDAQ:OPRA). This stock has a 1-month price increase of +22.25%. I do not agree with the prevalent buy recommendation that OPRA got from Seeking Alpha Quant. Raking in the profit when there’s a big 1-month gain is the right thing to do. Sell now while the stock trades above $5.60. The recent rally is thanks to Opera’s excellent Q3 revenue of $85.35 million. This is +28.1% YoY. It is also notable that Q3 produced a positive non-GAAP EPADS of $0.10. After three consecutive quarters of negative EPS, Opera has returned to profitability.

Seeking Alpha Premium

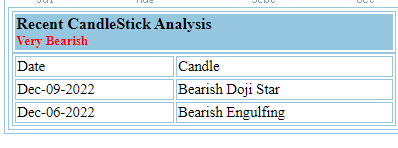

Based on the chart above, profitability is a major factor in OPRA’s market performance. Exit OPRA if you think it will not report a positive EPS for FY 2022. Its fast stochastic has not been above 80 for the past five trading days. The stochastic oscillator is bearish on Opera’s stock. This emotional reversal is also hinted at by the emerging pessimistic candlestick signal chart below. The Bearish Doji Star tells people when to avoid buying an asset.

StockTa.com

My profit-taking recommendation on OPRA is not the gospel. You can stop reading this thesis and instead heed the strong buy recommendation of four Wall Street analysts. These highly paid analysts have an average price target of $9.43. The expectation is that Opera Limited could wrap up fiscal year 2022 with an EPS of $0.20.

Why Holding On Is Justified

My usual valuation for a high-growth company like Opera is 20x forward P/E. Multiply 20 by $0.20 and my near-term price target for OPRA would be $4. On a long-term basis, Opera might just be able to achieve the projected $0.63 EPS for 2023. Multiply that by 20 and you get a 12-month price target of $12.63.

This essay is subjective. Please exercise your own critical thinking. My near-term recommendation is to cash out your one-month winnings. Wait for OPRA to become more affordable. This stock currently has a forward GAAP P/E valuation of 45.28x. OPRA is not a GARP stock.

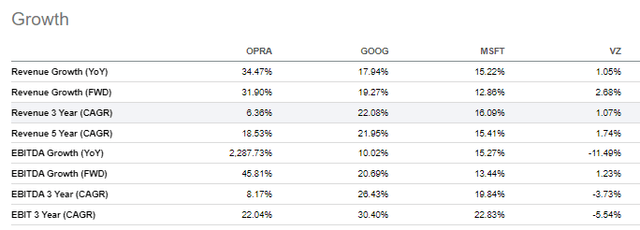

If you are bold enough to buy at 45.28x forward P/E, Opera Limited’s stock is certainly a high-growth stock. OPRA’s forward revenue CAGR estimate of 31.90% is higher than its internet browser-related peers. Opera Limited is expected to outpace the sales growth of Alphabet Inc. (GOOG) (“Google”) and Microsoft (MSFT). The TTM revenue growth of OPRA is 34.47%.

The projected 2023 revenue growth rate is 31.90% while also predicting a 2023 EPS of $0.63. Management might just surprise us all in February 2024. Opera Limited is promising high growth while also growing its bottom line. As per its historical performance, management could deliver positive annual EPS.

A return to consistent profitability is highly desirable. Better profitability will improve OPRA’S current Piotroski F-score of 6.

Why OPRA is not a Buy

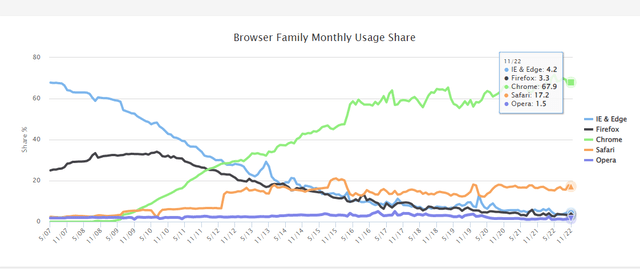

I can only rate OPRA as a hold or take-your-profit sell. Opera is still not among the top 5 web/mobile browser. It is discouraging that Opera only has 1.47% market share on mobile browser usage. Opera’s market share in desktop browsing is only 1.5%. Opera Limited has been around for 25 years. The managers of this company have not yet succeeded in making Opera achieve at least 8% market share.

The chart below says it is a nice pair trade to sell Opera and buy Alphabet. Sad but true, I opine the renewed search agreement with Google is largely why the Opera browser is still around. We do not know exactly how much Google is paying to keep its search engine the default on Opera browsers. It is obviously not as high as the estimated $400 million/year that Google is paying to remain the default search engine in Firefox.

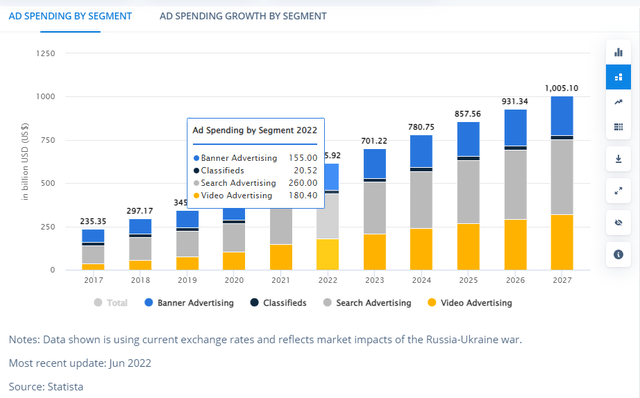

Valuation-wise, GOOG is the cheaper stock to own if you like the $616 billion digital advertising business. GOOG’s forward GAAP P/E valuation is only 19.46x. Nevertheless, the Opera for Business partnership with Google is a long-term tailwind for OPRA. The big brother stewardship of Google means Opera Limited can sustain its cred as a high-growth stock.

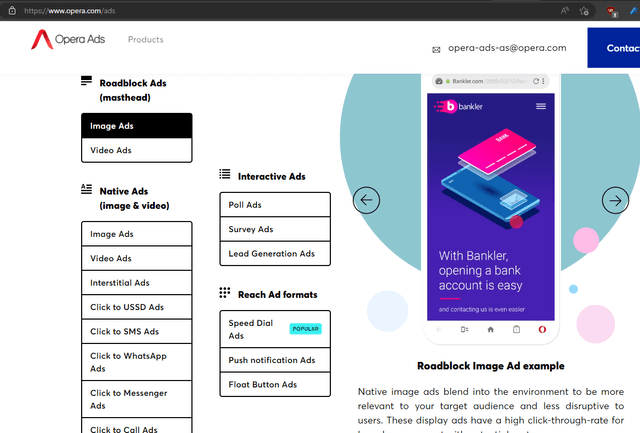

As per its Q3 report, search revenue was $35.4 million. The Opera Ads platform helped the company earn $49.1 million in Q3. Digital advertising revenue therefore accounts for almost 58% of Opera’s quarterly revenue. Take note that Opera Ads is delivered through multiple channels and third-party apps. It is not reliant on display ads delivered to the 1.5% market share of Opera browsers.

Growth Through Other Services

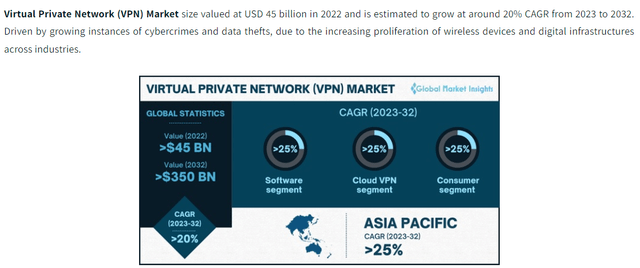

Search and advertising sales still account for more than 95% of Opera Limited’s quarterly revenue. Investors should track the growth of Opera’s diversification products. The Opera VPN Pro is currently very affordable at $47.88 per year. The Virtual Private Network or VPN industry is estimated to be worth $45 billion this year. It is growing at 20% CAGR. The Opera VPN Pro product is vital to sustaining that forward revenue CAGR of 31.90%.

My suggestion is to bundle Opera VPN Pro with free cloud storage to make it more attractive. Alphabet offers its VPN as a free service to people who subscribe to its $9.99/month 2-terabyte Google One cloud storage. Bundling free 50 or 100-gigabyte free cloud storage with its Opera VPN Pro might attract more customers.

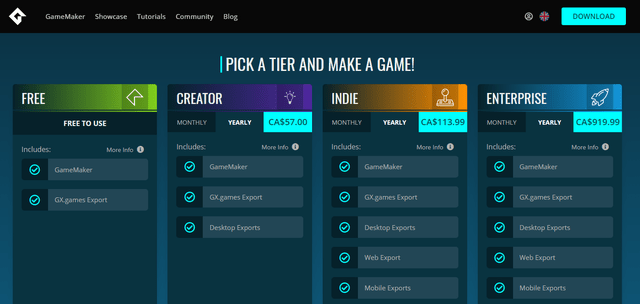

The $10 million purchase of YoYo Games is Opera Limited’s stepping stone into the $108.76 billion game applications market. This niche software market for developing games touts a CAGR of 13.32%. Opera Limited now owns YoYo’s freemium GameMaker Studio 2. Most serious game developers will go for that CA$113.99 ($82.74) annual GameMaker Studio 2 subscription plan.

Opera Limited has more than $201 million in cash and only $3.93 million in total debt. It can use another $10 to $30 million to buy another game engine. I recommend that management should also try to buy the freemium gdevelop game engine. Gdevelop is a no-code WebAssembly game engine. It still allows proficient programmers to use JavaScript to make complex cross-platform games.

I lost money on crypto and NFTs. I won’t discuss Opera Limited’s expansion into crypto browser. For the near future, I heed Warren Buffet’s verdict that cryptocurrencies are worthless because they do not produce anything of real value. The expansion product that creates actual value is Opera Cashback. Letting people earn back real money by shopping through Opera Cashback partners is truly rewarding. Hold on to OPRA because this company is engaged in the $108 billion cashback industry.

Loomi.tv is Opera’s VOD (Video-on-demand) freemium streaming service. Management can position Loomi as an ad-supported and cheap alternative to Netflix (NFLX). Loomi can target developing markets in Asia, Africa, and South America. Asians like me can afford a $3.99/month Loomi subscription. The 5 billion people in developing countries can boost Loomi as a global low-cost rival of Netflix. I expect management to eventually release Android/iOS apps for Loomi TV.

Loomi.tv is still in beta and restricted to Poland. However, it is Opera Limited’s attempt to monetize from the $94.88 billion video-on-demand industry. You should hold on to OPRA because management is acting on growing the company’s relevance beyond browsers.

These expansion services I discussed might bear fruit next year. They could help Opera Limited deliver that projected December 2023 EPS of $0.63.

Conclusion

Do not misunderstand me. The thesis of this essay is you should do some profit-taking. After which, you can let others make OPRA more affordable. The alternative option is to hold on and pray that OPRA rises above $6 before 2022 ends. Cashing out after a one-month gain of 22.25% is the most judicious move. The bearish stochastic oscillator and candlestick signals should be heeded based on your trading discretion.

Going forward, the expansion to VPN, cashback, and game development software SaaS should help Opera sustain a forward revenue CAGR greater than 30%. The renewed partnership with Google insured Opera can eventually grow its search and digital advertising revenue to more than $100 million/quarter. OPRA is not a GARP stock, but it sure is a high-growth company based on its quarterly revenue performance. Linear regression analysis based on the chart below hints that OPRA is on track to achieve $100 million/quarter revenue by Q3 or Q4 2023.

Macrotrends.net

Spending $30 million to advertise/market Opera Ads, Opera VPN Pro, GameMaker Studio, Loomi, and Opera Cashback is highly recommended. Opera Limited needs growth from these diversification services. They could significantly offset Opera’s exceptionally low market share in browsers.

Editor’s Note: This article was submitted as part of Seeking Alpha’s Top 2023 Pick competition, which runs through December 25. This competition is open to all users and contributors; click here to find out more and submit your article today!

Be the first to comment