PonyWang

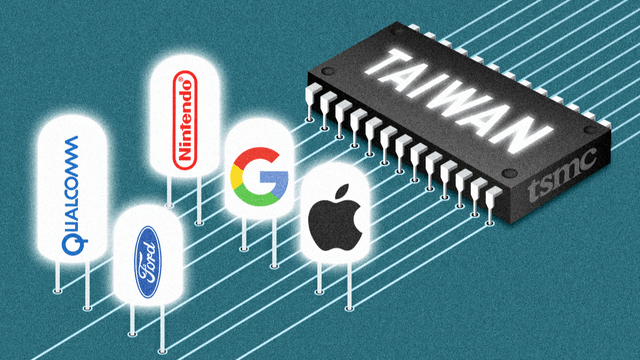

As the leading semiconductor foundry in the world, Taiwan Semiconductor (NYSE:TSM) produces one-in-four (26%) of every semiconductor chip manufactured in the world. Despite its size, TSM is riding a wave of growth that can see its earnings continue to grow by 15% a year over the next several years. In the last quarter alone, TSM’s earnings increased 76% from a year earlier, and grew 17% in the latest quarter.

Google Finance

Four Drivers of Growth

There are four main trends that will drive TSM’s growth. First, is growth in Internet of Things (IoT), which comprises smartphones, wearables, home automation devices (refrigerators, washer/dryers, etc.), surveillance systems, smart city, etc. In 2021, the digital transformation of IoT devices boosted TSM’s shipments by 30%, and represented over 8% of TSM’s revenues.

Taiwan Semiconductor

Second, is in high performance computing (HPC), which includes PCs, tablets, game consoles and servers. With the rise in artificial intelligence (AI) and machine learning capabilities, TSM’s specialized chips of 5nm and 7nm generated more than 50% of the company’s revenues in 2021 and will continue to be in high demand, especially with 4nm chips coming into production in 2023.

Taiwan Semiconductor

Third is in automotive. As the automobile industry is transitioning to electric vehicles and smarter cars, advanced driver assistance systems (ADAS) and smart cockpit/infotainment systems will lead to increased demand for processors and sensors inside cars. TSM’s automotive platform will be able to meet demands from three mega trends in the automobile industry- safer, smarter, and greener.

Taiwan Semiconductor

Fourth is the migration to 5G. The global demand for a more connected world as a result of 5G will drive growth across all segments of TSM’s business including HPC, IoT and automotive. Primarily, the transition to smartphones powered by 5G will continue to be TSM’s largest revenue segment at over 44%. Over the long term, improved performance, longer battery life, and more AI features will be the resulting benefits that consumers will experience going forward.

Geopolitical Risks

As a Taiwanese company, TSM has always operated with geopolitical risks related to China. With the stock down 23% the last six months, there is an assumption that the stock is down due to a potential takeover of Taiwan by China. I don’t see this as a high likelihood and if this were to happen, it would come at an extremely high cost to China and the ripple effects to the global economy cannot be properly measured. As a result, this short-term downtrend in the stock is more an opportunity for long term investors to buy the stock at depressed prices.

Analysis

Buy Rating: I have a Buy rating for Taiwan Semiconductor’s stock with a five-year target price of $173 per share.

In my analysis, I believe Taiwan Semiconductor can grow its annual revenues at 15% per year over the next five years. At the same time, I am estimating that the company’s net margin will expand from 31% to 40% knowing that it generated over 44% net margin in the latest quarter, and is in line with its 5-year average. With the stock currently trading at 22 times earnings (based on year end fiscal 2021 earnings), it is trading at a reasonable valuation considering its earnings growth. I am estimating that the stock’s P/E ratio can expand slightly to 24 times earnings over this time frame.

Below is a table contrasting the company’s current metrics and stock price to the 5-year estimate:

| Taiwan Semiconductor |

Current (as of 8/24/22) |

5-Year Estimate |

|

Revenue (in millions NT dollars) |

$1,878,000 |

$2,776,408 |

|

Net Margin (%) |

31.54% |

40% |

|

Net Income (in millions NT dollars) |

$592,360 |

$1,110,563 |

|

# Outstanding Shares |

5,186,000 |

5,186,000 |

|

Net Income per Share (NT dollars) |

$114.20 |

$214.15 |

|

Price/Earnings (P/E) Ratio |

22.25 |

24 |

|

Stock Price (U.S. dollar) [currency conversion $1:29.7 NT dollars] |

$85.56 |

$173.05 |

Source of company metrics: Morningstar & TSMC

To better understand how to read the table above, read my previous article Meta: Attractive Valuation.

Based on the company’s track record of meeting their conservative estimates, this is one stock that has a high degree of probability of meeting its guidance. Also, with TSM’s balance sheet of over $48 billion in cash and generating free cash flow of over $37 billion a year, the company can withstand the geopolitical uncertainties that may come its way.

Be the first to comment