Alistair Berg/DigitalVision via Getty Images

As the broad cryptocurrency market attempts to find a bottom, there are some good signs that indicate we might be, at minimum, entering a much needed bear market rally. One of those big indicators is the overperformance of many of the alt coins. I shared this chart with my Blockchain Reaction subscribers on Thursday:

Top Token Idea moving up (coinmarketcap)

The red line is the asset priced in dollars. The yellow line is the asset priced in Bitcoin (BTC-USD). When the alts outperform Bitcoin, it’s usually a bullish sign. That asset in the chart above is my latest Top Token Idea. While that idea doesn’t have a top 100 crypto market capitalization, one coin that does have a cap that big and is seeing similar outperformance is Synthetix (SNX-USD). Of the top 100 market capitalized coins, Synthetix has the second best 7-day performance of all of them.

Source: coinmarketcap

With that being understood, what is Synthetix and what might be driving the action in the coin?

Synthetix

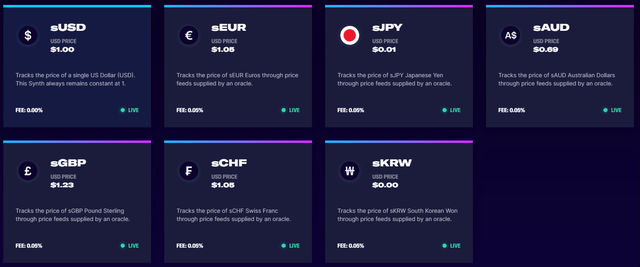

Simply put, Synthetix is a derivative protocol that allows crypto users to get exposure to synthetic assets that are designed to track the price fluctuations in real world assets. While most of these assets appear to be cryptos, through Synthetix, users can also make foreign currency wagers through the protocol’s products.

Synthetic Foreign Currencies (Synthetix.io)

Some of those synthetic currency products include exposure to Euros, Yen, and Swiss Francs among others. In order to get exposure to trades in the Synthetix protocol, users have to stake SNX tokens. From the litepaper:

Synths are minted when SNX holders stake their SNX as collateral using the Synthetix Staking application, a decentralized application for interacting with the Synthetix contracts. Synths are currently backed by a 400% collateralization ratio, although this may be raised or lowered in the future through community governance mechanisms.

SNX is active on both Ethereum (ETH-USD) and ETH layer 2 chain Optimism (OP-USD). SNX carries utility as both a protocol funding mechanism and also as yield generating asset. As an inflationary token, SNX requires staking to protect the purchasing power of the holder’s position. SNX rewards are paid out to stakers and the protocol shares revenue from protocol transaction fees:

Each trade generates an exchange fee that is sent to a fee pool, available for SNX stakers to claim their proportion each week.

An important mechanism in Synthetix is the capitalization ratio or the “c-ratio.” According to the litepaper, the optimal c-ratio is 400%. This is done to protect the protocol against token volatility. The lower SNX goes in price, the more pressure on the c-ratio. Users will be unable to claim their staking fee if they let their c-ratio fall too low. There is an embedded protection against c-ratios that fall too far through a liquidation contract:

After an account has been flagged, a liquidation timer of 72 hours begins on the account to give a window of opportunity to the flagged staker to fix their c-ratio and stop the liquidation countdown.

If a user’s liquidation ratio falls below 200%, a liquidation timer begins and the user has three days to restore their c-ratio back to 400% or be faced with a forced liquidation of assets.

Activity Spike

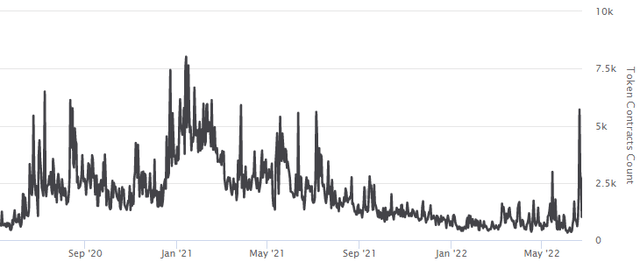

Understanding that SNX tokens are required to use the protocol, the simplest explanation for the rise in the SNX token price is that there has been a massive surge in demand over the last few days. On Monday, the transfer count surged to the highest single day level seen since March 2021.

SNX Transfers Count (etherscan)

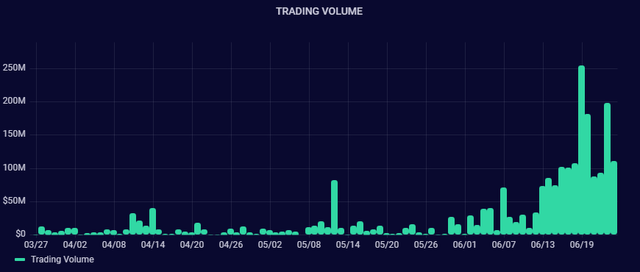

Maybe more importantly than the count in transfers though is the value of the transfers. According to Grafana, there has been over $1.7 billion in trading volume on mainnet so far in June.

Synthetix Trading Volume (Grafana)

This dwarfs what the protocol had been doing from a volume perspective in previous months. I should note that there is also volume on Optimism but it isn’t nearly as high as the volume spike seen on Ethereum. Given the spike in volume in the protocol, there has been a corresponding spike in protocol revenue from trades.

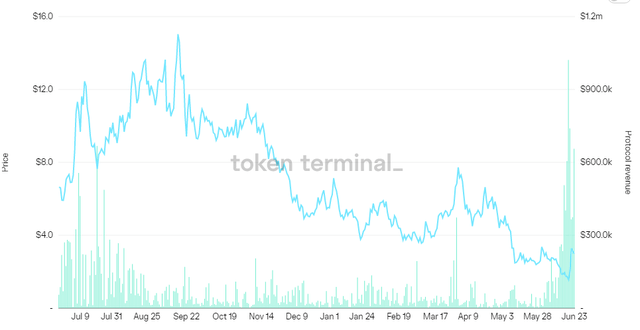

Protocol Revenue v Token Price (Token Terminal)

Because again, the staking reward that comes from using SNX for synthetic asset exposure gets paid out from the protocol revenue pool. This spike in revenue explains why the token price has done so well in the last week or so. As more users stake SNX and trade in Synthetix, the value for every staker of SNX is theoretically higher for those looking to claim shares from the revenue pool.

Risks

The Synthetix system, while interesting, seems complex. The protocol users are effectively minting synthetic dollars when they stake SNX tokens. There are scenarios where stakers who mint synthetic dollars could wind up owning more debt than they actually minted to begin with. An example of which is laid out in the “burning debt” section of the litepaper:

At its simplest: a staker mints 10 sUSD by locking SNX as collateral, and must burn 10 sUSD to unlock it. But if the debt pool fluctuates (and therefore their individual debt fluctuates) while they are staked, they may need to burn more or less debt than they minted.

Furthermore, traders can get exposure to most of the synthetic assets in the protocol by just buying them directly. In this way, the debt mechanism risk isn’t a concern.

Summary

Synthetix is a unique crypto project. If the protocol had a more robust offering of synthetic assets, I might be more interested. Also if the mechanism for participating wasn’t as complicated as it seems to be, I think there would be more potential adoption of the protocol. Generally, I try to steer clear of assets that are inflationary, though I make exceptions when I think there is a strong track record of user adoption. Despite the big spike in activity over the last few weeks, I’m not planning to start any exposure to SNX on the rally here.

Be the first to comment