Sundry Photography/iStock Editorial via Getty Images

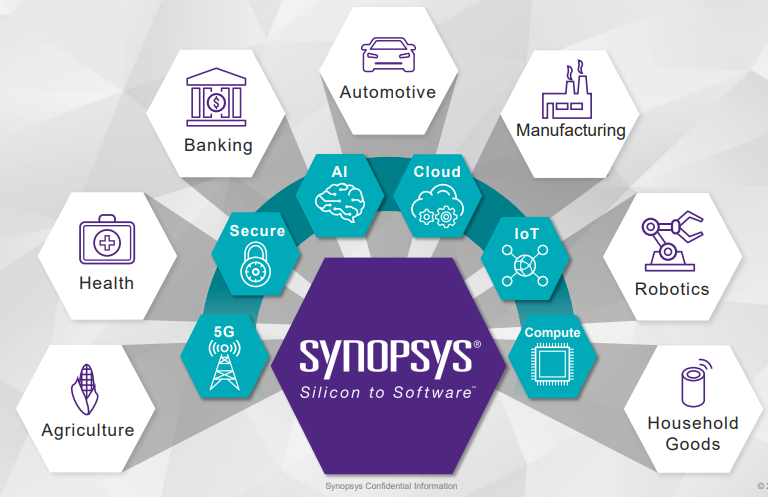

Claims of a potential collusion investigation between Synopsys, Inc. (NASDAQ:SNPS) and Huawei Technologies, and Semiconductor Manufacturing International Corp (OTCQX:SIUIF) could be a make-or-break situation due to the national threat issue underlined by the US government. The pertinent question in the minds of investors is why would a $48 billion company do this while knowing the risks involved? Though it does not sound right, the clearance of Synopsys will make the stock bounce back. Synopsys prides itself on the hallmark of the world’s most advanced chip design and verification technology. At the core of its silicon production is the delivery of Smart Everything to customers.

Thesis

At the moment, silicon and semiconductor technology are the basis for digital transformation Synopsys continues to enhance its software ecosystem as seen in its strong Q1 2022 earnings that reflected growth in its EDA software provision. The company has witnessed heightened demand for its IP and hardware including semiconductors. With software integrity beating estimates, the company is confident that it will reach the 15% to 20% growth objective in 2022 including multiyear margins. With the outcome of the Fed’s investigation on Synopsys still in question, I will explain why this stock is a hold.

Q1 2022 saw Synopsys register a 10.24% increase in revenue to $1.27 billion from $1.152 billion in Q4 2021. GAAP (diluted) EPS also rose 56.7% to $1.99 from $1.27 recorded in October 2021. This revenue surge is a result of heavy investment in unique innovations, targeted apps, and technical differentiation performed over the past 5 years. Synopsys also has a solid cash position at $1.27 billion against a total debt level of $580.60 million.

Synopsys market dynamics

The company also attributed a strong semiconductor market, increasing differentiation in technology and product execution to the strong results. The global semiconductor market that stood at $452.25 billion in 2021 is poised to reach $803.15 billion in 2028 growing at a CAGR of 8.6%. Apart from the increase in consumer electronics consumption, the industry’s growth will be boosted by artificial intelligence (AI) adoption, Internet of Things (IoT), and machine learning (ML) technologies.

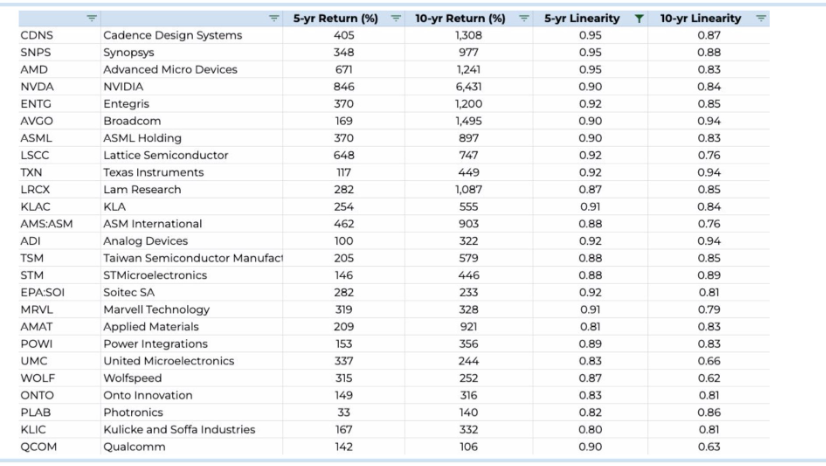

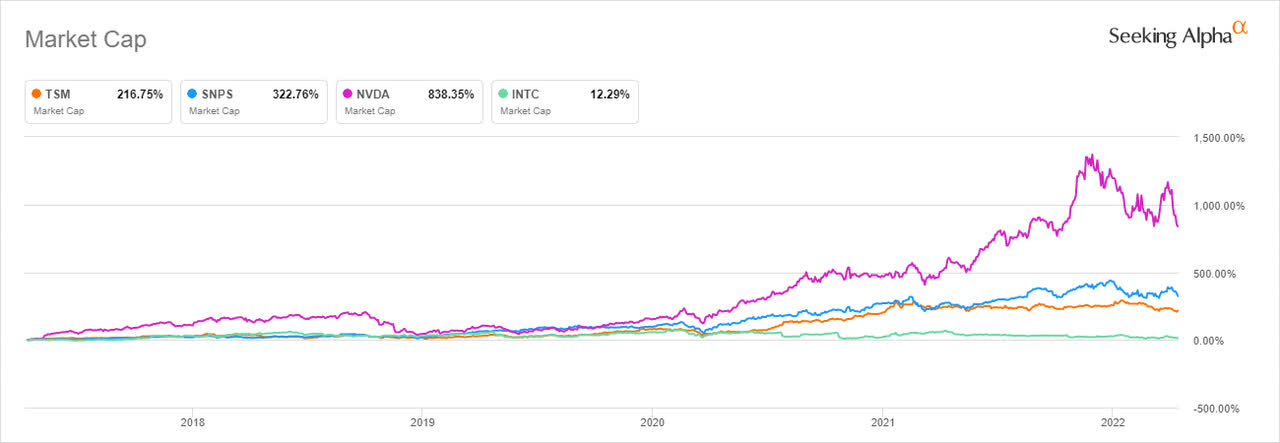

Except for NVIDIA (NVDA), Synopsys’ market cap has far outpaced semiconductor powerhouses in the world such as Taiwan Semiconductor Manufacturing Co (TSM) in the past five years.

Over the past five years, TSM’s market cap has grown by 216.75% while NVIDIA is at an upside of 838.35%.

Long Equity Fund- Twitter Page

Interestingly, Synopsys’ price return over the past five years was more than 310% almost similar to its market cap increase rate. Intel Corporation (INTC) had the slowest growth rate at 12% as the company is still reeling from the supply-related bottlenecks around the production of chips and computers. The companies are seen to be operating on the foundational importance of chips and electronic devices among customers that keep exhibiting recurring positive revenues.

Still, the modern world has seen heavy investments on the part of AI startups and hyper-scalers that prioritize design activities. In its Q1 2022 earnings call, SNPS CEO Aart de Geus stated that its award-winning DSO.ai solution is an autonomous system that drives tools in the design space. DSO.ai’s main feature of accelerating chip performance had seen its product design adopted by 5 of the top 10 leaders in the semiconductor industry.

In my view, the practicality of DSO.ai makes it a formidable contender in the critical Synopsys revenue stream section. It helps in the optimization of deep design space due to its feature of leveraging cloud computing. Towards the end of 2021, Synopsys announced that its DSO.ai attained the highest frequency and lowest power consumption for advanced mobile designs for Samsung (OTC:SSNLF).

Revenue Guidance

As a leader in electronic design automation (EDA), I believe that the $50 million increase in revenue for Q2 2022 is, to say the least, modest. First off as a market leader in the delivery of EDA tools and technologies, Synopsys controls a huge percentage of the $8.9 billion markets. Its innovative products include the DC NXT, TestMAX, and IC Validator NXT. It offers market leadership with AI-enhanced tools and AI-driven apps that are cloud-ready.

EDA tools contribute up to 65% of Synopsys’ revenue after an investment and execution of 35 years. The company is a robust vendor for semiconductor IP, an industry it has invested in for 20 years and it contributes 25% of its revenue. As an emerging leader in software integrity, Synopsys has invested up to 7 years in the industry that now contributes up to 10% of the company’s revenue. In the twelve-trailing month (TTM) period towards 2022, its total contribution amounted to $400 million indicating a significant revenue portion into the year.

As the world’s largest supplier of EDA software used in chip design, Synopsis is partnering with Microsoft (MSFT) to launch the Synopsys Cloud. This solution will run on the Microsoft Azure Cloud service to give chip engineers on-demand access direct from the cloud. What we know is that designing modern chips takes several years with engineers tasked to use EDA software to automate the steps. It is a complicated 3-D design process that needs more computing and EDA resources. Using Synopsys, Microsoft customers will have simplified access to custom infrastructure for all their chip-design requirements.

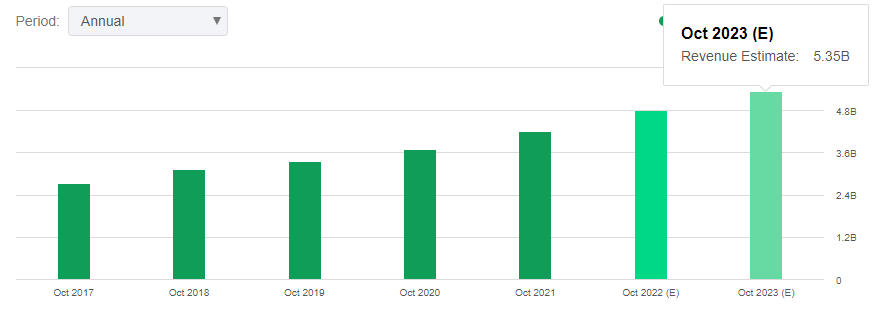

After garnering an annual revenue of $4.20 billion in FY 2021, Synopsys has set its FY 2022 target at a range of $4.775 billion to $4.825 billion (a growth rate of 14%-15%).

Seeking Alpha

Synopsys’ revenue growth since October 2017 by more than 14% with projections showing that will hit $5.35 billion by Q4 2023. To ensure the success of the recurring revenue model, Synopsys will hope to advance its non-cancellable backlog through 2023. As of Q1 2022, the company reported a backlog of $6.9 million. This backlog will provide financial stability throughout the business cycle as the company continues to invest in long-term growth.

In its Smart Everything future, Synopsys is looking to design new electronics architecture that will integrate computing and smart sensors. Part of the high-impact markets that will gain from this redesign is the internet of things (IoT) where smart home industries and wearables are attracting various customers in all segments.

Synopsys

In the artificial intelligence market, the deep learning chipset sector is projected to reach $72 billion by 2025.

Risks

Synopsys’ software integrity business segment which contributes up to 10% of the company’s revenue faces headwinds of security testing products and services. Security vulnerabilities continue to persist even in the open-source software segment. In a report dubbed the “2022 Open-Source Security and Risk Analysis,” (OSSRA) Synopsys established that outdated open-source software recorded several vulnerabilities from an operational and maintenance perspective.

In the report, it was stated,

The fact remains that over half of the codebases we audited still contained license conflicts and nearly half still contained high-risk vulnerabilities. Even more troubling was that 88% of the codebases [with risk assessments] contained outdated versions of open-source components with an available update or patch that was not applied.”

However, the company has reiterated the importance of keeping an accurate and up-to-date inventory of the open-source software used in their code to lower the vulnerability option.

The outcome of the investigation by the US Department of Commerce on the possible technological transfer to Huawei and SMIC by Synopsis could damage the company’s reputation especially if it is indicted.

Bottom Line

Synopsys continues to enjoy a perpetual increase in revenue with the second quarter expected to deliver up to $50 million in revenue guidance. The company is a market leader in the provision of EDA and is emerging as a top contender in the delivery of software integrity services despite the open-source software challenges. We believe that the ongoing investigation to establish the transfer of technology to Huawei and SMIC will have a significant impact on the stock’s performance in the future. For these reasons, we propose a hold rating for the stock.

Be the first to comment