J. Michael Jones

Synchrony Financial (NYSE:SYF) has managed to top analysts’ estimates for third quarter earnings with a smaller than expected decline in its bottom line. The consumer lender’s GAAP earnings per share came in at $1.47, while revenue was $2.91 billion. This compares with GAAP earnings of $2.00 per share and revenue of $2.37 billion in Q3 2021. Meanwhile, the consensus forecast for earnings was $1.38 per share, with revenue at $2.80 billion.

Tough Comparables For Synchrony Financial’s Q3 Earnings Results

The latest set of financial results came against tough comparables, as the company had benefited from a major provision release associated with the termination of its partnership with fashion retailer Gap in last year’s third quarter. Provision for credit losses for the quarter was $929 million, compared to $724 million in the prior quarter, and $25 million a year ago.

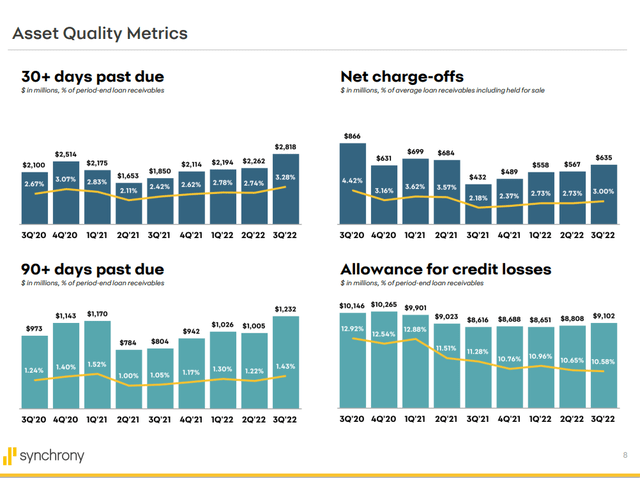

So far, the pace of provision normalization is slower than previously expected. The credit performance continues to be healthy, with the proportion of loans 30+ days past due at 3.28%, compared to 2.74% in Q2 2022. This represented quite a big ramp-up of 54 basis points from the prior quarter, and was 86 basis points higher than the third quarter last year. That being said, it still compared favorably to pre-pandemic levels of between 4-5%.

Synchrony Financial Q3 2022 Earnings Presentation

Net charge offs, which tends to be more of a lagging indicator, rose more modestly, by 27 basis points from the prior quarter to 3.00%. Although this still represented an 82 basis point increase from a year ago, it remained significantly below the ratio of around 5-6% seen in the two years leading up to 2020.

At the same time, resilient purchase volume, underpinned by robust consumer spending, helped to drive strong growth in loan receivables – which increased by 13% from a year ago to $86.0 billion. Meanwhile, net interest income increased 7% to $3.93 billion, while net interest margin widened by 7 basis points to 15.52%.

The annualized return on tangible common equity for the quarter was 26.6% – lower than the 40.1% reported for the third quarter last year and 30.3% in Q2 2022 – but still at a respectable level. Moreover, the strong underlying performance was beneficial to SYF’s already peer-leading cost to income ratio. Its efficiency ratio was 36.5% in the quarter, down from 37.7% in the prior quarter, and 38.7% a year ago.

Challenging Economic Backdrop

Synchrony Financial has so far held up better than expected, amid growing concerns on the US consumer as they grapple with rising concerns of inflation and recessionary risk. Despite signs of increasing pressure on households, credit card businesses seem to be in a sweet spot in the financial sector.

While mortgage lenders are seeing reduced levels of originations and refinancing activity, credit card issuers continue to benefit from continued resilience in the health of household budgets. Inflation, together with wage growth, has kept overall consumer spending growing, at least in nominal terms. This has driven up interchange fees, as well as loan receivables as consumers run down the savings built up during the pandemic and payment rates slow.

At the same time, delinquencies, although beginning to increase again, remain very low by historical standards. This is likely due to the strong jobs market, with unemployment at a pre-pandemic low of 3.5%.

“We continue to see signs of gradual normalization across the credit spectrum of our portfolio. The vast majority of our borrowers continue to perform consistently with or better than 2019 performance…Meanwhile, labor markets continue to be robust and portfolio payment rates remain elevated compared to our historical 5-year average. This suggests to us that borrowers generally remain well positioned to support robust demand for goods and services while responsibly meeting their financial obligations.”

Chief Financial Officer Brian Wenzel, Synchrony Financial Q3 2022 Earnings Call

For how long can the party continue? The operating environment will get more challenging, as although the labor market remains robust, the pace of jobs growth has slowed as employers have begun to scale back hiring in recent months. What’s more, with inflation stubbornly high, the Fed is under pressure to hike rates further than previously expected. This could raise the risk of a recession, as well as increase household interest costs, which in turn will have a detrimental impact on debt affordability and the ability to spend in the future.

SYF’s Strengths

The company’s excess capital position and peer-beating underlying profitability puts it in a strong position to weather an accelerated pace of credit normalization. Its common equity Tier 1 (CET1) ratio, at 14.3% is significantly above its long term target of 11%. And this was in spite of share buybacks worth $950 million and dividends worth $109 million that were paid for in Q3.

SYF’s nimble cost structure and above-average profitability is underpinned by its partnership-driven business model, as necessary spending on marketing and customer acquisition is greatly reduced. Its diversified retail partner relationships should help it to cope with shifting consumer spending patterns, especially as it pushes ahead with its expansion into healthcare.

Higher inflation will likely lead to continued weakness in discretionary spending, underlining the importance to diversify towards non-discretionary categories. What’s more, healthcare is a secular growth area.

“As health care costs continue to rise and the burden of out-of-pocket expenses intensified with the growth in high deductible health care plans, there is a clear and growing need for consumers to have access to the financial solutions that empower them with choice, choice in how and when they manage the cost of planned and unplanned medical procedures as well as elective care procedures.”

Chief Executive Officer Brian Doubles, Synchrony Financial Q3 2022 Earnings Call

Final Thoughts

Although Synchrony Financial has an attractive business model, the clouded macroeconomic outlook will continue to overhang on earnings expectations and valuations in the medium term. So although valuation multiples are low – the stock trades at just 6.1 times its expected earnings – the current benign credit environment may not last for much longer.

Be the first to comment