onurdongel/E+ via Getty Images

Introduction to Symbotic

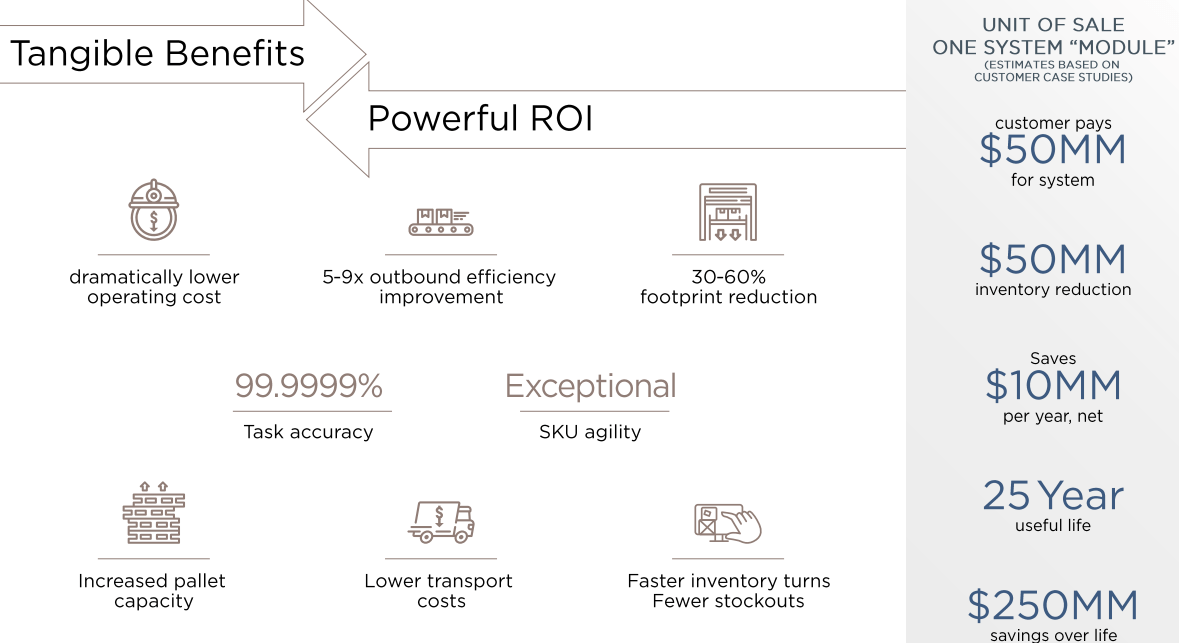

Symbotic (NASDAQ:SYM) is a unicorn warehouse automation technology provider that just IPO’d at over $5 billion through a SPAC deal. The company works with customers such as C&S, Walmart (WMT), and Albertsons (ACI) to process general merchandise, ambient food, groceries, and apparel. With time, the company expects to move into more complex areas of the market such as perishable foods, auto parts, home improvement, and even healthcare, around the world. The company currently offers clients 5x or more return on the system modules and is certainly a beneficiary of the post-pandemic era drive towards logistics and supply chain modernization. SPAC spokesmen certainly have a positive opinion on the company, and the first week of performance is another indicator of SYM’s potential.

‘We are thrilled to complete our business combination with Symbotic,’ said Yanni Pipilis, Chairman and CEO of SVF Investment Corp. 3 and Managing Partner for SoftBank Investment Advisers. ‘We believe Symbotic is years ahead of its peers, with an exceptional technology platform and impressive customer relationships. Symbotic’s ability to execute, from innovation to installation, gives me every confidence the company will be successful in the public markets.’

‘We believe Symbotic is at the forefront of a more than $350 billion market opportunity to reinvent warehouse automation and reshape the global supply chain,’ said Vikas J. Parekh, Managing Partner for SoftBank Investment Advisers and a member of Symbotic’s Board of Directors. ‘With its revolutionary A.I.-enabled technology platform and deep relationships with some the world’s largest companies, Symbotic is already making the right strategic investment decisions and we believe it is well positioned to achieve long-term success.’

Private Equity stakeholders are not the only ones pleased, as it was just announced that major customer Walmart (WMT) has taken a 62% stake in the company. This has allowed the shares to rise close to $20 per share, double the lows of less than $10 per share seen just last week. Due to this fact, valuation will play an important role when considering the investment.

Symbotic Investor Presentation

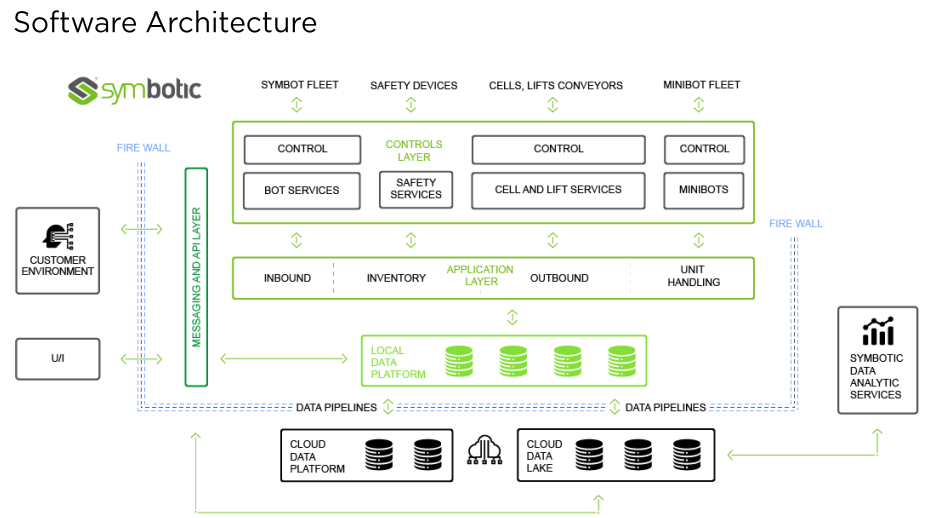

Symbotic’s automation platform is based on packaging robots and plenty of complex routing infrastructure elements across a warehouse. Development work is split evenly between the software and hardware platforms, as improvements to both will continue to be necessary for future growth. However, I would have to agree with investors in that SYM is the leading pure-play company in warehouse automation and is certainly worth a long-term bet on their tech platform. However, let’s look to see if the financials also support the investment thesis.

Symbotic

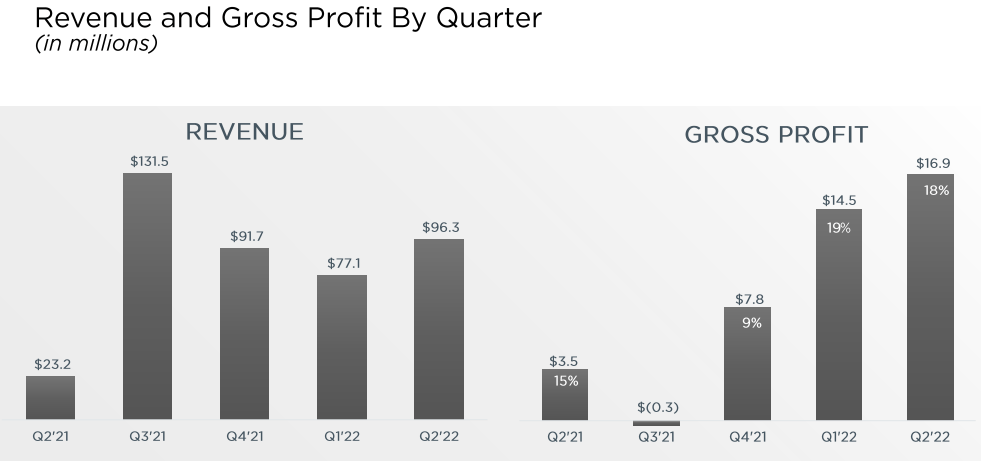

Financials

Although Symbotic has been in operation for at least the past decade, insights into the financials are hard to find due to being private. I will start with the revenues and gross profits provided in the most recent presentation. Revenues are cyclical within the year, perhaps as contracts get established. However, it is good to see that gross profits are positive, albeit at a low 18-19% level. This may be a red flag signaling most revenues are driven by low margin hardware and construction sales, and investors may be overconfident about final company margins. Or, it is just a sign of continued investments into growth, a common company trait in this modern era. As such, the balance sheet will be important to consider if you are looking for a shorter-term investment.

Symbotic

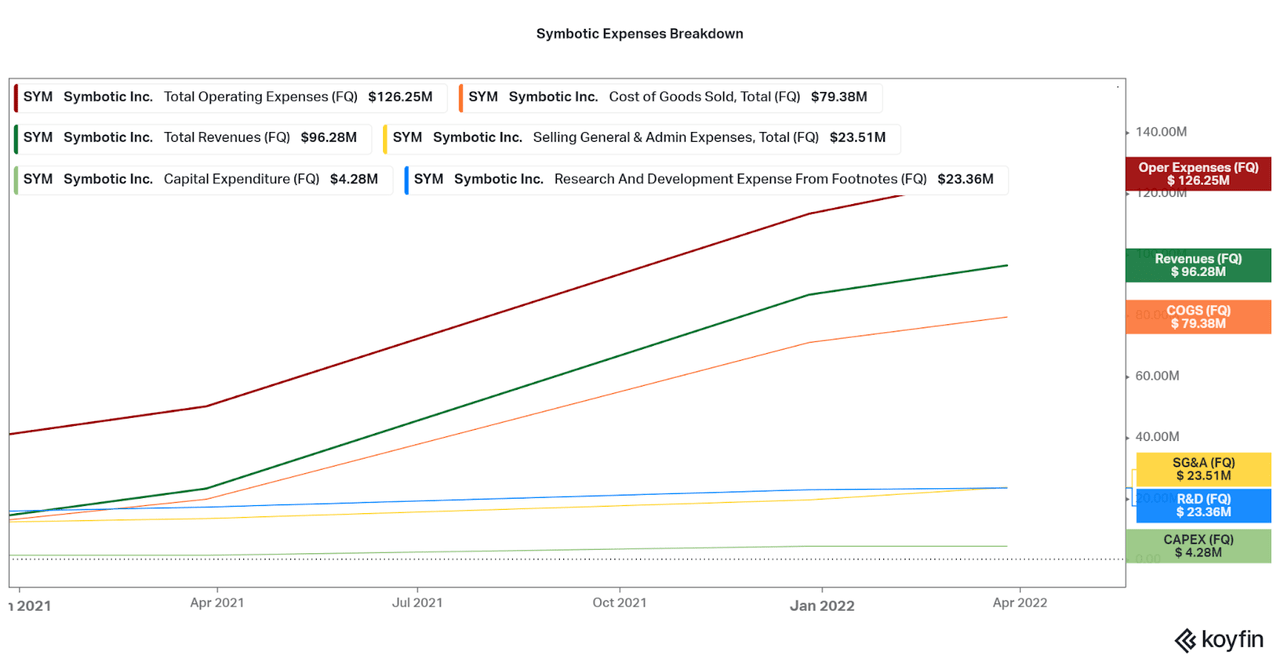

First, I will cover the expense profile, as this is an important determiner of the underlying revenue success. Losses can be acceptable if certain criteria are met. Importantly, we can see that revenues are mostly driven by the cost of goods sold (COGS) rather than excessive SG&A. Also, we can see that revenues are diverging slightly from the COGS, and if this pattern continues, should allow for revenues to exceed total operating expenses in due time. Also favorable is the fact that SG&A and R&D are not increasing with revenues or COGS. This may indicate that organic growth can be driven profitably and margins will improve easily with time. Also, the company does not seem to spend excessively on marketing or salesmen, as the result of low numbers of contracts to a few individual customers. It is unknown whether current growth can be maintained, and there is not a lot of data to drive long term conclusions.

Koyfin

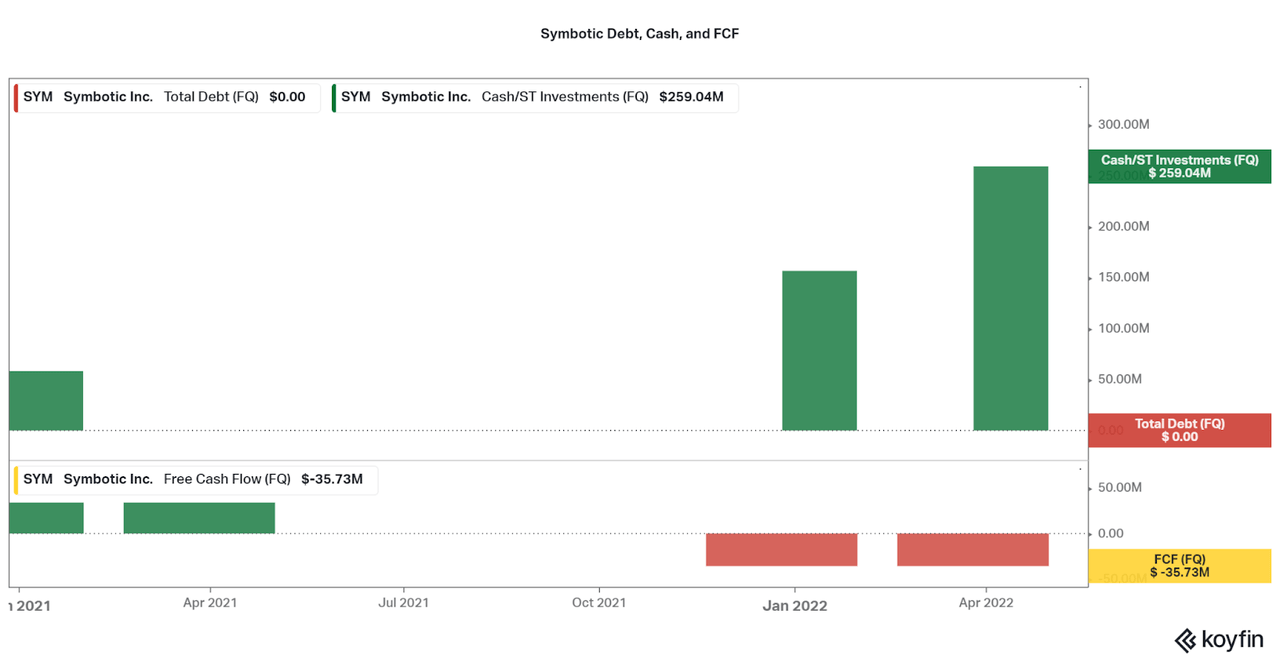

Along with an improving expense profile, Symbotic has a healthy balance sheet to support growth over the next few years. While current cash flows are reaching around $30 million per year, the current cash on hand-which does not include funds from the recent IPO-will provide at least two years of operations. I now expect cash on hand to reach close to $1 billion after the IPO and this may lead to the company announcing either significant production increases or an acquisition-type endeavor. Combined with the backing of a company like Walmart, I view the balance sheet and financial health of Symbotic to be extremely strong. This is an important quality as I find that the warehouse infrastructure industry is at risk of a bear market as companies such as Amazon have too much empty space at the moment.

Koyfin

Conclusion

Symbotic has a niche and enticing investment thesis. Factors such as fast revenue growth, tangible and realistic goals for continued development, and a healthy balance sheet all combine to make me have a positive view of the company. In particular, the strong balance sheet will allow for nimble movement over the next few years, regardless of the general market. Then organic growth into new applications will continue to drive growth even if current customers refuse to spend. However, this bullish outlook comes at a cost.

With $397 million in revenues and a $8.8 billion market cap, the current P/S is in fact 22x. The ratio then falls to 10x considering current analysts expect over $830 million in revenues for 2023. While I believe growth will beat expectations, this steep cost is only attractive for investors who in for the long run. I personally will wait to see if shares fall over the next few quarters before considering an investment. If the company seems interesting to you, and you have a long term mindset, recurring investments over time will help beat out volatility risk. Symbotic is certainly worth taking the time to research fully.

Thanks for reading. Feel free to share your thoughts below.

Be the first to comment