andersboman/iStock via Getty Images

When funds underperform expectations, investors tend to blame the managers. Often, the fault does not lie with the fund managers. The faults lie in the mismatch of expectations. We talk about two such funds today and tell you why their poor performance was easy to forecast simply based on their strategy. We also tell you which of these two is likely to do better in the months ahead.

Amplify BlackSwan Growth & Treasury Core ETF (NYSEARCA:SWAN)

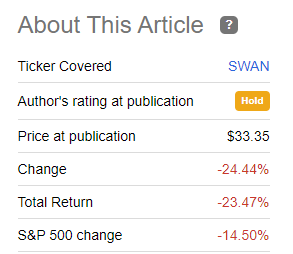

The S-Network BlackSwan Core Index is the target benchmark for SWAN. The SWAN Index seeks unconstrained exposure to the S&P 500 (SPY) while providing protection from the chance of significant losses. These days, there are a ton of ETFs attempting to accomplish this using various strategies. Options are used by the majority of them in one way or another, and SWAN is no exception. 90% of the assets of the fund are held in Treasury bonds, while the other 10% are held as in-the-money calls on SPY. This sounds like it would protect you in the worst of times. Unfortunately, it was a flawed strategy, to begin with. Since our initial coverage of this fund, it has given investors about 60% more losses than the SPY.

Seeking Alpha

Nationwide Risk-Managed Income ETF (NYSEARCA:NUSI)

This actively managed fund seeks to achieve the best of all possible outcomes.

Its goals consist of:

1) A substantial current income stream,

2) Protection against losses in declining markets, and

3) Participation in rising markets.

NUSI uses a “collar strategy” in which it trades Nasdaq-100 puts and calls.

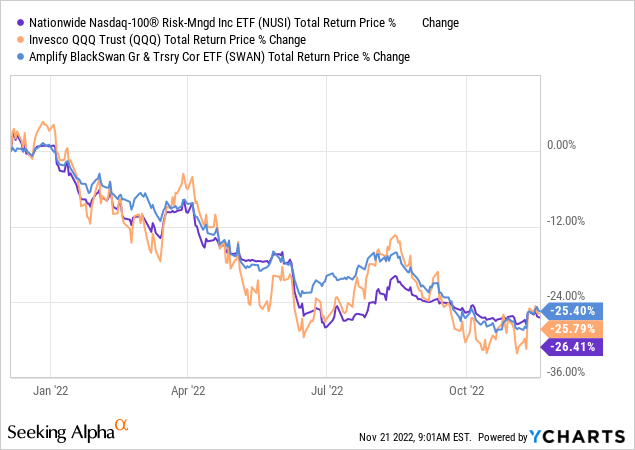

It uses the call premiums it sells to pay for the put premiums it purchases. Income is achieved via using a net credit strategy each month. In other words, it invests less in puts than it gets in call premiums. The option contracts often have expiration dates that are around a month after the trade is initiated. While the fund has provided income for sure, it has definitely failed in objective 2. You can see the total returns since early December 2021 (when we put a Sell on it), and they have been worse than the unhedged Invesco QQQ Trust (QQQ) and SWAN.

Outlook – SWAN

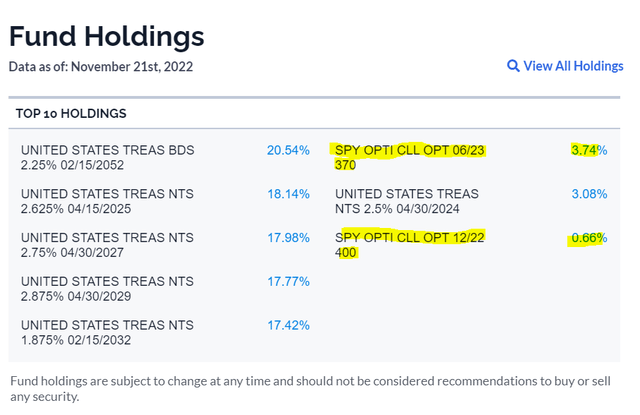

SWAN’s holdings are currently that of a medium-duration Treasury Bond fund, with about 4.4% in call options.

The treasury holdings are far better priced versus last year. Previously designated as Class A return-free-risk, they do provide some yield today. While coupons are low, the yield to maturity of these holdings is about 4%. That creates a far better buffer today than buying them when these yielded about 1%. At these yields, your duration risk is about twice the yield. So, if rates increase across the board by another 1%, your losses on the Treasury side should only be about 8%. This will be offset by about 4% of yield, leading to 4% net losses. We don’t think Treasuries offer substantial upside here but they can form part of a balanced portfolio.

The other investment, if we can call it that, remains problematic. The call options are designed to go to zero unless the fund stays over those strikes. For example, the SPY $400 strikes for December 2022, should decay to zero unless the SPY moves up in the next month. The in-the-money $370 call for June 2023 closed at $48.00 while the SPY was at $396.03 on November 18, 2022. You were hence effectively buying SPY at $418.00 (strike of $370.00 plus premium of $48.00). So not only would you not get any SPY dividends, but you would need it to rally to $418.00 to just break even. The strategy remains one we dislike, especially with our outlook of poor total returns for the indices. In such an environment, buying options will be a poor total return strategy. Here, the income from the treasury bonds is offset by the repeated complete losses on the call options.

Outlook – NUSI

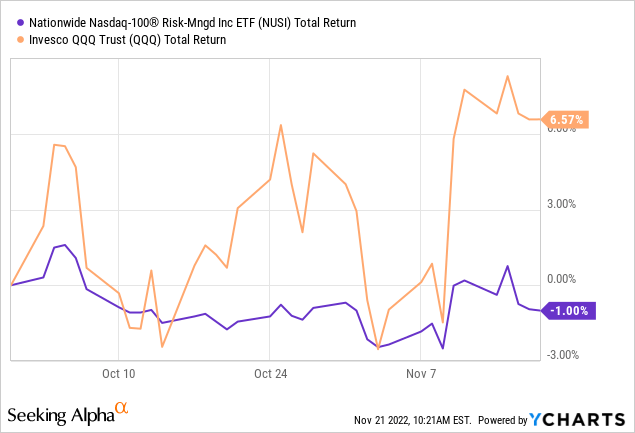

As the total return shows, NUSI’s collars have been ineffective in mitigating the NASDAQ declines. The broader reason is that collars require a high degree of certainty in predicting which band the underlying index will trade in. In general, the opposite has happened as the index has moved wildly in a big range. That means that the calls sold often compromise upside. Since these are shorter-term options, the fund has to then decide what to do at a higher index level. Repurchasing those call options at a loss is what initially is done to square off positions, and then the next step is even harder. The fund has to decide where to place its puts and calls next. It is not easy by any stretch of the imagination, and you can often see this kind of relative movement.

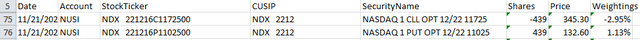

Our observations on NUSI’s strike points suggest that the fund is getting ultra-defensive.

We have been seeing this for the last three months. Hence, a big down move in the index will likely be mitigated well by NUSI, but don’t expect big returns from the fund.

Verdict

Both funds have heavy drawbacks that don’t really make them a good fit for any portfolio in our opinion. Yes, while they may move differently at times than your other holdings, they don’t offer any advantage. If you substituted SWAN with a long-duration bond fund like iShares Long-Term Corporate Bond ETF (IGLB) we think you would come out ahead over the next decade. For NUSI, as we have repeatedly stated, JPMorgan Equity Premium Income ETF (JEPI) is a far better alternative. While we would not want to own either SWAN or NUSI, we think NUSI has a slight advantage here as it is at least selling Vega (Greek for Option Volatility) versus buying it. This advantage is neutralized by NUSI’s underlying index, which is far more expensive than the SPY. If we had to own one here, we would pick SWAN and would say NUSI is the better sell.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Be the first to comment