tifonimages

Published on the Value Lab 29/7/22

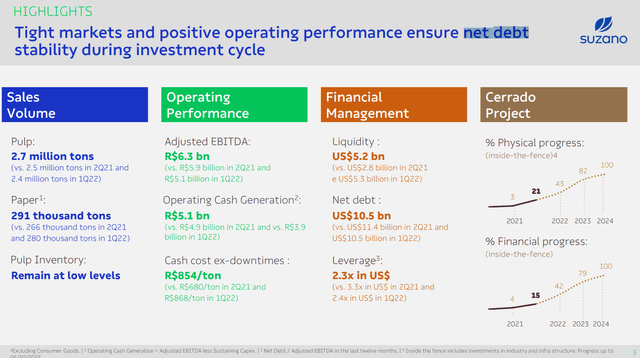

Suzano (NYSE:SUZ) just reported its results showing another strong quarter with still no signs of slowdown in pulp demand as the goods boom gets targeted by monetary authorities with rate hikes. Deleveraging has stopped, but realised prices continue to increase with EBITDA continuing its upwards trajectory. While a strong quarter, we stay true to our initial conviction that cycles will always end, and we’d rather not hazard money here given the other opportunities we see in the market.

The Q2 View

Things continue to look better for the company despite the fact that macroeconomic headwinds have mounted and should have been more apparent in the Q2. Net prices are rising, and YoY debt has fallen, but sequentially it hasn’t on account of CAPEX into the Cerrado project.

Financial Highlights (Q2 2022 Pres)

Cerrado continues to be on track, and the mounting cash flow is helping Cerrado get closer to the CAPEX inflection point, where some discretionary additional transactions of forestry assets in Brazil added to the CAPEX guidance this year. The trends in EBITDA and price both look linear with still no apparent dangers. With good financial management and supply management, the cash costs have actually managed to fall sequentially. EBITDA more than covers incremental CAPEX by about a 1.3x multiple, and net debt is unlikely to grow especially as there is further margin provided by the dividends and buybacks which could always be rolled back equivalent to about 25% of EBITDA.

Conclusions

There is really only one reason to worry about Suzano which is that it sells a cyclical commodity. There are two chief ways that the cycle could finally end for pulp, which admittedly is still going strong. The first is the obvious, which is rising rates targeting inflation in commodities like pulp connected to the goods boom could start becoming a problem. Shopify (SHOP) layoffs connected to ecommerce declines is a first sign of that. The second issue is that eventually projects like Cerrado will be complete. While the net effect in a vacuum will be positive for Suzano, giving up some price for way more volumes, the issue is that competitors are also investing in pulp facilities. Eventually, supply across the market will grow, and it might be just when demand starts to fall as well. While an oversupply glut is not something to be very worried about, the dynamics that go in that direction should be a consideration.

Everything comes in cycles, especially cyclical commodities. Deleveraging is taking a pause to set up Cerrado. Cerrado will be a leading facility with some of the lowest cost production in the pulp industry. But dynamics in pulp are subject to change, and institutions controlling the money supply have an interest in those dynamics changing in an unfavourable way for the Suzano investor. Best to avoid as the cycle becomes long in the tooth.

If you thought our angle on this company was interesting, you may want to check out our idea room, The Value Lab. We focus on long-only value ideas of interest to us, where we try to find international mispriced equities and target a portfolio yield of about 4%. We’ve done really well for ourselves over the last 5 years, but it took getting our hands dirty in international markets. If you are a value-investor, serious about protecting your wealth, our gang could help broaden your horizons and give some inspiration. Give our no-strings-attached free trial a try to see if it’s for you.

Be the first to comment