tifonimages

Published on the Value Lab 15/7/22

Suzano (NYSE:SUZ) is a company that we really like, although we sold it, thankfully at highs, some months ago as sentiment pressures began to mount on the stock which was positively exposed to the goods boom. We are seeing an evolution of these pressures in Q1, but they are not yet appearing on the demand-side. The company is still very cash generative, and the major CAPEX efforts are moving forward nicely, but the direction makes this a very mixed picture, with no clear downside protection except for the already low multiple if monetary authorities continue to push with rate increases. While the LBO economic of the Suzano investment remain attractive, we continue to keep it on the watchlist rather than in our portfolio.

Q1 Update

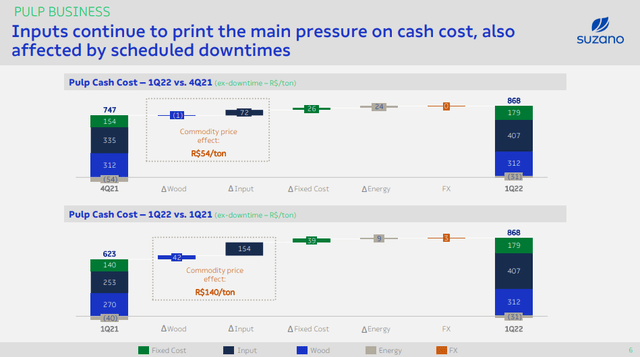

Let’s take a look at some of the key information from the Q1. Cash costs continue to evolve. Wood, which includes diesel costs associated with transport and processing, are beginning to pressure the cash costs as well as general issues with inputs outside of wood, including caustic soda and other chemicals that are in short supply.

Cash Cost Development (Q1 2022 Pres)

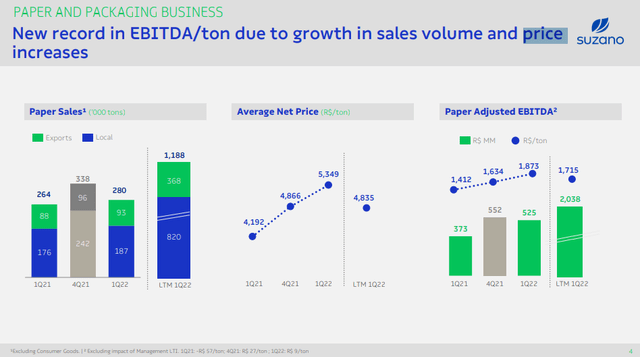

On the demand-side, selling prices continue to rise, indicating that there hasn’t been a hit to demand yet. Moreover, the massive appreciation of the US dollar hasn’t been fully reflected in effective prices yet. Finally, the company is continuing to implement price increases, so the sequential and YoY increases, which are both double digit, should actually continue into the next quarter for sure, with the picture beyond being less clear.

Net Price Growth (Q1 2022 Pres)

This increase in prices is not something we expected, but is a useful measuring stick for understanding the effects of monetary pressures. The quarter closed before the hiking regime, so we may be approaching a top after the price hike rounds to customers as well as FX effects take full effect. Monetary pressure is going to have to take commodity prices like pulp down in order to control the inflation situation. In Q3 we might start seeing the effect that lower disposable income will have on the price side.

Approaching Suzano

The Cerrado project, the company’s big initiative with construction company Andritz (OTCPK:ADRZF), is going to be completed in 2024, which took about 1.5 years longer than most factory build-outs would have taken prior to the lengthened lead times associated with our supply constrained environment. 10% of the total burden was accomplished this quarter in terms of industrial CAPEX, which shown the rapid progress that Suzano is able to make organically in funding its own initiatives. This will substantially skew down the company’s cash cost due to the strategic positioning of the Cerrado facility and its size (20%) relative to the overall current productive capacity, well timed for both the recession and also concurrent capacity build-outs by some other competitors in the industry. It should also concur with the end of the recession, where timings of their build-out should coincide with general efforts of manufacturers to grow capacity as is needed by the real economy suffering from cost push inflation.

The effects of rate hiking probably haven’t been reflected yet in the company’s demand-side situation, and while the price has come down substantially, trading at 5x EBITDA on a run-rate annualized basis with a 24% YTD decrease in stock price, the direction is undeniably poor, with post-Q2 results likely to see correction of the pulp commodity.

Our approach will be to keep Suzano on the watchlist. If it approaches March 2020 prices we’d buy it, otherwise, we’ll wait till the Cerrado project is completed and then look for a macroeconomic trough then before capacity increases across the economic board become realized by markets to buy. The company has slowed down deleveraging due to the CAPEX burden brought on by Cerrado, but a meaningfully decreased debt burden, now with a leverage ratio only at about 2.2x, shows how effective the cash generation has been in creating shareholder value till now. Overall, good company with low cost assets, constituting a real competitive advantage, that we will keep our eye on.

Be the first to comment