trekandshoot/iStock via Getty Images

On Thursday, the Atlanta Fed updated the GDPNow model estimate for real GDP growth in Q2 2022 from 0.3 to -1.0%. If that estimate holds, the U.S. will have entered a rule-of-thumb recession nearly 6 months ago as a result of two consecutive quarters of negative real GDP growth. In addition to this downgrade, the Q1 2022 real GDP figure was revised down to -1.6%.

Here is what the Atlanta Fed says on their website:

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the second quarter of 2022 is -1.0 percent on June 30, down from 0.3 percent on June 27. After recent releases from the US Bureau of Economic Analysis and the US Census Bureau, the nowcasts of second-quarter real personal consumption expenditures growth and real gross private domestic investment growth decreased from 2.7 percent and -8.1 percent, respectively, to 1.7 percent and -13.2 percent, respectively, while the nowcast of the contribution of the change in real net exports to second-quarter GDP growth increased from -0.11 percentage points to 0.35 percentage points.

Earlier this month, I wrote about recession based on forward-looking indicators and degrading economic conditions. Read that article to see how I forecasted this negative GDP estimate.

Recession is Teed Up and Ready to Play

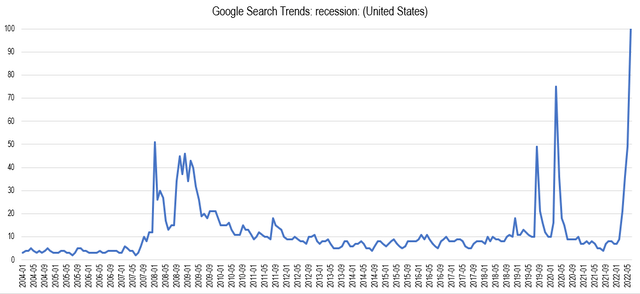

Incredibly, the Google Search Trends for the term “recession” is projected to reach all-time highs since trends were recorded in 2004.

Chart by author (data from Google Search Trends)

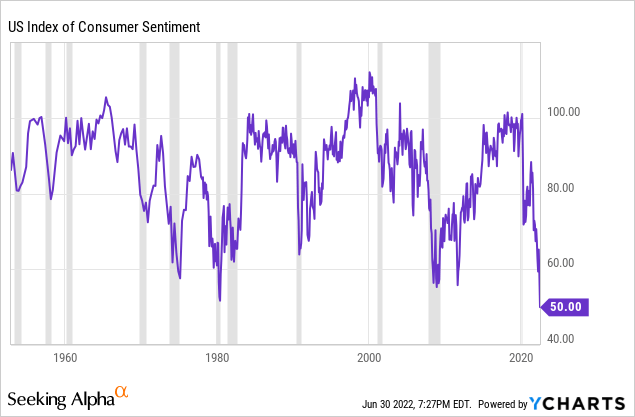

Similarly, the University of Michigan Index of Consumer Sentiment has reached an all-time low of 50.

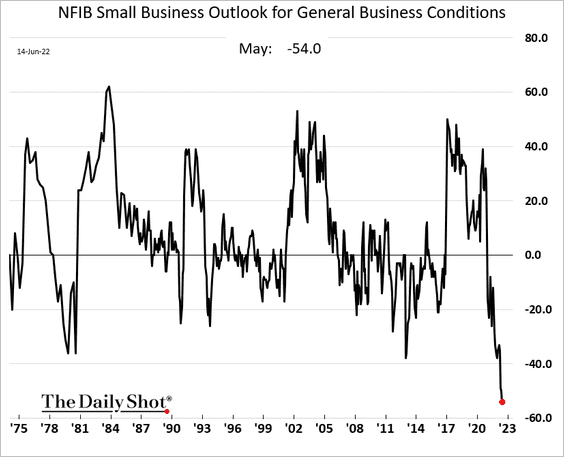

The Small Business Outlook index is not far behind, carving out new 50-year lows.

The Daily Shot (used with permission)

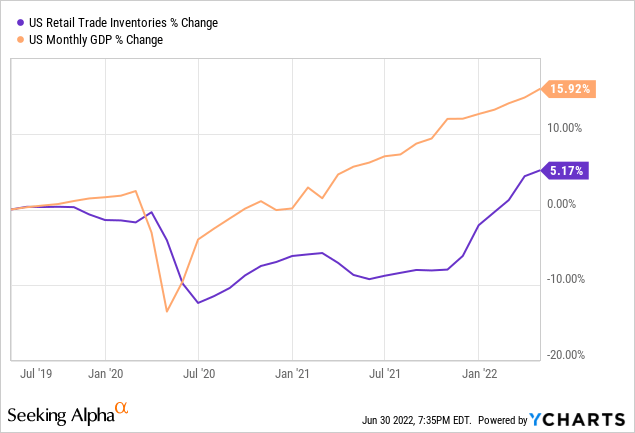

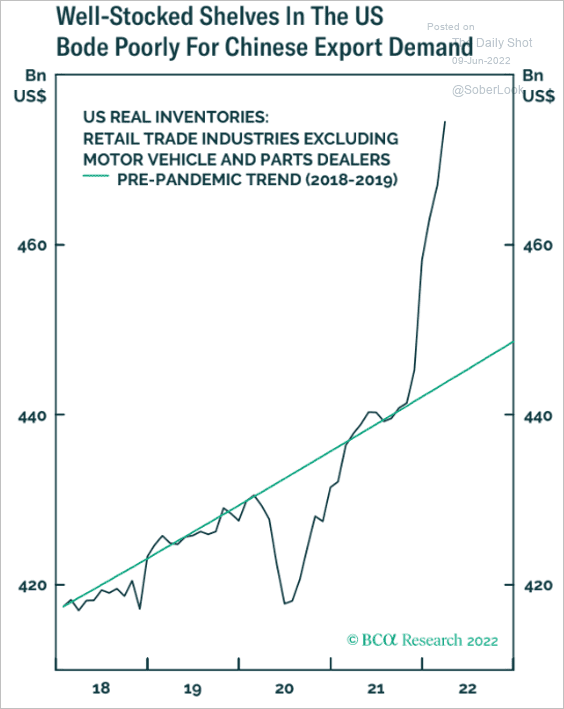

One of the reasons that this slowdown in growth has not appeared sooner is because of the contribution to GDP from retail inventories. Since July 2021, retail inventories have recovered strongly to pre-pandemic levels.

The problem is that retailers are having difficulty selling the inventory causing an inventory build. Moving forward, retailers will slow their inventory growth, thus removing that support to GDP. Bloomberg’s survey for retail inventories forecast growth of 1.8% in May but it came in at 1.1%.

The Daily Shot (used with permission)

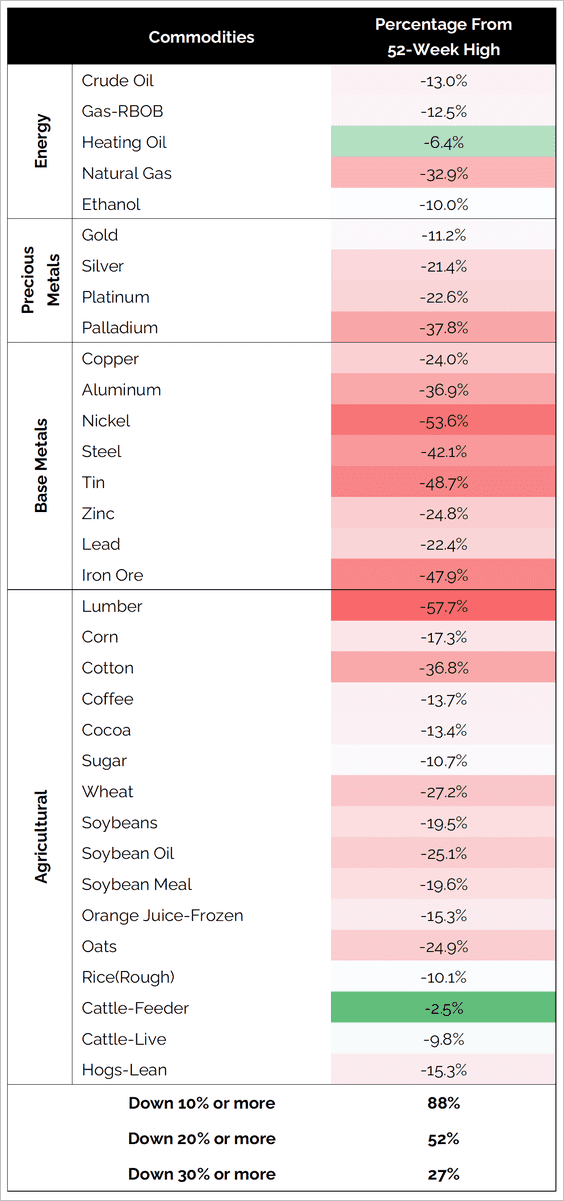

Many retailers find themselves in the midst of a bullwhip effect. The likely result is lower retail prices. In addition, commodity prices are declining quickly. Copper is down over 20%, corn 17%, wheat 27%, and lumber 57%. It is possible that we are near peak inflation and that disinflation is about to begin. The only commodities that I am constructively bullish on are oil, grains, and uranium. But commodities tend to suffer during recession, so I’m keeping positions small.

The Daily Shot (used with permission)

This Bear isn’t Fooling Around

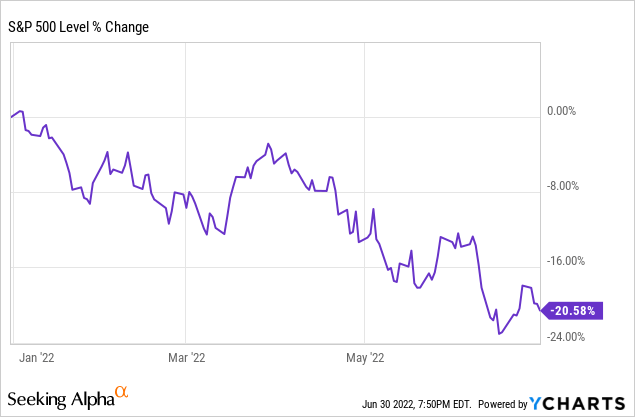

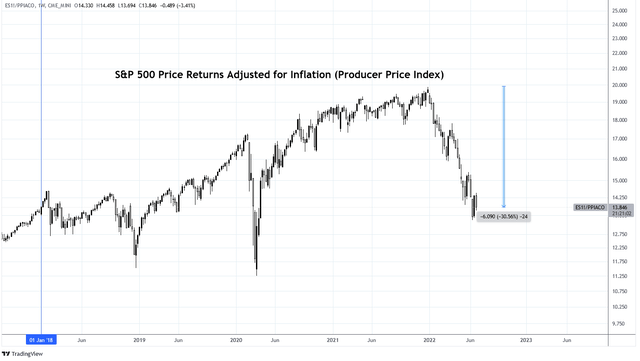

So far this year, about 60% of GDP has been lost from declines in bond and equity markets. Nominally, the S&P 500 is down 20%, but when adjusted for inflation using the Producer Price Index, it is down 30%, not including dividends.

Charts by TradingView (adapted by author)

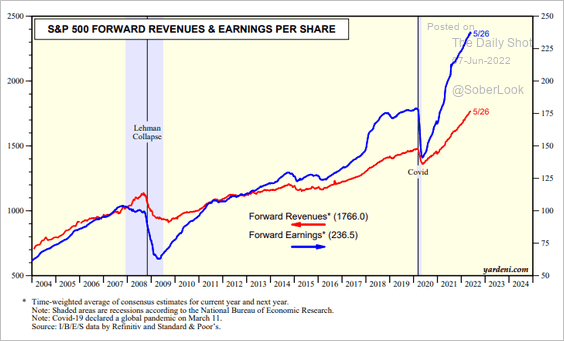

Largely, earnings estimates have remained steady through 2022 which I find astonishing.

The Daily Shot (used with permission)

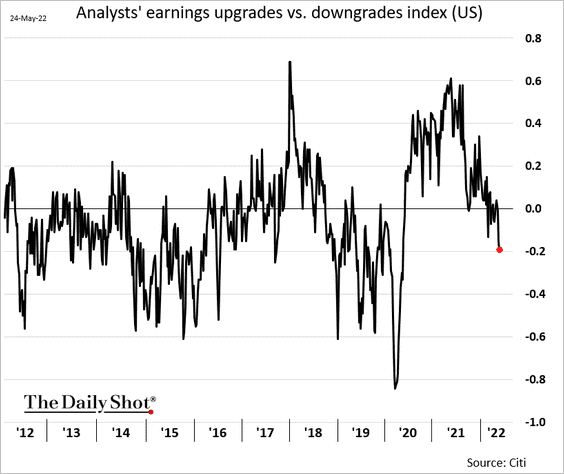

It is my expectation that we are entering into the earnings recession phase. Analysts have only begun to turnaround estimates, as demonstrated by the index below.

The Daily Shot (used with permission)

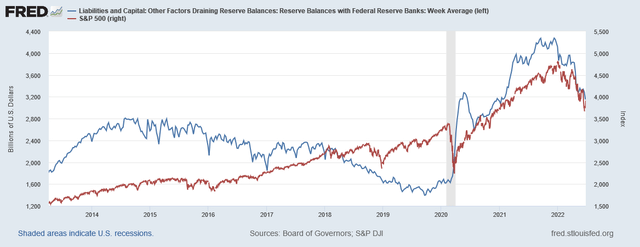

This means that short of a change to monetary policy, I expect equity markets to continue lower. Next is a chart of the correlation between the S&P 500 and reserve balance with Federal Reserve Banks. As long as liquidity continues to decline as monetary policy tightens, I expect the S&P 500 to continue lower.

Federal Reserve Economic Data | FRED | St. Louis Fed

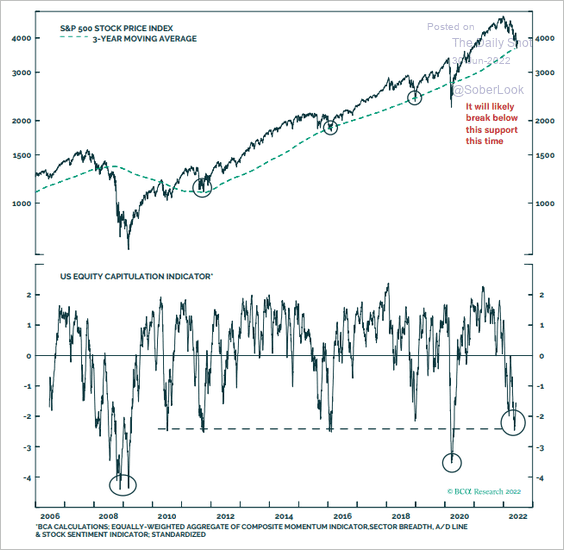

We find ourselves at a key point where either we print a bottom in equities or we begin the final stages of one of those infamous events in stock market history on par with the Dotcom Crash and Great Recession. My base case is infamous. A break of the 3-year moving average will support that idea.

The Daily Shot (used with permission)

The caveat is that if the Fed pivots, we could find ourselves in another 2018 or 2020 scenario. With disinflation on the way, I expect the Fed to pivot in Q3 or Q4 of 2022. Right now, I’m leaning on late Q3. I will be repositioning my portfolio in response to such pivot.

Summary

Recession is as good as official. The U.S. is primed for two consecutive quarters of negative real GDP growth. Consumer and small business sentiment is near all-time lows. Until the Fed changes their stance on monetary tightening, equity markets are vulnerable to further downside.

I am paying close attention and exercising extreme caution for the foreseeable future. Right now, my portfolio is about 75% cash, 10% commodities, 10% equities, and 5% shorts. I find the long bond trade intriguing with recession and disinflation imminent, but I’m going to wait a little longer before deciding on that trade. To hedge the risk, I have identified an interesting pair trade between Rent-A-Center (RCII) and The Aaron’s Company (AAN) that is worth reading here.

Be the first to comment