coffeekai/iStock via Getty Images

With some investments, you have to wait an extended period of time in order for your thesis to pay off. Sometimes, that can require years. In other cases though, the upside you want to achieve can be captured in just a few months. A really great example of this can be seen by looking at Superior Industries International (NYSE:SUP). With a market capitalization of only $120 million, Superior Industries International flies under the radar of most investors. But more likely than not, you have been near or even purchased one of its products. This is because the company specializes in the production and sale of aluminum wheels that are used for vehicles in both North America and parts of Europe. The company has had something of a rocky operating history. But all things considered, shares do look to be quite cheap. Add on top of this the fact that there is now a potential catalyst in the form of some mergers and acquisitions activities, and I still think that the stock deserves further upside from here. So as a result, I have decided to keep the ‘buy’ rating that I had on it previously.

Performance keeps rolling

The last article I wrote about Superior Industries International was published in early July of this year. In that article, I talked about how well the company had performed from a share price perspective over the prior few months. This was driven by somewhat mixed financial results and management’s promising guidance for the 2022 fiscal year in its entirety. It was also, I believe, driven by just how cheap shares of the company were. Ultimately, this led me to keep the ’buy’ rating I had assigned the company previously, a rating that indicated my belief that shares should outperform the broader market over an extended period of time. Since then, things have gone quite well. While the S&P 500 is up only 0.5%, shares of Superior Industries International have generated upside of 16.2%. Since my initial article on the company in April of this year, the return disparity is even greater, with shares up 19.7% at a time when the S&P 500 has dropped by 12.2%.

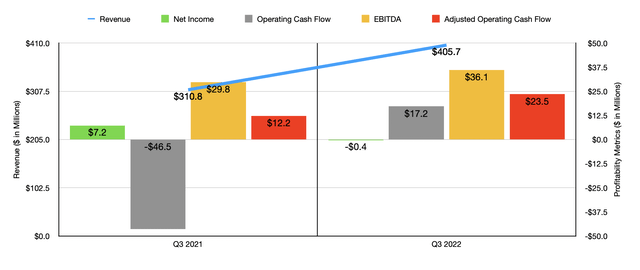

To understand exactly why the business continues to perform well like it has, we need only look at financial data covering the third quarter of its 2022 fiscal year. This is the most recent quarter for which data is available for the business. During that time, revenue came in at $405.7 million. That represents a sizable increase over the $310.8 million reported the same time last year. Some of this increase in revenue, totaling $19.7 million in all, was as a result of a rise in the number of units shipped. This number jumped from 3.50 million in the third quarter of 2021 to nearly 3.78 million the same time this year. The larger driver of the increase, however, involved higher aluminum and other costs that were passed on to its customers. This added $79.4 million to the company’s top line. It is worth noting that sales would have been even higher had it not been for an $18.8 million impact caused by foreign currency fluctuations.

On the bottom line, things were rather mixed. For instance, during the latest quarter, the company generated a net loss of $0.4 million. That compares to the $7.2 million profit achieved one year earlier. Although this was painful to see, other profitability metrics were largely positive. Operating cash flow went from negative $46.5 million to positive $17.2 million. If we adjust for changes in working capital, it still would have increased, rising from $12.2 million to $23.5 million. Meanwhile, EBITDA for the company expanded from $29.8 million to $36.1 million.

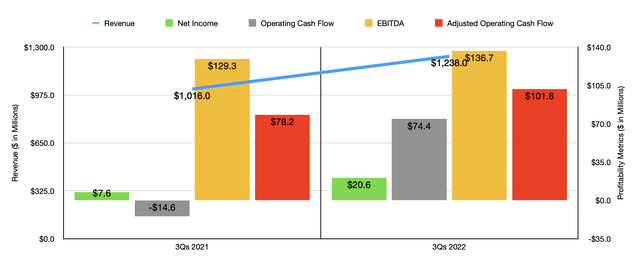

It’s important to note that the third quarter was not the only positive time for the company. For the first nine months of its 2022 fiscal year as a whole, results came in positively. Revenue of $1.24 billion beat out the $1.02 billion generated the same time last year. Over 100% of this increase was driven by higher pricing passed on to the company’s customers. In fact, during this time, the total number of wheels shipped dropped from 12.19 million to 11.87 million. Net income for the company almost tripled from $7.6 million to $20.6 million. Operating cash flow went from negative $14.6 million to $74.4 million, while the adjusted figure for this grew from $78.2 million to $101.8 million. Likewise, EBITDA for the company also improved, climbing from $129.3 million to $136.7 million.

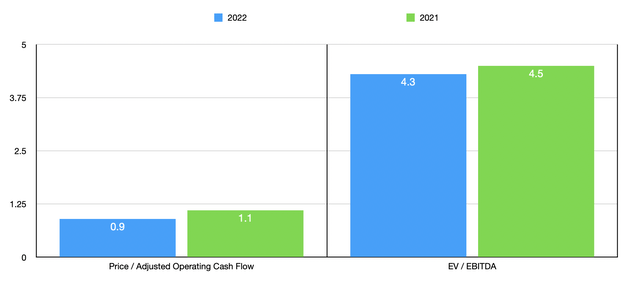

For 2022 as a whole, management expects shipments of between 16 million and 17 million wheels. That should bring in revenue of between $1.58 billion and $1.71 billion. The company is currently forecasting EBITDA of between $165 million and $185 million, while operating cash flow should be between $105 million and $150 million. Based on these figures, we can easily value the company. On a price to operating cash flow basis, the company is trading at a multiple of only 0.9. This is down from the 1.1 reading that we get using data from 2021. For the purpose of valuing the company, I did even exclude the $13.5 million in annual preferred distributions that are paid out. This is not really an operating cash flow item. But given that it’s a mandatory cash outflow item, I feel it more appropriately measures the value of the enterprise as far as common shareholders are concerned. Meanwhile, the EV to EBITDA multiple for the company should be 4.3. That compares to the 4.5 reading that we get using data from last year. As part of my analysis, I compared the company to five similar businesses. On a price to operating cash flow basis, these companies ranged from a low of 3.1 to a high of 52.3. In this case, our prospect is the cheapest of the group. Meanwhile, using the EV to EBITDA approach, the range is from 4 to 13.5. In this case, two of the five companies were cheaper than Superior Industries International.

| Company | Price / Operating Cash Flow | EV / EBITDA |

| Superior Industries International | 0.9 | 4.3 |

| Standard Motor Products (SMP) | 11.6 | 6.9 |

| Cooper-Standard Holdings (CPS) | 3.1 | 4.0 |

| LCI Industries (LCII) | 6.6 | 4.2 |

| Visteon Corp (VC) | 52.3 | 13.5 |

| Dorman Products (DORM) | 48.9 | 12.1 |

In addition to being incredibly cheap, the company also has an interesting catalyst that might or might not create some additional upside for shareholders in the near term. On November 11th of this year, shares of the company spiked in response to an offer from M2 Capital Partners to acquire the business for $5.85 per share. Interestingly though, instead of going through management, the organization decided to commence a tender offer to acquire the stock. This could be considered a hostile takeover. After initially putting out a response to this overture on November 11th, the management team at Superior Industries International put out a subsequent release several days later stating that documentation had still not been filed by M2 Capital Partners to move forward with such an offer. Management did say though that they would carefully review any such offer that might come about. Frankly, even if an offer is put forth, I do think that success is unlikely. This is because the transaction significantly undervalues Superior Industries International. In the event that this does go through though, it would provide common shareholders an additional immediate upside of 31.8% over where shares are trading today.

Takeaway

Although Superior Industries International has seen a fantastic ride since I started writing about it, I don’t believe that ride is over just yet. In the event that the company does get bought out, there could be some nice short-term upside for shareholders to enjoy. But with or without that, I do think that shares deserve to move higher from here. I see the company as being meaningfully undervalued and, as a result, I cannot help but to keep the ‘buy’ rating I had on it previously.

Be the first to comment