piranka

Years back, in 2018 we argued that the shares in Super Micro Computer, Inc. (NASDAQ:NASDAQ:SMCI) were really quite cheap as investors were waiting for an audit, the cost of which was depressing profits and sapping some investor confidence in the process.

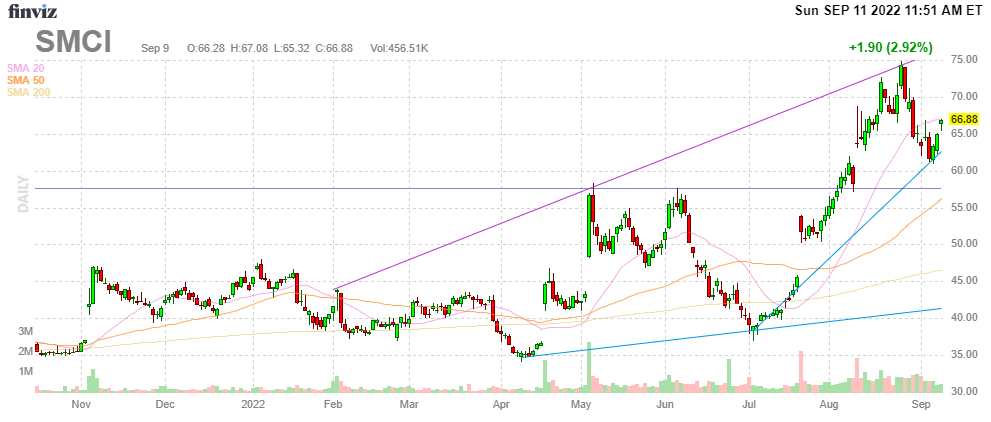

FinViz

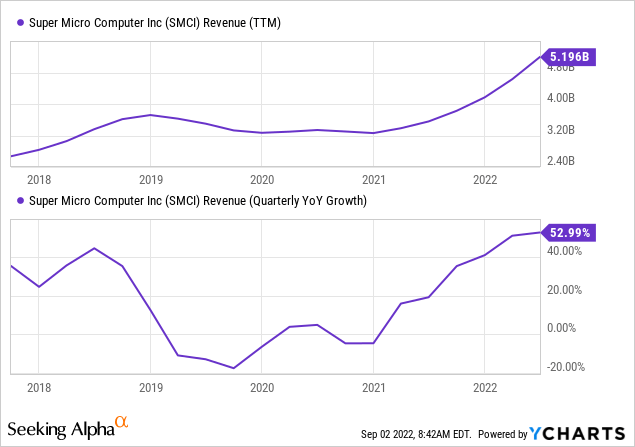

That’s all history now. The company since has gone from strength to strength, apart from the pandemic years:

Growth figures are still a little inflated by easy comps from the pandemic period, although by Q3/21 the company had recovered from the previous top in revenue (Q2/20). Since Q2/21, growth has been accelerating (keep in mind their fiscal year ends in June).

Growth

The company produces high-performance, high-efficiency server technology, providing advanced server building block solutions for enterprise data centers, cloud computing, AI (artificial intelligence), and edge computing solutions.

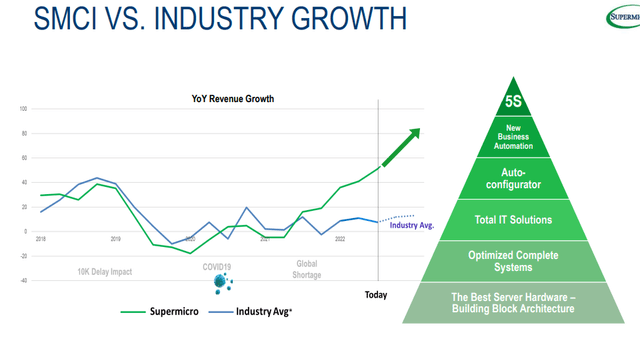

The company has secular tailwinds from operating in markets that are in long-term secular growth cycles, like cloud computing, edge computing, 5G, IoT, and AI. However, the company is actually growing significantly faster than the industry (Q3 earnings deck):

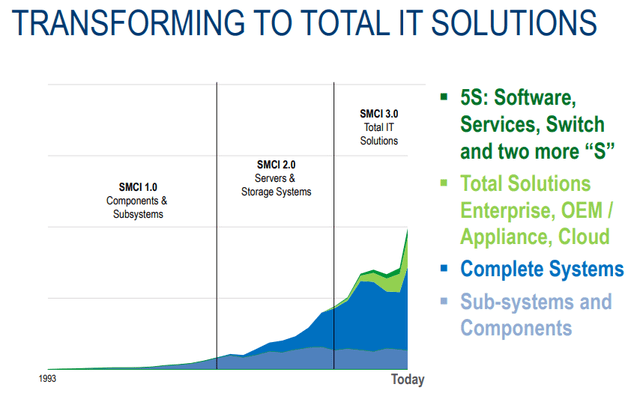

What is behind that relative recent outperformance? Basically, the company is innovating and moving upmarket, providing total solutions for customers. Here are some of the present and future growth vectors:

- Total solution

- Universal GPU system and AI platforms

- Green computing

The company is rapidly gaining market share with this strategy, outgrowing competitors 3 to 1 for the past four quarters and with increasing margins to boot, the company is a winner at the moment.

Total IT solutions

The company is morphing from being a supplier of parts to a Total Solution Provider, basically acting as a one-stop shop for customers.

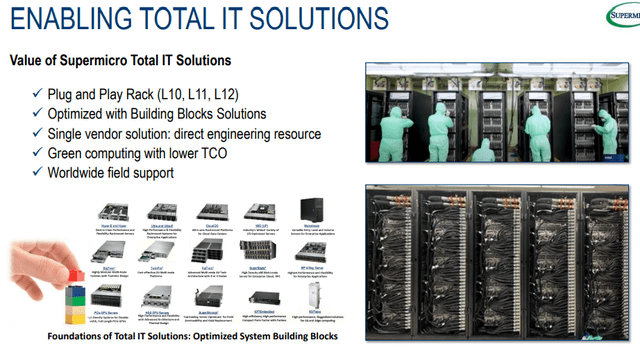

One of the core ideas behind this is plug-and-play modular systems:

There are several advantages of becoming a total solutions provider, especially based on plug-and-play modules:

- It lowers the anxiety of customers, enabling simple capacity flexibility and future-proofing solutions.

- It increases customer stickiness as the company solves problems, rather than just selling stuff.

- It improves the value proposition to customers which has a tendency to increase gross margins (as sales contain an increasing proportion of higher margin services and software).

- The company is able to have much shorter lead times for customers, adding to the value proposition.

On the latter (Q4CC):

Our total IT solution approach streamline design, dedication, solution and integration, resulting in a much shorter lead times for our customers which optimized quality and performance. Moreover, our total IT solution simplified integrated [indiscernible] control.

Fellow SA contributor Mayank N Sharma highlighted the importance of their universal GPU unit:

Universal GPU Platform is universal because it is built to work with different GPUs by being standard in design to accommodate various elements. For example, this system supports GPU interconnection between NVIDIA’s (NVDA) NVLink and AMD’s (AMD) Infinity Fabric that facilitates hyper-speed inter GPU communication, reducing bottlenecks caused by traditional GPU interlinks. This is one of a kind product, which as per my analysis, will take up the majority of the revenue share of SMCI by FY24.

And here is management at the Q4CC:

Our strong growth is fueled by recent run in design wins based on our rack scale total IT solutions, especially on GPU solutions and AI platforms.. We will also expand our total IT solution to both Europe and Asia markets in the coming quarters and years

The total solutions growth has been mostly a U.S. affair, with U.S. revenue growing a whopping 41% sequentially. This gives the company plenty of opportunities overseas.

In all, management sees room to grow the revenue from these total solution racks 4x in the coming years. Then there is the software, making things simple for clients (Q4CC):

In addition, our super cloud composer, orchestrator, security and other products can help only manage compute, acceleration, storage and network building products at cloud-enabled including rich analytics. Data center operator can easily leverage these information to [indiscernible] grow workload efficiency. So, we are expanding our investment in our data center management software stack that will enable to draw infrastructure as a service and secure monitoring as a service functionality for enhancing our total IT solution capability and value. This one stop shop approach we are aligned with emerging growth market across AI, machine learning, software defined storage, networking, public and hybrid cloud, and 5G, IoT and telco.

The auto configurator seems especially helpful in their sales process.

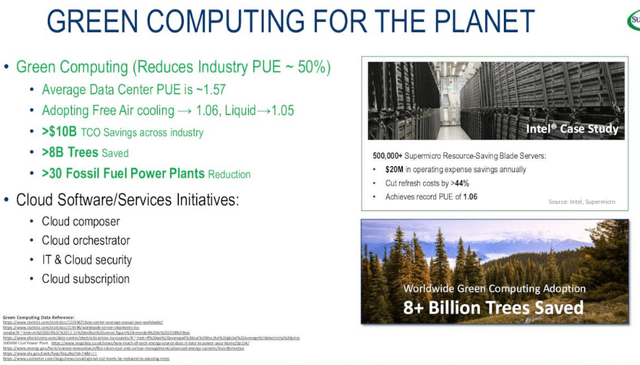

Green computing

Management is making some bold claims with regards to their green computing initiatives (Q4CC):

adoption of our green computing solutions or other suppliers’ solution with similar energy visions will potentially save the IT industry more than $10 billion in electricity costs… we are focused on building and delivering much more greener rack-scale total IT solutions. From an industry perspective this is that greatest opportunity Super Micro has ever seen since our founding 29 years ago.

Given rising energy prices, this is a boon to their sales pitch.

Finances

The quarter was a blast with revenue rising 53% y/y and 21% q/q and there was also a non-GAAP gross margin expansion of 390bp y/y and 200bp q/q to 17.6%, coming in above their long-term target (14%-17%) but management argues it’s sustainable. There are some reasons to back that up:

- Ongoing favorable product mix shift.

- Their facility in Taiwan is still plagued by supply chain problems and operates well below capacity.

- There are still considerable scale economies to be reaped with FY22 revenues at $5.2B while they have capacity for $10B-$12B.

- Freight costs could fall further

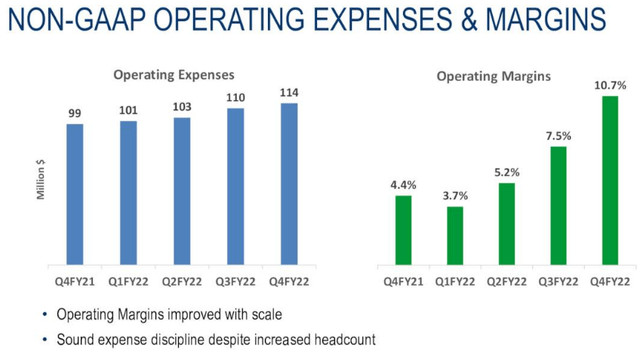

There is also considerable operational leverage:

Clearly OpEx is growing much slower than revenue (+53%) and operating margins are also operating well above their long-term target (5%-8%).

All this produced a rather stunning non-GAAP EPS increase (after twice increasing guidance during the year, adding a whopping $1.81 y/y and $1.07 q/q to $2.62.

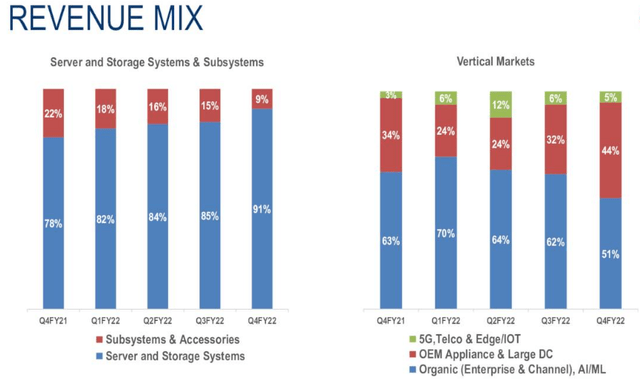

The vertical that is growing particularly fast is their 5G telco edge IoT segment at +172% y/y reaching 83M in revenues representing 5% of Q4 revenue versus 6% last quarter.

Cash

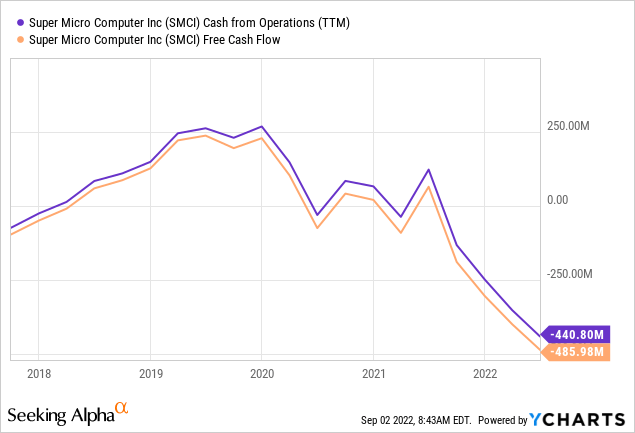

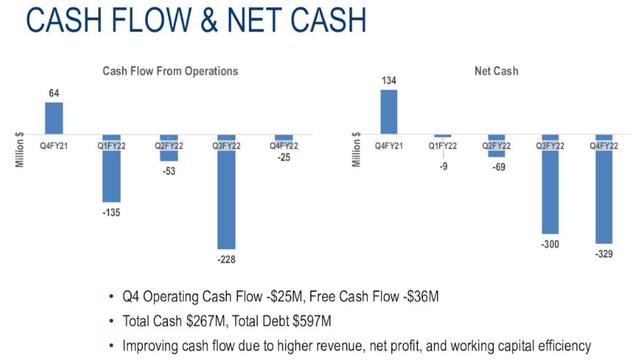

With the strong revenue growth and expanding margins, it’s a bit of a surprise to see that cash flow isn’t tracking that progress, quite the contrary:

That figure looks scary, but it’s the result of a massive increase in inventories by a whopping $561.5M in the first nine months of the year. The reasons are not hard to understand (10-Q):

We have actively managed our supply chain for potential shortage risk by building inventories of critical components required such as CPUs, memory, SSDs and GPUs to support our ability to fulfill customer orders. Our architecture, which is based on a “Building Block Solutions” design approach, has also assisted us during the pandemic, to qualify different components for compatibility with our systems to help us overcome some shortages.

As you see above, the problem was largely occurring in Q1 and Q3, as they trimmed their inventories a bit (3%) in Q4 while at the same time increasing receivables and declining accounts payable.

So the negative cash flow is mainly a working capital issue but it has to be noticed that the company swung comprehensively into negative net cash territory (the right side of the slide above).

Not dramatic by any means, but noticeable when the company seems to be firing from all cylinders. It doesn’t hold management back from instigating a $200M share buyback program.

CapEx

The company has the capacity to produce between $10B and $12B of revenues annually in the capacity to ship 6K of these plug-and-play racks that are selling like hotcakes these days (in Q4 they sold 1K+ so they have plenty of capacity to accommodate the expected increase in demand).

Guidance

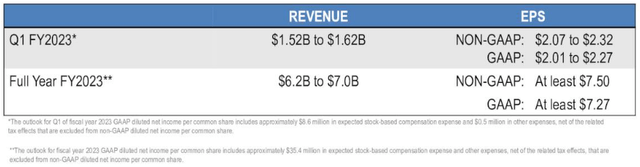

Q1 is seasonally weaker so there is a sequential decline (also because of lingering supply chain problems).

Given the rapid growth, management thinks it can achieve its $10B annual revenue target much sooner than they guided last year.

Valuation

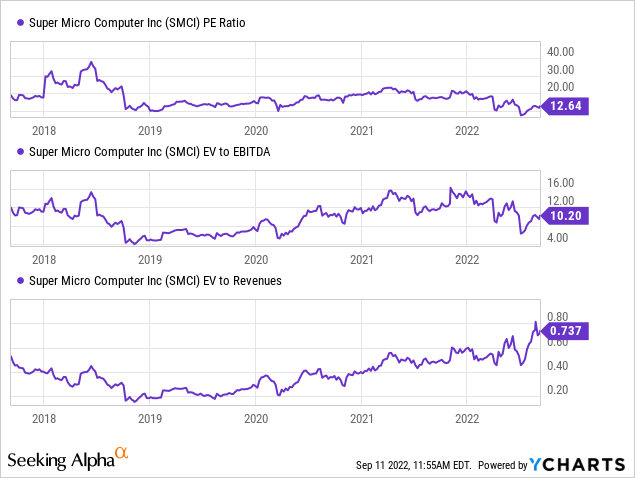

The company’s forward earnings multiple is in the single digits (only just) at an estimated non-GAAP FY23 EPS of $7.74. Its sales multiple is historically high, so there is a visible appreciation for the company’s transformation from investors, but we think this isn’t done yet.

Conclusion

The company is successfully transforming from providing products to providing solutions, and this is leading to an acceleration in revenue growth as well as margin expansion.

It very much looks like this development has considerably further to run, although the risk is that it might be derailed to some (we believe minor) extent by a worsening macro environment.

These low valuation multiples aren’t surprising for a company producing low margins but we feel the acceleration in revenues and margin expansion are insufficiently priced in.

Given the enormous rally over the last two months, we are a little hesitant to advise you to buy Super Micro Computer wholeheartedly. Maybe better to wait for the pullback to the support in the high 50s, although there is of course no guarantee this will materialize.

Be the first to comment