Diy13

Investment Thesis

Suncor Energy (NYSE:SU) is an integrated energy company. The bulk of its profits comes from its oil sands business. The business, like many oil companies, is oozing free cash flows.

I estimate that at some point in 2023, Suncor’s combined capital return program will reach 12.9% yield, via buybacks and dividends.

Meanwhile, I believe that Suncor is priced at approximately 6x 2023 free cash flow. Even in the oil sector, this is cheap.

In short, there’s a lot to like here. So let’s jump to it.

Suncor, What You Need to Know

Suncor is in the middle of a transition as it sheds key assets, as well as acquires other assets. Simply put, Suncor asserts that it’s optimizing its portfolio around its core assets.

Before digging down into Suncor’s numbers, it’s worthwhile to keep one thing in mind. As the price of WTI increases, working capital use will go up, as the company needs to invest in operations.

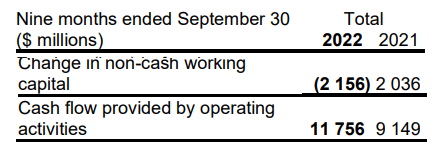

SU Q3 2022

Consequently, even though the nine months of 2022 don’t look all that different from the same period a year ago, given everything we’ve seen in the oil market, we have to keep in mind the use of working capital swing.

That working capital hasn’t gone in flames. Rather it’s an investment into operations that in time will reverse.

Capital Allocation Policy, 12.8%

Next, let’s turn our focus to discussing SU’s capital allocation program. SU has net debt of approximately $15 billion. Yes, this figure includes the post-quarter paid down with cash.

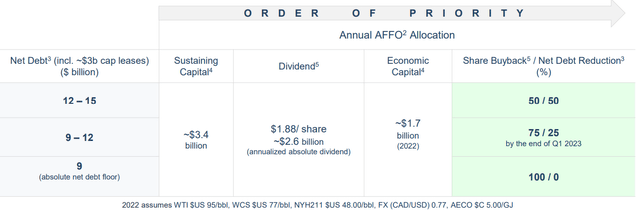

As the graphic that follows illustrates, this implies that until Suncor’s net debt gets into the $12 billion range, Suncor will be returning 50% of its free cash flow to shareholders.

SU Q3 2022

Once Suncor’s net debt drops to $12 billion, Suncor will be in a position to ramp up its share buyback strategy.

Previously, Suncor assumed that if WTI prices stayed around $95, it would be able to reach the new part of its cycle by the end of Q1 2023.

However, with WTI prices now closer to $80 than they are to $95, this implies it may still take some time until Suncor can start ramping up its share buyback further.

But I must make one thing clear. The buybacks are still going to come. It may just get pushed out slightly. But does it really break the investment case, if the buybacks fall into Q2 rather than Q1? I don’t think so.

Suncor echoed this on the earnings call,

Depending on commodity prices, we expect to increase our allocation to share buybacks to 75% by the end of Q1 2023, and this will complement our 4% dividend yield.

Consequently, looking ahead, I believe that Suncor will perhaps increase its dividend to approximately $2.10. Perhaps a little more, but I don’t believe Suncor will leave itself over-compromised by raising the base dividend too high.

Because, as you know, if things do turn sour at some point, and Suncor was forced to reduce its base dividend, the stock would be met by a strong sell-off.

Along these lines, Suncor is better off raising the dividend by only around 6% in 2022 and increasing its buyback program. Because if Suncor ultimately reduces its buyback, few investors would ”punish” the stock and sell it.

Altogether, I believe that in 2023, Suncor’s dividend will be around C$2.3 billion. For this figure, I’ve assumed $2.10 in dividends, but its 1.4 billion shares outstanding decreased over the course of 12 months.

What’s more, if we very roughly assume that Suncor’s free cash flow in 2023 will be around C$11 billion, with 75% returning to shareholders, that would imply approximately C$8.3 billion in total being returned to shareholders.

But of this C$8.3 billion, approximately C$2.3 will come in the form of dividends. This implies approximately C$6 billion in the form of buybacks.

Nevertheless, the total combined dividend yield ends up at 12.8%.

SU Stock Valuation — 6x Next Year’s Free Cash Flow

For 2023, I’ve assumed C$11 billion in free cash flows. But as noted already, nobody can predict oil prices.

What’s more, we know that production costs and wage inflation are running extremely hot in the oil sector. I’ve seen discussions of inflation reaching around 15% to 20%.

That implies that even if oil prices remain strong, in the range of WTI $85 to $95, that doesn’t necessarily equate to an equally strong free cash flow generation. In fact, it practically ensures that free cash flow would be lower.

But we must start our assumption somewhere, so I’ve assumed slightly lower free cash flow generation figures, but I’m not expecting to see a substantial slowdown in free cash flow.

The Bottom Line

The topic of the day facing oil right now is the overall fear that a global recession will lead to oil demand falling.

Personally, I don’t buy this argument on several fronts, even if I acknowledge that it’s always a possibility.

In the first instance, we know that China is still in lockdown. At some point, China will reopen. That’s the biggest oil consumer in the world, coming back.

Secondly, in countless emerging countries of the world, from South Africa to South East Asia, and India, the demand for energy is going up. As a proxy, I turn your attention to international flight demand.

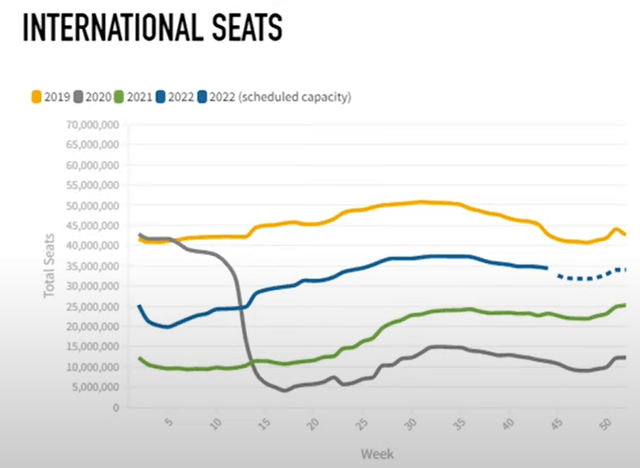

OAG.com

As you can see, flight demand in 2022 is above 2021 and while it’s getting close to 2019, it’s still under that level. Simply put, flight demand is climbing, but not yet level with normal demand.

Thirdly, the Strategic Petroleum Release (”SPR”) is still flooding the market. But this will slow down in the coming few months.

In conclusion, I believe that the setup here is quite bullish. Particularly compared with what else investors are being offered in the market elsewhere.

Be the first to comment