Editor’s note: Seeking Alpha is proud to welcome Jishan Sidhu as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

Sun Life Financial (NYSE:SLF) presents a strong value proposition for investors of all tolerances. Its aggressive geographic and product segmented expansion on the back of relatively little debt, alongside solid financial capabilities and favorable macroeconomic circumstances, lead me to rate the company a strong buy opportunity.

benedek/E+ via Getty Images

Investment Thesis

As I seek to present a multi-year, longer-term bullish outlook on Sun Life, I will focus on the corporate strategy of the company and its financial ability to achieve the said strategy.

Sun Life

However, it would be amiss to ignore the positive convexity of rising interest rates on insurers like Sun Life; although the company risks the opportunity cost of holding lower value bonds, it proactively reduced the carrying value of debt securities by 3% throughout Q2 whilst simultaneously operating an interest rate hedging program for their segregated funds. As such, my analysis suggests Sun Life will be able to take greater advantage of higher rates in its general funds.

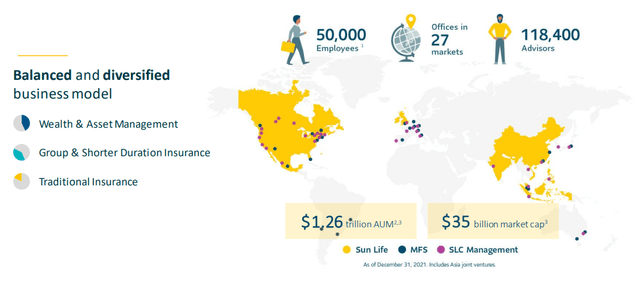

When it comes to the long term, Sun Life’s strategy is threefold – geographic expansion and penetration, diversification of product offerings, and digital rollout. All of this is being achieved through a combination of in-house product development and a dynamic M&A strategy.

These three divisions, as I later expand upon, support diversified revenue growth. This, in my opinion, sets Sun Life apart from the pack, as peers such as Manulife Financial (NYSE:MFC) and Intact Financial (IFC:CA) remain concentrated in geographic and/or product revenue streams.

Introduction

Sun Life Financial is the third largest Canadian life insurance company by premiums collected and the second largest by market capitalization. The company also represents the largest medical stop-loss provider and is a top ten group life and disability benefits provider in the United States.

Sun Life also maintains significant operations across South Asia and the Asia-Pacific, driving significant life insurance, mutual fund, and bancassurance penetration in the area.

The company can be broken down into three primary businesses; wealth and asset management, group and short duration insurance, and traditional insurance products.

Sun Life Q2 Investor Presentation

Valuation & Financials

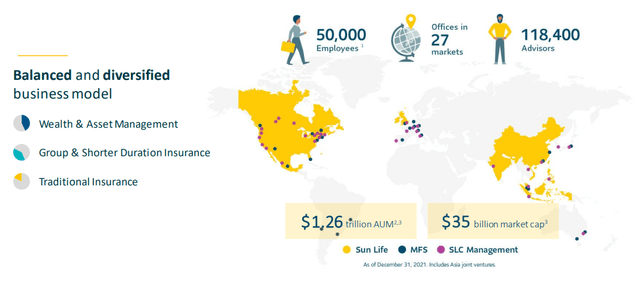

Sun Life, coming off a $57.50 all-time high in January 2022, has maintained strong earnings relative to peers in the insurance industry, only lagging Manulife amongst major Canadian insurers in terms of YTD and 12-month performance.

barchart.com

Even through the stress of the COVID-19 pandemic, Sun Life sustained a 7.1% profit margin for FY2020 and an 11.1% profit margin for FY2021.

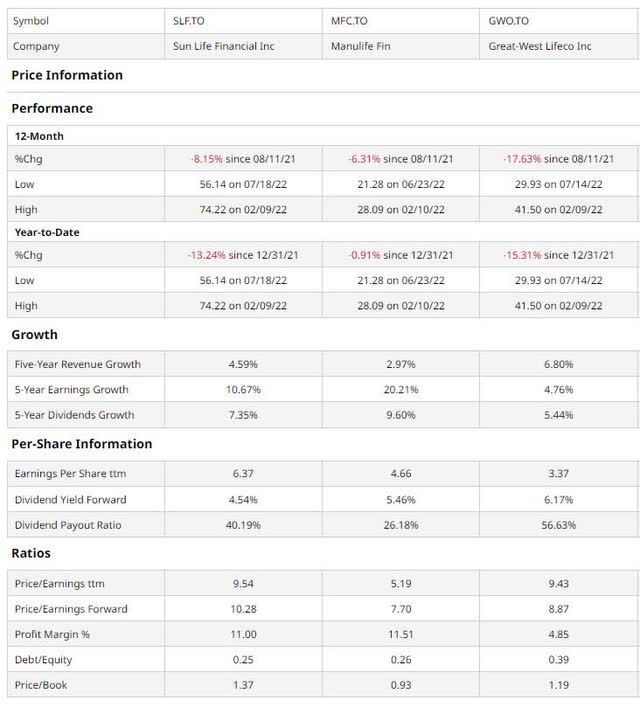

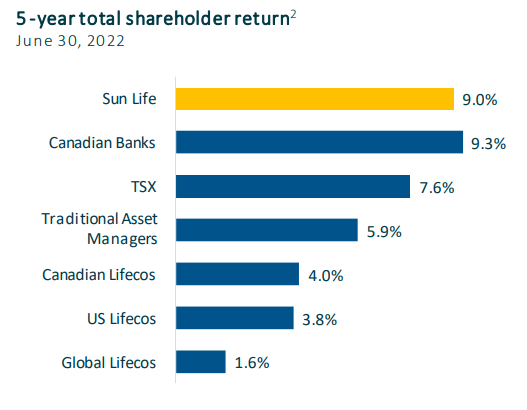

Although according to Morningstar, Sun Life has lagged the industry in trailing returns, I believe it is important to note that Sun Life treads the line between insurers and asset managers (the latter using more upfront capital for longer-term returns), and its attractiveness is in its dividends; the company maintains a 4.21% yield with a targeted dividend payout ratio of ~40%. Another point of heed is the company’s superior ROE relative to peers Manulife and MetLife (MET)-13.60% vs. 12.34% and 12.90% respectively- which is indicative of Sun Life better covering the cost of capital.

The last point, I believe, is of great importance, as the cost of capital in the insurance industry represents the rate of return required to cover the capital they use. As such, my view is that Sun Life is better equipped to finance expansions while covering pre-existing obligations.

morningstar.com

Sun Life Q2’22 Investor Kit

With a P/B value of 1.18, a P/E is consistently under 15,the company presents itself – to me – as a solid value opportunity.

Sun Life has seen shaky growth (-5%) in the Total Value of New Businesses – the increase in embedded value over the period due to new business – due to decreased sales in Asia. However, I believe this is nothing to worry about as Asian recoveries from COVID-19 have been slower than Western counterparts and the industry VNB decline has generally been greater. For reference, Manulife experienced a decline of -9% in the same time period.

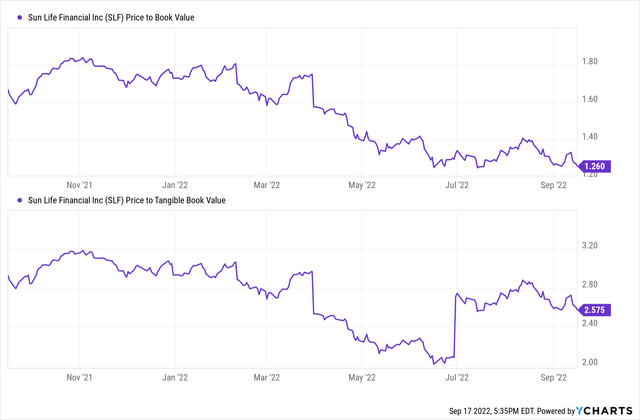

An additional item of note is Sun Life’s relative undervaluation to historical valuation, which I see as more room to grow, as well as the comparably high tangible book value, which, to me, indicates a strong financial position for investors.

Ycharts

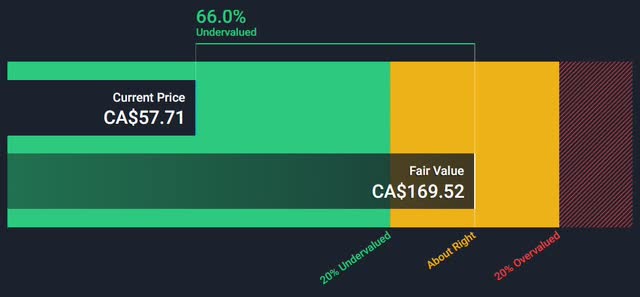

Moreover, when looking at a fair value estimate from SimplyWallStreet, Sun Life is still outperforming:

SimplyWallStreet

However, SimplyWallStreet does calculate the fair value using a discounted cash flow model. DCFs, while informative, are limited when it comes to insurance firms as their cash flow is difficult to gauge (partly owing to the nature of insurance portfolios being counted in cash flows), especially with fluctuating interest rates.

Although exaggerated, I still believe the SimplyWallStreet fair value forecast to be an endorsement of the undervaluation of the firm, especially when considering the low capital costs of Sun Life, reducing the skew of the DCF- particularly when considering new cash flows outside their life insurance business.

Another valuation item I see in favor of SunLife is its relative devaluation to traditional price-to-free-cashflow metrics:

TradingView

As we can see, Sun Life’s P/FCF has traditionally trended higher than its price. Since the COVID-19 crash, however, this trend has reversed, as highlighted by the maroon on the chart. But, as I have demonstrated on the chart, this newer trend is narrowing, which I forecast will enable greater price appreciation, given that the post-2020 trend continues. Though even if Sun Life returns to the pre-2020 trend, that would indicate a positive financial trend, thus still being a bullish sign.

Corporate Strategy

Geographically Driven Growth (Versus the Competition)

Generally, with lower P/E, P/B, and greater EPS growth over every time frame, Manulife may seem the superior value stock.

Manulife’s primary pitfall, however, is Sun Life’s greatest strength: global presence. At first glance, you can see Manulife has solid international diversification (data from their 2021 Annual Report): of $7.105 billion in net income attributed to shareholders, $3.057 billion was from Asia, $2.080 billion was from the U.S., $1.354 billion came from Canada, and the rest is from Global Wealth and Asset Management and Corporate and Other.

And core earnings for Manulife broke down as follows: $949 million from Hong Kong, $323 million from Japan, $619 million from Asia Other, and $96 million from Mainland China. As we can see here, Manulife relies on the Asia region heavily.

The Hong Kong market carries significant geopolitical risk, including downstream risk from trade and diplomatic friction between the U.S. and China. In an increasingly uncertain world, Manulife, which has further expanded into the Chinese market with the opening of a new office in the Shaanxi province, sustains a risk Sun Life does not.

As for Japan, demographic decline and economic stagnation come with restrictions on any potential avenues for growth; the Japanese life insurance market has declined from JPY44.4 trillion in 2012 to JPY36.9 trillion in 2019.

Moreover, HK, Japan, and China all have relatively high life insurance penetration reducing Manulife’s competitiveness in the regions. So, in summary, I see Manulife’s international operations as a detracting feature of the company.

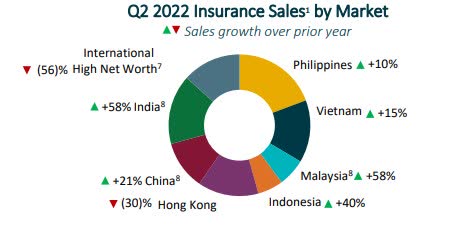

On the flip side, Sun Life’s international exposure is highest in the Philippines, India, and Vietnam. The penetration rate of life insurance in the Philippines is 1.67%; with Sun Life being the largest insurer and mutual fund provider in the nation, it is poised to take advantage of the 6.03% CAGR in Philippine per capita GDP as it reaches $17,000 by 2050.

Sun Life Q2’22 Investor Presentation

In addition, Sun Life’s partnership with BGO (BentallGreenOak, an asset manager with $80 billion + AUM) in forming the Aditya Birla Sun Life AMC Limited has enabled it to become a top 10 insurer in India and a top 5 mutual fund operator. Mutual funds, in particular, have been growing rapidly in India; Indian mutual fund AUM has increased fivefold in the past decade, from INR7.30 trillion in 2012 to INR37.75 trillion today. And that growth is expected to continue aggressively.

As such, my belief is that Sun Life’s geographic expansion can provide superior returns than that of competitors, particularly Manulife.

Capitalizing on Healthcare Trends

While most of Sun Life’s U.S. business is predicated on the pillar of health insurance, only recently has the company attempted such an aggressive expansion and vertical integration of their products.

With the U.S. healthcare market topping $4.1 trillion and an increasing number of people being self-insured, Sun Life sought to proactively capture this growing market with the acquisitions of DentaQuest, the second largest dental provider in the U.S. (over 50 million members) and PinnacleCare, as well as its partnership with Teledentistry.com, which will aid the company in synergizing and digitalizing health products. Already, Sun Life has already integrated pre-existing Sun Life dental products with the DentaQuest platform, and is on track to achieve run-rate expense synergies (meaning operational savings) of over $60 million by 2024.

Focusing on the dental market is inherently risk-averse and most policy proposals around healthcare avoid dental care, thus reducing any risk and costs associated with the government.

Sun Life ultimately seeks to provide quality healthcare, fill in the emerging healthcare gaps in the U.S., target the less-competitive dental market, and ensure accessibility by harnessing telehealth platforms.

The company has applied this strategy internationally, launching ‘GoWell Studio’ in the Philippines and ‘SunCanvas’ across the Asia-Pacific.

I foresee such healthcare strategies providing Sun Life a leg up in times of turbulence, as healthcare stocks typically outperform other sectors during recessions and inflation alike.

Other Strategies of Note

This targeted approach towards digitalization stretches beyond healthcare; in the U.S. Sun Life recently launched ‘Sun Life Onboard’ which aim to simplify their benefits setup process. 76% of Sun Life claims in the U.S. have been submitted digitally. In Canada, Sun Life’s digital assistant, ‘Ella’, has supported over CAD550 million in wealth deposits and CAD1 billion in insurance coverage, representing a YoY increase of 14% and 64% respectively. The company has also been dedicated to expanding its operational capabilities in the asset management business, highlighted by the 2020 acquisition of Crescent Capital. The acquisition has resulted in significant capital inflow, accounting for over a third of capital raised in 2021 through its two flagship funds. The alternative credit business also acts as a buffer against volatile economic conditions; private credit is preferred by businesses in a higher interest rate environment, thanks to the potential rate mitigation strategies they can provide. And with rising inflation and rates, distressed debt funds tend to foster greater returns.

Wall Street Consensus

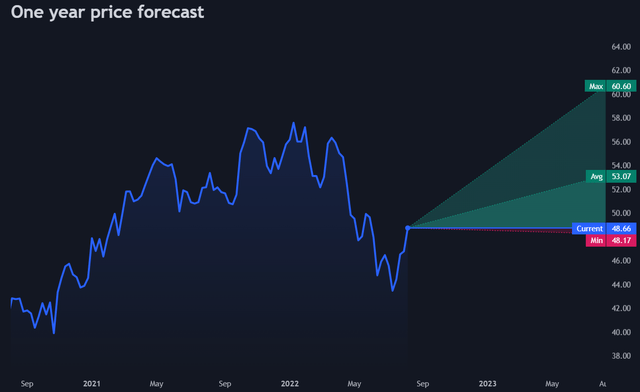

Analysts echo my positive outlook on the stock, forecasting an average one-year price increase to $53.07, up from $48.66 today.

tradingview.com

Even at the minimum projected price, of $48.17, there is no significant depreciation, especially when factoring in potential dividend income.

A large portion of the projected growth can be attributed to an overreaction in the markets to tightening by the Fed and global central banks. Inflationary pressures are subsiding faster than originally predicted, and thus markets are expected to rebound. More so than that, Sun Life sees a 50bp reduction in rates as a catalyst for a $250 million increase in OCI.

Risks

The following pose strategic risk to the value that would otherwise be captured by Sun Life’s market position and corporate strategy:

- Market Sensitivity: Equity and credit market downturns directly and negatively affect Sun Life’s insurance and asset management business, due to their inverse convexity with rising interest rates. Additionally, currency fluctuations are a natural hindrance to Sun Life’s international operations.

- Insurance Risk: In a highly regulated industry, international exposure means exposure to more and ever-changing regulatory structures, which can rapidly shift and can often reduce the attractiveness of the region and thus Sun Life’s own attractiveness. Additionally, any increased mortality, policyholder behavioral shifts, and reinsurance default risks can undermine the company’s market position.

- Strategic and Operational Risks: With rapid expansion, Sun Life risks poor execution of corporate strategy, the politico-economic risk from a multitude of regions, poor service, wrongly assessing growth markets, and ultimately potentially losing billions in strategic investment and partnerships

Conclusion

In the short term, I believe that Sun Life remains a strong stock, courtesy of market conditions that will likely reverse, stable prices relative to the rest of the market, and a solid dividend yield.

In the long term, I conclude Sun Life’s dynamic investments in low penetration, high-growth markets, ability to find business segments fortified from external risk, integrate services into its portfolio digitally, and ability to find financially sound and secure M&As, alongside strong financials to execute upon its vision, affords the company the unique ability to return value to its shareholders both via income and appreciation.

Be the first to comment