MJ_Prototype/iStock Editorial via Getty Images

Note: This article was written in coordination with Colorado Wealth Management Fund.

I believe Sun Communities (SUI) to be one of the absolute best housing REITs. Their vast portfolio generates strong growth and deserves a premium, as such. However, the current valuations across the housing REIT sector tend to be on the rich side, so I have come to a neutral view on a fantastic company. That being said, I would be interested at a 5% – 10% pullback.

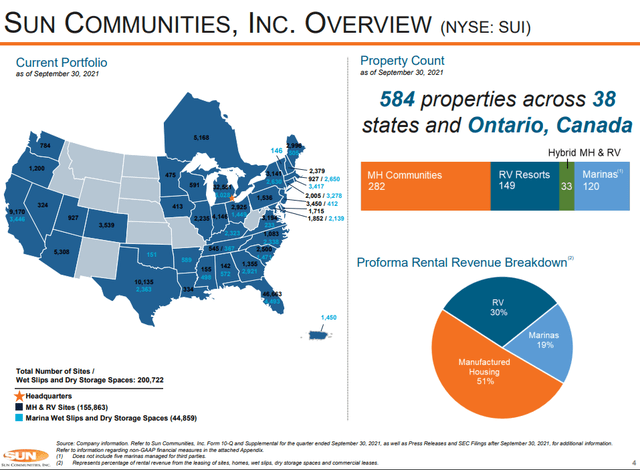

They are the biggest and baddest manufactured housing REIT with 584 properties as of September 30, 2021. To put the number of properties into perspective, Sun beats out its two REIT competitors Equity LifeStyle Properties, Inc. (ELS) and UMH Properties, Inc. (UMH) by 148 and 457 properties, respectively as of the same date. Their footprint across 38 states gives them the ability to serve the majority of the country expecting the same level of quality service wherever they go. I pulled this presentation from the investor relations section on Sun’s website.

In addition to manufactured homes, Sun also owns 149 RV resorts and 120 Marinas which supply nearly 50% of its overall revenues for 2021.

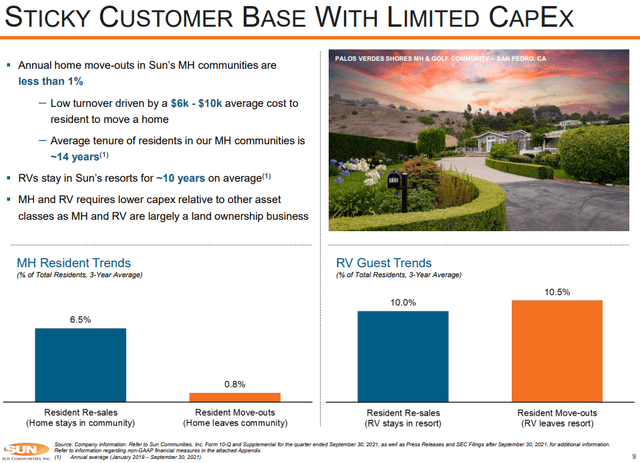

Built-in Advantages of MH community ownership

Owners and operators of a manufactured housing community enjoy a variety of spoils. For example, the main expenses incurred tend to be limited to those related to making the land usable for residents (utilities, landscaping, and paving to name a few). The best part is that typical rental expenses such as leaky toilets, broken appliances, HVAC units, and roofs are all typically the resident’s problem for non-park-owned manufactured homes. This allows operators to keep relatively low capital expenditures and operating expenses in comparison with traditional rental real estate.

To sweeten the deal, manufactured housing community owners have it even better on the extra-low vacancy side due to one very simple fact; moving a manufactured home costs an arm and a leg. Imagine you do not like the view from your manufactured home and want to move it to a better location only to get quoted an average cost of $6k – $10k from moving companies, ouch. That is probably better spent on garden gnomes and nice furniture. Believe me when I say that Sun Communities enjoys these built-in advantages to its fullest.

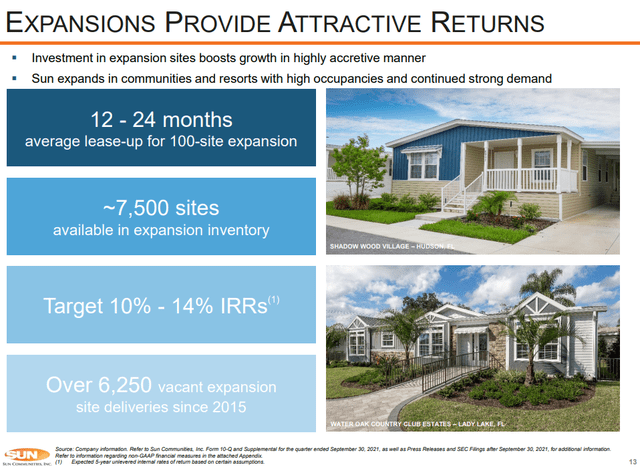

Expanding from within

All land is unique and when you have a winning asset in a nice location, why not expand where you can. In addition to acquisitions, Sun Communities looks inward to see what they can do with their existing properties to generate more revenue. Expanding lots in existing communities allows Sun to exercise its economies of scale by acquiring new homes at drastically lower costs than smaller operators. This, in turn, gives them the ability to target 10% to 14% IRRs (internal rates of return):

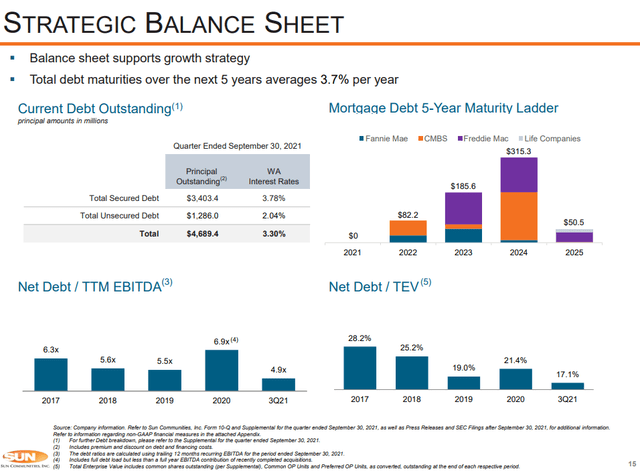

Finances fit as a fiddle

Sun’s balance sheet represents a company that is using debt responsibly. With a weighted average interest rate of 3.30%, it can easily afford its debt and grow. That growth shows in its lowest-in-sector 17.1% total market capitalization coming from debt. For comparison purposes, Equity LifeStyle’s weighted average interest rate is 3.6% with a debt to total enterprise value of 17.3%. Being one of the largest players in the manufactured housing REIT space grants Sun access to some of the lowest rates available. So, even if rates do increase in the near term, Sun should be able to secure low rates to fund its acquisitions and operations if needed.

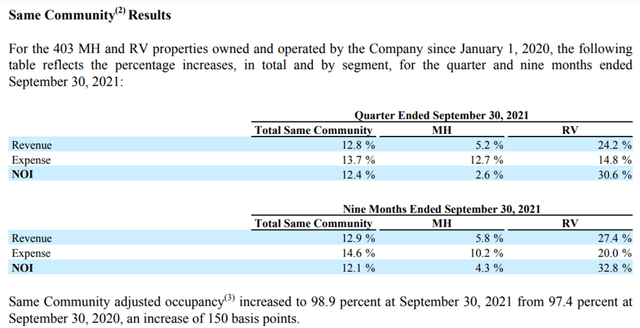

RV resort boom

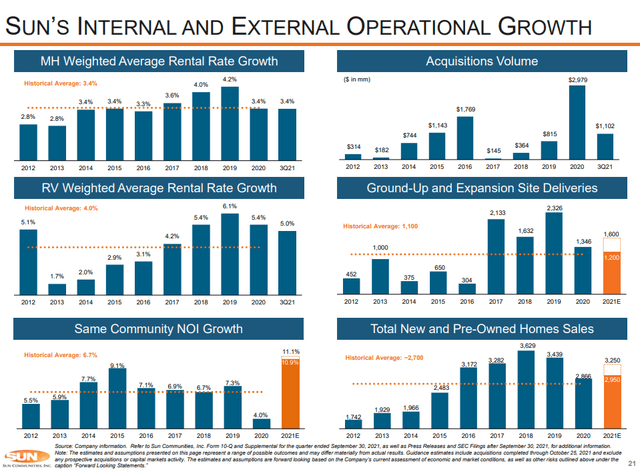

Although Sun’s pro forma rental breakdown shows only 30% of its revenues coming from RV resorts, the growth in this sector is quickly adding to its AFFO. From its 2021 Q3 supplemental, same park RV revenue grew by 27.4% for the nine months ended September 30, 2021. When compared to manufactured home revenue growth of 5.8% for the same period, therein lies a great opportunity for Sun to continue its RV resort expansion in 2022 as it has done with 7 newly acquired RV resorts in 2021. I pulled this information from the 2021 Q3 supplemental information on Sun’s website.

RV resorts can be a high-yielding investment. As RV resorts tend to be mom and pop owners with very little to no debt, a large player like Sun should be able to swoop in and acquire as many as they need. However, high-quality RV resorts are much harder to find in the domestic market as evidenced by SUI’s expansion to Europe.

RV resorts do come with their own risks as the asset class tends to be more in line with the hospitality business than a traditional rental business. As such, they require specialized knowledge and a quality on-site management team. Fortunately, Sun’s ability to manage its properties is one of its core strengths and therefore should not negatively affect its RV resort portfolio or future RV resort acquisitions.

Sun Communities Q3 Earnings Call Supplemental Information

Same community growth proved equally as impressive as RV growth for Sun. With the historical average at 6.7%, Sun managed to grow the revenue of its existing communities by 11.1%:

More accretive acquisitions seem to be in its future according to its CEO, Gary Shiffman.

We are pleased with our third quarter results which highlight successful execution across all of our growth strategies. The RV segment continues to deliver strong results producing same community NOI growth of nearly 31 percent in the quarter, as we benefit from the demand for outdoor experiences coming from existing and new Sun customers. As the leading industry consolidator, we have completed $1.1 billion of acquisitions year-to-date, and believe our cycle tested ability to create value through acquisitions will continue to result in accretive growth. We have remained active in the capital markets to support this growth including completing our second bond offering of the year. Our talented team will continue to execute on opportunities across operations, acquisitions, expansions and ground-up developments, providing us with a confident outlook.

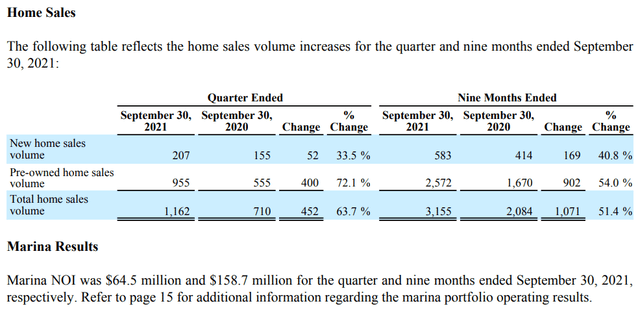

Growth from the smaller part of its portfolio

Although the smallest portion of its revenue comes from home sales and marina slips, it should be mentioned that both operations reflected impressive growth of their own for the end of the third quarter in 2021. Although the pandemic does play a part in inflating the sales amounts, Sun still sold 452 more homes as of September 30, 2021 than in 2020. For the same time period, Marina NOI sits at $158.7 million which represents a roughly 39.2% profit margin.

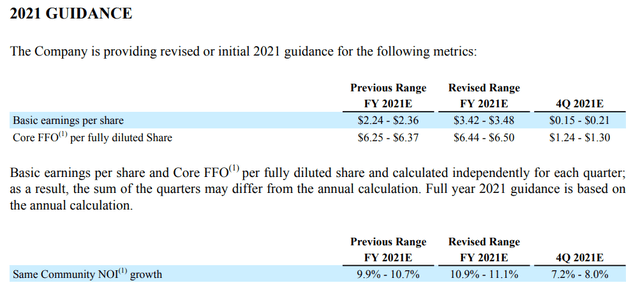

Due to the outstanding results of the third quarter, Sun revised its 2021 guidance to reflect an increased core FFO of $6.44 – $6.50 from $6.25 – $6.37. I would expect Sun to meet its 2021 guidance when Q4 results are made public on 2/21/2022.

Sun Communities Q3 Earnings Call Supplement Information Sun Communities Q3 Earnings Call Supplement Information

Risks to my thesis

A bull case scenario could be that Sun’s expansion into Europe results in acquisitions with higher cap rates thereby increasing their AFFO per share. This in turn would increase my target for Sun Communities.

In a potential bear case scenario, a near-term recession could bring down share prices across the sector. However, manufactured housing REITs tend to be more resilient in a recession. As such, I would expect Sun’s share prices to decrease less compared to other REITs that focus on a different asset class.

Conclusion

Sun has a lot going for it, and it shows. Although still primarily a manufactured home-heavy portfolio, its same park growth in the RV resort sector shows promising returns for the future. However, I am neutral at its current prices.

Be the first to comment