niphon

Investment Thesis

Summit Materials’ (NYSE:SUM) revenue should benefit from the pricing actions, M&As, and healthy demand in the public and non-residential end markets. The margins should improve through business portfolio optimization and pricing actions. The company launched its Elevate Summit Strategy to drive growth, create shareholder value, and improve the quality and consistency of earnings. Under this strategy, the company is divesting low-margin businesses and focusing on acquiring high-margin businesses. Through the implementation of this strategy, it is targeting a 30% adjusted EBITDA margin in the long term. The stock is attractively valued, and given its good long-term prospects, I have a buy rating on it.

The Elevate Summit Strategy

The company introduced its Elevate Summit strategy in March 2021 to drive growth, create value for its shareholders, and improve the quality and consistency of earnings. Through this strategy, the company plans to achieve a 30% adjusted EBITDA margin, which should be achieved in multiple stages (which the company calls “horizons”). Under each stage or horizon, the company has set target adjusted EBITDA margin ranges, ROIC, and leverage. The leverage target is <3x and is common under each horizon.

In Horizon 1, which is now substantially complete, the company worked on improving its business efficiency through smart standardization and by cultivating a culture of commercial and operational excellence. It also divested its dilutive businesses, like some of the downstream businesses, to boost margins and free up capital for growth. For Horizon 1, the company’s adjusted EBITDA margin target range is 23% to 25%, and the ROIC target is 9%.

In Horizon 2, the company plans to explore creative business models to reduce downstream capital investment and maximize aggregates pull-through. It also plans to reduce volatility by pursuing long-term contracts and supply agreements. The company plans to do M&As to enter prioritized markets. The three criteria for an M&A are: bridging the portfolio mix, focusing on bolt-ons, and entering or building strong footholds in high-growth strategic markets. For Horizon 2, the company’s adjusted EBITDA margin target range is 25% to 28%, and the ROIC target is 10%.

In Horizon 3, the company should start to realize and sustain consistent growth, as by then, it will have standardized processes, operational excellence, and competency in innovation and differentiated solutions. In this stage, it plans to boost margins and reinforce growth in new markets through innovative offerings and solutions with differentiated value. For Horizon 3, the company’s adjusted EBITDA margin target range is 28% to 30%, and the ROIC target is >10%.

The company has made good progress on its Horizon 1 initiatives so far. Since the launch of this initiative, the company divested 11 companies related to the downstream business, generated more than $500 mn in proceeds, and entered into eight long-term supply agreements. It also achieved net debt to adjusted EBITDA leverage of 2.3x in Q3 FY22, which is well below its target level of 3x. The company has now entered Horizon 2 and plans to focus on value-creating M&As and continue its divestiture process from Horizon 1.

In addition to the company-level targets in the Elevate Summit strategy, management has also introduced segment-level objectives in its businesses, which it calls North Star objectives. The company introduced these objectives on May 2022, Investor Day. The first North Star objective is to achieve a sustainable 40%+ LTM (Last Twelve Months) adjusted EBITDA margin in the cement business. The company plans to do it through a customer-centric approach, driving operational excellence and maximizing the entire value chain. The value creation projects include the Davenport Dome in Iowa, the conversion to lower-emitting Portland Limestone Cement (PLC), and improving the Cement grinding performance. The Davenport Dome should help reduce demurrage costs and provide supply to its Northern customers.

The second North Star objective is to reach a 50% adjusted cash gross profit margin in the aggregates business. Management plans to achieve it through commercial and operational excellence. Commercial excellence includes leveraging technology and data to enhance the customer experience, delivering sustainable customer solutions, and continuously investing in sales capabilities, whereas Operational excellence includes standardization and simplification of business processes.

The third North Star objective focuses on shifting the business portfolio towards more materials-led, which is a higher margin business. The target is to generate 75% of its EBITDA from aggregates and cement by the end of Horizon 2. The company’s commitment to shifting its portfolio to a materials-led business can be seen in its recent actions. The company recently sold its asphalt and paving business in the East segment to a local market partner and entered into a long-term supply agreement with the buyer for aggregates and ready-mix volumes. This allows SUM to grow in the southeastern Kansas market through an asset-light approach. Further, in October, it acquired SCI Materials, an aggregates business in Florida. SCI will integrate with SUM’s Georgia Stone Products business and contribute to the East segment.

Revenue growth prospects

In Q3 FY22, the company saw double-digit Y/Y pricing growth in all lines of business. The average selling price of aggregates, cement, ready-mix, and asphalt increased by 10.2% Y/Y, 12.8% Y/Y, 17.5% Y/Y, and 19.3% Y/Y. This was driven by the pricing momentum from the previous quarter and, in part, by the July 1 price increase. The volumes in the aggregates line of business were down 9% Y/Y, driven by the impact of divestitures (620 bps), unfavorable weather in Texas and the Carolinas, and supply chain issues, partially offset by 70 bps benefit from the SCI acquisition. The ready-mix business’s volume declined 12.1% Y/Y due to the impact of divestitures under the Elevate Summit strategy of 10.8% and cement shortages in Utah, partially offset by a low single-digit volume increase in Houston due to the resilient residential demand.

In Q3 FY22, the net revenue in the West segment was up 16.6% Y/Y driven by robust pricing across all lines of businesses and end markets, partially offset by volume declines in aggregates and ready-mix. In the East segment, net revenue declined 25.8% Y/Y due to divestitures, wet weather conditions, and supply chain challenges, partially offset by pricing increases in aggregates and ready-mix. The Cement segment is experiencing strong demand conditions, leading to 29.6% Y/Y net revenue growth in the quarter. The volume and pricing increased 12.4% Y/Y and 12.8% Y/Y. The volume growth was due to the increased capacity from the PLC conversion, better asset utilization, and supplementing some of its production with imports to satisfy the demand level. Imports contributed 5% of the cement volume in the quarter.

Looking forward, the strong pricing trends in the aggregates business should help the company exit 2022 with strong pricing momentum. The backdrop for cement pricing is also favorable as demand remains strong, supply remains tight, and imports are expensive. The company has locked in 2023 cement prices at higher rates with its partners and announced a $17 per ton cement price increase effective January 1, 2023. Furthermore, SUM intends to raise prices in its downstream business. The downstream business’ pricing is more pass-through in nature, and the Y/Y growth in pricing should reflect passing the higher input costs through the value chain.

One thing which I believe may pose some risk for revenue is the drought conditions in the Mississippi river basin. The company has two cement plants, one in Davenport, Iowa, and one in Hannibal, Missouri. It has a river-based distribution network for its Cement business and uses a barge to get its product into the market. However, the drought conditions from the plains to the Mississippi river basin are resulting in low river levels and are impacting the barge traffic along the Mississippi river. The company is working proactively with its customers to manage expectations and is not yet seeing any slowdown, but it is not immune to these conditions. If drought conditions continue, the company’s cement volume can be impacted, affecting revenue. However, this is a near-term headwind and should not sustain in the medium term.

The company’s medium-to-long-term prospects look strong. In 2023, the public end market is poised to experience robust growth given the well-funded state budgets and the funding from the U.S. Infrastructure Investment and Jobs Act (IIJA). The public end market contributes ~36% to the annual net revenue of the company. The solid Department of Transportation (DOT) budgets have begun to flow through contract awards for highway projects and paving awards. The non-residential end market, which contributes 32% to the annual net revenue, is supported by investments such as semiconductor manufacturing plants, electric vehicle and battery plants, LNG projects, and other projects. The Dodge Momentum Index and the Architectural Billing Index (ABI) are showing healthy signs of growth for the non-residential market. The growth in both non-residential and public end markets should offset the slowdown in the residential market which contributes ~32% to the annual net revenue of the company.

Apart from organic growth, acquisitions should also drive growth. Now that the company has entered its Horizon 2 phase, it will focus more on M&As, which should benefit the company by allowing it to enter new markets and grow its revenue. As the net leverage (2.3x) is well below the target levels, I believe the company is well-placed to do M&As.

Margin Outlook

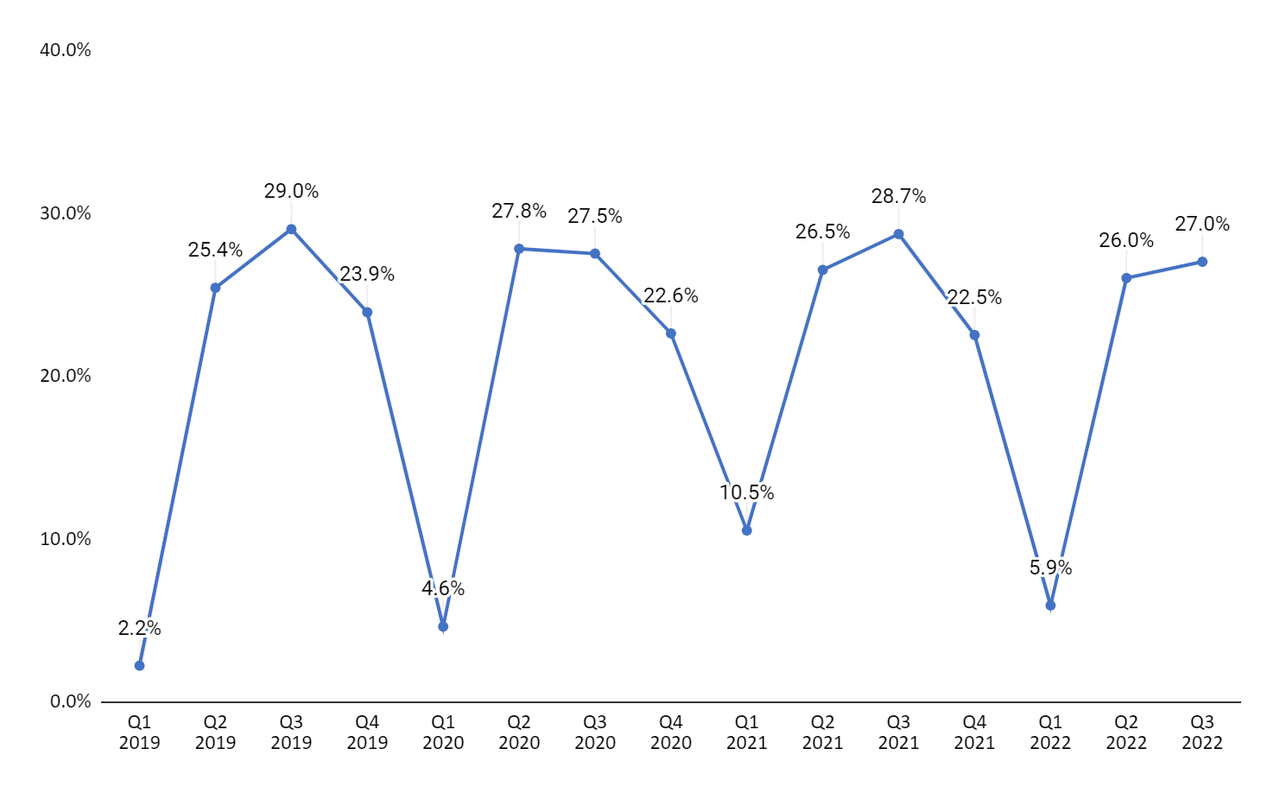

The adjusted EBITDA margin in Q3 FY22 was down 170 bps Y/Y to 27% due to higher variable costs, partially offset by pricing actions and G&A cost controls. The adjusted EBITDA margin in the West segment declined 240 bps Y/Y to 25% due to the aggregates product mix in Texas and input cost inflation. The adjusted EBITDA margin in the East segment declined 420 bps Y/Y to 26% due to higher repair and maintenance costs and elevated subcontractor costs. The adjusted EBITDA margin of the Cement segment declined 470 bps Y/Y to 39% due to volume mix, elevated repair and maintenance costs, and higher energy costs.

SUM’s adjusted EBITDA margin (Company data, GS Analytics)

Looking forward, the company should benefit from the strong pricing momentum of 2022 and proposed price hikes 2023. The company is increasing cement prices from January 1 to maintain a positive price/cost relationship and protect the margin. Its margin should also benefit from the richening of its business portfolio mix as it is divesting its lower margin downstream businesses. I am optimistic about the company’s long term margin prospects given the company’s strategic initiatives and ~30% long term adjusted EBITDA margin goal.

Valuation & Conclusion

The stock is currently trading at 20.04x FY23 consensus EPS estimate of $1.52, which is lower than its five-year average forward P/E of 25.26. The company’s valuation is also at a discount versus its peers Martin Marietta Materials (MLM) and Vulcan Materials Company (VMC).

|

Company Name |

P/E FY22e EPS |

P/E FY23e EPS |

|

Summit Materials |

25.19x |

20.04x |

|

Martin Marietta Materials |

28.43x |

23.49x |

|

Vulcan Materials Company |

34.43x |

26.95x |

The company’s revenue is expected to benefit from the pricing momentum of 2022 and the proposed price hike in the cement business. It should also benefit from the M&As, as the net leverage is well below the target level. Additionally, the tailwinds in the public and non-residential end markets should offset the slowdown in the residential market. The company’s margin should benefit from pricing actions and portfolio optimization. Given the strong revenue and margin growth prospects and lower valuation than its peers, I have a buy rating on the stock.

Be the first to comment