gesrey/iStock via Getty Images

Co-produced by Austin Rogers for High Yield Landlord

The stock market selloff in 2022 has been driven primarily by two big factors:

- High inflation, with the CPI rising 7-8% year-over-year.

- Rising interest rates, which have spiked extremely fast in the face of a hawkish Federal Reserve.

Though many investors know about the inflation-hedging characteristics of real estate, the common perception is that real estate investment trusts (“REITs”) will perform poorly in the midst of rising interest rates. This is an understandable yet fallacious belief.

REITs actually tend to outperform during periods of elevated inflation and rising interest rates, as we will show below.

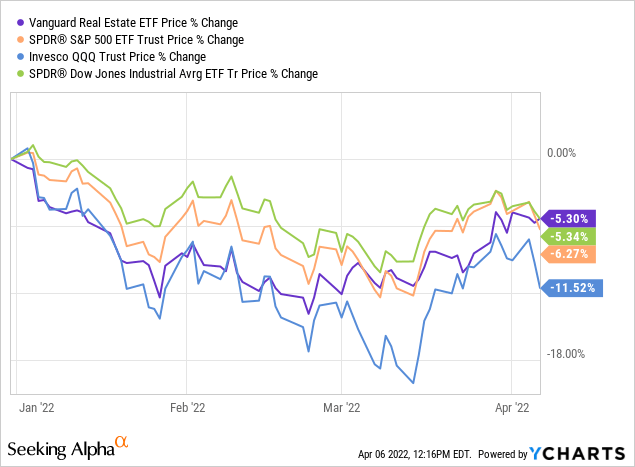

Interestingly, REITs (VNQ) (purple line) have performed better than the S&P 500 (SPY), Nasdaq index (QQQ), and Dow Jones Industrial Average (DIA) year-to-date on a price basis alone.

REITs outperform in 2022 (YCHARTS)

This does not even include the above-average dividend yields that REITs provide.

What’s more, if we drill down into REITdom, we find that certain types of REITs have performed even better this year. Those that own properties with short-term leases (NURE), such as apartments (CPT; MAA; IRT) and self-storage facilities (PSA; EXR; LSI), have outperformed the broader REIT index and generated strong positive returns year-to-date.

But it isn’t just property types that have short-term leases that can quickly reprice higher in the face of inflation that has performed well. Most REIT sectors have rebounded strongly from the pandemic and delivered solid results.

The reason why REITs tend to perform well even during periods of rising interest rates is that rental rates tend to rise a lot faster than REITs’ cost of debt. Moreover, REITs almost always take steps to lock in their mortgage rates for as long as possible when interest rates are low so that they can weather periods of higher rates.

In other words, when interest rates rise, the negative effect on most REITs is limited while the positive impact of rising rent rates is maximized.

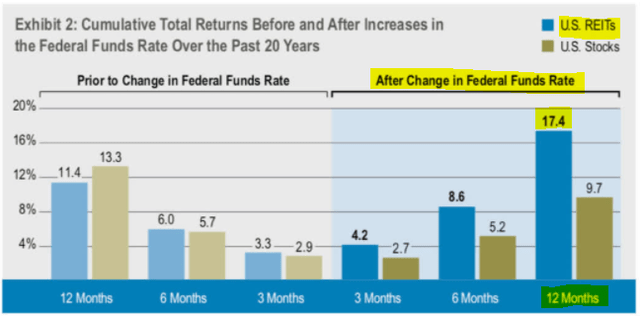

From the below chart, you can clearly see that REITs have historically outperformed stocks (SPY) during most time periods of rising interest rates:

REITs outperform following interest rate hikes (Cohen & Steers)

Of course, if rising interest rates were the only factor at play during this time, then REITs probably would have underperformed. But interest rates, regardless of their directional movement, are never the only factor at play.

What about inflation? There are at least three reasons why high inflation benefits real estate:

- During periods of rapidly rising prices, construction costs go up. This increases the replacement value of existing properties, which tends to raise their market value as well.

- Higher construction costs tend to increase the rent rate required to make the development project worthwhile. This has a trickle-down effect on rents elsewhere in the market.

- Higher inflation tends to lead to higher wages, which translates into higher retail sales, which then leads to the expanded ability of all kinds of real estate tenants to pay higher rents.

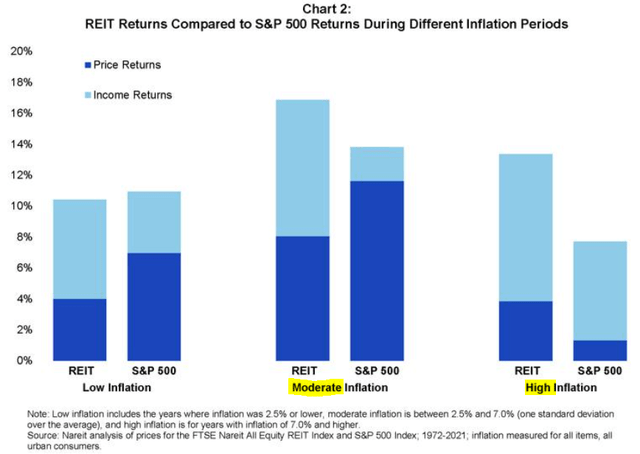

Of course, too high of inflation tends to eat into consumers’ real (inflation-adjusted) purchasing power, which then limits rent growth. That’s why moderate inflation is the ideal environment for maximum returns from real estate:

REITs outperform during times of high inflation (NAREIT)

But, as you can see above, even during periods of high inflation, such as we have right now, REITs tend to generate strong positive returns and outperform.

That is exactly what we are seeing play out right now.

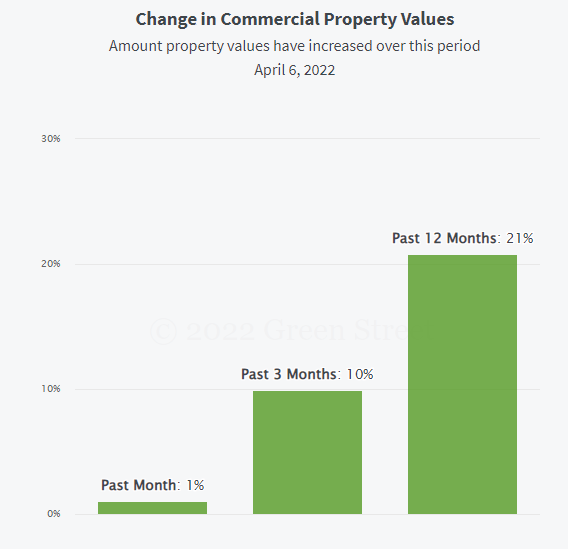

Using Green Street’s Commercial Property Price Index, we find that commercial real estate prices have soared 21% in the last twelve months.

Commercial real estate prices are surging (Green Street Advisors)

With property prices appreciating and cash flows growing in the double-digits, exposure to commercial real estate via REITs looks like a great way to play the current inflationary environment.

With that said, let’s look at two of our top REIT picks right now.

1. Brixmor Property Group (BRX)

BRX owns 382 open-air shopping centers across the country with an above-average weighting in Sun Belt states.

Grocery-anchored shopping center (Brixmor Property Group)

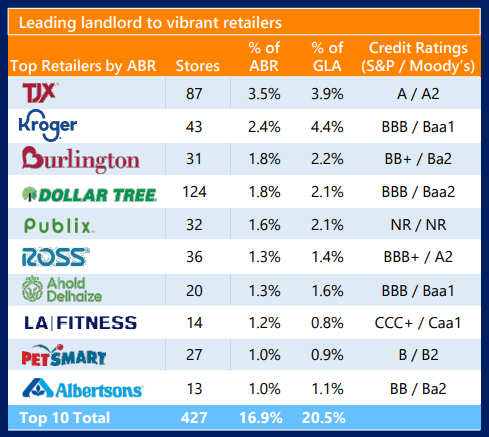

Around 70% of properties are grocery-anchored by national grocers like Kroger (KR), Publix, Ahold Delhaize (OTCQX:ADRNY) (e.g. Food Lion, Giant, Stop & Shop), and Albertsons (ACI).

Brixmor Property Group leases retail space to strong tenants (Brixmor Property Group)

BRX primarily conducts a value-add investment strategy, buying properties that need some work, fixing them up, getting them fully leased, and then either selling them for a nice gain or enjoying the increased rental revenue. About a third of BRX’s portfolio is either currently being fixed up or is in the reinvestment pipeline.

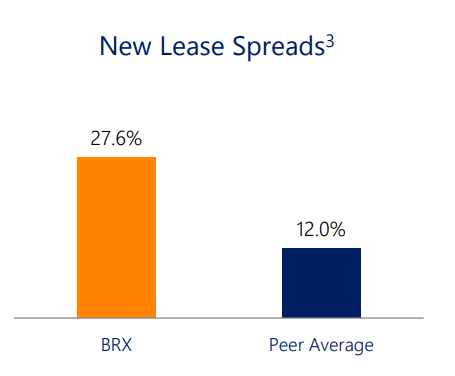

And the increased rent rates earned from these fixer-uppers are substantial. In 2021, blended (new and renewal) rent growth rose 11%, while rent rates for new leases on comparable spaces increased a whopping 27.6%.

Brixmor Property Group has great upside in its rents (Brixmor Property Group)

In the fourth quarter alone, rents for new leases on comparable space soared an astounding ~42%. This signals that BRX’s momentum from 2021 is probably going to carry over into 2022.

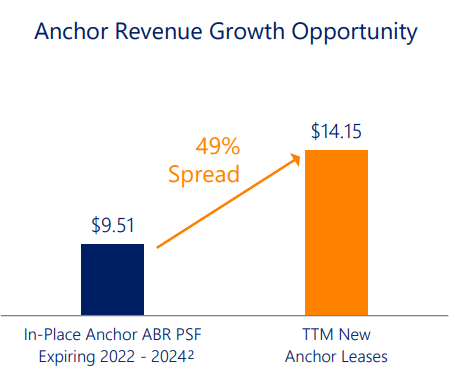

Even better, the spread between in-place rents and newly signed rent rates for anchor spaces is enormous – 49%.

Brixmor Property Group has great upside in its rents (Brixmor Property Group)

This presents a massive mark-to-market opportunity for BRX as anchor space leases mature and the REIT signs new or renewal leases for that space. All of this added up to same-property net operating income growth of 8.9% in 2021.

In short, BRX’s relatively short lease terms of 3-5 years allow for the REIT to roll leases over at dramatically increased rent rates, thereby allowing cash flows to more than keep up with inflation.

While you wait, you also earn a near-4% dividend yield, which combined with the growth should result in 10%+ annual total returns for shareholders.

2. VICI Properties (VICI)

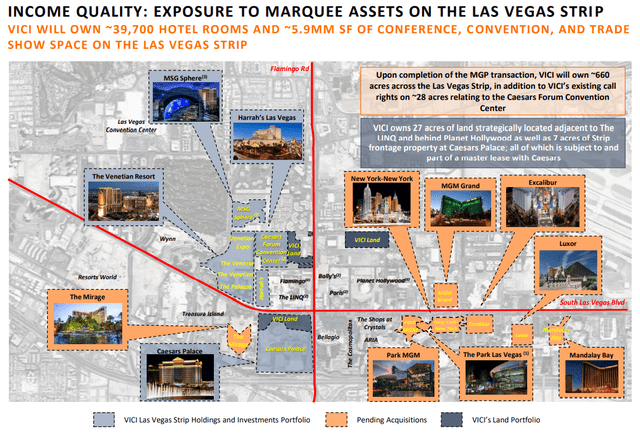

As the leading owner of casino real estate in the nation, VICI’s tenants have unsurprisingly enjoyed a powerful resurgence coming out of the pandemic. This includes both the iconic Las Vegas resorts like Caesars Palace and The Venetian as well as the numerous regional gaming hotspots across the nation.

Casinos owned by VICI Properties (VICI Properties)

Upon completion of the acquisition of MGM Growth Properties (MGP) within just a few months, VICI will own 11 iconic casino resorts on the Las Vegas Strip as well as a multitude of additional regional properties currently in MGP’s portfolio.

Casinos owned by VICI Properties (VICI Properties)

Most of the famous Las Vegas Strip resorts will soon be owned by VICI.

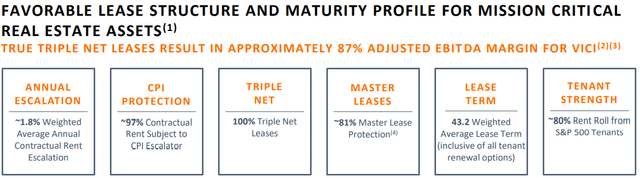

And the REIT has managed to secure extremely favorable lease terms for these irreplaceable assets. All of its properties are triple-net leased, meaning that the tenant-operator is responsible for all property maintenance, taxes, and insurance. This shields VICI from any inflationary operational expense increases.

VICI Properties enjoys superior inflation protection (VICI Properties)

Moreover, VICI also includes CPI-based rent escalations in its leases, and about 40% of current NOI derives from leases with uncapped CPI-based rent bumps.

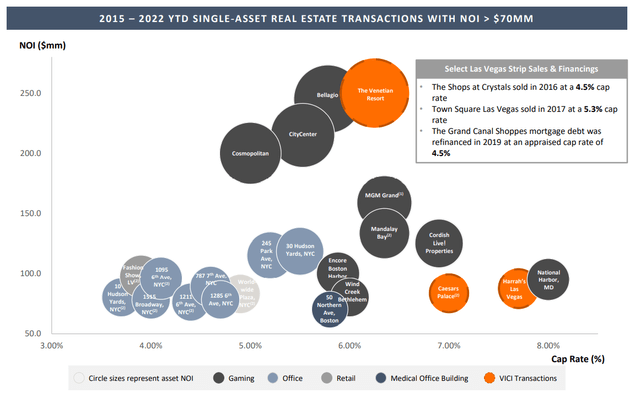

When it comes to property price appreciation, VICI’s portfolio market value has clearly risen over time, as demonstrated recently by Realty Income’s (O) $1.7 billion acquisition of a regional casino in Boston at a 5.9% cap rate. Compare that to VICI’s 2017 investments in Caesars Palace for a 7% cap rate and Harrah’s for 7.8%. Other regional assets in VICI’s portfolio were purchased at cap rates over 8%.

Clearly, the market values of VICI’s target property type are rising.

Casinos are experiencing cap rate compression and growing in value (VICI Properties)

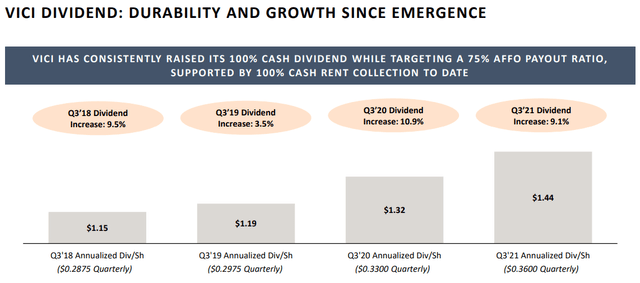

Lastly, in the previous four years, VICI’s dividend growth has been superb, averaging 8.25% annually.

VICI Properties is growing its dividend at a rapid pace (VICI Properties)

Between property price appreciation, organic rent growth, and acquisitions, VICI is more than capable of beating inflation and generating 10%+ annual returns in the coming years.

Bottom Line

There is a reason why real estate has long been the premier inflation hedge for investors. Property price appreciation and rent growth have historically been able to keep pace with inflation in a way that few other business models can do.

With BRX and VICI, investors can earn 4% and 5.1% dividend yields from assets that should prove effective at hedging against high inflation.

Be the first to comment