Arthurpreston/iStock via Getty Images

Last week I wrote an article on Federal Realty Investment Trust (FRT), saying that there were better alternatives to the Dividend King. I don’t spend much time reading comments on my articles, but I try to skim them and see if there are any recurring themes. I wasn’t that surprised to see comments asking about my preferred alternatives on that article. I make it a point to write my articles as clearly and concisely as possible, which is why I didn’t include other REITs in that article. However, I figured it was worth writing an update on one of my favorite REITs, STORE Capital (NYSE:STOR).

Investment Thesis

STORE is one of several net lease REITs that I plan to hold for years to come. The company focuses on middle market properties across the US and generates attractive cap rates on their portfolio. They also obtain unit level financials, giving them greater insight into the business performance at each location. At 12.2x price/FFO, shares a steal today. Income investors can collect a 5.9% dividend that is set to grow again this fall. I think investors are in for double digit returns from a combination of income and multiple expansion, and I still think the risk/reward is heavily skewed to the upside.

A Brief Update On The Business

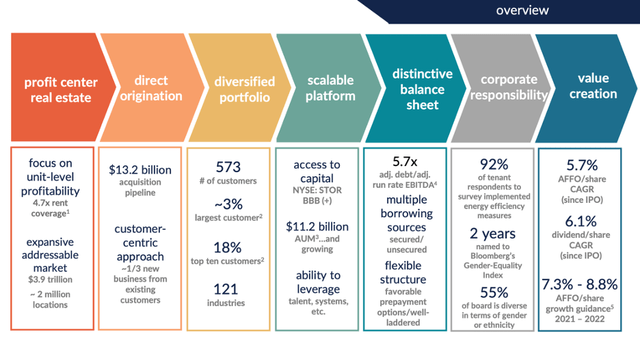

There are several factors that will drive STORE’s long-term success. I have covered them in more detail in my first article on the company, but a quick recap is in order. One of the things that I really like about STORE is that they obtain unit level financials for their properties, which shows how the tenant’s businesses are performing at a specific location.

STORE Overview (storecapital.com)

They also have long lease terms relative to peers, at cap rates that are typically higher as well. These factors drive attractive investment spreads, and investors can participate at a cheaper valuation now that shares have sold off over 20% YTD.

Valuation

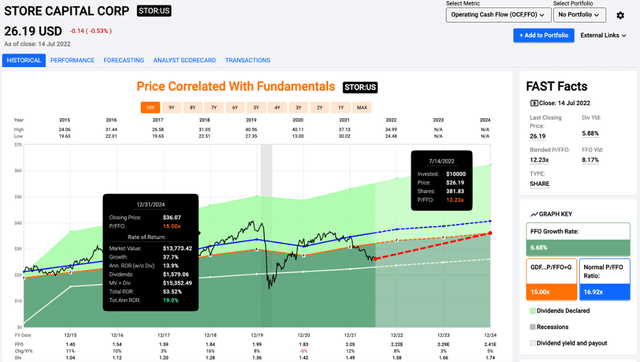

One of the main reasons that I’m so bullish on STORE is the cheap valuation. It is cheap relative to average multiples as well as cheap when compared to other net lease REITs. Shares currently trade at a price/FFO of 12.2x, which is well below the 16.9x average multiple. This is also a discount relative to other net lease REITs, which doesn’t make a whole lot of sense to me given the quality of STORE.

If shares return to a 15x multiple, investors are looking at attractive returns from continued FFO/share growth and a little bit of multiple expansion. I think shares will likely trade for more than 15x at some point in the next couple years, which would mean even better returns for investors. I’m choosing to reinvest my dividends, and if you don’t need the cash, I would recommend that long term investors do the same.

Dividend Growth

One of the reasons I passed on FRT is the lackluster dividend growth. STORE on the other hand offers an intriguing combination of current yield and a track record of attractive dividend growth. STORE is due for another dividend hike this fall if the pattern of the last couple years holds. That will be on top of a juicy 5.9% yield, and I think we will see a hike in the mid-single digit percentage range.

If you are looking for a REIT with a longer track record of dividend hikes, the other alternative that came to mind was none other than Realty Income (O). It is an investor favorite for good reason and is well-known for frequent raises of the monthly dividend. The current yield sits at 4.2%, and the valuation is a little richer than STORE currently at 19.4x price/FFO. It is a hold right now in my opinion, but if shares drop into the mid-60 range, I think it would be an attractive buy for long term investors.

Conclusion

While STORE isn’t quite in the same sector as FRT, it is my favorite alternative for investors looking for the trifecta of an attractive valuation, large dividend yield, and the potential for future dividend growth. One of the things that every investor must weigh for themselves is risk and reward. With STORE, it checks all of the boxes that I look for with long term income investments. A very attractive starting valuation at 12.2x price/FFO, a healthy underlying business, and a large 5.9% dividend that is set to grow for years to come.

Be the first to comment