Delmaine Donson/E+ via Getty Images

This article was coproduced with Williams Equity Research (‘WER’)

What’s In Store For STORE Capital?

Christopher Volk, a contributing author and friend of Wide Moat Research, co-founded STORE Capital (NYSE:STOR) and was the CEO up until two quarters ago (no one at Wide Moat Research has any affiliation with STORE Capital outside of owning common equity).

The firm IPO’d in 2014, and that’s a date we should keep in mind.

STOR’s historical financials encompass a period of very low interest rates – up until now.

We know the company well and have written about it many times over the years.

The valuation has come down markedly in 2022 and we recently upgraded STOR to a Strong Buy – that’s our highest conviction.

As mentioned in that article, Berkshire Hathaway owns 14.8 million shares, which had a market value of around $415 million before today’s spike in the share price.

Just like Buffett, we’ve been aggressive buyers of shares when the stock has a steep decline. (Remember that we also upgraded STOR to a Strong Buy in 2017 weeks before Berkshire purchased the initial tranche.)

STOR’s model is primarily a single-tenant triple net lease. Its peer group includes Realty Income (O), ADC, EPRT, SRC, NTST, NNN, and ADC.

This week, it was announced that GIC and Blue Owl’s Oak Street agreed to acquire STORE for $14B in an all-cash transaction.

Ultimately the market will decide whether the offer is fair, but we can perform our own analysis to see how it compares against where peers trade and STOR historically.

To do that, we need to start with what differentiates STOR.

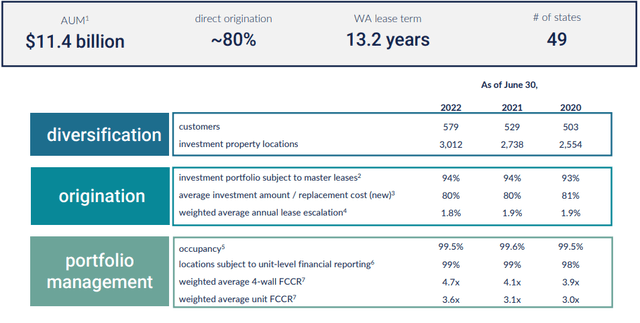

First, it has a lot of properties – just over 3,000 as of the end of the last reporting period. That’s 50% more than SRC, nearly 10 times NTST, and double EPRT.

O’s way bigger at nearly 11,500 properties, but that’s a whale very few acquirers can realistically take down. STOR strikes a great balance of a large, established platform that isn’t too big.

Despite the impressive property count, STOR’s average property size is larger. O’s is 13,000 sq ft vs. 26,000 for SRC and 35,000 for STOR.

The reason for the high square footage lies in manufacturing facilities that STOR owns.

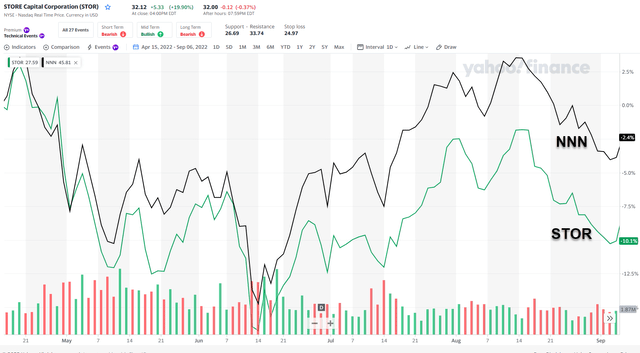

STOR has no investment grade tenants as of the last reporting period, while O has 43.2%. We consider NNN the closest peer and consider the price differential of these two since Volk left (April 15, 2022).

The annual rent escalators built into its leases are 1.8% and considered sufficient in most environments. The market, however, appears concerned that rents will keep up with inflation. As a company valued everyday by the stock market, that matters.

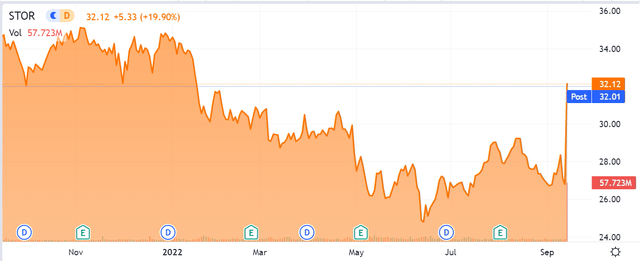

Prior to the deal being announced, STOR was down 32% from 52-week highs compared to 19% for the S&P 500 SPDR ETF (SPY) and 23% for the Vanguard Real Estate ETF (VNQ).

STOR has strengths too.

Its top 10 tenant concentration is a mere 17.7%, which is best and class and well under O’s 28.1%, for example. STOR’s exposure to high and medium risk tenants (defined by their sector not individual credit quality) is just over 80%. That ties O and beats SRC’s 28%.

STOR’s weighted average lease term of 13.2 years also is excellent and only bested by EPRT’s 13.8. 99.5% occupancy as of the end of Q2 is also difficult to beat. STOR’s leverage based on long-term debt as of the end of Q2 was 41%.

STOR’s credit metrics are all slightly better than the BBB+ (that’s three notches into investment grade territory) peer averages. STOR itself has a BBB rating with a positive outlook from S&P.

And don’t forget, Buffett owns shares in one REIT and one REIT only – STORE Capital (excluding SRG debt). If I had to guess, he doesn’t mind the 5.9% and 6.1% annual growth in AFFO and dividends, respectively, since 2016. (Note: BRK-A has reduced its stake in STOR as of Q2-22.)

Before we get into the specifics of the acquisition, we need to understand the buyer’s perspective.

Buyer Blue Owl Capital: What’s The Motivation?

Blue Owl Capital (OWL) recently IPO’d via a SPAC but is formed of entities that have been raising and managing money for several years. We’ve written in-depth articles on Blue Owl and will only touch on the most relevant points here.

Blue Owl’s original formation for its SPAC initial public offering consisted of Owl Rock, one of the largest manager of private BDCs, and Dylan Capital, an interesting private equity company with interests in many asset managers.

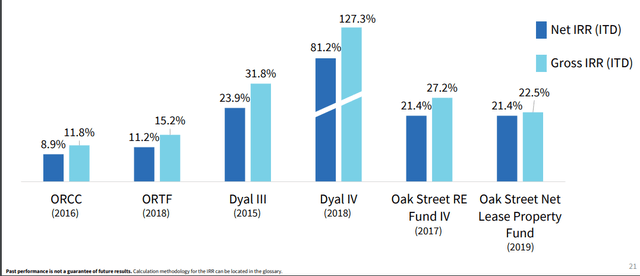

Blue Owl Investor Presentation

Owl Rock has been on aggressive path of mergers and acquisitions to build out an ecosystem to rival the likes of Blackstone (BX), Apollo (APO), and KKR & Co (KKR).

(See our deep dive on Blackstone’s private REIT here.)

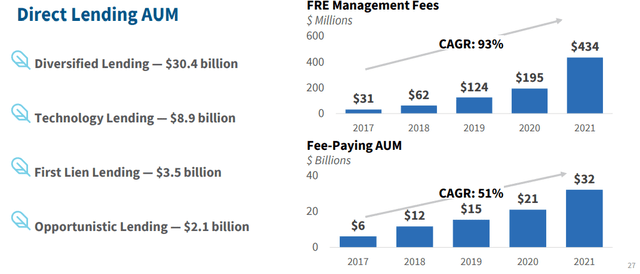

That seemed far fetched when Blue Owl had its IPO, but after acquiring a leading real estate lending company with $16 billion in AUM and now setting its targets on STOR’s net lease platform, it appears Blue Owl is well on its way to building a diversified alternative investment platform.

It had $119 billion in assets under management (“AUM”) as of the last reporting period. It’s that real estate division – Oak Street Real Estate Capital – that’s officially bidding on STOR.

Oak Street has been very active in the public REIT M&A space. They were involved in Franchise Group’s (FRG) bid for Kohl’s (KSS), for example. See our latest interview with FRG’s CEO here.

Blue Owl Investor Presentation

How has Blue Owl garnered so much capital?

It’s not complicated – performance is strong and consistent. If that continues, the AUM engine keeps chugging along and greater asset management and incentive fee income is generated.

Blue Owl Investor Presentation

I (Williams Equity Research) analyzed several of Owl Rock’s private offerings on behalf of large institutional investors and know the management team well.

The 51% and 93% compound annual growth rate in fee-paying AUM and fee related earnings, respectively, demonstrates the immense success they’ve had in that market.

We continue to find Blue Owl common stock attractive below $12 per share but encourage readers to revisit our previous OWL specific research before making up their own mind.

The Transaction: Seeing Both Sides

Oak Street is offering STOR $32.25 per share in cash, or an 18% premium over the previous day’s close. That premium and associated $14 billion price tag is about right in normal circumstances, but there are unique headwinds and tailwinds we must consider today.

While the headline price is $32.25, the actual consideration appears less.

Why?

An old trick of buying a company with its own cash flow from operations.

First, investors had anticipated a dividend increase for Q3. Assuming 6%+, which is below their reported AFFO growth, that’s 2.5 cents a share, or equal to the 2021 increase.

Then, the agreement calls for STOR to not pay out its Q4 dividend, which would be 41 cents. 41 + 2.5 is 43.5 cents. $32.25 – 43.5 is $31.815.

On one hand, STOR’s stock decline of ~33% in the past two quarters means $32.25 per share is likely to irritate many investors (especially since there’s no dividend in Q4).

Again, this is not really at $32.25 as I pointed out.

That’s below the 52-week high of $36.13 and well below its pre-pandemic stock price that exceeded $40 per share multiple times.

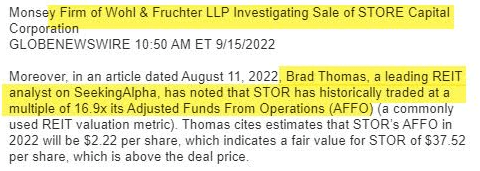

I was flattered to see that I was mentioned in the litigation (lawsuits are typical in this kind of M&A transaction):

GLOBENEWSWIRE

Adjusted funds from operations (“AFFO”) is the most accurate way to measure cash flow, and using that metric, STOR’s acquisition is approximately 14 times.

That’s a healthy improvement over the pre-deal’s 11.8 times, but keen investors know what STOR’s 5-year AFFO multiple is around 15.5 times (it’s a little over 16 times since inception). The deal is going through at about a 10% premium to net asset value vs. a 10% discount on Sept. 14.

Understandably, investors hope any premium to be on top of the long-term average cash flow multiple rather than a beaten down valuation.

These elements explain why Blue Owl is both interested in STOR and at $32.25 per share, but two key questions remain: Is it good for STOR shareholders and what’s the probability of obtaining a better price?

That last one is relevant as STOR has 30 days to shop the deal to another buyer. As a shareholder, we want to know if we should take the $32.25 while the iron is hot or wait for a better price.

(Again, the true price is less than $32.25 adjusting for suspended dividends.)

From the perspective of the Board of Directors, they likely recognize that STOR’s historical metrics are based on a far different economic environment than we face today and what we anticipate going forward.

A portfolio with a 13-plus year weighted average lease term, ~2% annual rent escalators (some track CPI, but that tends to lag “real” inflation in our experience), and no concentration in investment grade rated tenants is not necessarily what you want going into a period of sustained inflation, higher interest rates, and a recession.

If all those variables end up less severe than the current bearish outlook suggests, selling STOR at 14 times (less as adjusted) 2022 AFFO won’t look like a stellar deal. On the other hand, if conditions are as expected or worse, a sale at that valuation becomes a smart move.

Although human nature is to irrationally use the rearview mirror to drive our investment portfolios (e.g. “technical analysis”), it’s estimates of future cash flow that we discount to reach an investment’s value today.

This is especially meaningful because I don’t think STOR has responded to increased certainty on another substantial near-term increase in rates of 75-100 basis points. The stock price certainly hasn’t.

Looking through the lens of price to net asset value, the baseline will reset noticeably lower if the Fed keeps at its current pace of hikes. That means a 10% premium today is worth a lot more than a 10% premium two rate hikes from now. Cap rates are rising, and while that creates opportunities for lucrative acquisitions, it also means pain for “bond-like” real estate investments.

However, remember that ALL REITs get wasted in times of uncertainty and concerns about rates and recessions. Think 2008 -2020. But they eventually overcorrect. Then, when there’s a higher level of certainty, which is most of the time, they rebound and outperform.

Those are the reasons I believe, albeit begrudgingly as a STOR shareholder myself (speaking for WER), that:

- Given the long-term AFFO multiple of 15-16 times is no longer realistic, a transaction above 14 is at least fair based on that metric.

- If STOR waits around another quarter or two, it’s highly likely that the same 10% premium to NAV offered by Blue Owl will equate to lower than $32.25 per share. If you were Blue Owl or another bidder, wouldn’t you want a lower price in this market too?

- Since the deal is all cash, another buyer must improve on the $32.25 to be feasible. STOR and Blue Owl know that time is of the essence, and baking in another rate hike will all but ensure a less favorable price of STOR shareholders.

- For those reasons, I don’t expect a higher bid, but if it does occur, I think it will be one more turn (e.g. 14 times to 15) for a share price around $35 – but no higher.

Keep in mind, this year, all REITs have lost multiple.

STORE has done one better.

It has lost relative multiple.

The question is whether STOR’s multiple will rise after rate increases. Well, it might, if things stabilize and investment AFFO spreads revert.

Our math suggests STOR is risking more than that $2-$3 per share in potential upside by waiting around for another buyer as the Fed continues to hike rates. Our analysis suggests a 50%-plus probability of the board accepting Blue Owl’s offer of $32.25 per share (‘WER’). (Brad Thomas targets 75% probability of acceptance.)

The valuation associated with it earns a “fair” classification from us, and while one can argue it should be slightly higher (STOR shareholders) or lower (OWL shareholders), it isn’t unreasonable.

Fortunately, WER owns equity in both, so it’s basically a wash.

Brad Thomas has exited his position in STOR and reallocated it to another net lease REIT mentioned today on iREIT on Alpha’s chat board.

Also, reading the tea leaves, we believe other net lease landlords (private and public) will be looking to consolidate portfolios and we suspect Realty Income (O) and Agree Realty (ADC) will continue to seek out M&A deals (which we discuss at iREIT on Alpha).

Disclosure: WER is long STOR and OWL and short STOR put options.

Be the first to comment