Lyndon Stratford/iStock via Getty Images

Investment Thesis

StoneCo (NASDAQ:STNE) is a leading provider of payment and software solutions in Brazil. Before diving deeper into this analysis, I must make a little confession. I wrote about Stone in Q3 2021 when Stone was in the middle of problems with its registry of receivables and provision of credit. These problems were manageable but dragged the stock down. While the stock was in the low 40’s, it seemed to me that market was not understanding correctly the true value Stone has been providing to its customers and thus was undervaluing its stock. Today, Stone trades below 9 USD per share. In public markets, market price and intrinsic value often follow different paths – sometime even for longer periods – but eventually they meet. In the past two quarters, management of the company focused on growing its payments solutions and integrating Linx (software acquisition) into its product offering. Now, its software division is a key differentiating factor between Stone and its competitors. Even though new credit is not issued at the moment, it should be restarted in the following quarters under the new Head of Credit, Gregor Ilg. All in all, Stone is building a more robust product than its main competitors. Stone is slowly building a franchise, which does not depend only on the lowest costs in payments processing but on providing the complete solution, extending from payments and software to banking for SMB merchants.

Payment processing segment is gaining market share

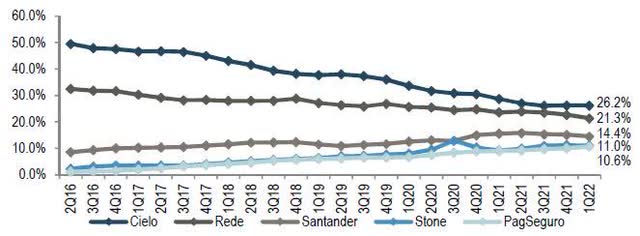

The payment processing industry in Brazil is dominated by five major competitors: Cielo ((OTCPK:CIOXY)(OTCPK:CIOXF)), Rede, Santander (BSBR), Stone and PagSeguro (PAGS). Payment processing is a commodity-like business. For most merchants, the lowest processing fees and customer support are the main factors in deciding which merchant acquirer to choose. Looking at the development of market share since 2Q2016, it is apparent that Stone and PagSeguro are slowly gaining market share at the expense of incumbents Cielo and Rede. Stone, with its 11% market share, is the fourth largest payment processor in Brazil. Its main distinguishing feature is strong customer support and simple technology, which helps entrepreneurs increase their sales and, eventually, productivity.

J.P. Morgan Brazilian Payments Report

I would argue that underlying competitive trends will continue also in the future and in the following years we will see more market share grabbed by Stone and PagSeguro. This trend will continue until some market equilibrium is reached, in which the visibility of lower processing fees is not worth the cost of changing the payment processing provider. An interesting comparison is between the two fastest growing players in the market: Stone and PagSeguro. While both companies have approximately equal TPV (Total Payment Value) – R83.2 bil. for STNE vs. R80.1 bil. for PAGS – StoneCo achieved this TPV with only 1.9 mil. active merchants, against 7.7 mil. merchants for PagSeguro. This indicates that Stone is targeting larger clients with bigger flows of volume, which creates higher efficiency in COGS. This way, Stone could achieve gross margins above 60%, while PagSeguro’s margins are below 50%.

Banking and credit offering are key segments to successful profitability

At the moment, there are about 40 different digital banks and fintechs in Brazil, with a big space for consolidation in the coming quarters. (Source: FT, June 21, 2022). It is not a secret that for Stone, payment processing segment serves only as a gateway to gain relationships with different SMEs. Once the client uses Stone’s payment solution, it is offered either one of its financial products (working capital financing / loan) or a software product. Based on the Stone’s estimates, the total addressable market (TAM) in payments is roughly R20 billion. However, the banking / credit market for SMEs is more than R85 billion. That is four times larger than the payment processing market. To see why so many fintechs are trying to gain a foothold in Brazil’s banking sector, let’s look at its profitability.

FT, Brazil’s biggest banks battle for reinvention in digital era

For Stone, offering credit to SMEs was an immensely lucrative business. However, in 2Q 2021, management realized that some of its collateral used for loans and working capital financing was non-existent, due to problems with the Brazilian registry of receivables. Their stock plummeted from high 80’s to current levels. Since that time, Stone stopped underwriting new credit and issued provisions for the balance of its portfolio. Even though the problems which Stone experienced were at the time unexpected, they are fixable. Currently, Stone is in the process of restarting offering of new credit and Gregor Ilg, former head of Santander Brasil for SMEs, who should be a key figure to change the course of this segment. In 1Q 2022, management delivered an adjusted EBT margin of 9% in financial services. With the restart of credit offerings and gaining synergies in its banking platform, profit margins closer to its competitors in the range of 15% to 20% in the near horizon are probable.

STNE Stock Valuation

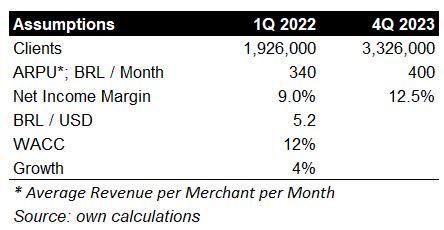

When StoneCo stock had been trading north of 70 USD per share, it had seemed to me to be trading ahead of its intrinsic value. On the other hand, at current levels of under 9 USD per share, Stone seems to be quite undervalued. To prove my point, I would want to abstain from complicated DCF valuations or multiple comparisons; I would rather use simple assumptions we already know from previous quarters. We know that STNE can add over 200,000 new merchants per quarter and that current average revenue per merchant (ARPU) is BRL340 per month. I assume that within next two years, Stone could reach ARPU of BRL400 per month, which is still below peers in the Brazilian banking sector, but more realistic given more products will be used by existing client cohorts. Other assumptions are mentioned in the table below.

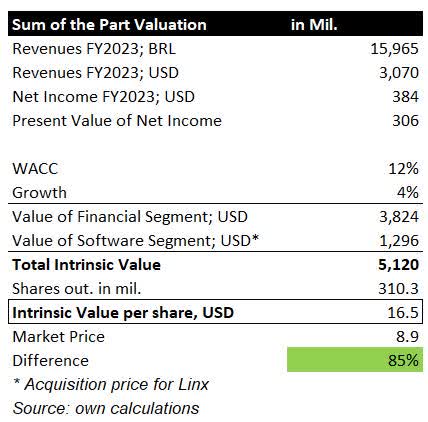

Based on the sum of the parts valuation above, I would assume that Stone should trade way above its current market price of 8.9 USD. If my assumptions are correct, then the fair market value should be somewhere in the range of 16.5 USD per share, which is approximately 85% higher than the current market price. Additionally, there is a reasonable margin of safety because the combined software divisions of Stone and Linx should be worth more than just the acquisition price of Linx itself.

Conclusion

In the past two quarters, management fixed many mistakes it had made during its rapid expansion phase. Stone returned to its basics, which is to win market share in payment processing and slowly expand through additional services in software and, later, in banking, credit and insurance. With every following quarter, Stone provides more incentives for its customers to stay within its ecosystem and less reason to leave to its competitors. These characteristics are usually defining of a franchise. For investors who are willing to invest in Stone for at least three years, the current market price offers a good entry point. For those who are not able to stick with this investment horizon, I would probably recommend looking somewhere else.

Be the first to comment