Melpomenem/iStock via Getty Images

This article was prepared by Nirasha Senanayake, CFA in collaboration with Dilantha De Silva.

“This past year was unsatisfying for Stone. We executed well in some areas, but we certainly made some mistakes,” said StoneCo Ltd. (NASDAQ:STNE) CEO Thiago Piau during the fourth quarter 2021 earnings call. Berkshire Hathaway-backed, StoneCo stock has been on a downward trend since February 2021 – from $92 to $9 in just one year before recovering to $14. The rising Selic rate, elevated operating expenditures, and the weak cash balance post acquisitions of Linx and Inter have been taxing the bottom-line of the company in the recent past, and these were some of the major reasons behind the lackluster performance of its stock as well. However, on March 18, following the release of better-than-expected fourth-quarter earnings and painting a positive outlook for the first quarter of 2022, shares of StoneCo jumped 43% to $13.80. On the back of these interesting developments, we thought StoneCo needs to be revisited to determine whether we are missing an important piece of the puzzle (we have been bullish on the company since mid-2021) or whether Mr. Market is far from pricing StoneCo perfectly.

Earnings update

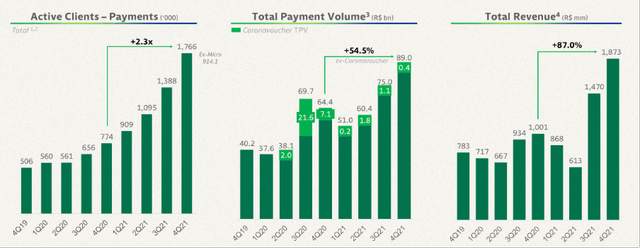

StoneCo revenue grew 87% year-over-year (60% YoY excluding Linx) to R$1.9 billion, mainly driven by the MSMB segment. Total revenue for Fiscal 2021 was up 45.3% YoY. The MSMB segment’s TPV grew 87% YoY to R$66.7B with a record growth of MSMB active payment clients which were up 27% QoQ. During the quarter, StoneCo added 377,700 net new clients. In the Micro Merchant space, the active client base grew with 743,500 net additions during the year. StoneCo has expanded its management team and going forward, the company will be operating under two main operating segments: Financial Services and Software. Each segment will have its own leadership team to focus on the operations and performance.

Exhibit 1: StoneCo financial performance metrics

On the bottom line, the adjusted net income of the company contracted 90.6% for the quarter and 78.8% in Fiscal 2021. The increase in funding costs and a substantial rise in marketing costs had a significant negative impact on profit margins last year. Selling expenses almost doubled to R$1 billion compared to R$506 million in 2020, and funding expenses, as a result of the rising Selic rate, cost the company R$1.1 billion compared to R$300 million in the previous year. These two were the major reasons behind the noteworthy decline in profitability of the company along with the negative impact resulting from the Banco Inter deal that led StoneCo to book mark-to-market losses on its investment.

What went wrong for StoneCo?

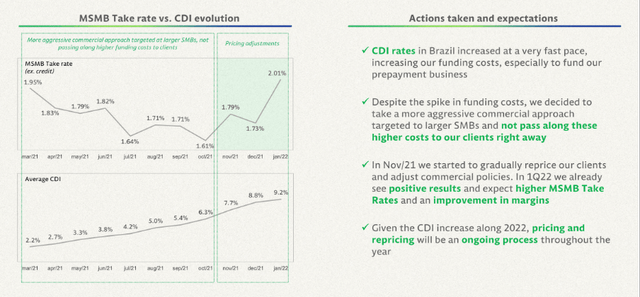

StoneCo’s main focus last year was on refining its business model while creating a foundation to achieve growth. Unfortunately, the CDI rates (interbank rates) in Brazil increased at a very fast pace, and StoneCo failed to pass on the added burden from the increased funding costs to its clients. While PagSeguro Digital Ltd. (PAGS), one of StoneCo’s major rivals, was focused on passing through the higher funding costs to its clients, StoneCo took on a more aggressive “commercial approach” targeted at larger SMBs and did not pass along these higher costs to clients.

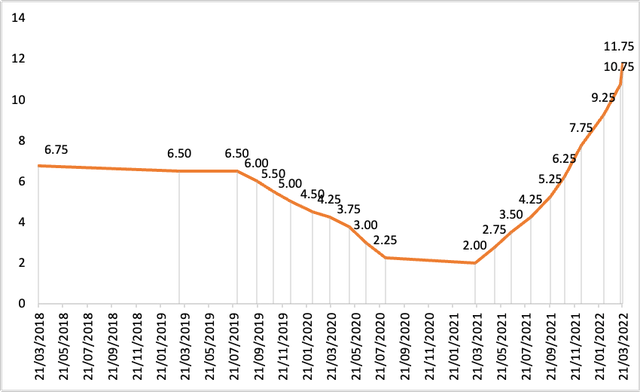

Exhibit 2: The target for Selic rate in Brazil (%) – Annual Data

In mid-2021, StoneCo paused its credit operations, and in prepayments, its focus on growth delayed repricing of the product offerings. The increased funding costs damaged the company’s margins substantially, so the company was forced to adjust its pricing policies last November, which is expected to allow margins to improve over the next few quarters. The take rate in MSMBs increased from 1.73% in Q4 2021 to 2.01% in January 2022 as the company continued to reprice its products to improve margins. Management expects a negative impact on the net additions of new clients in the first quarter of 2022 as a result of this pricing strategy, but it will be an essential step to improve margins.

Exhibit 3: MSMB take rate vs CDI

The Covid-induced recession in Brazil is another obstacle that made things go wrong for StoneCo. Brazil had one of the highest death tolls from Covid last year, inflation is continuing to make life difficult for both businesses and consumers alike, hunger in Brazil has become a major issue, and families are struggling to even pay their power bills. In the third quarter of 2021, Brazil officially entered a recession, which did not come as a surprise. In summary, business conditions are as bad as they could get in Brazil, and StoneCo has become a victim of these poor business conditions, and the company understandably had little control over these negative developments.

The path to recovery

“We learned a lot from last year’s challenges, and we have also made some important changes in our structure and management team to strengthen our execution capabilities,” said CEO Thiago last week during the most recent earnings call. StoneCo aims to relaunch its credit product and continue to grow the MSMB client base and expand its banking solutions. Management has been implementing major fixes to its credit product and operations. From revamping the product to simplifying the user experience, introducing new originations processes, and implementing new risk monitoring systems and strategies, StoneCo has shifted its focus from growth at any cost to sustainable growth. This pivot in business strategy, in our opinion, will be a catalyst for growth in the future as it would help the company account for the uncertainty in the Brazilian economy. The company is planning to launch a business credit card and overdraft products for SMBs, and these new developments strengthen our belief that StoneCo will emerge as a full-service, digital financial services platform in the coming years.

The management team has set out priorities and strategies for Fiscal 2022 as well, which are in line with our expectations for StoneCo’s recovery phase. In the financial services segment, the company aims to become a one-stop-shop for MSMBs without sacrificing its profit margins to grow the top line. In the software segment, the focus will be on increasing the productivity of Brazilian merchants through POS and ERP solutions, enabling clients to sell through more digital channels. This is in sync with where the Brazilian economy is headed.

All in all, the main focus will be margin expansion in 2022, as opposed to securing topline growth in 2021. In other words, the company is focused on profitability this year, which is a need of the hour as the company’s previous approach failed to accurately account for the risks associated with the Brazilian economy.

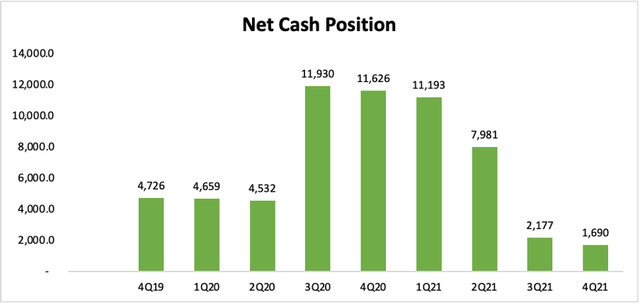

Keeping an eye on the deteriorating net cash balance

Looking at StoneCo’s net cash balance, which also includes accounts receivables from card issuers and card payables, it becomes evident that the company’s net cash position has deteriorated drastically over the last few quarters. From R$11.9 billion at the end of March 2021 to R$1.6 billion in December 2021, net cash has tumbled. The increasing Selic rate is only going to add to the burden of the costs that are not passed on to its clients. StoneCo’s focus on acquisitions and growth, which resulted in payments to acquire Linx and Inter, puts the company at greater risk in comparison to its peers that have been able to manage their cash position better due to conservative policies.

Exhibit 4: Net cash position (R$ millions)

We are keeping a close eye on the liquidity profile of StoneCo to identify any potential inflection points.

Takeaway

As highlighted in our previous article on StoneCo, we believe the Brazilian economy has a lot to offer StoneCo and the FinTech industry. One major drawback of investing in StoneCo is the exposure to the uncertainty of this Latin American economy, but in the long term, we believe this very same characteristic could turn out to be the best thing about investing in StoneCo. The company seems to be making conscious decisions to position itself well to weather the structural risks associated with the Brazilian economy, and we believe StoneCo deserves a rerating in the market, which could be triggered by a better-than-expected financial performance this year.

Be the first to comment