martin-dm

Investment Thesis

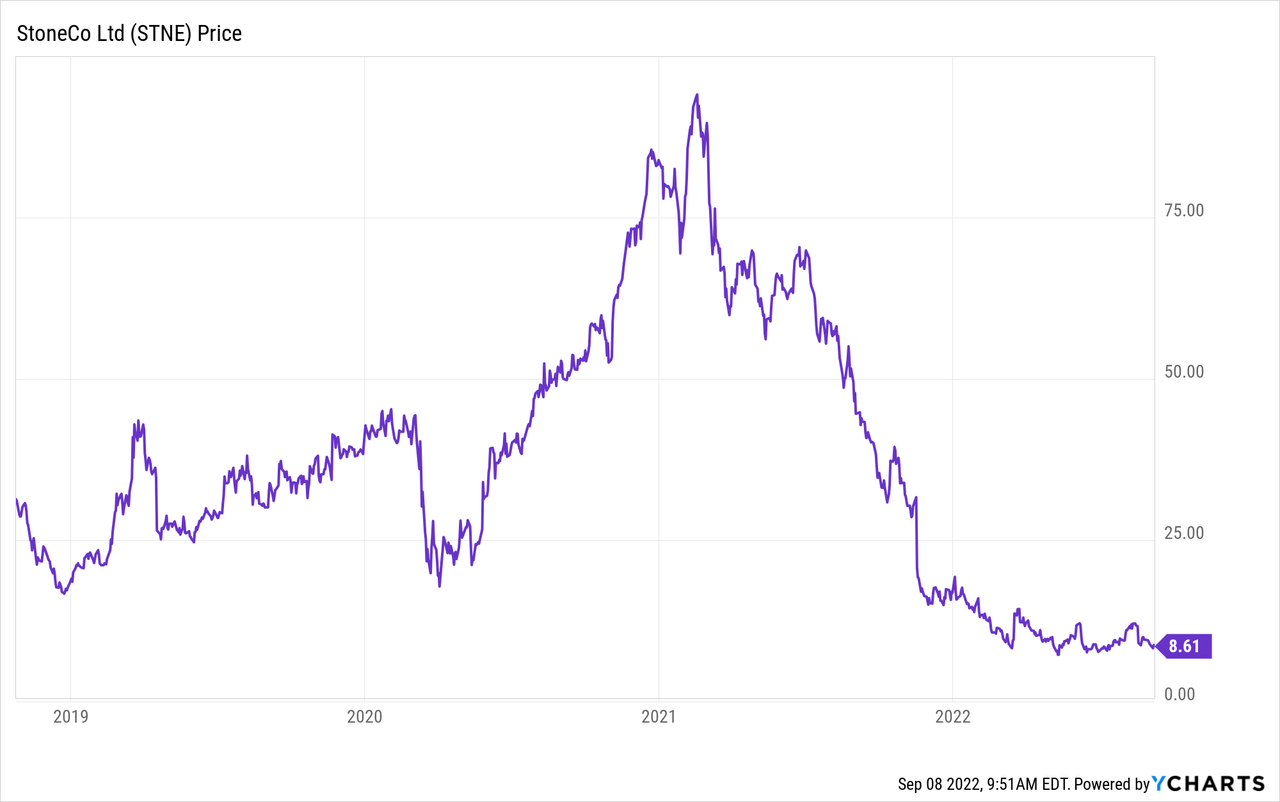

StoneCo (NASDAQ:STNE) went public back in late 2018. The Buffett-backed company gained a lot of traction initially, with its share price tripling in a little less than two years. However, the company got caught in the broad market sell-off last year and dropped significantly, now trading over 90% below its all-time high. However, I believe this offers a great bottom fishing opportunity for long-term investors. The company is benefiting from the acceleration of digital transformation in LATAM (Latin America) and is continuing to post strong revenue growth. It is also trading at a significant discount compared to its peers, as the current valuation is at a multi-year low. Therefore, I rate the company as a buy.

Overview

StoneCo is a Brazil-based fintech company founded back in 2000. The company offers financial services and software solutions to merchants and consumers across Brazil. The company’s subsidiaries include Stone, Pagar.me, Mundipagg (now operates under Pagar.me), Equals, and Cappta.

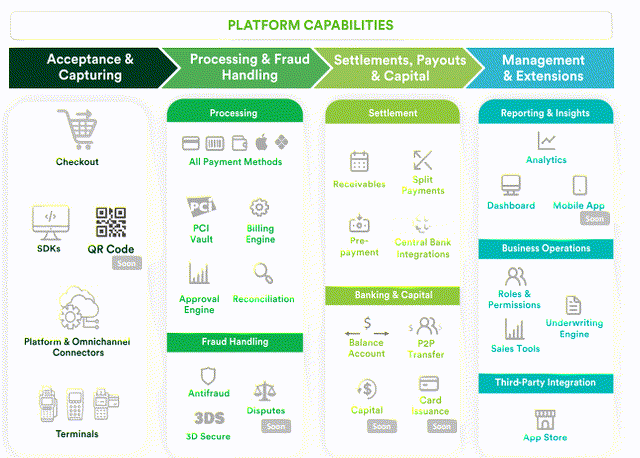

Stone is the company’s main product, which provides POS (point of sale) solutions to small and medium businesses. It allows these businesses to accept digital payment easily via handheld terminal, QR code, links, and more. Besides, it also offers digital bank accounts for merchants. Merchants can easily make transfers and manage sales through the account. The account also comes with business cards for payments. This allows merchants to keep track of their businesses conveniently.

Pagar.me is a payment service provider that helps small businesses to accept card payments online easily. It offers features like recurring billing, online voucher enablement, fraud management, and more. Equals offer smart financial management, which provides sales visibility and insights for clients. While Cappta provides business automation and tax solutions to merchants. StoneCo’s comprehensive product portfolio allows it to meet different customer needs with different dedicated solutions.

Market Opportunity

The fintech industry in the LATAM region is booming as digital transformation continues to accelerate. I believe the market opportunity for StoneCo is huge, as the country is now starting to adopt digital payments. Currently, the unbanked population in Brazil is very high. According to PagBrazil, around 16.3 million adults in Brazil do not have a bank account (10% of the adult population), while another 17.7 million adults have not used their bank account for at least a month. These unbanked adults combined transact over $67 billion USD annually, which presents a large untapped TAM for StoneCo.

Since the pandemic, the number of unbanked population has been drifting down as neobanks like Nu Holding (NU), PagSeguro (PAGS) and MercadoLibre (MELI) continue to gain significant traction. For instance, Nu Bank customers increased by 51% YoY to 62.3 million in its latest quarter, indicating consumers’ strong demand for digital banking. As the country continues to shift from cash transactions to cashless transactions with a wider digital banking and credit card adoption rate, the demand for StoneCo’s products will also continue to increase and boosts its transaction volume.

Second Quarter Earnings

StoneCo recently reported its second-quarter earnings in mid-August, and revenue growth continues to impress. StoneCo reports in Brazilian Real, therefore, the figure below will be in Real rather than in USD.

Thiago Piau, CEO, on second-quarter results

I believe our strong second quarter results continue to reinforce our recovery and we are seeing a more consistent pattern of performance so far in the first half of 2022. Our business is performing very well. We are winning new clients faster than last quarter and are producing strong revenue growth while improving profitability. We are encouraged by the trends we have seen in our business in the first half of the year and believe the outlook for continued growth and margin expansion reflect this view. We see the second half of the year as an opportunity to build on our first half successes, demonstrate that our recovery is in full swing and position Stone favorably for the longer term.

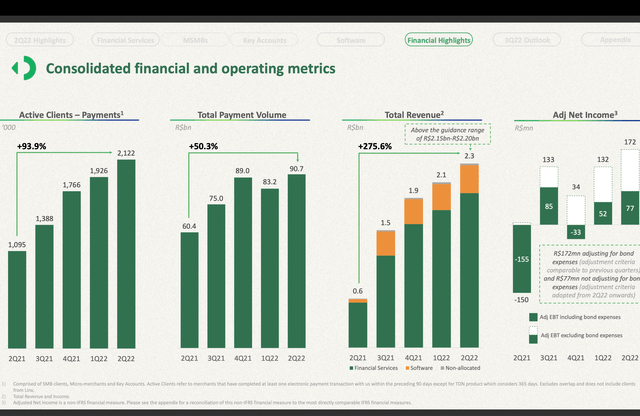

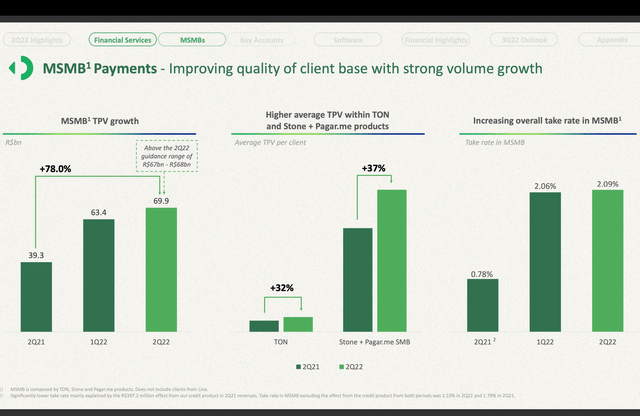

The company reported revenue of $2.3 billion, up 275.6% YoY (year over year) from $613.4 million (or 82.8% growth ex-credit and pro forma for Linx). Driven by strong TPV and improving take rate for banking. Financial services generated $1.9 billion and Software services generated $350.7 million, up 242.5% and 720.3% respectively. TPV (total payment volume) for the quarter was $90.7 billion compared to $60.4 billion, up 50.3% YoY.

Small and medium business banking continues to gain strong traction. The active payment client base was 2.07 million, up 97.6% from 1.05 million. The total account balance was $2.3 billion compared to $862 million, up 168.9%. Stone Card TPV also increased 81% from $293.7 million to $531.6 million.

The bottom line also improved significantly. Adjusted EBITDA went from negative $(17.9) million to $1.06 billion this quarter. Adjusted EBITDA margin was 45.9%, a 6.4 percentage points improvement sequentially, attributed to better cost control and lower marketing expenses. Adjusted net income also flipped from negative $(155.5) million to $76.5 million, as the company continue to benefit from strong operating leverage. The company’s balance sheet is also very healthy. It ended the quarter with $1.75 billion in cash and only $1.3 billion in debt.

Valuation

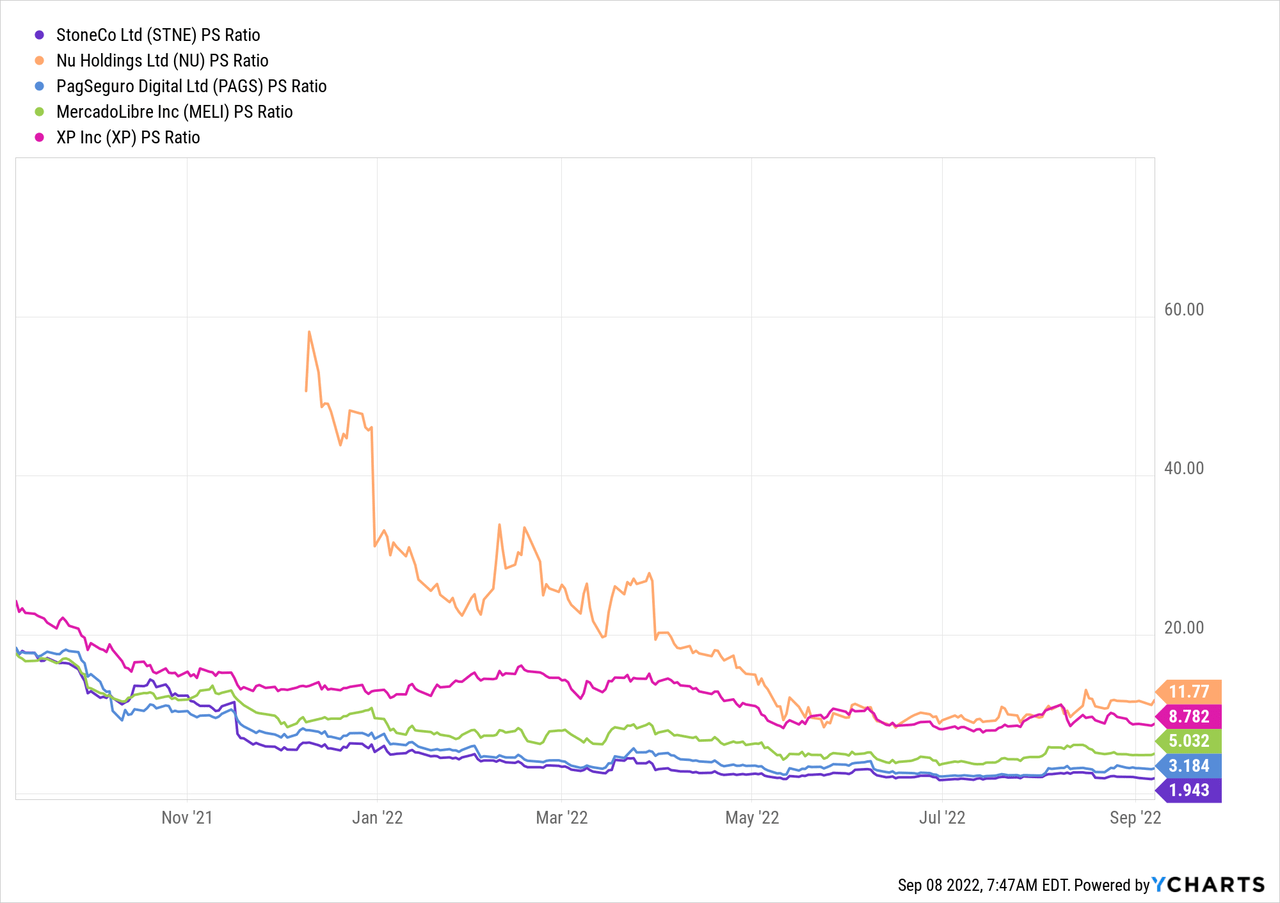

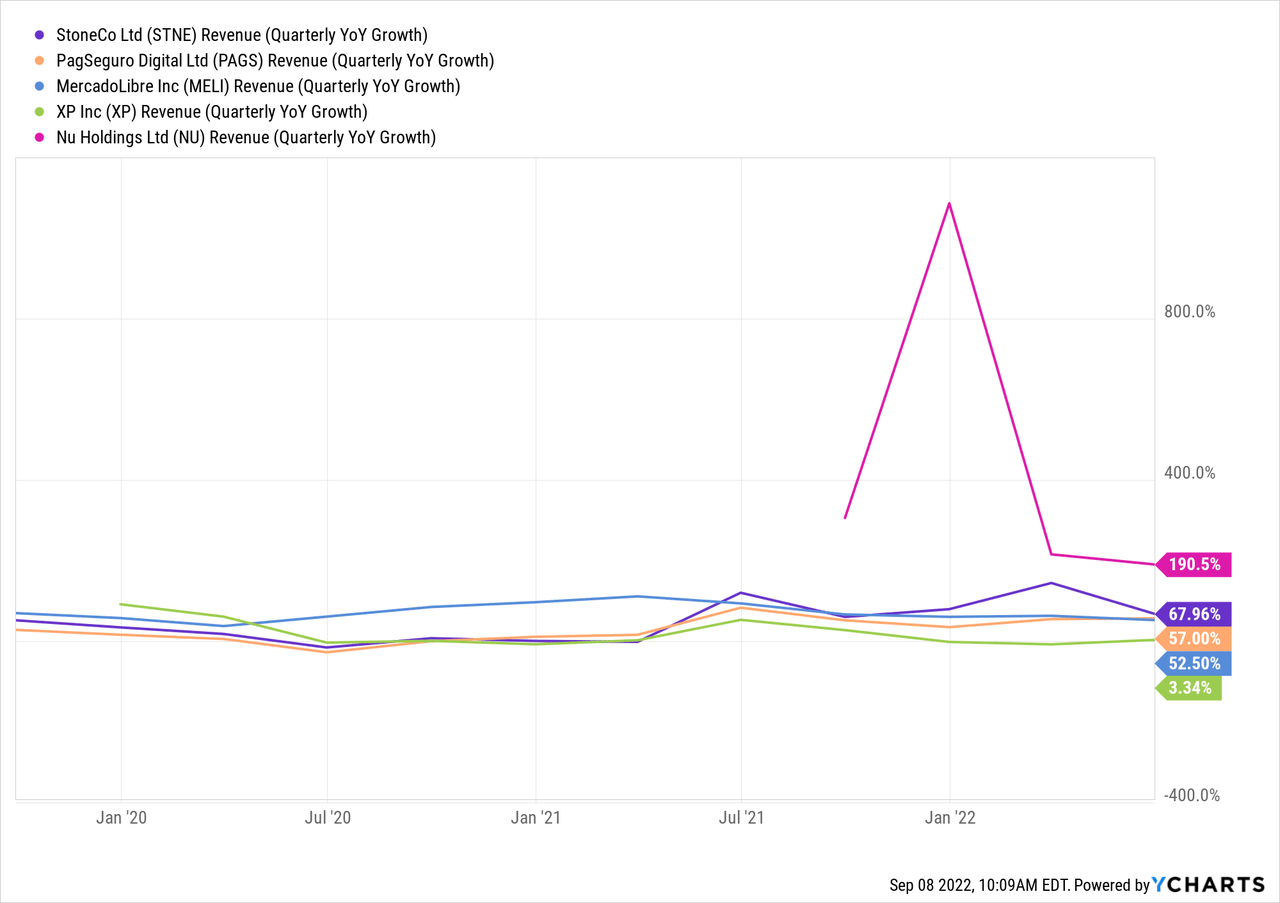

After the massive drop in share price, StoneCo is now trading at a very compelling valuation. On a P/S ratio (price to sales) basis, the company is currently valued at a significant discount compared to its peers such as Nu Holding, PagSeguro, MercadoLibre, and XP Inc (XP), as shown in the first chart below. The current group average is 6.14x compared to StoneCo’s 1.94x, representing a 216% premium. Yet, in the second chart below, you can see that StoneCo’s revenue growth is actually the second highest among the group, only behind Nu Holdings. The current growth rate is also above StoneCo’s historical average growth rate, indicating strong fundamentals. I believe the market is mispricing StoneCo as it continues to show above-average growth, yet valuation remains very compressed. A reversion back to the group average P/S ratio will offer a meaningful return to shareholders.

Risks

The current turbulence in the economy may pose substantial risks to StoneCo. As a fintech company, StoneCo generates most of its revenue from transaction fees via its payment solutions and POS. If inflation continues to remain at a high level while rates continue to rise, consumer spending will likely decrease, which will hurt StoneCo’s payment volume. This will also affect the company’s credit and banking segment, as delinquency rates will likely tick up as well. The economy in Brazil is also a lot more unstable and volatile compared to the US. According to Statista, the current unemployment rate in Brazil is 9.1%, much higher than US’s 3.7%. The inflation rate is also higher, standing at 10.1% compared to 8.5% in the US. I believe these are some potential risks that investors should pay attention to when investing in the company.

Conclusion

In conclusion, I believe StoneCo currently offers a great buying opportunity for investors. The company market opportunity is huge as the fintech industry in LATAM and Brazil is growing rapidly. The acceleration in digital transformation and the adoption of digital banking is continuing to post strong tailwinds on the company. Its comprehensive suite of products is allowing merchants to vastly increase their operating efficiency. Despite facing a tough macro environment, revenue growth in the latest quarter remains very strong, and the bottom line is continuing to improve as well. The current valuation is significantly discounted when compared to its peers. I believe a higher multiple should be rewarded as fundamentals and growth remain strong. Therefore, I rate StoneCo as a buy at the current price.

Be the first to comment