svetikd

Stocks Crushed After Earnings Miss

Many companies have been beaten down this year, with earnings misses punishing stocks even lower. War, geopolitics, viruses, and other factors have led stocks on a volatile ride, causing rallies and massive selloffs. Underwhelming earnings add an additional layer for investors whose negative sentiment remains at the heart of market volatility. But the union between computing power and human expertise is helping investors lower costs while increasing gains.

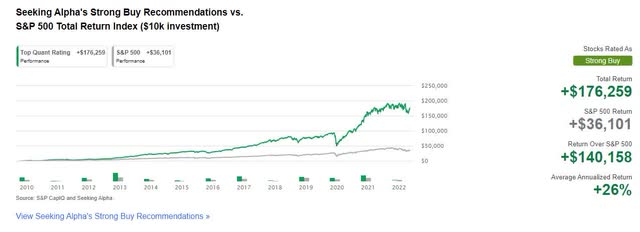

Seeking Alpha Quant System’s Strong Buy Ratings vs S&P 500 Total Return (Seeking Alpha Premium)

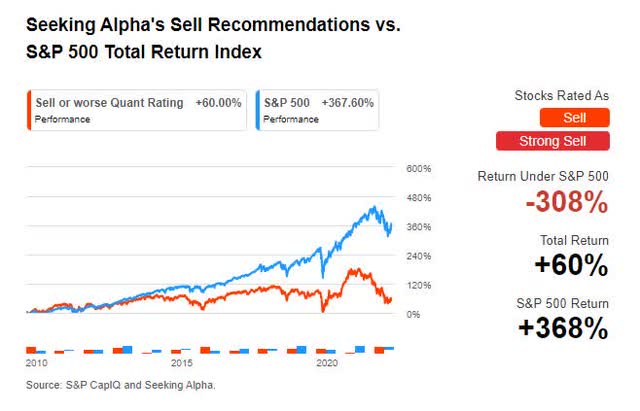

The power of ‘quantamental’ analysis delivers powerful results by combining the strongest collective metrics for value, growth, profitability, momentum, and EPS revisions in picking and avoiding stocks. Stocks that underperform the S&P 500 are dead money and risk losses to investor portfolios. Seeking Alpha’s Quant System prides itself on delivering impressive returns, as showcased above, beating the S&P 500 for 12 years using a backtested strategy, and providing tools to understand the risks involved when investing. Let’s look at some of the beaten-down stocks like ROKU, PTON, and SNAP that our quant ratings warned investors to avoid or sell long before their most recent earnings miss and how our Quant Ratings & Factor Grades define those risks.

Power of the Quant Ratings

I joked with a colleague a few months ago who loves buying dips and insisted on buying Roku Inc. (ROKU) at $100 per share. I said, “Heed the quant ratings.” I insisted that ‘quantamental’ analysis works and that ROKU’s warning banner is a solid indication that the stock is destined to fall. I think we all know how this pans out! Fast forward a few weeks later, and ROKU drops to its 52-week low of $62 per share. I couldn’t help but think, winner, winner, chicken dinner, quant ratings win again!

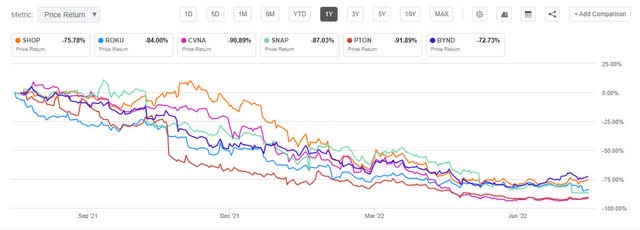

1-yr Price Performance of Six Crushed Stocks With SA Bearish Ratings

1-yr Price Performance of Six Crushed Stocks With SA Bearish Ratings (Seeking Alpha Premium)

ROKU and stocks like (SHOP), (CVNA), (SNAP), (BYND), and (PTON) have been on a downward trend, as evidenced in the above graph. ROKU substantially missed earnings on July 28th, plunging more than 22%, as did countless other stocks. While many investors consider bearish stocks an opportunity to buy at lower prices, assessing the stock’s fundamentals is crucial to its long-term prospects as a dip pick worthy of upside. Stocks with very bearish ratings possess the most significant risk of downside.

Our Quant Grading System is an excellent resource, so I advise investors to heed the Quant Factor warnings. While some stocks perform amazingly well, I am referencing stocks that performed well during the pandemic when isolation was mandatory and prompted a rally for stay-at-home products and services. But the environment has changed. Supply chain issues still abound, and bearish stocks expected to underperform are still at risk of underperforming the overall market.

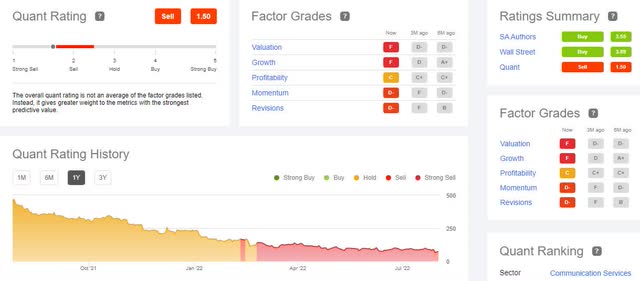

The purpose of investing is to grow your investment portfolio. Avoid the stock losers due to negative compounding. Seeking Alpha’s quantitative model indicates that the probability of loss is higher with stocks with poor investment characteristics. Using ROKU as an example, you can see that the factor grades look dismal except for the C Profitability grade below.

ROKU’s Poor Report Card & Ratings on Key Investment Characteristics

ROKU Stock Poor Ratings and Factor Grades (Seeking Alpha Premium)

Similar report cards can be seen for PTON, SNAP, BYND, SHOPIFY, (W), (DOCU), CVNA, and (RCL). To create a portfolio that identifies and avoids high-risk stocks, let us dive into what the factor grades mean.

Stock Valuation, EPS Revisions, and Momentum

Seeking Alpha’s quantitative system aims to focus on the best characteristics of the fundamental building blocks of stocks. We like to base the quant investment strategy on highlighting companies with solid growth potential at a reasonable price, also known as Growth at a Reasonable Price (GARP). GARP measures the quality and health of stocks using our grading system. It also showcases those stocks with less than optimal characteristics. Let’s dive into the first building block, valuation.

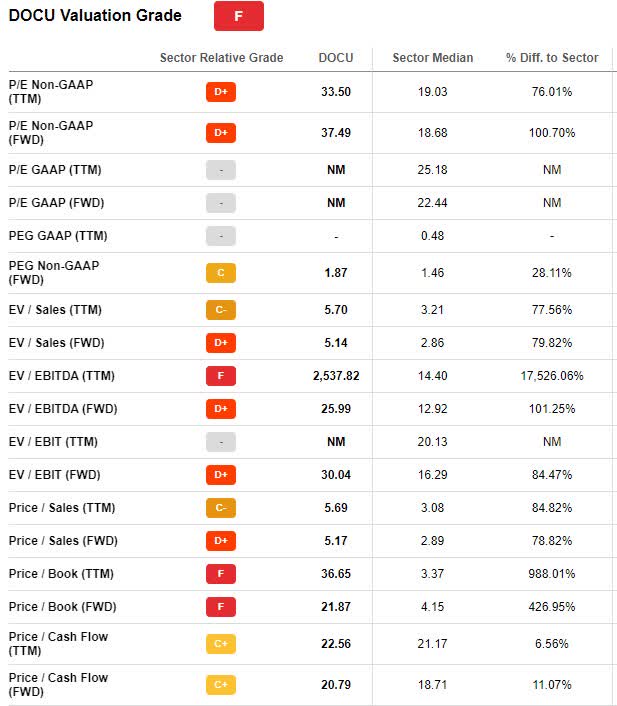

Stock Valuation

Valuation is crucial because it determines a stock’s current – and projected worth – and whether it comes at a discount or premium price. Using DocuSign (DOCU) stock as the valuation and momentum grade example, this e-signature software company for digital preparation and signing agreements has been very unattractive on valuation and momentum since last year. With an F valuation grade, not only is DOCU considered highly overpriced compared to its sector peers, its forward P/E ratio of 37.49x is nearly 3x higher than the sector. DOCU has a forward Price/Book of 21.87x. Meanwhile, the IT sector media is 4.15x. And with its latest earnings miss and 17 analysts’ downward revisions in the last 90 days, DOCU may have peaked during the pandemic, as its outlook is currently bleak.

DocuSign Stock Valuation (Seeking Alpha Premium)

Stock EPS Revisions

Earnings season has been a rough road for many companies navigating the difficult economy and outlook. As companies battle the bear market and inflation eats into profits, stunting growth, both businesses and investors can use these times as an education tool.

DocuSign Revisions Grade (Seeking Alpha Premium)

Missed earnings are resulting in analyst downward revisions and guidance. The key for investors is asking why companies have missed earnings. Do they have too much debt, or perhaps they have an inventory problem? Did COVID have too much of a devastating effect, or perhaps supply chain constraints have lingered? Many factors can play into an earnings miss. The key is digging into why a company misses EPS because revisions play a huge role and influence on future stock performance.

Studies and our quant data show that stocks with upward earnings revisions tend to outperform while those with negative earnings revisions tend to underperform. DocuSign’s latest June 9th, 2022 Q1 EPS of $0.38 miss, according to DOCU CEO Dan Springer, a result of “experiencing many of the macro challenges that our peers are seeing, with inflationary concerns, a volatile workforce environment, and general global instability.” Coupled with DOCU’s D- Momentum, this stock is a strong sell according to the quant ratings.

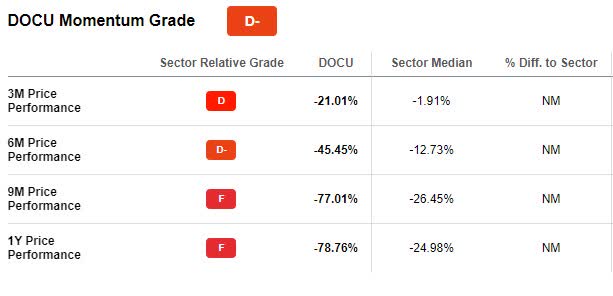

Stock Momentum

The Momentum Factor Grade is one of the most important of our five core factors concerning price predictability. DocuSign has a D- grade. DOCU is underperforming its sector by -78.76% over the last 52 weeks and the industry by almost -21% over the previous three months. The stock is down 58% year-to-date, which is why the risk warning and its momentum grades are well warranted.

DOCU Momentum Grade (Seeking Alpha Premium)

Stock Growth & Profitability

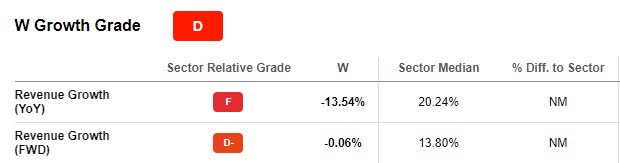

Using Wayfair Inc. (W) as the growth and profitability example, this e-commerce company offering online selections of furniture, decor, and many home products benefited early in the pandemic but has been on a bearish trend since. The Seeking Alpha quant ratings have indicated bearish growth and profitability for Wayfair since 2021. Strong growth is an indicator of a healthy company. Investors focused on growth typically measure a company’s strength by how fast its revenues and earnings are growing compared to its sector peers. In the case of W, it’s down more than its peers, as evidenced by the year-over-year revenue growth below.

Wayfair Stock Growth Grade (Seeking Alpha Premium)

The latest Q1 2022 earnings resulted in an EPS of -$1.96 missing by $0.43. Despite revenue of $2.99B beating by $6.21M, 28 analysts gave FY1 Down revisions in the last 90 days, resulting in an F revisions grade.

W Stock Revisions (Seeking Alpha Premium)

The continued rise in energy prices poses headwinds for shipping and fulfillment costs. Supply chains are still in need of improvement. As consumers budget and cut out discretionary purchases as recession fears mount, Wayfair could be in for an even rougher road as their growth and profits have already taken several hits. Companies with strong profits are viewed as healthy and tend to earn more than they spend operating, buying, and producing their products. Wayfair reports Q2 earnings this week, but the outlook amid recession fears and macroeconomic backdrop appears bleak. As Seeking Alpha Marketplace Author David Trainor writes,

“While Wayfair benefited greatly from work-from-home and the accelerated shift to online shopping during COVID-19, the improvements to its business are already fading. We counsel investors not to try and catch falling knives – stocks that have seen steep declines but still have further to fall…Wayfair: A Falling Knife to Steer Clear Of.”

Conclusion

Before buying the dip, or jumping into bearish ideas, consider evaluating your stock pick(s) by creating a Seeking Alpha portfolio. This tool will help you to determine the losers in a portfolio that can save you from catastrophic losses.

Seeking Alpha Quant System’s Sell Recommendations vs S&P 500 Total Return Index (Seeking Alpha Premium)

If you had some of the stocks mentioned in this article, ROKU, PTON, SNAP, BYND, SHOPIFY, W, DOCU, CVNA, or RCL, you likely received a warning banner like the below, or at the very least, noted the poor factor grades and characteristics in red. Seeking Alpha Quant System’s sell recommendations are a powerful way to avoid getting caught by a bear. From a perceived value perspective, bearish stocks may appear to be an opportunity to buy at a lower price; they come with risks and can be value traps. Our Quant System can readily identify these stocks.

Be the first to comment