Win McNamee/Getty Images News

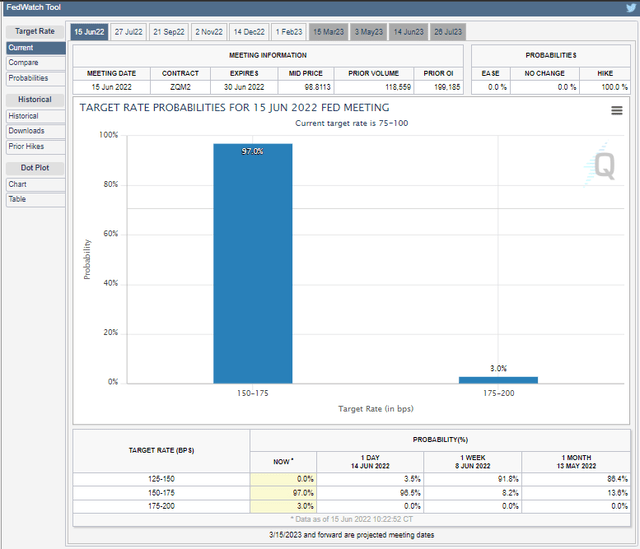

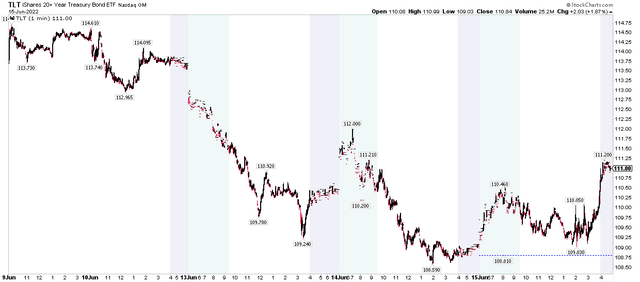

The so-called “most important Fed meeting ever” was sort of lackluster. Chair Jay Powell hiked rates by 75 basis points, right what the market expected, according to CME Fed Funds Futures pricing. We were basically told what would happen at this afternoon’s FOMC meeting late on Monday when the Wall Street Journal reported that there were Fed whispers of a 75 basis point upward change. Perhaps the most interesting price-action of the week was then – the bond market turned incredibly loose. The most liquid market in the world did not trade like it.

CME Fed Watch: Futures Traders Were Confident About a 3/4-Point Policy Rate Hike

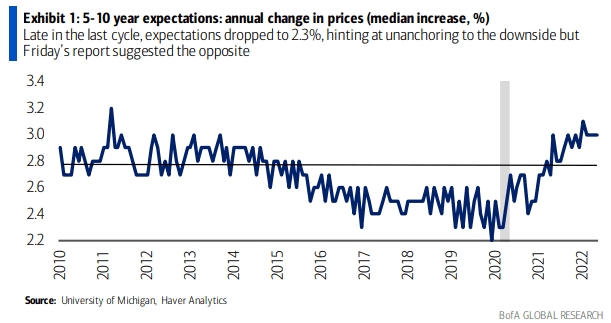

This all began last week. Stocks began to sink Wednesday. Then Thursday afternoon was a disaster. Friday morning was when the fireworks began. The U.S. CPI report came in much hotter than expected and then the 10 a.m. University of Michigan Consumer Sentiment survey revealed big-time 5-10-year inflation expectations – something the Fed looks at. Ultimately, that led the Fed (likely) to leak that whisper to the WSJ. Markets were in turmoil Monday grappling with a disintegrating fixed income market.

Consumers’ Inflation Expectations Above the Long-Term Average

Bank of America Global Research

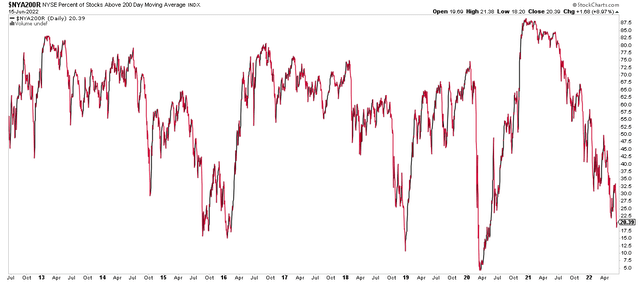

Moreover, the European Central Bank held an emergency meeting to deal with an apparent impending crisis regarding surging yields and plummeting bond prices across the pond. Risky assets continued to sink before a respite rally ahead of the 2 p.m. Fed decision today. Without any shocking moves this morning, and then a somewhat uneventful conference, this afternoon featured likely some short-covering after oversold conditions. Consider that just 20% of NYSE stocks traded above their 200-day moving average going into Wednesday – the lowest figure since right after the COVID Crash.

Oversold Conditions: 20% of NYSE Stocks Trade Above Their 200-Day Moving Average

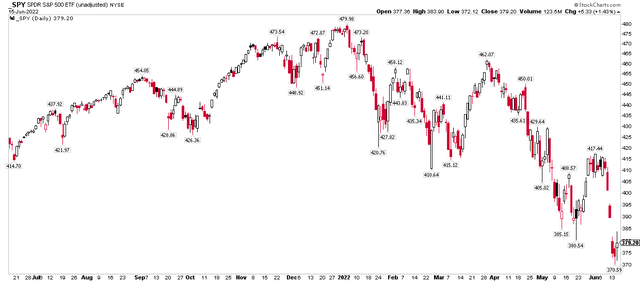

Digging deeper into the market reaction, SPY printed a small bullish real body on today’s candle, but it was close to a doji (which represents indecision). Tuesday’s low just above $370 on SPY will be a key spot to watch. But recall what happened the day after the prior Fed meeting bounce – stocks plunged. Thursday’s price action will be critical, but so too will Friday’s. Read on.

Stocks Settled About Where They Opened, Watching Tuesday’s Low For Support

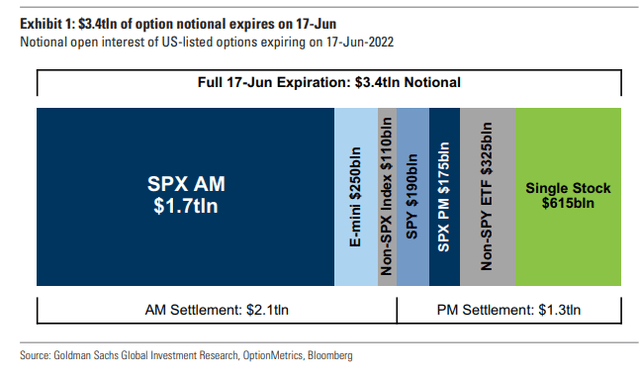

Friday is options expiration which will be a doozy this time. Goldman Sachs reports that $3.4 trillion of option notional will expire. It’s also a three-day weekend, which could add to volatility.

Goldman Sachs: A Significant OpEx on Friday Afternoon

Goldman Sachs Investment Research

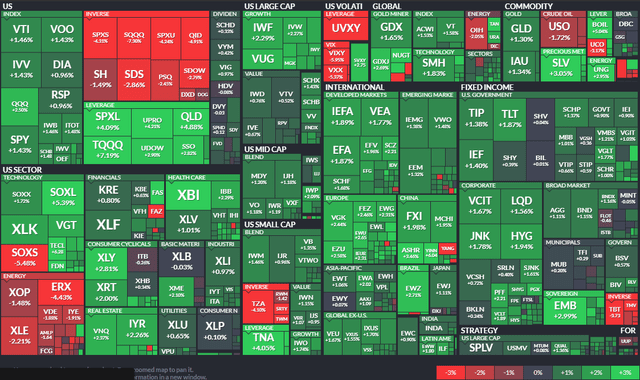

As for the bond market’s feeling about the Fed, it was a volatile post-decision market. Short-term rates were sharply lower as the Fed seemed to reassure the Treasury market. Corporates were also bid. Investment-grade credit (LQD) rallied 1.6% while junk bonds (HYG) were up almost 2%.

The Fed Day ETF Performance Heat Map: Risk-On, Bonds Rally

Interestingly, the long bond caught a big bid late in the day – maybe that is a sign of future growth concerns.

Long-Term Treasuries Rallied Sharply Late Wednesday

Commodities were rather weak on Wednesday sans precious metals while crypto failed to participate in the risk-on rally. The U.S. Dollar Index was down hard.

The Bottom Line

Ultimately nothing really changed today in my view. Perhaps the bond market found its footing after an absolutely wild few days that saw the U.S. two-year rate jump the most over two days in almost 40 years. The S&P 500 bulls have a lot to prove. For now, it’s simply a countertrend stock market rally.

Be the first to comment