Edwin Tan

The tech sector correction of 2022 has pretty much punished the entire group uniformly. While many stocks are now sitting below what I’d consider their intrinsic worth, some steep corrections this year were also perfectly in line with business erosion.

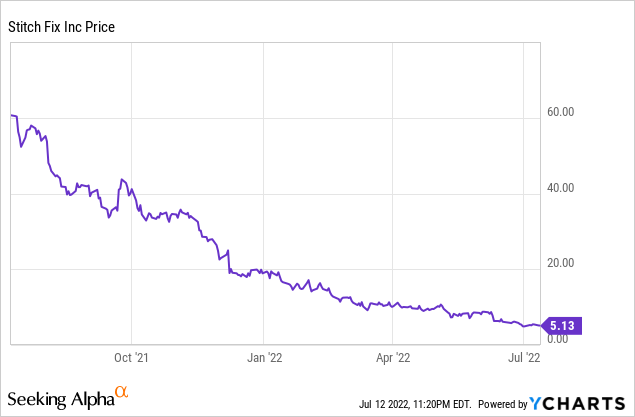

Stitch Fix (NASDAQ:SFIX) is an example of this. The clothing e-commerce company was once a popular fad, but in the waning days of the pandemic and the return of brick-and-mortar retail, Stitch Fix’s popularity among consumers has declined dramatically. Year to date, shares have lost more than 70% of their value – which I think is in keeping with the performance of the business.

I remain quite bearish on Stitch Fix. I think the company is in a very precarious situation – and in particular, I’m concerned about the following factors:

- Is Stitch Fix relevant anymore, or is it just a passing fad? The idea of getting a “Fix” of five items and keeping only what you like was the whole selling point behind Stitch Fix in the first place. But declining active customers seem to be suggesting that people don’t want this complexity in the shopping process. In fact, Stitch Fix introduced its direct-buy “Freestyle” program to mirror classic e-tailers: and in doing so, it lost its niche in the first place. Without much of a powerful brand to draw from, it’s unclear how Stitch Fix plans to remain relevant.

- No clear moat. Stitch Fix’s innovative buying method was part of its appeal versus the dozens of e-commerce clothing competitors out there. With the business doubling down on Freestyle, it’s unclear what Stitch Fix plans to do to hold onto customer loyalty.

- Weighed down by inflationary pressures. Stitch Fix’s gross margins are declining. At the same time, even though the company is letting go of a chunk of its staff, it is also facing corporate wage inflation. The net result is a deep gush of red ink, which is exactly what Wall Street does not want to see in this very cautious stock market.

When it comes to consumer internet businesses, momentum is everything. Consumers catch onto what is “hot” at the moment, and rarely is there ever an opportunity for a company past its popularity point to suddenly become desirable again. It wouldn’t be too far of a stretch to say that Stitch Fix may mirror some of the consumer internet failures of the dotcom era. Especially as more and more clothing brands themselves double down on their e-commerce chops, marketplace-style companies like Stitch Fix will be left competing against brands that have far better direct relationships with their customer bases.

The bottom line here: resist the temptation to buy Stitch Fix on the dip. There is little value to salvage here. Unlike a struggling software business which at least would have some amount of recurring revenue, Stitch Fix makes for quite an unattractive “rescue acquisition” target – it’s weighed down by inventory, it has a fickle customer base, and the nature of its business/its cost structure are much lower in margin. Continue to steer clear here to avoid further losses.

Q3 download

Stitch Fix’s fiscal Q3 results, covering the quarter ending in April, were nothing short of a disaster. Let’s go through some of the highlights here, starting with the top-line metrics:

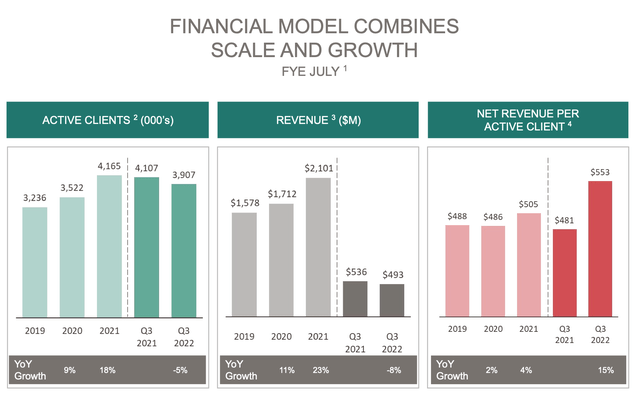

Stitch Fix revenue metrics (Stitch Fix Q3 earnings deck)

Stitch Fix’s revenue declined -8% y/y to $493 million in the quarter, missing Wall Street’s expectations of $494 million. Note that this represents the first shift to a decline for Stitch Fix, which had grown at a 3% y/y pace in Q2.

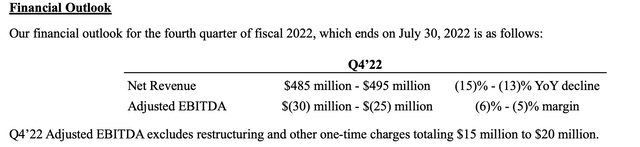

Adding insult to injury: this decline is only going to get worse. In Q4, the company is now forecasting a -13-15% y/y decline:

Stitch Fix Q4 outlook (Stitch Fix Q3 earnings release)

Active customers, too, are peeling off. Sequentially versus Q2, the company lost 112k active customers (which is defined as a person who made a purchase over the past year, which is a fairly loose metric), or roughly 3% of its overall base.

The company’s main strategy to address this issue is to re-examine its user interface. Stitch Fix went on a redesign overhaul in Q3 which has apparently yielded favorable results – though we’ll see if this translates into stabilization of revenue. Per CEO Elizabeth Spaulding’s prepared remarks on the Q3 earnings call:

Given that conversion of new visitors was not where we wanted it to be in the second quarter, we took action to refine the onboarding experience and our landing page. This has resulted in approximately 40% improvement in new client conversion in the third quarter as compared to the second quarter. First, we began directing all stitchfix.com traffic to a simplified Fix first onboarding path. Now, clients entering through stitchfix.com are directed to schedule a fix upon completing a style profile. After scheduling, their Freestyle shop is unlocked.

Second, our landing page experience better clarifies our offering and highlights our key differentiators. We now feature more community-based stylist content, and we enable visitors to interact with Style Shuffle before creating an account. While this is indeed positive progress, we are still not yet at our desired conversion level. In addition, overall new client traffic to our website was down in Q3. As I noted at the outset of the call, both factors, conversion and traffic, ultimately played a role in the 3% decline in our total active client count quarter-over-quarter. We are deeply focused on driving traffic into our ecosystem and reigniting new customer conversion.”

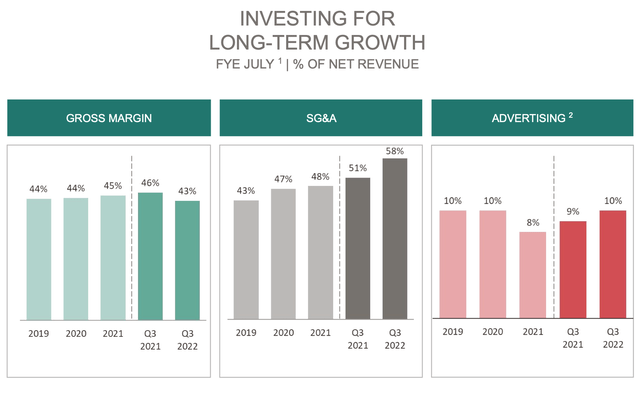

Margins have bled as well. Gross margins lost three points to 43%, driven both by declines in product margins plus increased transportation costs.

Stitch Fix margins (Stitch Fix Q3 earnings deck)

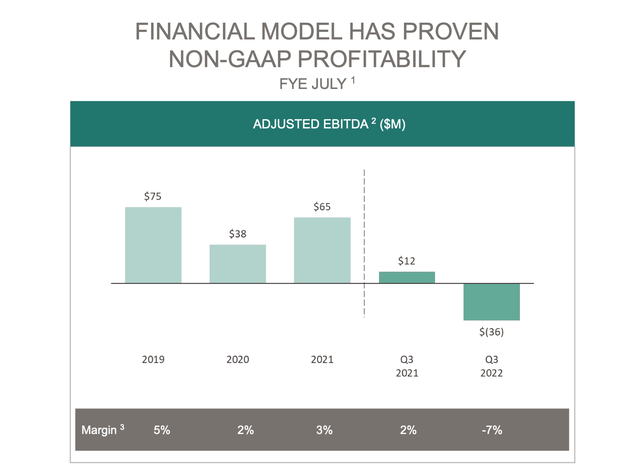

But the company is spending more on opex, as well: with selling, general and administrative costs rising by 7 points as a percentage of revenue, on top of a one-point increase in advertising costs. The company is, however, enacting a series of layoffs and restructurings that should shave $40-60 million off its annual cost base, or roughly 8-12% of annual revenue. Still, in the near term, bottom-line profitability looks quite dire, with adjusted EBITDA losses widening to -$36 million or a -7% adjusted EBITDA margin (versus a $12 million profit in the prior-year Q3, and a $10 million profit in Q2).

Stitch Fix adjusted EBITDA (Stitch Fix Q3 earnings deck)

Key takeaways

Stitch Fix is a painful bag of problems right now. It’s losing relevance with consumers, and it’s juggling rising cost pressures and sinking margins. With all the competition in the retail/e-commerce space and the common knowledge that brands past the peak of their popularity seldom recover, it’s difficult to find reasons to be long on Stitch Fix.

Be the first to comment