Thien Woei Jiing/iStock via Getty Images

Between internal mistakes and online shopping normalization, Stitch Fix (NASDAQ:SFIX) has struggled over the last year. The promotional retail environment hasn’t helped an apparel business focused on full price items and premium services. My investment thesis remains ultra-Bullish on the stock trading with a limited $400 million market cap, as the company works on improving efficiency and turning cash flow positive despite the weak sales forecasts.

Another Tough Quarter

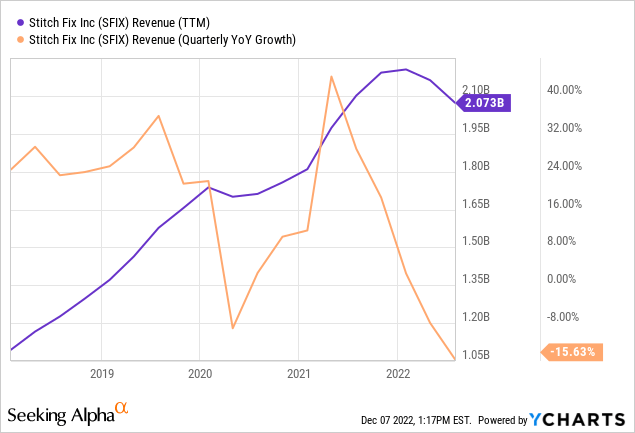

Stitch Fix reported FQ1’23 revenues fell 21.6% to $456 million. The company technically missed analyst targets at closer to $460 million in the quarter, but the revenues actually fell into the guidance range of management following the prior quarter. The online personalized shopping service has now reported 3 straight quarters of declining revenues.

The key to the business has been active clients and the boost during the early part of covid is falling apart now with the weak apparel sector. In FQ1, active clients were 3,709,000 for a decrease of 471,000 over last year. The active clients decreased only slightly from 3,795,000 in the prior quarter.

As with a lot of companies that benefitted from covid boosts, the market is extrapolating far too much with the current results. Stitch Fix only had a $1.7 billion business back in 2019 and sales didn’t top $1.8 billion until 2021.

The stock has slumped below $4 in the process of watching the sales disappear from the covid boost. The market much preferred a business with more consistent 20% growth rates regularly valuing the stock above $20 pre-covid.

The guidance for FY23 sales of $1.6 to $1.7 billion didn’t initially help the stock following earnings. Stitch Fix has rebounded as the market better understands the latest round of cuts comes from more efficiency.

Slashing Advertising

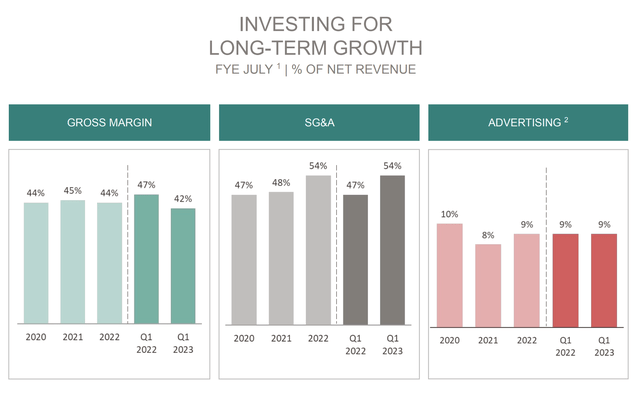

Interestingly, a big part of the story is the advertising budget. Stitch Fix was regularly spending anywhere from $150 to $200 million annually on advertising via channels like broadcast TV and digital performance. The online personal stylist spent 10% of FY20 revenues on advertising and had recently settled at spending rates of ~9% of annual revenues.

Source: Stitch Fix FQ1’23 presentation

Management stated a new goal of stripping out $135 million in costs this year, up from $40 to $60 million, with a prime focus of shifting advertising spending down to 5% to 6% of revenues. A 5% target would place advertising expenses at only $85 million for the year on $1.7 billion in sales.

The key here is that Stitch Fix has always been a growth story with limited focus on producing positive cash flows or profits. The company did produce a $65 million adjusted EBITDA profits in FY21 for a small 3% margin, but the stock valuation was based on sales growth, not profits.

The company guided FY23 adjusted EBITDA to basically break-even, up from a prior guidance of a $13 million loss. The major hope is the shift towards targeted advertising and influencers will produce better advertising efficiency at a far reduced cost.

On the FQ1’23 earnings call, CEO Elizabeth Spaulding made the following comment on new advertising path:

As a business, we have relied on digital performance-based channels and lower funnel spending on client prospects. While these channels did and still prove to be successful, they are now less efficient than they once were. In addition, we have a pool of over 10 million consumers that have already interacted with us, but have not recently or ever made a purchase that we can more directly target to bring back into our ecosystem.

Recent testing showed the cost per acquisition for reengagement of this pool is significantly less than prospective clients who have never interacted with us. Our experience has continued to evolve and we want to reach those clients who already know us and help them rediscover their love for Stitch Fix. In addition, we are continuing to expand our under-penetrated marketing channels, such as affiliates, influencers and SEO SEM, which will take time to develop into meaningful contributors, but will be important over time for new customer acquisitions.

Of course, management has to actually execute on these plans and Stitch Fix has definitely lacked execution since Elizabeth Spaulding took over back in 2021. The timing couldn’t have been worse with the covid issues and the launch of the Freestyle product.

Stitch Fix has a cash balance of $209 million and another $220 million in inventory, bolstering the balance sheet. Any progress to turn the business cash flow positive would have a big boost to the stock with a market cap of only $415 million.

The stock only has an enterprise value of $200 million with a normalized revenue target of $1.65 billion. Stitch Fix now trades at a valuation below department stores in a sign of the cheap valuation, though the management team has to execute.

Takeaway

The key investor takeaway is that Stitch Fix has a difficult path ahead. The company still has to execute on the new advertising plan and prove the business for online personalized stylists is a much larger portion of the targeted retail TAM of $435 billion. The Freestyle product still provides a massive catalyst to expand the market opportunity.

The stock has bounced after cutting sales targets for the year is a positive sign Stitch Fix has finally reached bottom.

Be the first to comment