jetcityimage

The iShares 10-20 Year Treasury Bond ETF (NYSEARCA:TLH) is a longer duration bond ETF that is a cheap way to play the yield curve in the US. Inflation is the key concern for duration speculators, and Powell’s recent speech from Wednesday doesn’t give the markets a whole lot to work with. With CPI rates having momentarily peaked, people are bidding up duration again, but we think the moment might be slightly early still as things on the inflation side could still disappoint markets. Nonetheless, cost factors are receding from the picture, and the savvy investors should keep their eye on duration issues like TLH over the next couple of months.

TLH Breakdown

TLH is just treasury bonds, so for the US investors there’s no FX concerns to have and there are no duration concerns to be had either. Costs for the ETF are also extremely low at only 0.15%, which barely eats into the 3.94% YTM average across the current portfolio.

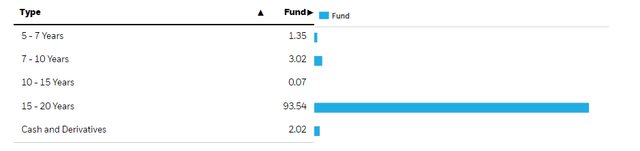

Almost all the bonds have a current duration between 15-20 years. The only ones that don’t are the ones that are closer to maturity. They were likely still issued with long durations. The average modified duration in this portfolio is 13.8 years, which means a lot of sensitivity to changes in YTM.

The current YTM of the portfolio at 3.94% reflects the data on the yield curve which is flat between the 3.5-4% market for maturities up to 30 years. This flat shape of the yield curve is unusual, and the interpretation is that markets believe that a higher baseline rate is coming, and that it lies at about 3.5% for the US. Current rates are almost 5%, and this is expected to be a peal that will revert back to a 3.5% rate for the indefinite future.

Remarks

The question is whether this is actually a reasonable interpretation or not. To some extent there is the recognition that higher rates are coming from structurally higher costs brought on by the economic disintegration with Russia, affecting in particular the energy supply. It is true that these effects will not be overcome. Meanwhile, other cost push factors are receding such as logistic costs, which are coming down substantially when looking at charter rates for example.

Inflation is still running high. Last CPI figures were just below 8%. This could bounce back up to above 8% again and scare markets. Demand is still playing a role in the figures, and the jobs data today could further create volatility if it indicates inflation may still run hot. Then there’s the issue of inflation expectations. The Fed has been clear that this will be key in deciding whether they will continue to hike or not. Expectations must be stomped at the expense of the economy. Factors like rent and food have an impact on expectations more than most sources of inflation, and rent especially is running high. Shorter term interest rates affected by these factors matter less for long duration bonds that are getting discounted more aggressively on future years. Those later PVs are more sensitive to rate changes, and therefore long-term rate expectations matter more. Structural factors will matter more, and if everything goes back to normal except energy, rates won’t have to be that much higher than they used to be to fight inflation. The short term will be affected by demand factors more than the long-term interest rates, which will depend on longer-term inflation and productivity.

Still, while duration might be less affected by shorter term rates, they are still affected by them a fair bit. And the issues in the economy are not easy to deal with and will be extrapolated into the future and punish duration still. We think disappointing CPI results could come, and a more relentless Fed is not being fully priced by markets. The yield curve could see a bit more upward shift. Duration is getting more interesting, but we’re still on the sidelines.

Thanks to our global coverage we’ve ramped up our global macro commentary on our marketplace service here on Seeking Alpha, The Value Lab. We focus on long-only value ideas, where we try to find international mispriced equities and target a portfolio yield of about 4%. We’ve done really well for ourselves over the last 5 years, but it took getting our hands dirty in international markets. If you are a value-investor, serious about protecting your wealth, us at the Value Lab might be of inspiration. Give our no-strings-attached free trial a try to see if it’s for you.

Be the first to comment