smodj/iStock via Getty Images

Investment Thesis

Sterling Infrastructure (NASDAQ:STRL) witnessed strong demand in Q2 FY22, which led to the building of a healthy order backlog, which should benefit the revenue growth in the near term. The company should benefit from the federal infrastructure funding and the positive trends in the non-residential market as demand for building warehouses and data centres remains healthy. The company plans to continue implementing its strategy, which was introduced in 2016 to improve the project mix and profitability and expand into new markets. In the long term, the company’s margins should benefit from this strategy, while in the short term easing supply chain challenges and inflationary pressures should help margins.

STRL Q2 FY Earnings

STRL recently reported its second quarter FY22 financial results, which were better than expected. The net sales in the quarter grew 27% Y/Y to $510.57 mn (vs. the consensus estimate of $479.9 mn). The EPS increased 25% Y/Y to $0.86 (vs. the consensus estimate of $0.74). The net sales growth was a combination of $76 mn or 19% growth from the acquisition of Petillo, and 8% Y/Y organic growth. The gross margin in the quarter declined 60 bps Y/Y to 13.4%, whereas the operating margin declined 10 bps Y/Y to 8%. However, the EPS increased year-over-year supported by solid revenue growth.

An Overview of STRL’s Strategy

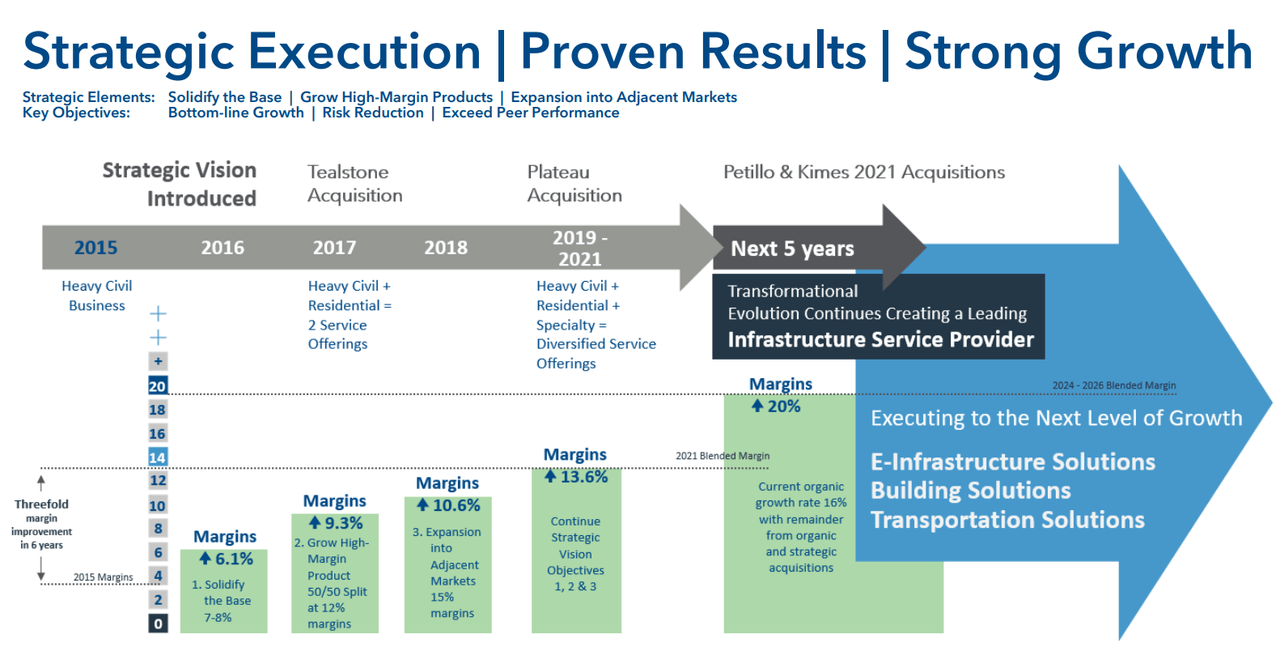

Back in 2016, STRL announced its multi-year business strategy with three elements, namely solidifying the base, growing high-margin products, and expanding into adjacent markets. The objective of this strategy is to reduce the risk exposure, grow the bottom line, exceed peer performance, and build a platform for future accretive growth. The base business of the company is its low-bid heavy highway projects. Under the first element, the company plans to reduce the risk exposure of its business by improving bid discipline to significantly reduce the probability of project losses. Since its implementation, the company has been able to improve the heavy highway backlog gross margin from 4% before 2016 to 9.5% as of December 2021.

STRL Strategic Vision (Company Presentation)

The second element focuses on improving the gross margin of the company by shifting the project mix from low-bid heavy highway projects to alternative delivery projects and other high-margin work such as airports, commercial, piling, and shoring. The company is targeting projects with gross margins in the range of 12% to 15%. The last element of this strategy focuses on expanding into adjacent markets and broadening the execution of different types of projects by acquiring quality companies and assets. STRL has been acquiring companies with a gross margin of 15% or more. The most recent acquisitions include Petillo and Kimes, which were acquired in December 2021.

Revenue Growth Potential

Sterling Infrastructure experienced strong demand for its services in Q2 FY22, which led to a healthy backlog. The total backlog at the end of the quarter was $1.54 bn, up $51 mn compared to that at the end of FY21. The gross margin of this backlog was 12.6%, a 40 bps increase compared to year-end 2021. The margin growth was due to a higher portion of the E-Infrastructure Solutions segment backlog. The unsigned low bid awards at the end of the quarter were $184 mn, leading to a record combined backlog of $1.73 bn, up 14% Y/Y. The gross margin in the combined backlog was 12.5%, compared to 12.2% at the end of FY21. The current quarter’s book-to-bill ratios were 1.06x for backlog and 1.26x for the combined backlog.

The organic growth of $34 mn in the E-Infrastructure Solutions segment over the prior year reflects strong demand for distribution centres and warehouses across the company’s East Coast footprint. Including the acquisition of Petillo, which is reported under the E-Infrastructure Solutions segment, the revenue grew 88.7% Y/Y. The Building Solutions segment grew 15% Y/Y due to the continued residential revenue growth in Dallas Fort Worth market and Houston and Phoenix. The company was able to grow its Phoenix and Houston markets in the quarter as both markets together contributed 18% of the total residential revenue, compared to 6% in the prior year’s same quarter. The Transportation Solutions segment’s revenue declined 6% Y/Y due to lower aviation orders and the company’s strategic intent to decrease low-bid heavy highway work. This decline was partially offset by increased water projects and alternative delivery projects.

The E-Infrastructure Solutions segment is seeing strong demand in e-commerce and data centre activities, whether it be just basic warehousing for work in process goods or finished goods. Traditional retailers are continuing to build out their E-Infrastructure strategies to better compete with Amazon (AMZN), which should benefit the segment’s growth. There are several new manufacturing facilities being built in the U.S. as the Biden Administration continues to encourage companies to reduce their reliance on Chinese manufacturers, and the company is expecting projects to ramp up by the end of FY22 in the Northeast and Southwest regions. Additionally, the company is seeing increased opportunity in the industrial and manufacturing design phase and later stages of the project. These activities, coupled with the current backlog, should support the revenue growth of the company.

The Building Solutions segment saw healthy demand in the second quarter, but the slowdown in the housing industry due to interest rate hikes started to have an effect late in the quarter, which is expected to continue in 2H FY22 as well. The company is anticipating a slowdown in the Dallas market but is expecting the Phoenix and Houston markets to grow. In Dallas, the company has a large market share compared to the Houston and Phoenix markets, and as a result, the company is more vulnerable in Dallas if a slowdown occurs. As the company has a lower market share in Houston and Phoenix, the decrease in the overall market is unlikely to impact the company’s business significantly. The company should be able to work with its existing builders and add incremental revenue even in case of a market slowdown as labour and material availability improve.

In the Transportation Solutions segment, the bid activity in the back half of Q2 FY22 started to pick up and has started to see some benefit from the federal infrastructure bill. The company saw the largest pickup in activity in the Rocky Mountains region, Nevada, and Texas. In Texas, the majority of the bids are low-bid heavy highway projects. In the Rocky Mountains region, the projects are more of alternative delivery types such as design-build or value-added projects. In Nevada, the company has a competitive advantage in material availability and logistics. Given the trends in the end markets for the company and a healthy backlog, the company should be able to grow its revenue in 2H FY22 and beyond. Management has raised its revenue guidance range from $1.825 bn to $1.8875 bn to its new range of $1.865 bn to $1.885 bn. This depicts a 19% Y/Y growth in the revenue in FY22.

Margins

STRL’s margins were impacted due to inflationary pressure and supply chain challenges in Q2 FY22. The biggest challenge the company is facing is procuring concrete due to its shortage in the market and we are seeing similar commentary from the suppliers of aggregates and cement such as Martin Marietta Materials (MLM). This impacts the company’s productivity and, thus, margins. Additionally, the fuel prices on the East Coast in the second quarter were at higher levels and the company was facing availability issues for several weeks, which hampered the margins in the quarter.

The company is expecting the shortage of concrete to affect the third quarter but should improve in Q4 as supply chain constraints improve. This should alleviate the pressure on the margins. This coupled with improving margins in the backlog and the company’s strategy to diversify away from low-bid projects and focusing more on alternative delivery projects with higher margins should help STRL expand margins in the medium to long term.

Valuation & Conclusion

The stock is currently trading at 8.22x FY22 consensus EPS estimate of $3.04 and 7.63x FY23 consensus EPS estimate of $3.28, which is lower than its five-year average forward P/E of 13.37x. The company’s revenue growth should benefit from the healthy backlog and the trends in the infrastructure as well as non-residential markets. The margins should be under pressure in the near term, but as the higher cost of inputs and supply chain constraints ease up, the margins should improve. In the long term, the company should be able to improve its profitability and project mix as it continues to make progress in implementing its strategy. Hence, I believe, STRL is a good buy.

Be the first to comment