jetcityimage/iStock Editorial via Getty Images

Investment thesis

Stellantis N.V. (NYSE:STLA) is currently the most interesting buy I see among the automobile manufacturers that, as a whole, belong to an industry I consider mostly undervalued. There are several reasons I see to support this thesis about Stellantis being cheap and with a lot of upside potential over the next years.

First of all, among its peers, Stellantis has the strongest balance sheet. Secondly, the merger of FCA with Peugeot is unlocking new value, while contributing to huge savings and a stronger scaling power that lead to greater margins. Thirdly, it has been hit by the multiples contraction the whole industry suffered, and it has valuation metrics that are extremely low. Last, but not least, while most of the electric vehicles (“EVs”) revolution focused on Tesla (TSLA), Stellantis got ready to play a major role in the future of the industry.

The Context

The auto industry is considered a very mature one, with established players that were very well known. Then Tesla came; the electric vehicle theme caught all the attention and the whole industry started preparing to be fully electrical by 2030. Suddenly, many major automakers didn’t enjoy the attention that was paid to Tesla to the extent that Tesla came to have a market cap as big as all the other players in the market.

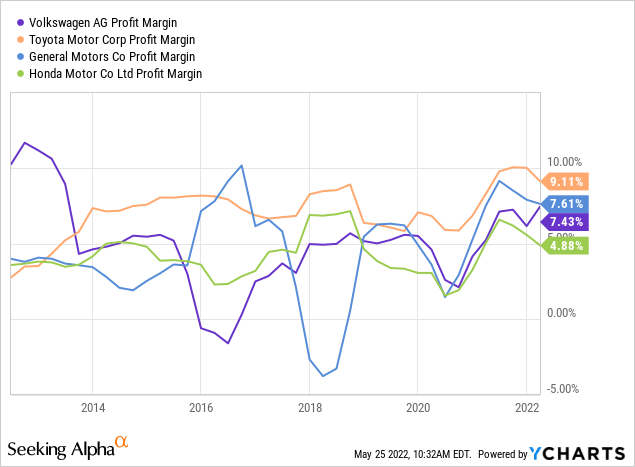

In addition, one of the reasons the auto industry has not attracted many investors is its strong cyclicality. Another one is the low marginality that is linked to tight competition. As the graph below shows, over the last 10 years none of Stellantis main competitors ever achieved a profit margin above 10%, apart from VW (OTCPK:VWAGY) almost ten years ago.

This situation drove the industry to M&As to create big groups that sell 6-8 million vehicles per year in order to have enough scaling and better synergies to sustain low marginalities and tough pricing competition. This is why, just in a few years, Fiat bought Chrysler, becoming FCA, to then merge with PSA (Peugeot) and become one of the top five manufactures by vehicles sold.

Stellantis in the next decade

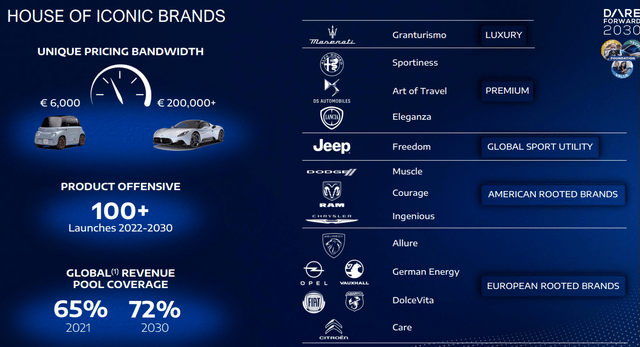

Stellantis is now a group that owns 15 different and well-established brands: Abarth, Alfa Romeo, Chrysler, Citroën, Dodge, DS, Fiat, Fiat Professional, Jeep, Lancia, Opel, Peugeot, Ram, Vauxhall, and Maserati, a premium luxury car brand. In 2021, Stellantis shipped 6.142.000 vehicles. Its revenue reached €152 billion with a net profit of €14 billion, and €6.1 billion of industrial free cash flows. These results were outstanding, both because of the 2020 easy comparables and because of increased profitability.

In fact, Stellantis reported that, although shipments were down 12% due to supply chain constraints, net revenues were up 12%. This result has only one explanation: increased pricing power. The cost of revenue went up only by 8.9%, thus improving further the profitability. At the end of the year, to everyone’s surprise, Stellantis reached an outstanding 11.8% profit margin, which, as we have seen from the graph above, is a number never-heard-of in the past decade for the whole industry.

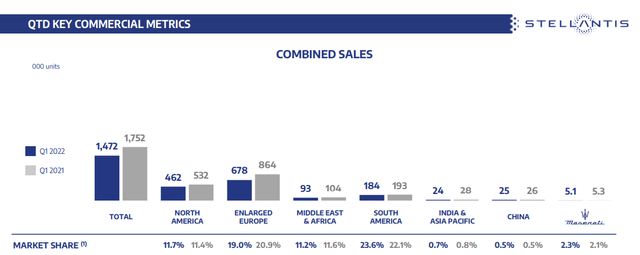

In the most recent quarter, Stellantis reported a strengthening market leadership in South America, it consolidated its position in Europe as the second largest automaker and it kept on holding a significant market share in North America, as shown in the graph below.

Stellantis sale and market shares (Stellantis 1Q 2022 Revenues Presentation)

With a 34% share, Stellantis is also the European market leader in the light commercial vehicles segment.

Given the fact that this industry has very high fixed costs, high volume sales are necessary to keep the marginality up. It’s true, high volumes lead to low prices, but if sales do increase a bit as the supply chain normalizes we should see at least a year of both increasing volumes and high pricing which should create perfect market conditions for Stellantis. This leads me to have high expectations from Stellantis 2022 and 2023 full year results.

Stellantis is committed to transitioning very quickly towards EVs and on March 1st 2022 presented its Dare Forward 2030 long term strategic plan. It announced more than 100 new products from 2022 to 2030 with a clear brand structure to cover all kinds of segments in the car industry, as shown from the slide below. Please notice Stellantis’ price bandwidth and the clear target each brand is linked to.

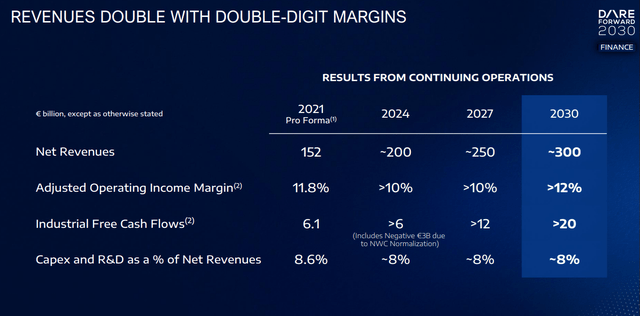

Stellantis expects its net revenues to double by 2030 with a marginality that will stay above 10%, thus consolidating the outstanding results it achieved last year. For sure, Stellantis has on its side, compared to its peers, the tailwinds given from the merger’s synergies that still have to be implemented and that will lead to significant savings.

Just to get an idea of what we are talking about, in 2021, the Company has achieved approximately €3.2 billion of net cash synergies and is planning to reach €5 billion cut in costs. This is a strong basis for a long-lasting high marginality. As the current environment influenced by chip shortages is expected to last at least one more year, Stellantis, alongside with the whole industry, will be able to keep up its newly found pricing power which will enable to keep up the achieved marginality at least for the second half of 2022 and most of 2023. This, too, will help Stellantis keep up with its goal of double-digit margins.

Carlos Tavares, Stellantis CEO, during the 2021 results presentation, stressed this a lot and kept on highlighting how much cash the company is going to save (emphasis added):

€6.1 billion of industrial free cash flow were significantly supported by a very significant level of cash synergies, no less than €3.2 billion, which is aligned with what we have committed to the market, which is the fact that the merger will generate on a run rate €5 billion per year, which represents a €25 billion value creation as the result of this merger.

This is why, when I look at the table below, I see it actually quite conservative from the marginality point of view.

Projected Revenues to 2030 (Stellantis Dare Forward 2030 )

As we can see, industrial free cash flow will keep on being positive and will enable the company to invest, as Tavares said, around 8% to 9% of revenues in CapEx and R&D to execute on the numerous LEV and BEV launches.

Stellantis in the EV space

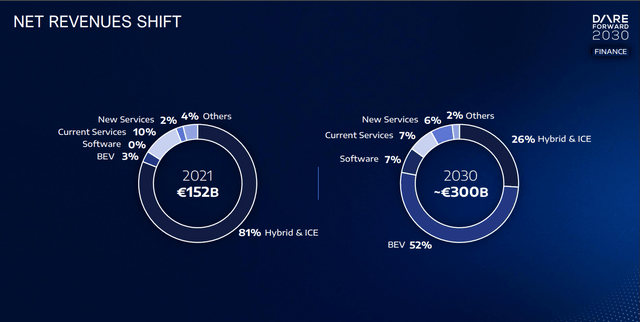

We have to take into account the strong commitment Stellantis has undertaken to become by 2030 a major EV producer, which should turn out to be a higher margin business compared to the traditional automotive industry’s margins. Here is one of the most interesting slides from the Dare Forward 2030 strategic plan, showing how net revenues will shift. We will see the company making more than half of its net revenue from EV while the hybrid and internal combustion engines (ICE) will shrink from providing 81% of net revenue to just 26%. This will bring Stellantis to develop also a software division that will account for another 7% of net revenues, that, if summed up with the EV’s will lead Stellantis to obtaining around 60% of its future net revenue from industrial activities that are starting.

How Stellantis revenues will shift through the EV revolution (Stellantis Dare Forward 2030 Strategic Plan)

Stellantis right now has 19 EVs on sales and will add for the rest of 2022 and 2023 13 more ending up with 32 models on sales in just 18 months. This shows that the company is ready and has been preparing with a correct timing for the EV turnaround.

Management’s commitment to marginality

Marginality is the key of a business. As I read through Tavares calls, I really like how he points out that he is aiming at building teams that follow highly profitable business models. Let’s read how he described the results achieved after one year from the merger:

North America is right now the most profitable region of the company with a record 16.3% AOI margin, which says a lot about the way our North American team is mastering the business model of North America. It’s important that they take the best out of the market conditions, and this is exactly what they have been doing. We can see it that we have been able to deliver the highest U.S. retail average transaction price among the Detroit 3 OEMs, with a significant improvement of 20% year-over-year to reach no less than $47,000 per car, significant result that also highlights the fact that our North American teams are mastering the business model. […]

We have multiplied by 5 the amount of profit that we could extract from the Latin American markets with an AOI margin of 8.3%, which is much, much better than what we could experience in the past.

But Tavares doesn’t only want to talk about good results. He knows that Stellantis owns brands that are not expressing their full potential and that need to be taken care of. In particular, I think what he said about Lancia, an Italian luxury car brand that could really compete with Mercedes and Lexus but that has always been a minor player not very well considered, gives an idea of his commitment to making every part of Stellantis highly profitable:

the Lancia brand that we are now preparing for the rebound, we can say that we’ll be 100% electrified in 2024. And that from 2026, all the launches will be purely BEV. The pricing power is minus 20%. And against the benchmark, which is a way to say that there is a significant potential to improve moving forward, which is great news. And this is exactly what we are going to do and that means that the Lancia brand will represent a significant profit driver for the company moving forward.

The same will apply to Maserati, which, given its brand value, could really become one of the future cash cows of the company.

Financials compared to major peers

It can be incredible to read, but Stellantis is actually an unlevered business. This means that it is not relying on debt to run, as it has more cash on hand that debt. Let’s look at its balance sheet and compare it to its major peers.

| Cash ($ billion) | Debt ($ billion |

Net debt ($ billion) |

|

| Stellantis | 57.36 | 38.33 | -19.03 |

| Volkswagen (OTCPK:VWAGY) | 53.28 | 233.91 | 180.64 |

| General Motors (GM) | 21.76 | 110.95 | 89.20 |

| Toyota (OTCPK:TOYOF) | 50.23 | 217.67 | 167.45 |

| Honda (HMC) | 31.98 | 68.88 | 36.90 |

| Ford (F) | 28.61 | 135.60 | 106.99 |

Every time I look at this data I am surprised and I have to make sure I am reading it right. The competitors are all levered, having a lot more debt than cash. Stellantis has a balance sheet that not only is strong, but leaves the company with a lot of freedom to deploy cash at its will for what it needs to do. If we factor in that the company is free cash flow positive and is thus generating enough cash from its operations to cover all its costs (including investments), we see a company that is clearly in profit mode.

Stellantis’ dividend and buybacks

Now, what is Stellantis going to do with this excess cash? Tavares was clear:

I just want to tell you that we consider that the cash of the company is owned by the shareholders.

Not by chance, Stellantis announced an ordinary dividend of € 3.3 billion, which meant a € 1.05 (about $1.12 when paid) dividend per share that was paid in April 2022 (for now, the dividend is annual). The yield is something unheard-of in the past years of this industry: 7.6%. One would think the payout ratio was too high, but it actually was 25%. This is a safe dividend, with a lot of upside potential sustained by marginality and a strong balance sheet. As we’ve seen above, Stellantis synergy’s savings are more than enough to fully cover the actual dividend and give it room to grow in the next years. This, to me, appears like a very safe dividend because it doesn’t even require Stellantis to grow its EBITDA (which, by the way, I expect to be growing in the future). To own an industrial company and have that kind of a yield doesn’t seem real, if we consider the S&P 500 average dividend yield is just a little above 1%.

Even with this alluring dividend, the company is left with a lot of cash that will opportunistically use for up to 5% share buybacks from this year to 2025. Stellantis will still have cash on hand to keep on investing or to consider interesting acquisitions that may take it to a world leading position in the industry. Cash on hand makes a company strong, even if inflation may eat away part of its value, because it doesn’t force to company to take on new debt at higher rates.

Valuation

All of these considerations lead us to Stellantis’ valuation. One thing may already be noticed to understand that Stellantis is cheap: the dividend yield is so high because the stock price is low.

Now let’s compare the stock price of the major automakers (at the time of writing) with two parameters: cash per share and earnings per share (data taken from Seeking Alpha‘s stock comparison).

| ($) | STLA | HMC | F | GM | VWAGY | TOYOF |

| price | 14.80 | 25.15 | 13.63 | 38.57 | 211.00 | 16.68 |

| cash per share | 18.31 | 18.69 | 7.12 | 14.92 | 106.28 | 3.66 |

| earnings per share (diluted) | 5.13 | 3.38 | 2.87 | 6.02 | 40.06 | 1.69 |

Let’s make these numbers talk to a shareholder. When I buy a share, I own a certain part of the underlying business. What am I owning when I buy Stellantis? Of course, I buy a company that manufacturers vehicles. But what exactly am I owning financially? One of the things to consider is that by paying $14.80, I own $18.31 of the cash. Clearly, these $18.31 are not directly paid to me. But they are indeed working for me as a shareholder. None of Stellantis peers have a cash per share that is more than the stock price. If we subtract to the cash per share the dividend paid of $1.12, we still have $17.19 per share which, in any case, is more than the current stock price.

Furthermore, Stellantis has a eps/share price ratio of 34.6% which means that in about three years, assuming that the EPS will not grow at all (very conservative assumption), I would own enough earnings to repay the initial investment. Here, again, Stellantis beats by a large extent its peers.

There is no other way around it: Stellantis is very cheap and, at the current price, it actually gives the shareholder an ownership to more cash than the price paid.

The all so classic P/E ratio is here even more helpful. The FWD P/E is 3.11. Let’s put into words what this metric means. It tells how many years are needed by the company’s earnings to cover the stock price paid by the investors. Such a low P/E states that investors are currently willing to pay for Stellantis a price that will be covered by the company’s earnings from 2022 to 2025. This is a very short timeframe that investors are pricing in, as if the company were not providing enough guarantees that it will still be around in three years. But, I ask, can we really be so afraid of such an outcome, given the strength of this company? I clearly don’t expect the company to be wiped away and, as I have shown, I really think it will play a major role in the future of the EV industry.

Price to sales is the lowest of the industry, at 0.27. I clearly don’t see, given the healthy sales and margin situation of Stellantis, why the stock is being so discounted by the market.

Not by chance, Seeking Alpha’s Quant rating of the company is best in class, giving Stellantis an A+ valuation grade. I strongly invite everybody to take a look at all the different metrics and consider if the company is not currently a steal.

If Stellantis were to be priced as Ford, that currently has a FWD P/E of 15, the stock price should be 5x today’s, that is $74. If we compare it to GM’s FWD P/E, which is currently a 6, Stellantis would be worth, in any case, at least $29. Tesla currently has a P/E of 102, but it will not be the only player of the industry. Between a PE of 102 that the current EV market leader has and a P/E of 3 that is given to Stellantis by the market there is such a spread that will sooner or later be reduced, surely raising Stellantis’ price.

If Stellantis’ balance sheet will not deteriorate, I expect a multiple expansion that should bring the stock price at least at 1.7x its cash per share, making Stellantis worth around $30, which I still consider a very conservative valuation. In the best-case scenario, with Stellantis keeping high its marginality and cutting down costs, I would see the stock at least at a 10 PE, which gives us from today’s price an upside of around 321%.

Conclusion

Strong balance sheet, healthy impact of newly found synergies, high marginality and a good management are all factors that make me see a bright future ahead of this company. Every time I look at it I find myself believing more and more that it is so cheap for no reason and that investors who dive into it and hold if for the next few years will see in their portfolios a multibagger.

Be the first to comment