Stockbyte/Retrofile RF via Getty Images

Thesis

The last couple of years has been unprecedented in the markets due to the COVID-19 pandemic. We’ve seen pandemic winners and losers, and as the pandemic has come to a close, some winners have given back those gains, and some of the losers have rebounded. One pandemic loser is Steelcase Inc (NYSE:SCS), which sells office furniture to companies, governments, schools, and hospitals. The pandemic sparked a shift from office work to remote work, negatively affecting the demand for office furniture and decimating SCS stock price. Now that the pandemic lockdowns are over, many companies are returning to the office. Though SCS is a resilient company, I don’t believe SCS stock will ever rebound to pre-pandemic levels as it navigates this new relationship between office spaces and the companies that work there.

Company Profile

SCS is a furniture company that manufactures office furniture, including desks, benches, storage, seating, textiles, surface materials, work tools, and architecture for offices, hospitals, schools, and residential spaces. SCS employs over 11,000 employees and is headquartered in Grand Rapids, MI. The company is a global player with 800 Steelcase dealer locations in 17 countries and 15 manufacturing locations, including 8 outside North America. SCS has three reportable segments, including the Americas, EMEA, and other categories. The vast majority of SCS’ revenues come from its Americas segment, which reported revenues of $651 million last quarter. At the same time, it’s EMEA segment reported $137 million, and its other category reported $73 million in revenues.

One thing about SCS that you may not know is just how old the company is. SCS is 110 years old. The company was founded in 1912, and back then, the company went by a different name, The Metal Office Furniture Co. It was in 1921 that the company officially changed its name to Steelcase as a part of an advertising campaign to promote its metal furniture over wood furniture, which was most popular back then. If you look at old photos of offices or even watch reruns of the famous TV show Madmen, you can see how much workspaces have changed over the years, but SCS has consistently remained a leader in the office furniture industry. Of course, the world has changed a lot since then, and so has Steelcase. Today, SCS has a family of brands that include Steelcase, Coalesse, AMQ, Smith System, Orangebox, Viccarbe, and Halcon. Steelcase has been innovating for decades and is mainly responsible for the look and feel of modern-day office space. Still, SCS faces a new challenge today as many employees and employers have transitioned to hybrid and remote work. SCS believes the office will continue to be very relevant for innovation, culture, and collaboration but whether or not it can execute this vision remains to be seen.

What’s The Story

SCS is a very old company but not a large one. With a market cap of just under $1 billion, SCS is a small-cap company. However, SCS used to be a lot larger. Before the pandemic, SCS was trading at a high $23.02 per share, but SCS was not a pandemic winner. As a result, the share price cratered and has yet to recover, reaching a 10-year low of $6.52 in September. This 71% drop from its peak has been a horrifying experience for shareholders, and though the stock market is known for overreaction, this price drop may be justified.

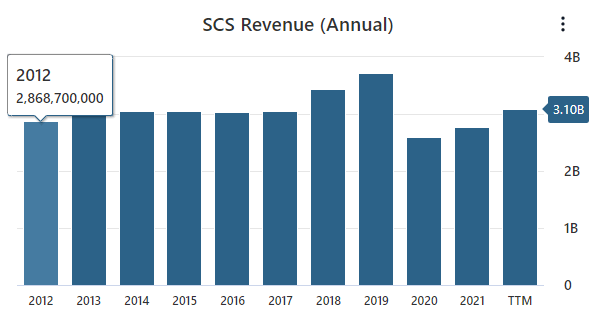

The pandemic has undoubtedly been disruptive to SCS’ business, but even before the pandemic, growth had been stagnant. In 2012, SCS made $2.82 billion in revenue, and right before the pandemic in 2019, SCS had $3.72 billion, just a 31% gain in seven years. Revenue dropped significantly when the pandemic hit but has rebounded slightly since, with $3.09 billion over the last 12 months. When I look for potential investments, I want to see a company double its revenues over the past decade. Of course, having a track record for growth doesn’t guarantee future growth by any means, but it’s difficult for me to predict future growth when the company hasn’t been growing at all. Therefore, this level of revenue growth for SCS over the past decade is a red flag for me.

SCS Data by Stock Analysis

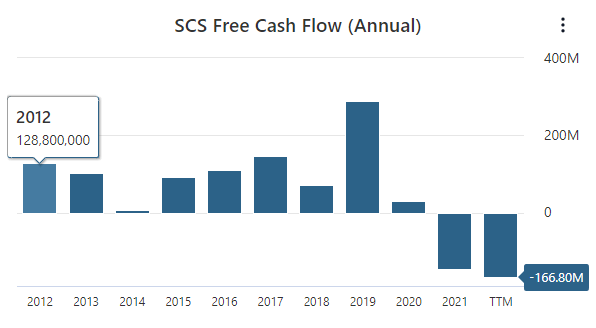

SCS’ top line has been hit hard by the pandemic, and it’s not surprising that SCS’ free cash flow has also been hit hard. Unfortunately for SCS, we have yet to see the free cash flow rebound as its revenue has. Over the last 12 months, SCS has recorded a negative free cash flow of -$166 million. Knowing that the more free cash flow a company has, the more it can allocate to pay dividends, repurchase shares, pay down debt, or invest in growth opportunities, having negative free cash flow is another red flag for me.

SCS Data by Stock Analysis

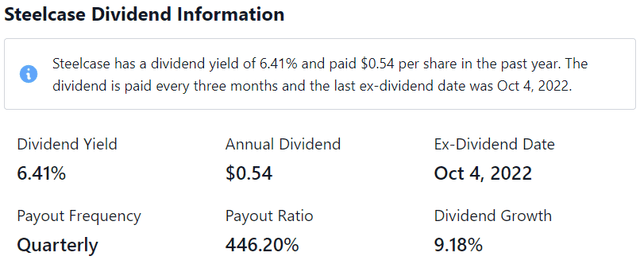

One thing about a 110-year-old company that investors may expect is a good dividend, and SCS pays its shareholders a dividend. SCS had been steadily increasing its dividend until the pandemic, but at least it never cut its dividend completely. Over the past 12 months, SCS has paid out $0.54 per share, making an excellent dividend yield of 6.41%. Unfortunately, SCS’ dividend yield is probably too good to be true since the payout ratio is 446%. A high payout ratio leads me to believe that either the company’s net income is set to grow significantly, or a dividend cut is coming. With analysts currently estimating 2023 EPS of $0.46, or $0.10 less than its current dividend, the latter is a more likely outcome.

In addition to shrinking revenue, free cash flow, and dividend, SCS has also seen its return on equity drop. SCS had an ROE of 21.90% before the pandemic, which has dropped to just 1.90% over the past 12 months. The same goes for SCS’ operating margins which were 6.9% before the pandemic, down to 1.10% over the last 12 months. The pandemic has disrupted SCS’ business, but what’s done is done, and investing is a forward-looking game. The covid lockdowns are over, and companies have been returning to the office, which is a tail wind for SCS moving forward. However, working remotely is part of the new post-pandemic world because some businesses may never return to the office which means they no longer need SCS’ products. Therefore, I see the revenue, free cash flow, and dividend numbers that SCS posted back in 2019 as the absolute ceiling for SCS, and since SCS wasn’t even growing that much before the pandemic, SCS may never surpass what it was able to do in 2019. With that being said, the 71% share price drop from SCS’ peak may still be an overreaction by the market, making SCS stock a buy at current prices.

Valuation

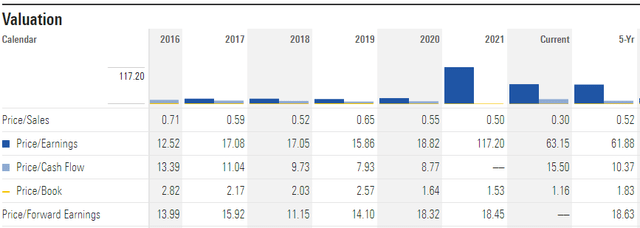

When I estimate a stock’s intrinsic value, I like to run a comparative analysis based on the stock’s 5-year average P/E ratio multiplied by its next year’s consensus EPS estimates. It’s best to use multiple valuation methods to find a stock’s intrinsic value, so I also like to run a discounted cash flow analysis. When I do the comparative analysis, I look at a few different scenarios, including a bull case, a bear case, and a base case based on the stock’s high, low, and average P/E ratio over the past five years. Unfortunately, since the pandemic has affected SCS so much, this comparative analysis will not be helpful. For example, you can see that in 2021, SCS had an unusually high P/E ratio of 117.20. This high multiple wasn’t because the market got overly excited about SCS; instead, it was caused by SCS’ earnings falling so drastically. This ruins the bull, base, and bear case approach based on 5-year high, low, and average P/E ratios. The best comparative analysis I can do is to take the SCS pre-pandemic P/E ratio of 15.86 and apply it to its 2023 EPS estimate of $0.46, which would give us an intrinsic value of $7.29. Since this intrinsic value is less than SCS’s current share price, I don’t see SCS as an excellent investment opportunity, at least using this valuation method.

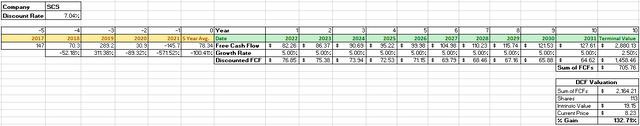

Turning to the DCF analysis, we’ll start by taking the average of SCS’s last five years of free cash flow, which is $78.3 million. I don’t see SCS as a fast-growing company over the next decade, so we’ll use a modest 5% growth rate for the next ten years. Then to figure out the terminal value, we will use a growth rate of 2.5% into perpetuity. Finally, we will use a discount rate of 7.04%, based on a weighted average cost of capital calculation. The sum of all future free cash flows is $2.16 billion, divided by the 113 million shares outstanding, and we land at an intrinsic value of $19.15 per share for SCS. This valuation would give investors a 132.71% gain from the current share price, which is a much better return than what we saw from the comparative analysis.

Summary

As you can see, both valuation methods give us wildly different intrinsic values. Neither scenario is out of the realm of possibility. SCS was trading higher than the bullish intrinsic value of $19.15 before the pandemic. We’ve also seen SCS recently trade lower than the bearish intrinsic value of $7.29. One thing that I don’t take lightly about SCS is that it is a 110-year-old company. It has undoubtedly endured many challenges during its history. However, I am still bearish on SCS, and I believe the pandemic has negatively affected its business for good. Even though many companies are returning back to the office, I think the number of workers working from the office will never return to pre-pandemic levels making many companies question if they really need new office furniture altogether. That, combined with the fact that SCS struggled to find growth before the pandemic, turns me off to this investment. If you disagree with me, please let me know your point of view in the comments section below.

Thank you for reading!

Be the first to comment