imaginima/E+ via Getty Images

Intro

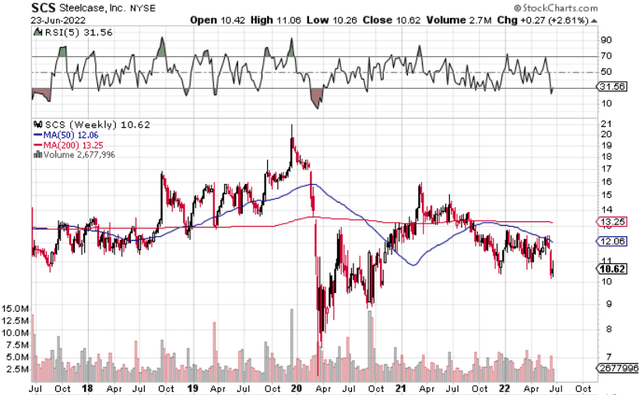

We wrote about Steelcase Inc. (NYSE:SCS) back in mid-2020 after the stock got absolutely decimated due to pandemic-induced lockdowns. The exodus from the office environment and demand shock resulted in a significant restructuring of the company which entailed a meaningful reduction of the firm’s headcount. Although shares managed to rally above $16 a share by March 2021, lower lows have been the order of the day over the past 15 months or so. Shares currently sit at $10.75.

Steelcase Technical Chart (StockCharts.com)

Q1 Tailwinds

Although shares remain trading well below their 200-day moving average ($11.86), there were encouraging signs in the company’s recent better-than-expected first-quarter earnings numbers which lead us to believe that a sustained rally may be on the cards here. Although posting a slight loss, the -$0.05 bottom-line number was a significant improvement over what consensus (-$0.18) was expecting. Furthermore, internal trends within the various facets of Steelcase point to sustained growth going forward where the speed of which will be largely influenced by how fast internal teams can overcome the sky-high inflation which continues to plague the industry.

Steelcase’s order book continues to grow, and 2023 guidance remains on track. The company’s EMEA and Americas segments were very strong and China should now get a lift from the loosening of Covid-related restrictions in that market. The Halcon acquisition will certainly add value on the design side for Steelcase in what is becoming a hybrid future, and the AMQ business as well as Education continue to gain traction.

Suffice it to say, based on the bullish trends which Steelcase has throughout its organization, the company’s present valuation looks cheap from a variety of angles. Valuing a firm can be tricky, especially in a high inflation environment where price-to-sales ratios for example appear more attractive than usual due to inflation. However, when one looks at forward-looking trends in Steelcase’s assets and cash flow, for example, it becomes apparent that shares look cheap and should rally from present levels.

Price To Book Ratio

Steelcase’s trailing book multiple comes in at 1.46 whereas its forward counterpart comes in at 1.37. The company’s five-year average book multiple comes in at 1.89. Inventories rose to $372 million in the first quarter due to increasing sales of Smith System which are expected to come down the track and also to protect against potential supply chain shocks later on in the fiscal year. Suffice it to say, given how Steelcase’s sales, came in ahead well ahead of expectations in the first quarter and the fact that sales are expected to grow by well over 20% in the second quarter, the company’s assets look particularly cheap at present. Why? Because assets are essentially what causes sales growth to take place. They are roots that bear the tree which means this metric should see a reversion upward towards its long-term mean in due course.

Price To Cash Flow

Steelcase’s forward price to cash-flow ratio comes in at 7.46 whereas the company’s 5-year average is 10.26. Although management recently announced a further price increase as well as a surcharge in the Americas to offset the company’s higher costs on the front-end, management also will curb spending to ensure only focused investment takes place in critical areas. This is good news for dividend-based investors as a lower cash-flow multiple essentially protects cash as well as the company’s assets in general. Suffice it to say, based on the growth of the company’s order book and the higher expected operating cash flow in fiscal 2023, we see the present 5%+ dividend garnering renewed interest, especially among value investors at this juncture.

Conclusion

Value plays are all about buying growing companies that have attractive valuations and manageable debt. Furthermore, the 5%+ dividend yield is a strong calling card for Steelcase at present given the search for yield among investors has rarely been as important. Steelcase will bounce back strongly this year but yet its sales and assets in particular trail historic averages. This, we believe, will not be the case for long. We look forward to continued coverage.

Be the first to comment