sdlgzps/E+ via Getty Images

Thesis

Steel Dynamics, Inc. was a successful company even before inflated steel prices. As steel prices relax, and revenue and margin numbers slow down, STLD still exhibits many indicators of a “Buy” at the current price for investors holding for ten years.

Business and Industry Outlook

Steel Dynamics, Inc. (NASDAQ:STLD) is a large steel producer and metal recycler. Their revenue streams comprise of manufacturing steel products, processing of recycled metals, and fabrication of steel joists and deck products. From an industry standpoint, we are seeing a cooldown in steel prices, with futures dropping around 40% (YTD) and current prices remaining stable into 2023. This will drastically reduce revenue and margins of STLD in the upcoming years. From a growth perspective, we can expect around a 3.3% CAGR to 2025. Overall, STLD is in a slow-growth, but essential, industry.

Financials and Risks

STLD had amazing revenue growth in 2021 due to inflated prices of steel, and thus should not be taken into the norm. Prior to 2021, they still showed overall revenue growth, on average 3% a year from 2012 to 2020. Growth on free cash flow was on average 26% YoY and Net income 30% YoY from 2012 to 2020. STLD was a money-making machine without the help from inflated prices.

They also have consistently raised their dividends over the past ten years and repurchased on average 1% of shares YoY. They have also slightly beat earnings each of the last four quarters. From a competitive standpoint, they are highly rated on valuation, profitability, momentum, and peer scorecards.

One downside, and possibly their biggest risk, is growth among peers and competition. Failing CapEx growth grade is being counteracted through new investments. So long as they continue their historical tradition of successful return on total capital, their new investments should help this lackluster growth grade. STLD is a solid company now, and they were even before inflated steel prices.

Valuation

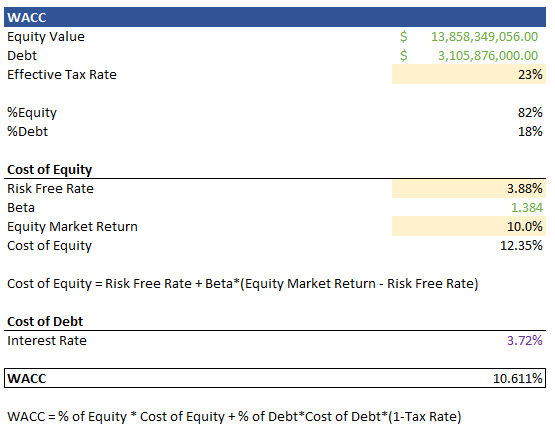

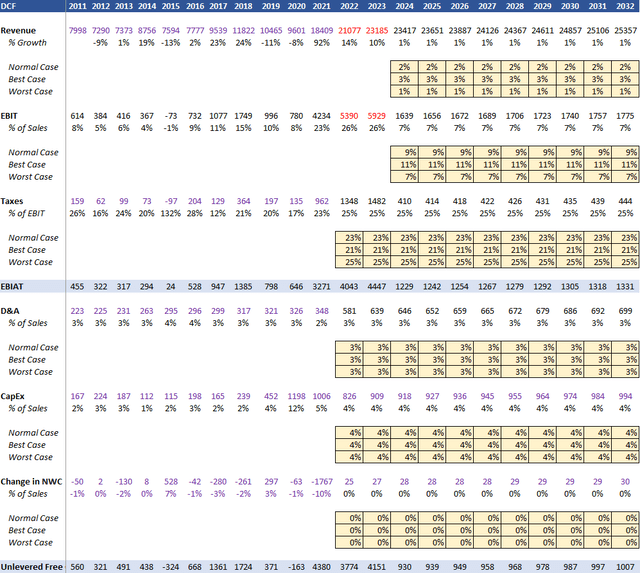

A fair value of $94 per share was calculated by a 10-year Unlevered Discounted Cash Flow (“DCF”) analysis using CAPM with a 2.5% terminal growth rate (“TGR”) and a 10.61% weighted average cost of capital (“WACC”) discount. A worst case, best case, and normal case scenario were averaged to arrive at the fair value. Revenue and EBIT projections were used from average results of (19) analysts for 2022 and (12) analysts for 2023 from Financial Modeling Prep (Red Text). Personal projections were used thereafter, with the following conservative assumptions in the tan boxes:

After projection assumptions were input, free cash flow was projected out and discounted by a WACC value of 10.61%. Assumptions to arrive at this WACC value are in the tan boxes:

WACC Assumptions (Author)

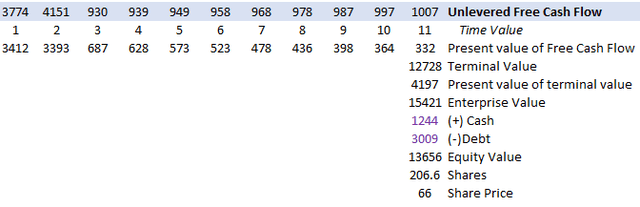

Once the discounted values were found, they were added up along with the present value of terminal value to find the enterprise value. Cash was added and debt was subtracted from this value to find our equity value. Our share price is this equity value divided by the number of shares outstanding. For more information on the calculations and steps taken, I have attached a reference sheet (Mitchells_Reference_Sheet.pdf).

Fair Value Calculations (Author)

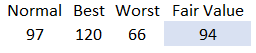

This was repeated for each case and values were input and averaged in the table below to find our final fair value of $94, indicating a “Buy” at the current price:

Fair Value (Author)

Conclusion

Even after taking in low growth and the relaxation of steel prices, STLD still seems undervalued through DCF. They are doing many things to reward the investor, such as growing their dividend and repurchasing shares. They have excellent financials over the last ten years, with the only gripe being a lackluster growth grade. They are combatting this growth through CapEx investments with the pile of cash obtained in 2021. Steel prices eventually will drop, and so will STLD’s revenue and margin. However, for investors holding over ten years, STLD is “Buy” at the current price.

Be the first to comment