AlSimonov/iStock via Getty Images

The United States economy appears to be in pretty great shape.

Yes, the rate of growth in real GDP for the second quarter of 2022 came in negative, the second down quarter in a row.

The United States is in recession.

Yet, inflation is at near-term highs and the Federal Reserve is going after these price increases with a tightened monetary policy.

But, this is not all the evidence.

Let’s look at some other figures.

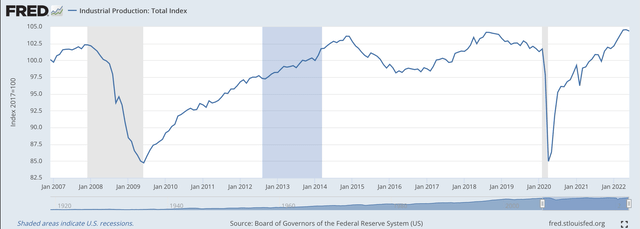

First, industrial production in the United States is at an all-time high.

Industrial production (Federal Reserve)

In June 2022, industrial production was 104.3648.

Just before the start of the Great Recession, just about 15 years ago, industrial production peaked at 102.3185.

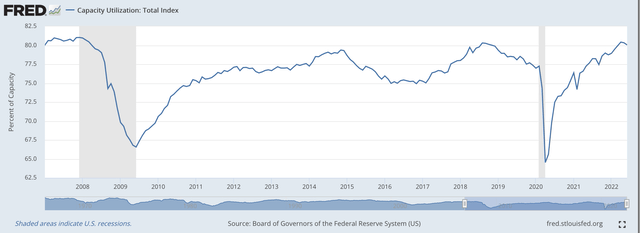

What about capacity utilization?

Again, we have to go back before the Great Recession to get a comparable figure.

Just before the start of the Great Recession, capacity utilization stood at 81.0160.

In April of 2022, capacity utilization was up to 80.4220, lower than at the earlier date just mentioned, but higher than either of the peak levels that were achieved between these two dates.

Capacity Utilization (Federal Reserve)

Again, the statistic, like industrial production, is at or near the highs achieved over the past 15 years or so.

So, we have looked at how the capital stock is being used.

What about the labor supply?

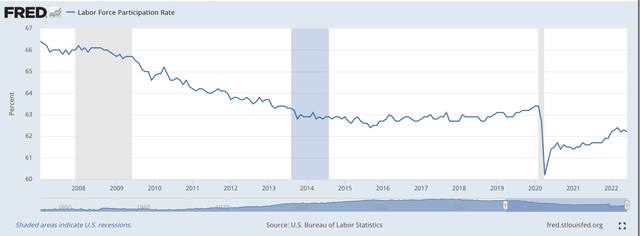

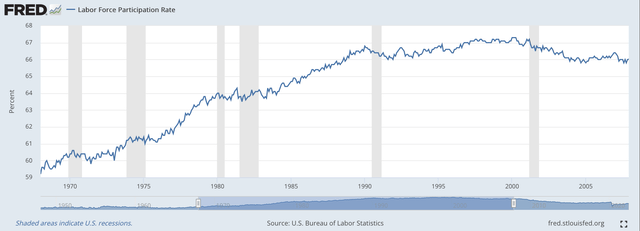

Here we find a major difference. The labor force participation rate has dropped way off.

Labor Force Participation Rate (Federal Reserve)

In June of 2022, the labor force participation rate was only 62.2 percent!

Fifteen years ago, right before the Great Recession started, the labor force participation rate was around 66.0 percent.

Quite a decline.

The lower unemployment rate resulted from a declining labor force participation rate.

And, there was a major drop in the labor force participation rate following the appearance of the Covid-19 pandemic.

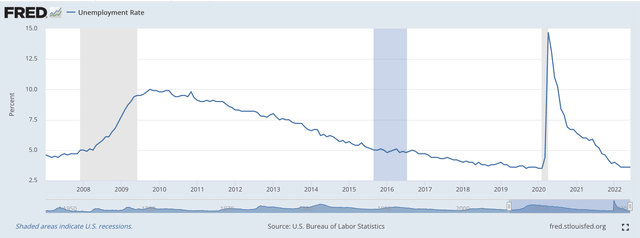

And, the unemployment rate?

Well, this is something everyone is cheering for. The unemployment rate in the U.S. is 3.6 percent.

One has to go back to 1968 to find such a low figure for unemployment.

Here is the chart for the unemployment rate, only going back before the Great Recession.

Unemployment Rate (Federal Reserve)

Note that over the time period covered as the unemployment rate fell, the labor force participation rate fell.

Historical Perspective

I would like to introduce one other element in this picture to help put things into context.

Here is a chart showing the movement of labor force productivity before the Great Recession.

Labor Force Productivity: Earlier Years (Federal Reserve)

Notice that the labor force participation rate began moving up rapidly in the late 1960s and into the 1980s and 1990s.

This was the time when many women, who were not counted as a part of the labor force, joined the labor force, and participated in the workforce outside the family home.

This movement was significant.

Looking at the earlier chart on labor force participation, we see that starting in the early 2000s, the labor force participation rate began to decline, leading us up to where we are today.

What should we make of this?

Well, there appear to be several movements in the composition of the labor market in recent years.

Furthermore, it appears as if there has been a significant movement in the labor market since the appearance of the Covid-19 pandemic.

In effect, what these data seem to show is that the physical capital in the United States is being used, and being used at a historically high capacity.

What about the labor force?

Well, it seems as if there have been some major changes taking place.

Many people have, seemingly, left the labor force.

Should we be so cheerful about the 3.6 percent unemployment rate?

What about the people that are not seeking jobs right now?

What is the narrative behind this situation?

Is this something the government should be very worried about?

The Future

This type of situation is something we should be very cognizant of.

Because of the pandemic, because of the supply chain problems, because of the war in Ukraine, because of the changes in technology, because of government policy, both fiscal and monetary, and because of a lot of other things, the world is in substantial disequilibrium.

Almost everything seems out of place.

Working out these conditions of disequilibrium is what we are facing now.

And, this world of disequilibrium is a place of radical uncertainty.

We don’t know what the future is going to look like. Yet, we need to function, need to operate, need to create policies, and need to work hard at finding solutions to these dislocated opportunities.

But, we are at historical highs when it comes to industrial production. And, we are at highs when it comes to capacity utilization.

We look like we are near historical lows when it comes to unemployment.

Yet, we are way out-of-equilibrium.

And, inflation is a serious problem.

This is what we…and the policymakers…have to work out.

It is not going to be easy, and, I believe, that there will be a lot of pain experienced in this evolving world.

Be the first to comment