Viktor_Gladkov

Stocks are not for everyone, especially those who can’t stomach volatility as we’ve been seeing over the past weeks and months. For those investors, maybe physical real estate or bank CDs are a better idea.

To quote the baseball legend Yogi Berra, “the stock market is the only place where people don’t want to buy when things go on sale.”

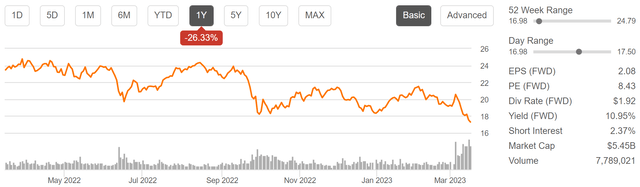

Such may be the case with Starwood Property Trust (NYSE:STWD), which as shown below, is now trading at just about its 52-week low, with an 11% dividend yield. Let’s explore why the market sentiment may be too negative on the stock, presenting an excellent opportunity for income investors.

(Note: Dividend yield as of 3/16 market close is 11.1%)

Why STWD?

Starwood Property Trust was founded over three decades ago, and is led by its long-time CEO and Chairman, Barry Sternlicht, who has been in the real estate business for most of his career. Since its founding, STWD has deployed $94 billion in capital and, at currently manages a portfolio of $28 billion across debt and equity investments.

STWD differentiates itself from peers like Blackstone Mortgage Trust (BXMT) with its multi-cylinder model of doing commercial and infrastructure loans, and owning physical real estate. This diversified model gives STWD a distinct advantage, as it’s able to tap into multiple sources of income and opportunistically allocate capital towards the ups and downs of each segment.

Notably, STWD saw robust capital deployment last year, with $10.7 billion in new investments across all business lines, including $1.2 billion during Q4 alone. This contributed to STWD now having a record total asset base of $28.3 billion at year-end. Importantly, STWD isn’t growing just for growth’s sake, as it was able to grow undepreciated book value YoY by $0.96 to $21.70.

Meanwhile, STWD’s commercial lending portfolio appears to be conservatively managed, with a weighted average loan-to-value ratio of 60%, implying that borrowers have significant equity stake in the game.

The commercial portfolio has the relatively safe multifamily segment as its biggest property collateral, at 33% of portfolio value, followed by office (23%), and hotels (16%). Moreover, STWD’s weighted average risk rating remains unchanged on a sequential basis at 2.6 (on a scale from 1 to 5, with 1 being the lowest risk).

Encouragingly, STWD’s property segment is performing well, with unrealized fair value increase of $68 million during Q4 and $555 million for the full year 2022. This was quite impressive considering the pressure that higher interest rates have had on property values in general last year. STWD also saw a 10.6% increase in effective rents in its Master Lease portfolio, resulting in $2.8 million higher rental income annually.

Admittedly, risk is currently elevated considering recent headlines around macroeconomic risks. It was also reported this month that delinquencies on commercial real estate loans at U.S. banks increased during Q4, with loans overdue for 30 days and those in nonaccrual status accounting for 0.65% of CRE loans as of end of Q4, compared to the 0.58% delinquency rate at the end of Q3. While this number remains low, it’s still worth monitoring and tracking.

Management appears to be in tune with potential for economic headwinds, as it increased CECL (current expected credit loss) reserve by $27 million to a balance of $94 million, or just over 0.5% of its commercial loan portfolio. Also, STWD is proactively shifting to multifamily and industrial loans, as they represent 39% of portfolio total, which is nearly 3x that of the pre-2020 level.

Plus, STWD carries a relatively strong balance sheet for a commercial mortgage REIT with a debt to undepreciated equity ratio of 2.5x and has $1.1 billion in liquidity. Unlike SVB Financial Group (SIVB), which got into hot water with long-duration Treasury Bonds purchased at lower interest rates, 99% and 97% of STWD’s commercial and infrastructure lending portfolios are floating rate.

Lastly, STWD now appears to be solidly in value territory at the current price of $17.29 with a price to undepreciated book value of 80%. It also yields a hefty 11% and the $0.48 quarterly dividend rate is covered by $0.50 in distributable EPS last quarter. Analysts have a consensus Buy rating on STWD with an average price target of $23, translating to potentially very strong total returns over the next 12 months.

Investor Takeaway

STWD is a well-diversified commercial mortgage REIT with robust capital deployments and conservatively managed portfolios. Management has proactively shifted its portfolio to more defensive property types and the owned property portfolio has seen appreciation in a rising rate environment. STWD is also preparing for potential challenges by upping its CECL reserve. Lastly, it appears that headwinds are already priced into the stock, providing value investors with a compelling discount and dividend yield.

Be the first to comment