Scott Olson

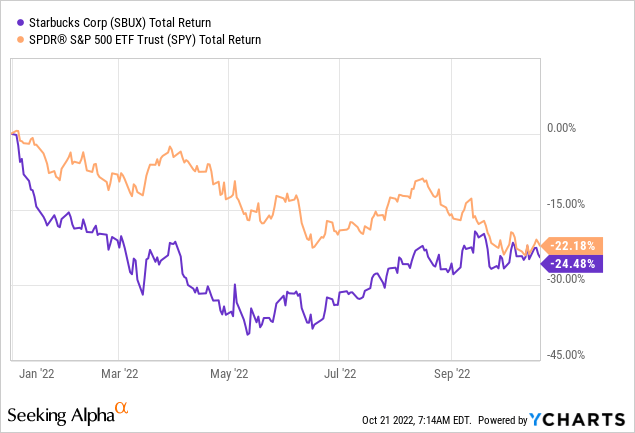

Starbucks (NASDAQ:SBUX) has not experienced the easiest of times as it needed to cope with rising input costs and geopolitical risk. However, we’ve spotted a turning point and believe the company’s fortunes could change soon. In addition, we picked up a few market-based indicators that suggest Starbucks stock could be set for a bullish reversion.

Pivoting Input Costs

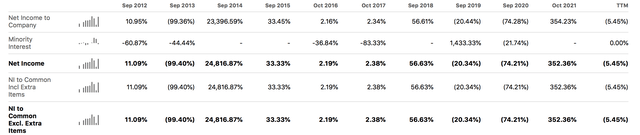

Much of Starbucks’ recent tailwinds pertain to rising input costs. Recently, the company has struggled with rising commodity prices and surging wage demands. To provide some context, the company’s latest earnings report indicates that its net income receded by 5.5% (year-over-year).

Despite its recent cost struggles, the tide seems to be turning for Starbucks. The company’s revenue has resumed its upward trajectory (covered later); however, input costs seem to be reverting.

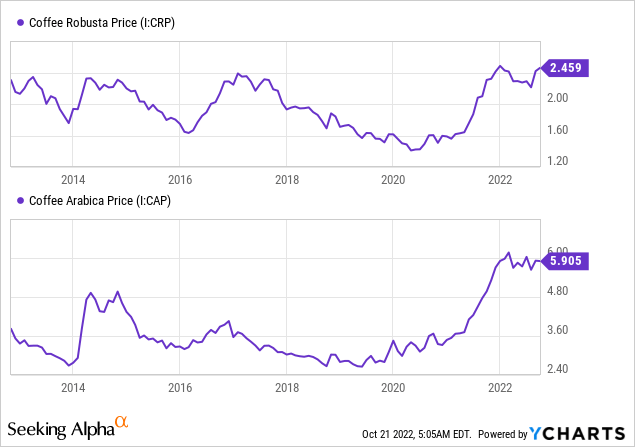

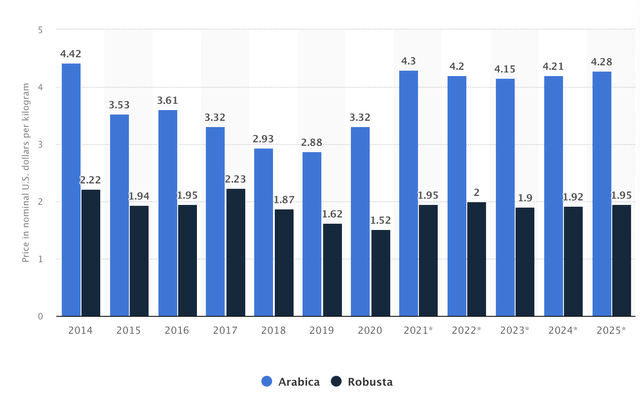

The cost of both Robusta and Arabica coffee beans has pivoted lately amid supply/demand corrections. In addition, data suggest that the long-term growth rate of coffee bean prices could enter a downward trajectory, potentially benefitting Starbucks.

Statista

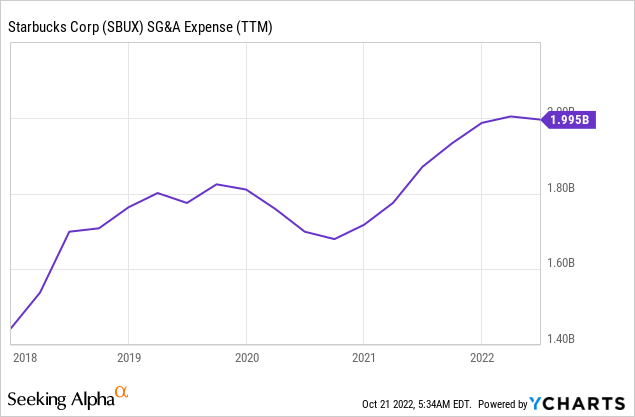

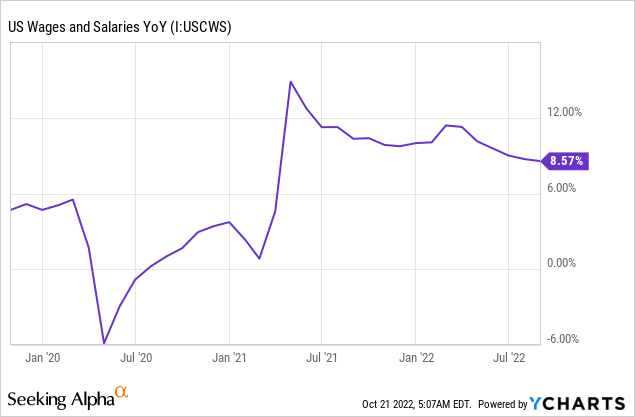

Furthermore, U.S. wages and Starbucks’ SG&A costs have started tapering, suggesting tightness in the labor market might be waning, which could benefit Starbucks’ income statement.

Brand Identity

Customer Loyalty

Although the company has recently faced significant headwinds from China-related issues, Starbucks’ third-quarter earnings report revealed a 9% year-over-year increase in U.S.-based same-store sales amid rising demand for cold beverages and snacks. In our opinion, this indicates that Starbucks possesses customer loyalty as there are no clear signs that the company’s consumer base is opting for substitute products.

Furthermore, the firm’s organic compound annual growth rates reveal Starbucks’ market stronghold. Starbucks owns approximately 36% to 37% of the coffee shop market in the United States and possesses a global footprint, allowing it to exert pricing power.

| Y/Y CAGR | 17.94% |

| 3-Y CAGR | 7.06% |

| 5-Y CAGR | 7.38% |

| 10-CAGR | 9.45% |

Source: Seeking Alpha

Starbucks sells beverages that you could essentially make at home at the cost of a button. Yet, we choose to buy Starbucks instead. We believe Starbucks’ brilliant branding strategy is why people would spend a premium on its products, thus providing the company with pricing power.

Growth Plan

Starbucks CEO, Howard Schultz recently unveiled Starbucks’ updated growth plan. According to Schultz, Starbucks is set to invest aggressively with a targeted 40% increase in revenue three years from now.

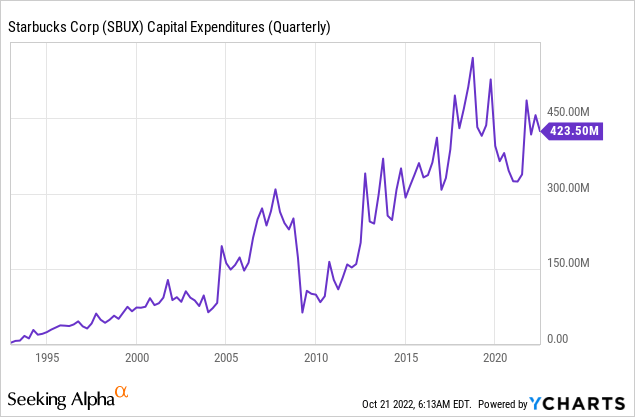

Starbucks’ goals are to open 2000 new stores in the U.S., spend $450 million on U.S.-store maintenance-related CapEx (and upgrades), and operate 9000 stores in China.

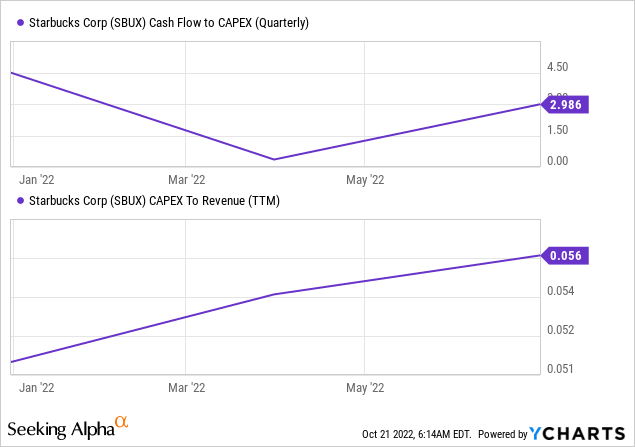

The company’s capital expenditure metrics indicate that it produces strong enough revenue and cash flow growth to fund an expansion. Thus, we believe Starbucks’ aggressive expansion plan is realistic and could yield significant results.

Valuation, Dividends & Return Metrics

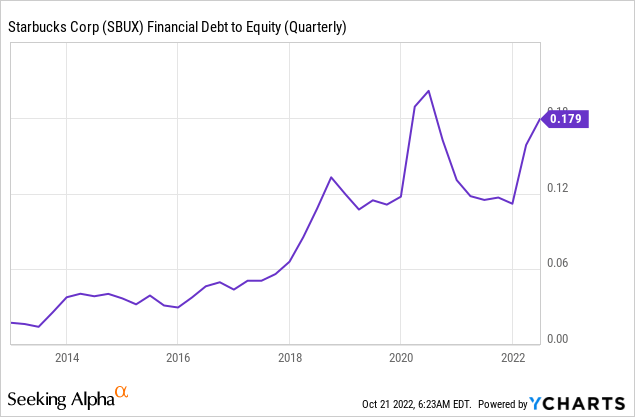

At first glance, Starbucks’ subtle debt-to-equity ratio tells us that it passes along much of its income to its shareholders. Furthermore, the company’s return on total capital of 18.58% speaks volumes about the company’s ability to garner residual value for its shareholders.

At face value, there are a few concerns pertaining to Starbucks’ valuation. For example, the stock’s trading at more than three times its sales and nearly 25 times its earnings. However, Starbucks’ price-to-earnings ratio isn’t as much of a concern as it seems because its PEG ratio of 0.50x suggests that the company exhibits robust earnings-per-share growth.

Furthermore, Starbucks’ dividend yield of 2.26% is sound, and its 1.46x dividend coverage ratio implies that it’s reasonably secure. However, there’s an implication here. As previously mentioned, Starbucks is set to administer a multi-year growth plan, which would likely require the company to utilize a portion of its residual value; as such, the company’s dividend payout ratio of 62.22% could recede in the coming years.

| Price-Sales | 3.15x |

| Price-Earnings | 24.36x |

| PEG | 0.5x |

| Dividend Yield | 2.26% |

| Dividend Coverage Ratio | 1.46x |

Source: Seeking Alpha

Risks

In our opinion, the primary risk Starbucks currently faces is its exposure to China’s continuous lockdowns. Based on observation, China’s not willing to let go of its Covid-zero policy, and Starbucks’ 44% decline in year-over-year regional same-store sales communicates the severity of the problem. Moreover, according to the company’s recent growth plan, Starbucks is set to expand its footprint in China. Will this yield results? Potentially, but it could go very wrong if pandemic-related issues don’t fade.

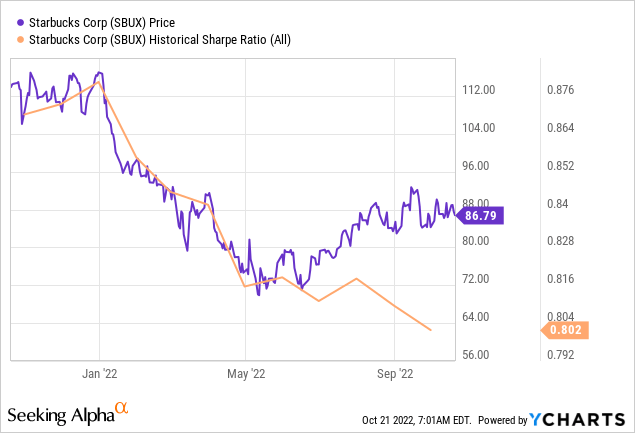

Furthermore, Starbucks stock exhibits questionable quantitative risk metrics, with its Sharpe Ratio now reading below one. Thus, If a bear market resumes, Starbucks could be one of the big losers.

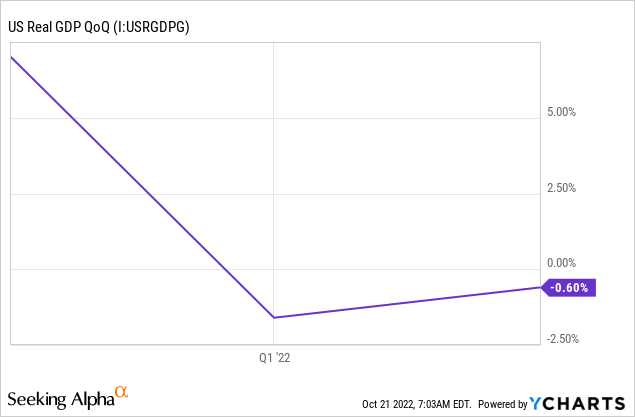

Lastly, the lower costs mentioned earlier could simply be due to demand reasons. If a deep recession unfolds and demand continues to recede, we might see Starbucks’ sales sink into the abyss.

Concluding Thoughts – We Think Starbucks Stock Is A Buy

We’re buying the dip here. Starbucks’ cost issues look set to pivot while its top-line revenue remains robust due to its unparalleled brand identity. Furthermore, Starbucks’ stock seems overvalued at first glance; however, its earnings-per-share growth counteracts a bearish argument.

Lastly, the company’s planned expansion could yield exponential returns, and we’d like to invest before the potential operational benefits are baked in.

Be the first to comment