segray

Investment Thesis

Starbucks (NASDAQ:SBUX) is in the middle of a rally following blockbuster Q3 earnings. The current price of the stock is $88 and while the stock has risen considerably in recent months, there is still more room left for it to run. While the Chinese market will have more trouble going forward with consumers saving more and borrowing less, the U.S. market and all other international markets posted positive growth. Additionally, with more workers being sent back to in-person work, this can prove to be another catalyst for Starbucks. This stock is a long-term story and will continue to do well. Over the long term, margin pressure should ease and growth continue to be positive.

China

The narrative promoted by Starbucks management is that the China slowdown is merely temporary and demand will come roaring back once lockdowns are over. However, in a broader sense the Covid lockdowns were merely the icing on the cake for many Chinese customers to reduce spending. The housing market is in decline and there is more uncertainty than ever before in the last decade. According to Bloomberg, Chinese consumers have reduced borrowing and are piling up more savings.

Households amassed 10.3 trillion yuan in bank deposits in the first half of 2022, an almost 13% increase from the same period a year earlier and the largest jump on record.

For Starbucks, revenue in China declined 40%. Starbucks in their earnings call brings up the point that once the Shanghai lockdowns were lifted sales rose steadily to be about negative 24%, which is still a heavy loss. However, despite the loss in China, Starbucks has international operations across the globe and they still managed positive revenue growth driven by other markets mainly the U.S. Going forward, as lockdowns lift, the situation will not be as bad (as illustrated by the Shanghai numbers). However, increases in savings and lower borrowing will have an impact on growth and Starbucks may have to deal with slow growth in China. It may also be important to note that while most countries are increasing interest rates to fight off inflation, China just cut rates.

China on Monday announced surprise interest rate cuts in a bid to boost its struggling economy as industrial production and retail sales weakened while youth unemployment hit a record high.

Numbers

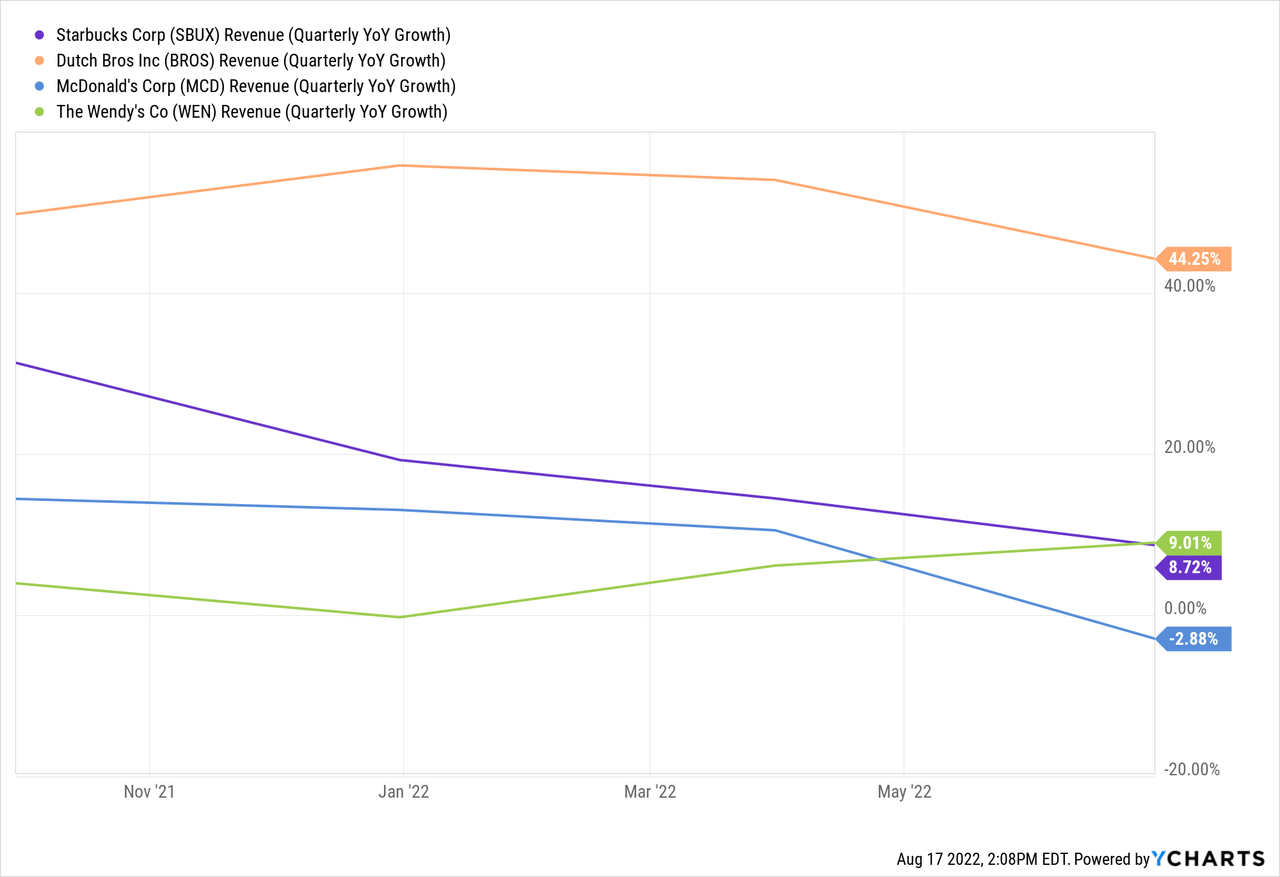

Starbucks has a debt to EBITDA ratio of 2.1 and a dividend yield of 2.2%. Quarterly revenue growth stands at 8.7% and has come down since January. However, it is still outperforming McDonald’s (MCD) and is at a similar growth rate as Wendy’s (WEN).

Starbucks gross profit margin is surprising low at 26%. In 2018, gross profit margin was around 30% so this represents quite a decrease. Starbucks also predicts operating margin to be depressed for the rest of the year so this represents some margin pressure. Operating margin decreased 400 basis points to 15.9% according to the most recent SEC filing. At the same time last year, operating margin was 19.9%. This has been attributed to inflationary pressure, store changes, and wage increases, however, other food companies don’t seem to be facing as much downward pressure as SBUX. Hopefully, this margin pressure is eased as supply chain issues are fixed. While Starbucks spends a lot on marketing, which puts pressure on margins, it is far better than the alternative, which is lower sales. Starbucks has a P/E ratio of 24, while the average S&P ratio is 23. This means SBUX is valued within market range. At this price point, there is room to make a considerable gain on SBUX, however, this is a long-term hold at this price.

North America

The biggest surprise coming out of the North American sales was the fact that food sales increased 19%. This represents a vehicle of growth that allows Starbucks to compete with other chains for the breakfast crowd. The beverage part of the business has steadily remained on top with 60% share of the business. However, increasing revenue for the food segment as well as the ‘other’ segment which involves packaged products allows Starbucks multiple streams of revenue. The average ticket price in both North America and the U.S. grew by 8% and U.S. comp sales grew 9%. For now, the U.S. remains a stream for growth, however, there have been warning signs of a temporary slowdown in America as well. However, Starbucks has seemed to have implemented itself as a necessary good and for the most part delivers stable revenue in the U.S.

Valuation

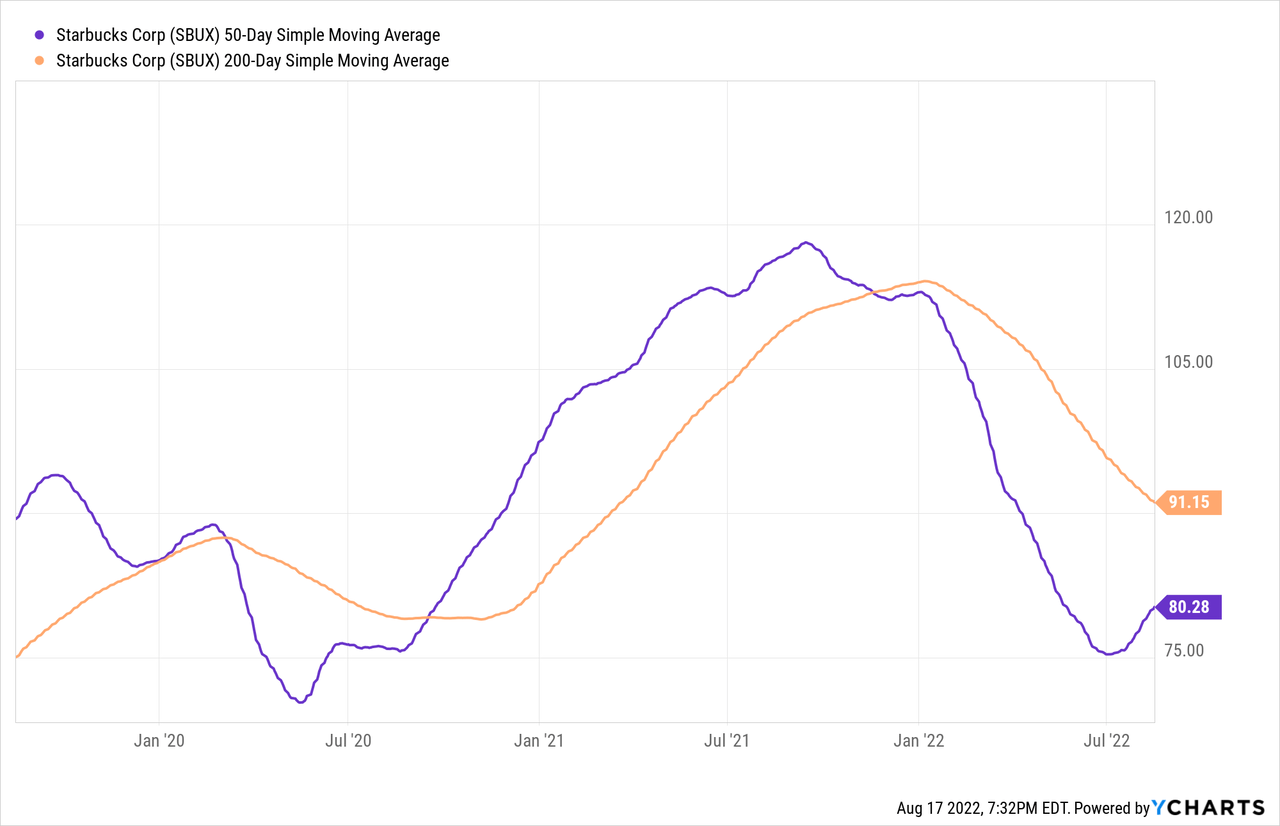

The 50-day SMA is far below the 200-day SMA, however, in recent weeks the 50-day SMA has begun to turn up as the 200-day SMA keeps falling. This seems like an ideal place to buy because based on previous analysis once the golden cross has been achieved (the 50 day SMA crossing the 200 day SMA) much of the rally is over. At this point, the Starbucks rally has already begun and the question is how much rally is left. The golden cross is a traditional bullish sign and for the most part it is a general practice to buy once the golden cross has been achieved, however, it may be better to buy before the golden cross has been achieved. For example, when the 50-day SMA crossed the 200-day SMA for SBUX in October of 2020, the stock price was around $88 which was an almost $30 increase from the March 2020 lows of $58. If you had bought SBUX right when the 50-day SMA began turning up, you would have bought at around $75 and if you had held it to the price when the 50-day crossed the 200-day you would have made a 17% gain. Even though you may not have made the impressive 51% gain if you had bought at $58 this is still an attractive price point to ride the rest of this rally. As we can already see the 52-week low was at $68 and has risen considerably since then, but there is still steam in the engine and room to make a considerable gain.

Conclusion

To state the obvious, there is a lot of chaos going on in global markets right now. China going forward may be vulnerable to slower growth and there is even talk of a slowdown in the U.S. However, Starbucks’ international presence allows it to be a better hedge against global slowdowns. Overall, the Starbucks story remains strong and, while it may get a bit tougher, this stock remains a winner.

Be the first to comment