Erdark/E+ via Getty Images

A Quick Take On Starbox Group Holdings Ltd.

Starbox Group Holdings Ltd. (STBX) has filed to raise $22.5 million in an IPO of its ordinary shares, according to an F-1 registration statement.

The firm provides a mobile platform for merchants to better connect with potential customers.

While the low nominal price for the IPO may attract volatility-chasing day traders in early trading, I’m on Hold for the IPO.

Starbox Overview

Kuala Lumpur, Malaysia-based Starbox was founded to develop the ability for retailers to provide cash rebate offers through technologies such as its websites and mobile applications.

Management is headed by Chairman and CEO Lee Choon Wooi, who has been with the firm since January 2020 and was previously executive director at Teclutions, a multi-level marketing and e-commerce software company.

The company’s primary offerings include:

-

GETBATS website and mobile app

-

SEEBATS website and mobile app

-

Digital advertising solutions

-

Payment gateway solutions

Starbox has booked fair market value investment of $955,000 in equity and debt as of September 30, 2021, from investors including ZYZ Group Holdings, Liu Marketing, EVL Corporation, WJG Group and CC Growth Edge.

Starbox – Customer Acquisition

Starbox seeks merchants who want to advertise their rebate offerings to potential customers, as well as receive payment services at reduced rates.

The firm collects data from its websites that help it to create a database of consumer spending behaviors that it can then use for its advertiser and merchant offerings.

Marketing and Promotional expenses as a percentage of total revenue have dropped as revenues have increased, as the figures below indicate:

|

Marketing and Promotional |

Expenses vs. Revenue |

|

Period |

Percentage |

|

FYE September 30, 2021 |

5.3% |

|

FYE September 30, 2020 |

103.9% |

(Source)

The Marketing and Promotional efficiency multiple, defined as how many dollars of additional new revenue are generated by each dollar of Marketing and Promotional spend, was 18.0x in the most recent reporting period. (Source)

Starbox’ Market & Competition

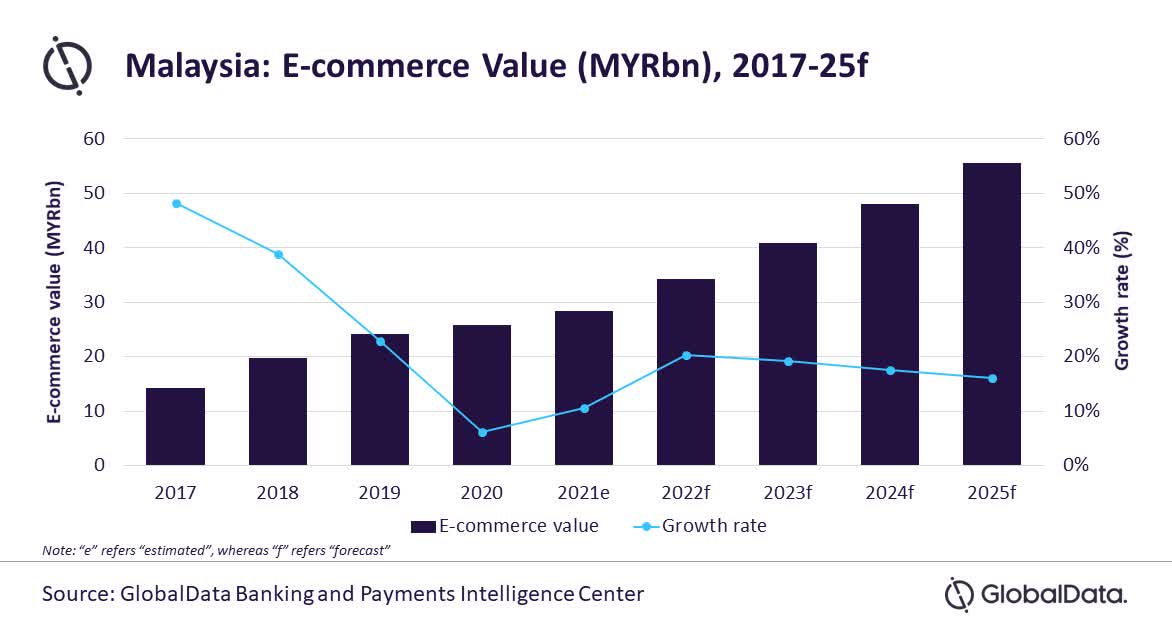

According to a 2021 market research report by GlobalData, the e-commerce market in Malaysia was an estimated $7.1 billion in 2021 and is forecast to reach $13.8 billion by 2025.

This represents a forecast CAGR of 18.3% from 2021 to 2025.

The main drivers for this expected growth are a higher demand for day-to-day items that users want to purchase online, such as food and groceries.

Also, below is a historical and projected future growth trajectory of the Malaysian e-commerce market:

Malaysia E-Commerce Market (GlobalData)

Starbox Group’s Financial Performance

The company’s recent financial results can be summarized as follows:

-

Growing topline revenue from a tiny base

-

A swing to operating profit

-

Positive cash flow from operations

Below are relevant financial results derived from the firm’s registration statement:

|

Total Revenue |

||

|

Period |

Total Revenue |

% Variance vs. Prior |

|

FYE September 30, 2021 |

$3,166,228 |

1957.8% |

|

FYE September 30, 2020 |

$153,863 |

|

|

Operating Profit (Loss) |

||

|

Period |

Operating Profit (Loss) |

Operating Margin |

|

FYE September 30, 2021 |

$2,139,889 |

67.6% |

|

FYE September 30, 2020 |

$ (190,163) |

-123.6% |

|

Comprehensive Income (Loss) |

||

|

Period |

Comprehensive Income (Loss) |

Net Margin |

|

FYE September 30, 2021 |

$ 1,428,587 |

45.1% |

|

FYE September 30, 2020 |

$ (205,308) |

-6.5% |

|

Cash Flow From Operations |

||

|

Period |

Cash Flow From Operations |

|

|

FYE September 30, 2021 |

$ 1,883,895 |

|

|

FYE September 30, 2020 |

$ (342,348) |

|

(Source)

As of September 30, 2021, Starbox had $2.3 million in cash and $2.8 million in total liabilities.

Free cash flow during the twelve months ended September 30, 2021, was $1.9 million.

Starbox Group’s IPO Details

Starbox intends to raise $22.5 million in gross proceeds from an IPO of its ordinary shares, offering 5 million shares at a proposed midpoint price of $4.50 per share.

No existing shareholders have indicated an interest to purchase shares at the IPO price.

Assuming a successful IPO, the company’s enterprise value at IPO would approximate $181 million, excluding the effects of underwriter over-allotment options.

The float to outstanding shares ratio (excluding underwriter over-allotments) will be approximately 11.1%. A figure under 10% is generally considered a ‘low float’ stock which can be subject to significant price volatility.

Management says it will use the net proceeds from the IPO as follows:

approximately 60% for expanding our business into other countries in Southeast Asia, including [i] establishing representative offices or appointing local partners and hiring key marketing employees who are familiar with local languages and cultures, [ii] integrating our websites and mobile apps with the representative offices or local partners, and [iii] promoting our brands in these countries;

approximately 20% for upgrading our software and systems; and

approximately 20% for promoting our brands in Malaysia.

(Source)

Management’s presentation of the company roadshow is not available.

Regarding outstanding legal proceedings, management said it was not aware of any legal proceeding that would have a material adverse effect on its financial condition or operations.

The sole listed bookrunner of the IPO is Network 1 Financial Securities.

Valuation Metrics For Starbox

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure [TTM] |

Amount |

|

Market Capitalization at IPO |

$202,500,000 |

|

Enterprise Value |

$180,519,722 |

|

Price / Sales |

63.96 |

|

EV / Revenue |

57.01 |

|

EV / EBITDA |

84.36 |

|

Earnings Per Share |

$0.03 |

|

Operating Margin |

67.58% |

|

Net Margin |

45.12% |

|

Float To Outstanding Shares Ratio |

11.11% |

|

Proposed IPO Midpoint Price per Share |

$4.50 |

|

Net Free Cash Flow |

$1,883,895 |

|

Free Cash Flow Yield Per Share |

0.93% |

|

Revenue Growth Rate |

1957.82% |

(Source)

Commentary About Starbox’s IPO

STBX is seeking U.S. public market investment to fund its expansion plans outside its primary market of Malaysia and into other Southeast Asian countries.

The company’s financials have shown increasing topline revenue from a tiny base, a swing to operating profit and positive cash flow from operations.

Free cash flow for the twelve months ended September 30, 2021, was $1.9 million.

Marketing and Promotional expenses as a percentage of total revenue have dropped as revenue has increased; its Marketing and Promotional efficiency multiple was 18.0x in its most recent fiscal year.

The firm currently plans to pay no dividends on its shares and anticipates that it will use any future earnings to reinvest back into the business.

The market opportunity for e-commerce in Malaysia is large and expected to grow at a strong CAGR of 18% through 2025.

Network 1 Financial Securities is the sole underwriter, and IPOs led by the firm over the last 12-month period have generated an average return of negative (82.7%) since their IPO. This is a bottom-tier performance for all major underwriters during the period.

The primary risk to the company’s outlook is its reliance on advertisers for its revenue, which is still very low.

As for valuation, management is asking investors to pay an Enterprise Value/Revenue multiple of 57x, which is extremely high for a tiny company with little operating history.

The IPO appears to be priced for perfection.

While the low nominal price for the IPO may attract volatility-chasing day traders in early trading, I’m on Hold for the IPO.

Expected IPO Pricing Date: To be announced.

Be the first to comment